Finance

How To Measure Market Risk

Modified: December 30, 2023

Learn how to measure market risk in the finance industry. Gain insights on effective risk management strategies and techniques.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing or managing a financial portfolio, understanding and managing market risk is essential. Market risk refers to the potential for investments to be affected by external market factors, such as economic trends, political events, or changes in overall market conditions. These factors can lead to fluctuations in asset prices, which can have a significant impact on the value of an individual’s investments.

Measuring market risk is crucial for investors, fund managers, and financial institutions as it allows them to assess the potential losses they may face and make informed decisions about asset allocation and risk management strategies. By quantifying market risk, investors can better understand the likelihood of losses and take necessary steps to mitigate or manage those risks.

There are several different types of market risk, each with its own unique characteristics and implications. Some common types of market risk include:

- Equity Risk: the risk that the value of stocks or equity investments will decline due to market fluctuations.

- Interest Rate Risk: the risk that changes in interest rates will affect the value of fixed-income investments such as bonds.

- Currency Risk: the risk arising from changes in foreign exchange rates that can impact the value of investments denominated in different currencies.

- Commodity Risk: the risk that the prices of commodities, such as oil or agricultural products, will fluctuate and impact the value of related investments.

- Liquidity Risk: the risk that assets cannot be sold or converted into cash quickly enough without incurring a significant loss in value.

To accurately measure market risk, various metrics and approaches can be utilized. Some key metrics commonly used in market risk measurement include volatility, beta, value-at-risk (VaR), and expected shortfall (ES). These metrics provide insights into the potential downside risk associated with different investment strategies and help investors make more informed decisions.

There are also different approaches to measuring market risk, each with its own strengths and limitations. The three main approaches include:

- Historical Simulation Approach: This approach uses historical data to simulate possible future investment outcomes.

- Parametric Approach: This approach utilizes mathematical formulas and statistical techniques to estimate market risk based on key variables.

- Monte Carlo Simulation Approach: This approach involves generating numerous random scenarios to simulate possible investment outcomes and measure market risk.

It is important to continuously monitor and review the effectiveness of market risk measures. Backtesting, which involves comparing predicted risk measures with actual outcomes, helps in determining the accuracy and reliability of risk measurement models.

While market risk measurement is a valuable tool, it is not without limitations. For instance, reliance on historical data may not account for unprecedented events or changes in market conditions, and assumptions made in the measurement models could introduce biases or inaccuracies. Therefore, it is crucial to interpret risk measures within the context of their limitations and supplement them with additional risk management strategies.

Overall, understanding and measuring market risk are essential for effective financial decision-making and risk management. By employing robust risk measurement techniques, investors and financial institutions can better navigate the uncertainties of the market and make informed choices to protect and grow their investments.

Definition of Market Risk

Market risk refers to the potential for losses in investments or portfolios due to changes in market conditions. It is the inherent uncertainty and volatility associated with the broader financial market that can lead to fluctuations in the value of assets. Market risk is influenced by various factors such as economic trends, geopolitical events, changes in interest rates, and investor sentiment.

Market risk is an important consideration for investors as it affects the potential returns and the overall performance of an investment portfolio. Investors and fund managers need to be aware of market risk and take measures to manage and mitigate its impact.

Market risk can broadly be categorized into systematic risk and unsystematic risk. Systematic risk, also known as undiversifiable risk, is the risk that cannot be eliminated by diversification because it is inherent in the overall market. It affects a wide range of investments and is caused by factors that impact the entire market, such as economic recessions or political instability. Unsystematic risk, on the other hand, is specific to individual investments or sectors and can be reduced through diversification.

There are several types of market risk that investors need to be aware of:

- Equity Risk: This is the risk associated with investing in stocks or equity securities. Equity prices can be influenced by a multitude of factors, including company performance, industry trends, market sentiment, and macroeconomic conditions.

- Interest Rate Risk: Interest rate risk refers to the impact of changes in interest rates on the value of fixed-income securities such as bonds. When interest rates rise, bond prices generally fall, leading to potential losses for bondholders.

