Finance

What Is A Market Risk?

Published: November 3, 2023

Learn about market risk in finance and how it affects investments. Understand the potential volatility and uncertainty involved, and make informed decisions to manage your financial portfolio effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to finance, understanding and managing risks is crucial. One of the key risks that investors and financial institutions face is market risk. Market risk is the potential for losses arising from changes in market factors such as interest rates, equity prices, foreign exchange rates, commodity prices, and credit spreads.

In simple terms, market risk refers to the possibility of losing money due to adverse movements in the market. This risk is inherent in financial markets and affects a wide range of assets and investments. From stocks and bonds to currencies and commodities, market risk can impact the value and performance of these assets.

It’s important to note that market risk is different from specific risks related to individual companies or industries. While specific risks are unique to particular assets or sectors, market risk is broad and affects the overall market.

Market risk is influenced by various factors, such as economic conditions, geopolitical events, and market sentiment. These factors can lead to volatility and fluctuations in asset prices, making it essential for investors and financial institutions to be aware of and manage market risk effectively.

In this article, we will explore the concept of market risk, its different types, and how it can be measured and managed. Understanding market risk is crucial for individuals and organizations involved in financial markets, as it can help them make informed investment decisions, implement risk management strategies, and safeguard their portfolios against potential losses.

Definition of Market Risk

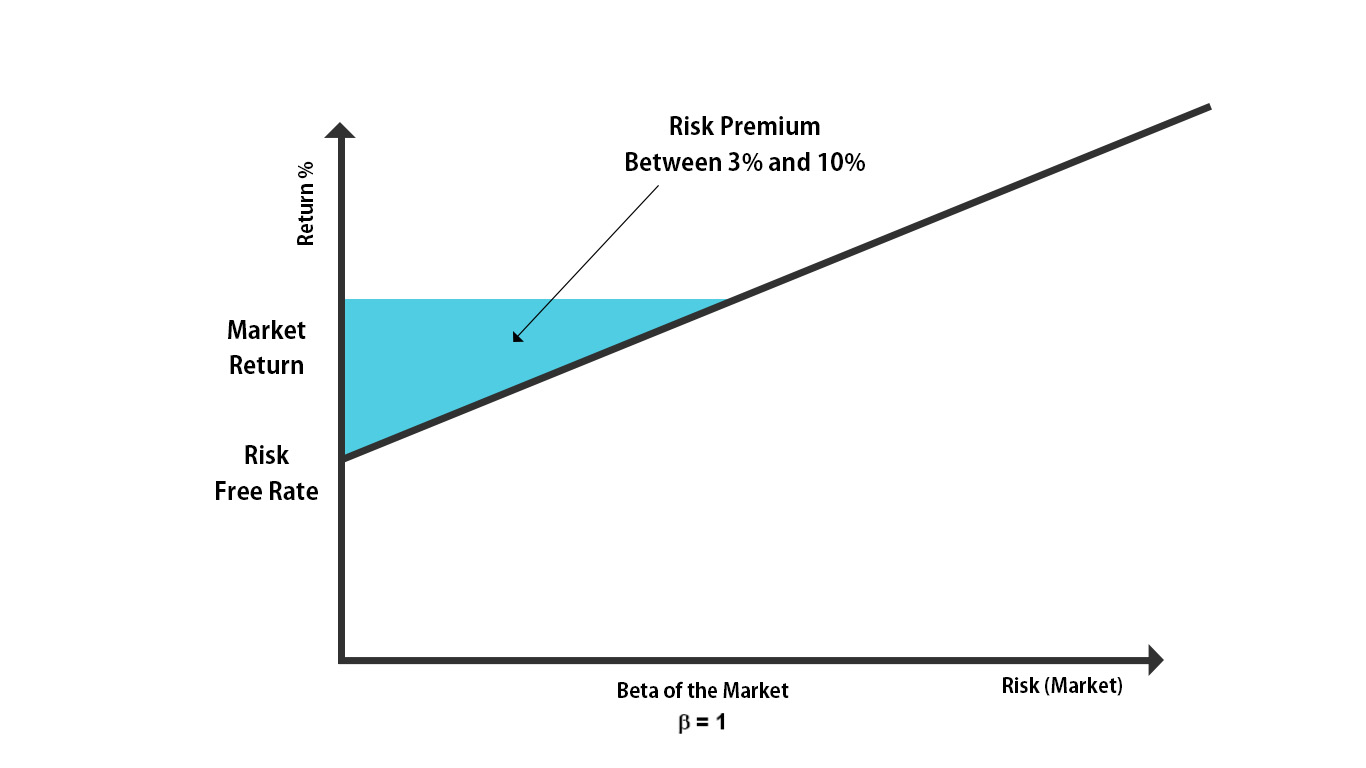

Market risk is the potential for losses that arise from changes in the market value of financial instruments. It refers to the uncertainty and volatility in the value of investments caused by external factors, rather than company-specific risks. Market risk is influenced by various market forces, including interest rates, equity prices, currency exchange rates, commodity prices, and credit spreads.

Market risk can be categorized into two primary types: systematic risk and unsystematic risk.

Systematic risk, also known as non-diversifiable risk, is the risk that is inherent in the entire market or a specific segment of the market. This type of risk cannot be eliminated through diversification. Factors such as changes in macroeconomic conditions, political events, and market sentiment contribute to systematic risk. Systematic risk affects all investments to some degree, and its impact cannot be mitigated through individual stock selection or portfolio diversification.