- Currency Risk: Currency risk arises from changes in foreign exchange rates. It affects investments denominated in a different currency than the investor’s base currency. Fluctuations in exchange rates can impact the value of these investments positively or negatively.

- Commodity Risk: Commodity risk is the risk associated with investments in commodities such as oil, gold, or agricultural products. The prices of commodities can be volatile and subject to supply and demand factors, geopolitical events, and weather conditions.

- Liquidity Risk: Liquidity risk refers to the potential difficulty of buying or selling an asset at a fair price due to insufficient market participants or low trading volumes. Illiquid assets can be challenging to sell quickly without incurring significant losses.

Measuring and managing market risk is crucial. It enables investors and financial institutions to make informed decisions, implement appropriate risk management strategies, and allocate their investments effectively. By understanding and quantifying market risk, investors can evaluate the potential dangers their portfolios face and take necessary steps to protect their assets and optimize investment returns.

Importance of Measuring Market Risk

Measuring market risk is of utmost importance for investors, fund managers, and financial institutions. It allows them to assess the potential risks their investments face and make informed decisions about asset allocation and risk management. Here are some key reasons why measuring market risk is crucial:

1. Quantifying Potential Losses: By measuring market risk, investors can quantify the potential losses they may face in varying market conditions. This information is vital for setting realistic investment goals, designing appropriate risk tolerance levels, and determining the appropriate diversification strategies.

2. Identifying Risk-Return Trade-Off: Measuring market risk helps investors understand the trade-off between risk and return. It enables them to evaluate potential investment opportunities accurately and make informed decisions about the expected returns based on the level of risk associated with an investment.

3. Asset Allocation and Portfolio Optimization: Measuring market risk assists in determining the optimal portfolio allocation to different asset classes. By considering the risk profile of various investment options, investors can allocate their capital to achieve the desired level of risk and return based on their investment objectives.

4. Risk Management Strategies: Measuring market risk is essential for implementing effective risk management strategies. By identifying and quantifying market risk factors, investors can develop strategies to hedge against potential losses or mitigate the impact of adverse market conditions.

5. Regulatory Compliance: Financial institutions and investment firms are often required to meet certain risk management standards and regulatory requirements. Measuring market risk helps ensure compliance with these regulations and guidelines, safeguarding the interests of both the institution and its clients.

6. Investor Confidence: Measuring market risk and implementing robust risk management practices enhances investor confidence. Investors feel more secure when they know that their investments are subject to thorough risk analysis and that steps have been taken to mitigate potential risks. This can attract more investors and strengthen the reputation of financial institutions.

7. Strategic Decision Making: Measuring market risk provides valuable insights for strategic decision-making processes. It allows investors to identify trends, anticipate market movements, and adjust their investment strategies accordingly to maximize potential returns while minimizing risks.

8. Performance Evaluation: Measuring market risk helps evaluate the performance of investments and portfolio managers. It allows for comparisons against benchmark indices or competitors, enabling investors to assess whether their investments are providing adequate returns after considering the associated risks.

Overall, measuring market risk is essential for effective financial decision-making, risk management, and regulatory compliance. It provides investors and financial institutions with the information and tools needed to evaluate and manage risks appropriately, safeguard investments, and optimize portfolio performance. By staying vigilant and proactive in measuring market risk, market participants can navigate market uncertainties and improve their chances of achieving their financial goals.

Types of Market Risk

Market risk encompasses various types of risks that can impact the value of investments. Understanding these different types of market risk is crucial for investors and fund managers as it allows them to assess and manage the potential risks associated with their portfolios. Here are some common types of market risk:

- Equity Risk: Equity risk refers to the potential for investments in stocks or equity securities to decline in value due to market fluctuations. It arises from factors such as company performance, industry trends, market sentiment, and macroeconomic conditions. Changes in stock prices can significantly impact the value of equity investments, making equity risk a key consideration for investors.