Unsystematic risk, also known as specific risk or diversifiable risk, is the risk that is specific to an individual company, sector, or investment. This risk can be minimized or eliminated through diversification. By spreading investments across different assets and sectors, investors can reduce their exposure to unsystematic risk. Examples of unsystematic risk include company-specific events like management changes, product recalls, or industry-specific factors.

Market risk is calculated using various statistical measures, including standard deviation, beta, and value at risk (VaR). These measures help quantify the potential loss or volatility in an investment due to market fluctuations. Risk management techniques, such as hedging, diversification, and implementing risk mitigation strategies, are used to minimize the impact of market risk on investment portfolios.

Understanding market risk is crucial for investors, financial institutions, and even regulators. It helps them assess the potential impact of market movements on their investments, make informed decisions, and implement risk management strategies to protect their capital and optimize returns.

Types of Market Risk

Market risk encompasses several different types, each stemming from specific market factors. Understanding these types is essential for effective risk management. Let’s explore the most common types of market risk:

- Interest Rate Risk: Interest rate risk refers to the potential losses resulting from fluctuations in interest rates. When interest rates rise, the value of fixed-income securities, such as bonds, tends to decline. This is because the fixed interest payments on these securities become less attractive compared to newer securities offering higher interest rates. Conversely, when interest rates fall, the value of fixed-income securities rises. Interest rate risk can impact a wide range of investments, including bonds, loans, and interest-sensitive derivatives.

- Equity Risk: Equity risk, also known as stock market risk, is the potential for losses in equity investments, such as stocks and equity-based funds. Equity risk arises from changes in the market value of stocks. Factors such as economic conditions, company performance, and market sentiment can influence stock prices, leading to gains or losses for investors.

- Currency Risk: Currency risk, also called foreign exchange risk, arises from fluctuations in exchange rates. Investors who hold assets denominated in foreign currencies are exposed to currency risk. Changes in exchange rates can impact the value of these assets when converted back into the investor’s home currency. Currency risk affects international investments, foreign trade, and companies operating in multiple countries.

- Commodity Risk: Commodity risk is associated with investments in commodities such as oil, gold, agricultural products, and other natural resources. The prices of commodities can be affected by various factors, including supply and demand dynamics, geopolitical events, weather conditions, and government policies. Fluctuations in commodity prices can impact the profitability of companies involved in the production, distribution, or consumption of these commodities.