- Interest Rate Risk: Interest rate risk is the risk that changes in interest rates will impact the value of fixed-income securities, such as bonds. When interest rates rise, bond prices typically fall, leading to potential losses for bondholders. Conversely, when interest rates decline, bond prices tend to rise. Interest rate risk affects both individual investors and financial institutions that hold fixed-income investments.

- Currency Risk: Currency risk arises from changes in foreign exchange rates. It impacts investments denominated in a different currency than the investor’s base currency. Fluctuations in exchange rates can result in gains or losses when investments are converted back into the investor’s base currency. Currency risk is particularly relevant for international investors and businesses engaged in cross-border transactions.

- Commodity Risk: Commodity risk refers to the potential for investments in commodities, such as oil, gold, or agricultural products, to experience price volatility. Factors such as supply and demand dynamics, geopolitical events, and weather conditions can significantly impact commodity prices, making commodity risk a crucial consideration for investors involved in commodity trading or holding commodity-based investments.

- Liquidity Risk: Liquidity risk relates to the possibility of an investor being unable to buy or sell an asset quickly enough without incurring a significant loss. Illiquid assets, such as certain stocks or securities with low trading volumes, can be challenging to sell at a fair price, particularly in times of market stress. Liquidity risk can impact both individual investors and financial institutions, leading to potential difficulty in meeting redemption requests or accessing funds when needed.

It is important for investors and fund managers to consider the different types of market risk when assessing their portfolios. Each type of risk has its own unique characteristics and implications, and they can interact with one another, amplifying or offsetting their effects. By understanding the various types of market risk, investors can develop appropriate risk management strategies and diversify their portfolios to mitigate the impact of these risks.

Key Metrics for Measuring Market Risk

Measuring market risk requires the use of various metrics and tools to assess the potential losses or fluctuations in investment portfolios. These metrics provide insights into the volatility and downside risk associated with different investment strategies. Here are some key metrics used for measuring market risk:

- Volatility: Volatility is a measure of the variability of an investment’s returns over time. Higher volatility indicates a greater degree of price fluctuation and potential risk. Volatility is commonly calculated using the standard deviation of returns over a specified period. It provides investors with an understanding of the historical price movements and enables comparisons between different investments or asset classes.