- Credit Risk: Credit risk refers to the potential for losses resulting from the default or non-payment of debt obligations by borrowers or counterparties. Lenders and investors who hold debt instruments like bonds, loans, or credit derivatives are exposed to credit risk. Factors such as the creditworthiness of the borrower, economic conditions, and industry trends influence the likelihood of default. Credit risk can be managed through credit analysis, diversification, and credit derivatives.

- Systemic Risk: Systemic risk is the risk of widespread financial instability or the breakdown of the entire financial system. It arises from interconnections and dependencies among various financial institutions and markets. Systemic risk can be triggered by events such as financial crises, economic recessions, or severe disruptions in financial markets. Its impact can be far-reaching and can lead to significant losses for investors and financial institutions.

It’s important for investors and financial institutions to identify and understand the different types of market risk they are exposed to. By recognizing these risks, they can develop appropriate risk management strategies to mitigate the potential impact and protect their investments.

Interest Rate Risk

Interest rate risk is a type of market risk that arises from fluctuations in interest rates. It refers to the potential for losses in the value of fixed-income securities, such as bonds and loans, due to changes in prevailing interest rates. Understanding and effectively managing interest rate risk is crucial for investors and financial institutions.

Rising interest rates can have a negative impact on the value of fixed-income securities. As interest rates increase, the fixed coupon payments offered by existing bonds become less attractive compared to newly issued bonds with higher coupon rates. Consequently, the market value of existing bonds decreases, leading to potential losses for bondholders if they decide to sell before maturity.

Conversely, falling interest rates can benefit bondholders. As interest rates decrease, the fixed coupon payments offered by existing bonds become more attractive compared to newly issued bonds with lower coupon rates. This increased demand for existing bonds leads to an increase in their market value, potentially resulting in capital gains for bondholders.

Interest rate risk can impact a wide range of investments, including bonds, loans, and interest-sensitive derivatives. Duration, a measure of a bond’s sensitivity to interest rate changes, helps quantify interest rate risk. Bonds with longer durations are generally more sensitive to interest rate fluctuations compared to bonds with shorter durations.

Financial institutions are also exposed to interest rate risk. Banks, for example, borrow funds from depositors and lend those funds at higher interest rates to borrowers. If interest rates rise, the cost of borrowing for banks increases, potentially squeezing their net interest margins. However, banks can also benefit from rising interest rates by earning higher interest income on loans.

To mitigate interest rate risk, investors and financial institutions employ various strategies. One common approach is diversification. By diversifying their fixed-income portfolios across different bonds with varying maturities, investors can reduce the impact of interest rate changes on their overall portfolio value.

Another risk management technique is hedging. For instance, investors can use interest rate swaps or futures contracts to offset the potential losses from interest rate movements. These derivative instruments allow investors to fix the interest rate on their investments or speculate on interest rate movements.

It’s worth noting that interest rate risk doesn’t only affect fixed-income investments. It can also influence other asset classes, such as real estate. When interest rates rise, borrowing costs increase, potentially dampening demand for real estate properties. Conversely, falling interest rates can stimulate the real estate market by reducing borrowing costs and increasing affordability.

Managing interest rate risk requires careful analysis, monitoring, and proactive risk management strategies. By staying informed about macroeconomic conditions, central bank policies, and market trends, investors and financial institutions can make informed decisions to protect their portfolios from adverse interest rate movements.

Equity Risk

Equity risk, also known as stock market risk, is a type of market risk that refers to the potential for losses in equity investments, such as stocks and equity-based funds. Equity risk arises from the fluctuations in the market value of these investments, driven by various factors in the financial markets.

The value of stocks can be influenced by a multitude of factors, including economic conditions, company performance, industry trends, geopolitical events, and investor sentiment. Changes in any of these factors can lead to price volatility and impact the overall value of equity investments.

Investors who hold stocks are exposed to equity risk. When stock prices decline, investors may experience losses if they decide to sell their shares at a lower price than the purchase price. However, it’s important to note that equity risk also presents opportunities for potential gains when stock prices increase.

Equity risk affects not only individual stocks but also equity-based funds such as mutual funds and exchange-traded funds (ETFs). These funds pool investors’ money and invest in a diversified portfolio of stocks. As a result, their performance is directly influenced by changes in the underlying stock prices.

One way to manage equity risk is through a diversified portfolio. By spreading investments across different stocks, sectors, and regions, investors can mitigate their exposure to the performance of any single company or industry. Diversification helps offset potential losses in some investments with gains in others.

Investors may also consider using risk management tools such as stop-loss orders. A stop-loss order is a predetermined sell order that is triggered when a stock price reaches a specified level. This allows investors to limit their potential losses by automatically selling their shares if the stock price drops below a certain threshold.

Hedging strategies can also be used to manage equity risk. For example, investors can use options or futures contracts to protect their stock holdings against downside risk. These derivative instruments can provide insurance against potential losses by allowing investors to sell their stocks or establish short positions to offset any decline in value.

It’s worth noting that equity risk is not limited to individual stocks or equity-based funds. Other investments such as equity real estate investment trusts (REITs) and equity derivatives are also exposed to equity risk. Therefore, it is important for investors to carefully assess their risk tolerance, investment objectives, and time horizon when considering equity investments.

Overall, understanding and managing equity risk is crucial for investors looking to participate in the stock market. By monitoring market conditions, conducting thorough research on companies and sectors, and implementing risk management strategies, investors can navigate the challenges of equity risk and potentially achieve their investment goals.

Currency Risk

Currency risk, also known as foreign exchange risk, is a type of market risk that arises from the fluctuations in exchange rates between different currencies. It refers to the potential for losses in investments denominated in foreign currencies when converted back into the investor’s home currency.

Investors who hold assets or investments denominated in foreign currencies are exposed to currency risk. Changes in exchange rates can significantly impact the value of these investments and potentially lead to losses or gains for investors.

Currency risk can affect various types of investments, such as stocks, bonds, mutual funds, and international businesses with operations in different countries. For example, if an investor holds stocks of a foreign company and the value of the investor’s home currency strengthens against the foreign currency, the value of the stocks in the home currency may decline, resulting in losses for the investor.

Several factors influence exchange rates and, therefore, currency risk. These factors include macroeconomic conditions, interest rate differentials, political stability, trade balances, and market sentiment. Changes in any of these factors can lead to fluctuations in exchange rates, which in turn impact the value of investments denominated in foreign currencies.

To manage currency risk, investors and businesses can consider implementing various strategies:

- Hedging: Hedging involves using financial instruments such as forward contracts, options, or futures contracts to protect investments against unfavorable currency movements. These instruments allow investors to lock in exchange rates for future transactions, minimizing the impact of currency fluctuations.

- Diversification: Diversifying investments across different currencies can help reduce exposure to a single currency. By spreading investments across multiple currencies, investors can mitigate the risk of adverse movements in any particular currency.

- Currency Overlay: Currency overlay involves actively managing currency exposures within an investment portfolio. Professional currency managers can analyze and adjust currency positions based on market trends and expectations, aiming to maximize returns and minimize currency risk.

- Natural Hedging: For multinational businesses with operations in different countries, natural hedging involves matching revenues and expenses in the local currency, reducing the impact of currency fluctuations on their financial performance.

Currency risk is not only limited to investments but also affects international trade and transactions. Businesses engaged in cross-border trade face currency risk when they buy or sell goods and services in foreign currencies. Changes in exchange rates can impact the cost of imports, the competitiveness of exports, and the overall profitability of international business activities.

It’s important for investors and businesses to carefully assess and manage currency risk as part of their overall risk management strategy. By staying informed about global economic conditions, geopolitical events, and market trends, they can make informed decisions, employ hedging strategies, and mitigate potential losses resulting from adverse currency movements.

Commodity Risk

Commodity risk is a type of market risk that arises from investments in commodities, such as oil, gold, agricultural products, and other natural resources. It refers to the potential for losses or gains resulting from fluctuations in commodity prices.