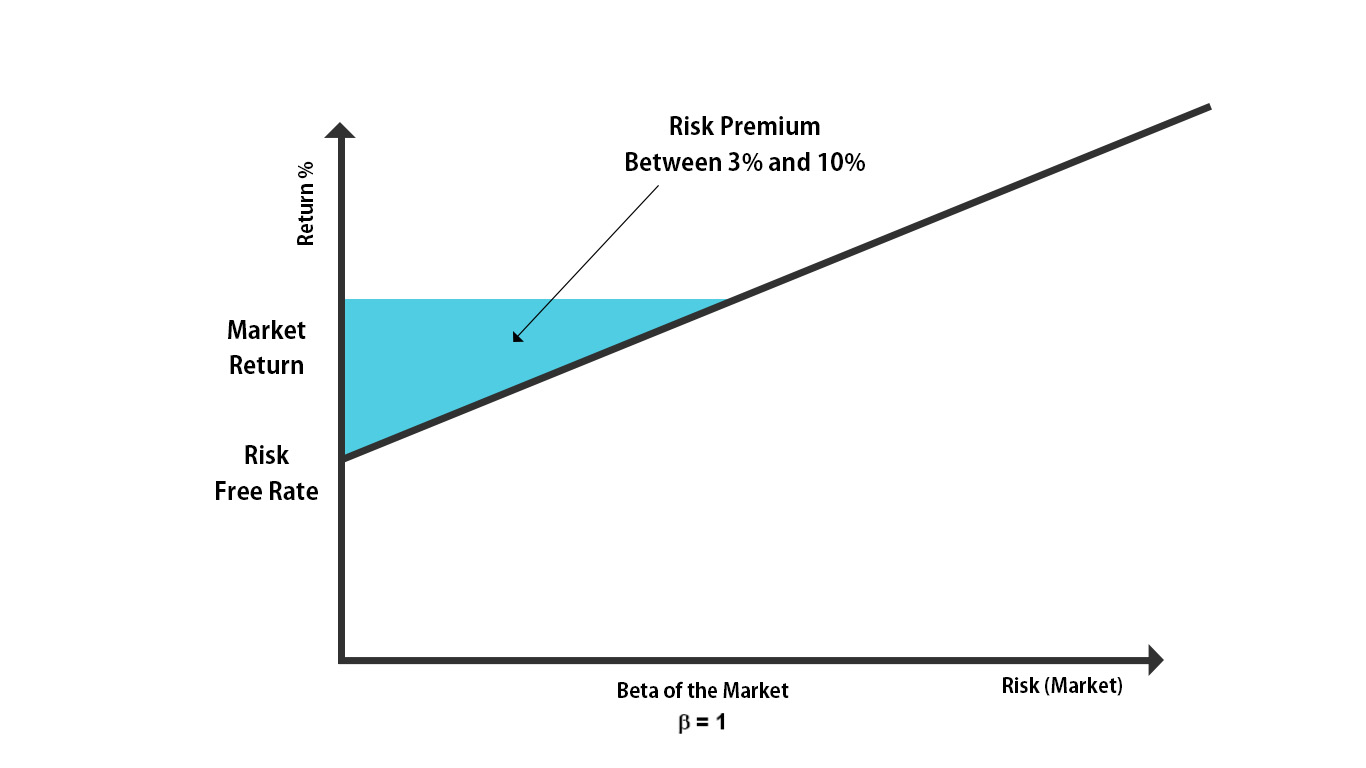

- Beta: Beta is a measure of the sensitivity of an investment’s returns to movements in the overall market. It quantifies the risk relative to the benchmark index. A beta of 1 indicates that the investment tends to move in line with the market, while a beta greater than 1 signifies higher volatility compared to the market. A beta less than 1 indicates lower volatility. Beta is useful for assessing the systematic risk and diversification potential of an investment.

- Value-at-Risk (VaR): VaR is a widely used metric for measuring the potential losses investors may face within a specified time frame and at a given confidence level. It estimates the maximum expected loss that a portfolio may experience under normal market conditions. VaR calculates the downside risk by considering the historical or simulated distributions of investment returns. It helps investors set risk tolerances and determine appropriate asset allocations.

- Expected Shortfall (ES): ES, also known as conditional value-at-risk, provides further insights beyond VaR by estimating the average expected loss for an investment portfolio in the event that losses exceed a specified VaR threshold. ES accounts for the tail risk associated with extreme market events. It helps investors assess the potential magnitude of losses during severe market downturns and supports risk management decision-making.

- Correlation: Correlation measures the relationship between the movements of different investments or asset classes. Positive correlation indicates that investments tend to move in the same direction, while negative correlation suggests they move in opposite directions. Correlation helps investors assess the diversification benefits of adding different assets to a portfolio. By combining investments with low or negative correlations, investors can potentially reduce portfolio volatility and mitigate overall risk.

These metrics, along with other risk management tools and techniques, assist investors in understanding and quantifying market risk. However, it’s important to note that no metric can provide a comprehensive view of all possible risks. Different metrics and tools should be used in conjunction and interpreted within the context of the investment objectives and risk appetite of individual investors or fund managers.

Historical Simulation Approach

The historical simulation approach is a method used to measure market risk by simulating possible future investment outcomes based on historical data. This approach assumes that historical patterns and relationships will persist in the future and provides a straightforward way to estimate the potential losses a portfolio may face.

In the historical simulation approach, a specified historical time series of returns is analyzed to calculate the risk associated with particular investment strategies. The approach involves the following steps:

- Data Selection: Relevant historical data, such as daily, weekly, or monthly returns of the investment or portfolio, are gathered.

- Estimation of Statistics: Historical statistics, such as mean return and standard deviation, are calculated based on the selected data. These statistics provide an estimate of the average return and the degree of variability of the investment or portfolio in historical periods.

- Simulation: The historical data is used to generate a large number of simulated returns. These simulated returns reflect the variability observed in the historical dataset.