Commodities are essential raw materials or primary agricultural products that are traded on various exchanges worldwide. Factors such as supply and demand dynamics, geopolitical events, weather conditions, and government policies can significantly impact commodity prices.

Investors and businesses involved in commodities are exposed to commodity risk. For example, if an investor holds investments in oil futures contracts and the price of oil declines, the value of the investment may decrease, resulting in losses. Conversely, if the price of oil increases, the value of the investment may rise, leading to potential gains.

Commodity risk can impact a wide range of investments and industries. For instance:

- Energy Sector: Commodity risk is particularly relevant in the energy sector, where oil, natural gas, and other energy sources are crucial. Fluctuations in oil prices can affect the profitability of oil and gas companies, as well as industries dependent on energy, such as transportation and manufacturing.

- Agricultural Sector: Commodities like wheat, corn, soybeans, and livestock products are essential in the agricultural sector. Weather conditions, changes in demand, and government policies related to agriculture can significantly impact the prices of these commodities and the profitability of agricultural businesses.

- Metals and Mining Industry: Commodities such as gold, silver, copper, and other metals play a vital role in the metals and mining industry. Price fluctuations in these commodities can impact mining companies’ profitability, exploration activities, and the overall value of mining investments.

Managing commodity risk can be challenging due to the inherent volatility and unpredictability of commodity markets. However, there are several strategies that investors and businesses can employ:

- Hedging: Hedging involves using derivative instruments, such as futures contracts or options, to protect against adverse price movements. By entering into hedging positions, investors can mitigate potential losses resulting from unfavorable commodity price changes.

- Supply Chain Management: Businesses that rely heavily on commodities can implement effective supply chain management strategies to minimize the impact of commodity price fluctuations. These strategies may include long-term contracts with suppliers, inventory management techniques, and proactive sourcing efforts.

- Monitoring Fundamental Factors: Keeping track of factors that influence commodity prices, such as supply and demand dynamics, geopolitical events, and weather patterns, can help investors and businesses make informed decisions. This includes staying informed about market trends, government policies, and global economic conditions that can impact commodity prices.

It’s important for investors and businesses to assess the risk-return profile of commodities and consider their investment objectives, risk tolerance, and time horizon when engaging in commodity investments. A thorough understanding of commodity markets and effective risk management strategies can help mitigate potential losses and capitalize on opportunities in the dynamic world of commodities.

Credit Risk

Credit risk is a type of market risk that refers to the potential for losses resulting from the default or non-payment of debt obligations by borrowers or counterparties. It is the risk associated with lending money or extending credit to individuals, corporations, or governments.

Lenders and investors who hold debt instruments like bonds, loans, or credit derivatives are exposed to credit risk. The creditworthiness of the borrower is a critical factor in determining the level of credit risk associated with an investment. Factors such as the borrower’s financial health, ability to generate cash flows, historical repayment track record, and prevailing economic conditions influence the likelihood of default.

There are different types of credit risk, including:

- Default Risk: Default risk is the risk of non-payment by the borrower or counterparty as per the agreed terms. This can result in partial or total loss of the invested capital or expected cash flows.

- Downgrade Risk: Downgrade risk refers to the risk of a deterioration in the credit rating of a borrower or issuer. A credit rating downgrade can lead to a decrease in the market value of the debt instrument and potentially affect the ability of the borrower to access new funding at favorable terms.

- Spread Risk: Spread risk is the risk associated with changes in credit spreads. Credit spread is the difference between the yield of a bond or loan and the risk-free rate. Changes in credit spreads can impact the value of fixed-income securities and the overall return on investment.

Managing credit risk is crucial for lenders and investors to protect their capital and optimize returns. Several techniques are employed to mitigate credit risk, including:

- Credit Analysis: Conducting thorough credit analysis allows lenders and investors to assess the creditworthiness of borrowers or issuers. This analysis involves evaluating financial statements, assessing the borrower’s financial ratios, and analyzing industry trends to make informed decisions.