- Loss Calculation: The simulated returns are sorted in descending order, representing potential portfolio losses. The historical simulation approach then estimates the value at risk (VaR) or expected shortfall (ES) at a specified confidence level.

The historical simulation approach has several advantages. It is relatively simple to implement and does not require strong assumptions about the distribution of returns. By utilizing actual historical data, it captures real-world market dynamics and reflects the historical pattern of risk and return. Additionally, the approach allows for the consideration of tail events or extreme market movements that might be missed by other risk measurement methods.

However, there are limitations to the historical simulation approach. It assumes that the future will follow the same pattern as the past, which may not always hold true, especially during rapidly changing market conditions or unprecedented events. The approach also assumes that historical data accurately represents the underlying risk structure, but market dynamics can shift over time. Furthermore, the historical simulation approach does not account for the impact of potential future events or changes in market conditions that have not yet been observed in historical data.

Despite its limitations, the historical simulation approach remains a valuable tool for measuring market risk. It provides a practical and intuitive method to estimate potential losses based on historical patterns and is widely used in risk management practices to assess and manage the risk exposures of investment portfolios.

Parametric Approach

The parametric approach is a widely used method for measuring market risk that relies on mathematical formulas and statistical techniques to estimate the risk of investment portfolios based on key variables. This approach assumes that investment returns follow a specific statistical distribution, such as the normal distribution, making it a convenient and efficient way to estimate market risk.

In the parametric approach, the following steps are typically involved:

- Model Selection: A statistical distribution is selected to model the returns of the investment or portfolio. The normal distribution is commonly used due to its simplicity, but other distributions, such as the t-distribution or the GARCH model, can also be used to capture more complex patterns.

- Parameter Estimation: Historical data is used to estimate the parameters of the chosen distribution, such as the mean and standard deviation. These parameters serve as estimates for the expected return and the risk level of the investment or portfolio.

- Risk Calculation: Once the distribution is specified and the parameters are estimated, risk measures such as value-at-risk (VaR) or expected shortfall (ES) can be calculated at a desired confidence level. These measures provide an estimate of the potential losses under different market conditions.

The parametric approach offers several advantages. It allows for more precise estimation of market risk compared to the historical simulation approach, as it incorporates mathematical and statistical techniques to model the returns distribution. It also provides a less computationally intensive method compared to Monte Carlo simulations, making it more efficient for large portfolios or frequent risk calculations.

However, there are limitations to the parametric approach. It assumes that returns are normally distributed or follow a known distribution, which may not always hold true in real-world market conditions. Extreme events or outliers can significantly impact the results, and the assumption of a constant distribution may not capture changing market dynamics accurately. Additionally, reliance on historical data may introduce biases or inaccuracies if future market conditions differ significantly from the observed historical period.

To mitigate these limitations, the parametric approach should be used with caution and in conjunction with other risk measurement techniques. Sensitivity analysis, stress testing, and scenario analysis can help assess the robustness of the parametric approach and provide a more comprehensive understanding of market risk.

Overall, the parametric approach is a valuable tool for measuring market risk, as it combines mathematical and statistical methods to estimate the risk of investment portfolios. Used alongside other risk assessment techniques, it can provide insightful insights for risk management and decision-making processes.

Monte Carlo Simulation Approach

The Monte Carlo simulation approach is a powerful method for measuring market risk by generating numerous random scenarios to simulate possible investment outcomes. This approach allows for a comprehensive assessment of the potential range of investment returns, enabling investors to understand the probability of different risk levels and optimize their decision-making processes.

In the Monte Carlo simulation approach, the following steps are typically involved:

- Modeling Inputs: Key variables, such as asset returns, volatilities, and correlations, are specified based on historical data, market expectations, or expert judgment. These inputs are used to generate random scenarios.

- Random Scenario Generation: Using the specified inputs, a large number of random scenarios are generated, representing different potential market conditions. Each scenario includes random values for the variables based on their respective probability distributions.