- Diversification: Spreading credit exposure across different borrowers or issuers can help mitigate concentration risk. By diversifying the credit portfolio, lenders and investors can reduce the impact of potential defaults on the overall portfolio performance.

- Collateral and Security: Securing loans and investments with collateral or obtaining guarantees can help mitigate credit risk. Collateral provides lenders with a form of asset-backed security that can be used to recover losses in the event of default.

- Monitoring and Risk Surveillance: Regularly monitoring the creditworthiness of borrowers or issuers is essential to detect early warning signs of potential deteriorations in credit quality. This enables lenders and investors to take timely actions to mitigate credit risk.

Credit risk management is also important for banks and financial institutions. They employ comprehensive credit risk management frameworks that include credit risk assessment, credit approval processes, and ongoing risk monitoring. Regulatory requirements and international standards often dictate the minimum capital requirements for credit risk exposure to ensure the safety and soundness of financial institutions.

Understanding and effectively managing credit risk is crucial for investors, lenders, and financial institutions. By employing prudent credit risk management practices, they can mitigate potential losses, safeguard their capital, and make informed lending or investment decisions.

Systemic Risk

Systemic risk is a type of market risk that refers to the potential for widespread financial instability or the breakdown of the entire financial system. It arises from interconnections and dependencies among various financial institutions and markets, making it a significant concern for investors, financial institutions, and regulators.

Unlike individual or idiosyncratic risks that affect specific assets or institutions, systemic risk impacts the entire financial system, posing a threat to the stability of the economy as a whole. It can originate from various sources, including:

- Financial Crises: Major economic disruptions, such as the global financial crisis of 2008, exemplify systemic risk. Financial crises often result from a combination of factors, including excessive leverage, asset price bubbles, inadequate risk management, and contagion effects.

- Economic Recessions: Severe economic downturns, marked by a significant decline in economic activity, can trigger systemic risk. Recessions can lead to a cascade of financial problems, such as loan defaults, business failures, and a decrease in consumer spending, resulting in a broader systemic impact.

- Interconnectedness: The interconnected nature of financial institutions and markets amplifies the potential for systemic risk. When institutions or markets experience financial stress or failure, the impact can quickly spread to other institutions and markets, creating a domino effect.

- Contagion: Contagion refers to the rapid transmission of financial distress from one institution or market to others. It can occur through various channels, such as counterparty risk, confidence shocks, or liquidity shortages, leading to a systemic crisis.

Systemic risk is a complex and challenging risk to manage due to its multifaceted nature. The consequences of systemic risk can be severe and long-lasting, leading to widespread economic recession, job losses, and a decline in asset values.

Regulators and policymakers play a critical role in monitoring and mitigating systemic risk. They implement regulations to promote stability in the financial system, conduct stress tests to assess the resilience of financial institutions, and establish mechanisms for crisis management and resolution.

Financial institutions also have a responsibility to manage systemic risk. They employ risk management frameworks that incorporate stress testing, scenario analysis, and contingency planning. These measures help identify potential vulnerabilities and develop strategies to mitigate the impact of systemic events.

Investors can protect themselves from systemic risk through diversification and a long-term investment approach. By spreading investments across different asset classes, sectors, and geographical regions, investors can reduce their exposure to the performance of any single investment and minimize the impact of systemic events.

Systemic risk reminds us of the interconnectedness and interdependencies of the financial system. It highlights the importance of strong risk management practices, effective regulation, and proactive monitoring to ensure the stability and resilience of the financial system and protect against potential systemic crises.

Measurement and Management of Market Risk

The measurement and management of market risk are essential for investors and financial institutions to understand and mitigate potential losses arising from market fluctuations. Proper risk measurement helps in making informed investment decisions and designing strategies to protect and optimize investment portfolios. Here are key approaches used in the measurement and management of market risk:

- Value at Risk (VaR): VaR is a widely used measure for quantifying potential losses in a portfolio over a specific time horizon at a given confidence level. It considers the historical price movements, volatilities, and correlations of the assets in the portfolio to estimate the maximum possible loss within a predefined probability. VaR allows investors to set risk tolerance levels and take appropriate risk management actions.