- Portfolio Evaluation: For each simulated scenario, the investment portfolio’s returns and associated risks are calculated. This computation may involve complex portfolio calculations, including asset allocation, rebalancing, and consideration of risk management strategies.

- Risk Measurement: Risk measures such as value-at-risk (VaR), expected shortfall (ES), or probability of portfolio losses exceeding a certain threshold are computed based on the simulated portfolio returns. These measures provide insights into the portfolio’s potential downside risk and help investors set risk tolerances.

The Monte Carlo simulation approach offers several advantages. It provides a flexible and robust framework for capturing the complex dynamics of financial markets, allowing for more accurate risk estimation compared to simpler methods. By incorporating correlations and the non-linear relationships between variables, it can better capture the impact of diversification and dependencies among different asset classes.

Additionally, the Monte Carlo simulation approach can generate a wide range of scenarios, including extreme events or outlier scenarios that may not be adequately covered by historical data. This feature is particularly valuable for assessing tail risks and evaluating the robustness of investment strategies in different market conditions.

However, the Monte Carlo simulation approach is computationally intensive and requires careful consideration of the model inputs. The accuracy and reliability of the results heavily depend on the quality of the input assumptions, including the choice of probability distributions and correlations. It is essential to ensure that the model inputs reflect the specific characteristics and dynamics of the investment portfolio under analysis.

Overall, the Monte Carlo simulation approach is a powerful tool for measuring market risk, enabling investors to assess a wide range of potential outcomes and make informed decisions. Used alongside other risk measurement methods, it offers valuable insights into portfolio risk, diversification opportunities, and the potential impact of various investment strategies across different market scenarios.

Backtesting Market Risk Measures

Backtesting market risk measures is an essential process for evaluating the accuracy and reliability of risk measurement models. It involves comparing predicted risk measures with actual outcomes to assess the effectiveness of the models in capturing and predicting market risks. Backtesting can help identify potential weaknesses, biases, or limitations in risk measurement approaches and support the development of more robust risk management strategies.

The process of backtesting market risk measures typically involves the following steps:

- Data Selection: Historical data representing a relevant time period is selected, including price or return data for the assets or portfolios under analysis, as well as the variables used for risk measurement.

- Model Specification: The risk measurement model or methodology is implemented based on historical data. This includes the calculation of risk measures such as value-at-risk (VaR) or expected shortfall (ES) using the chosen model.

- Comparison of Predictions and Outcomes: The predicted risk measures are compared to actual outcomes observed during the historical period. This can involve evaluating the accuracy of the predicted losses or the performance of the risk measures in capturing extreme or unexpected market events.

- Statistical Analysis: Various statistical techniques can be applied to assess the performance of the risk measures. This may include calculating metrics such as the hit ratio, the exceedance ratio, or analyzing the distribution of exceedances. These analyses provide insights into the reliability and effectiveness of the risk measurement models.

- Adjustments and Improvements: Based on the results of the backtesting analysis, adjustments and improvements can be made to the risk measurement models or methodologies. This iterative process helps refine the models and enhance their accuracy in predicting and managing market risks.

Backtesting market risk measures offers several benefits. It provides a means to evaluate the performance of risk measurement models under various market conditions, including periods of stress or extreme events. It helps identify potential model deficiencies, such as underestimation or overestimation of risks, and highlights the need for model enhancements or alternative approaches. Backtesting also assists in regulatory compliance by demonstrating that the risk measures employed are reliable and aligned with expectations.

However, there are limitations to backtesting market risk measures. Historical data is inherently limited to past market conditions and may not fully capture future uncertainties or structural changes in the market. The accuracy of the backtesting process heavily relies on the quality and representativeness of the historical data used. Additionally, extreme or tail events that are infrequent but have significant impacts on portfolio risk may not be adequately captured by backtesting due to the limited occurrence of such events.

Despite these limitations, backtesting remains a critical component of risk management. It helps validate the accuracy of risk measurement models, supports decision-making processes, and enhances the understanding of potential risks. By continually refining and improving risk measurement models through iterative backtesting processes, investors and financial institutions can better navigate market uncertainties and make more informed investment decisions.

Limitations of Market Risk Measurement

While market risk measurement is a valuable tool for assessing the potential risks associated with investments, it is important to recognize its limitations. Understanding these limitations can help investors and financial institutions make more informed decisions and employ additional risk management strategies. Here are some key limitations of market risk measurement:

- Reliance on Historical Data: Most market risk measurement models rely on historical data to estimate future risks. However, historical data may not be a reliable predictor of future market conditions, particularly during times of significant disruptions or structural changes in the financial markets.

- Assumptions and Simplifications: Market risk measurement models often make assumptions and simplifications to facilitate calculations and estimates. These assumptions can introduce biases or inaccuracies, as they may not perfectly reflect the complexities of real-world market dynamics.

- Normal Distribution Assumption: Many risk measurement models assume that investment returns follow a normal distribution. However, in reality, market returns often exhibit skewness and kurtosis, meaning they are not perfectly symmetrical and can have significant deviations from the mean. Relying on the normal distribution assumption may underestimate the potential for extreme events or tail risks.

- Correlations and Dependencies: Market risk measurement models rely on the assumption of stable correlations and dependencies between different asset classes. However, these relationships can change over time, particularly during periods of market stress or during structural shifts in the economy. The failure to accurately capture changing correlations can lead to inaccuracies in risk estimates.

- Illiquid or Untraded Assets: Market risk measurement models may struggle to accurately capture the risks associated with illiquid or untraded assets, as these assets may not have sufficient market data available for analysis. The lack of reliable pricing or liquidity information can make it challenging to estimate the potential losses or risks associated with such assets.

- Modeling and Data Errors: Market risk measurement models are subject to modeling and data errors, which can lead to incorrect risk estimates. Errors in data input, calibration of model parameters, or implementation of the models themselves can all introduce inaccuracies in risk measurement results.

Despite these limitations, market risk measurement remains a valuable tool for assessing and managing investment risks. It provides a structured approach to understanding the potential downside risks associated with investments and helps guide decision-making processes. However, it is essential for investors and financial institutions to interpret risk measures within the context of their limitations and supplement them with additional risk management strategies, such as diversification, stress testing, and scenario analysis. By recognizing the limitations of market risk measurement, market participants can navigate the uncertainties of the financial markets more effectively and make well-informed investment decisions.

Conclusion

Market risk measurement is a crucial aspect of investing and portfolio management. Understanding and quantifying market risk allows investors and financial institutions to assess the potential losses they may face, make informed decisions about asset allocation, and implement effective risk management strategies.

Throughout this article, we explored key concepts related to market risk measurement. We discussed the various types of market risk, including equity risk, interest rate risk, currency risk, commodity risk, and liquidity risk. We also explored the importance of measuring market risk, which includes quantifying potential losses, identifying risk-return trade-offs, optimizing asset allocation, and ensuring regulatory compliance.

We further delved into the key metrics employed in market risk measurement, such as volatility, beta, value-at-risk (VaR), expected shortfall (ES), and correlation. These metrics help investors evaluate the potential downside risk associated with different investment strategies and assets.

The historical simulation approach, parametric approach, and Monte Carlo simulation approach were discussed as the main methods for measuring market risk. Each method has its own strengths and limitations, and combining these approaches can provide a more comprehensive understanding of market risk.

We also looked at the importance of backtesting market risk measures to assess the accuracy and reliability of risk models. Backtesting allows for the evaluation of predicted risk measures against actual outcomes, supporting the refinement and improvement of risk measurement models over time.

Finally, we acknowledged the limitations of market risk measurement, such as the reliance on historical data, assumptions and simplifications in models, normal distribution assumptions, changing correlations, and difficulties with illiquid or untraded assets.

In conclusion, market risk measurement is an indispensable tool for investors and financial institutions in analyzing and managing investment risks. By employing a combination of measurement approaches and considering the limitations involved, market participants can make informed decisions, mitigate potential losses, and effectively navigate the uncertainties of the financial markets.