- Stress Testing: Stress testing involves subjecting a portfolio or financial system to extreme scenarios or market conditions to assess its resilience. Through stress testing, financial institutions can evaluate the impact of adverse events and ensure they have sufficient capital and risk management measures in place to withstand potential shocks. Stress testing helps identify potential weaknesses and develop contingency plans to address them.

- Sensitivity Analysis: Sensitivity analysis examines how changes in specific market factors, such as interest rates or exchange rates, affect the value of a portfolio. It helps identify vulnerabilities and understand the potential impact of different market conditions. By assessing the sensitivity of investments to various factors, investors can make informed decisions and adjust their portfolios to manage risk exposure.

- Correlation Analysis: Correlation analysis assesses the relationship between the returns of different assets in a portfolio. It helps measure the extent to which assets move together or in opposite directions in response to market conditions. By understanding the correlations, investors can diversify their portfolios effectively and reduce risk by selecting assets that are not highly correlated.

- Hedging: Hedging is a risk management technique used to offset potential losses in one investment with gains in another. It involves taking positions in assets or derivatives that have an inverse relationship to the assets being hedged. Hedging can protect against specific risks such as interest rate risk, equity risk, or currency risk, helping to mitigate the overall market risk exposure.

Effective management of market risk requires continuous monitoring and assessment of portfolios, staying abreast of market trends and events, and implementing risk mitigation strategies. Investors and financial institutions should establish risk management frameworks that outline risk tolerance levels, risk measurement methodologies, and appropriate risk management actions.

Furthermore, diversification is a crucial strategy in managing market risk. By spreading investments across different asset classes, sectors, geographic regions, and investment instruments, investors can potentially reduce their exposure to any single source of risk. Diversification allows for a balanced risk-return profile and helps mitigate the impact of adverse events or market fluctuations in any particular investment.

Regular risk review and evaluation are essential to ensure that risk management strategies remain appropriate and effective. It is important for investors and financial institutions to stay informed about market developments, adopt sophisticated risk management tools and techniques, and adapt their strategies as market conditions change.

By employing sound risk management practices, investors and financial institutions can navigate the challenges of market risk, protect against potential losses, and optimize their investment outcomes.

Value at Risk (VaR)

Value at Risk (VaR) is a widely used measure for quantifying potential losses in a portfolio over a specific time horizon at a given confidence level. It is an important tool in the measurement and management of market risk, providing investors and financial institutions with a way to estimate and control their exposure to potential losses due to market fluctuations.

VaR estimates the maximum potential loss in a portfolio under normal market conditions within a specified time period. This measure takes into account the historical price movements, volatilities, and correlations of the assets in the portfolio. By using statistical techniques, VaR provides a numerical value that represents the level of potential loss that could be experienced with a specified probability, often expressed as a confidence level (e.g., 95% VaR).

For example, if a portfolio has a 95% VaR of $1 million over a one-day time horizon, it means that there is a 5% chance (or 1 in 20) that the portfolio will experience a loss greater than $1 million within a single day under normal market conditions.

VaR provides investors and financial institutions with several key benefits:

- Risk Measurement: VaR offers a quantitative measure of potential losses, allowing investors to assess and compare the riskiness of different portfolios or investments. It provides a standardized metric that facilitates risk monitoring and evaluation.

- Risk Control: VaR enables investors to set risk tolerance levels and establish risk management controls. It helps identify the level of potential downside risk and assists in the determination of appropriate risk mitigation strategies.

- Portfolio Optimization: VaR is useful for portfolio optimization, as it helps investors determine the optimal allocation of assets to balance risk and return. By considering the VaR of different asset combinations, investors can construct portfolios that align with their risk preferences and investment objectives.

- Regulatory Compliance: VaR is often required by regulatory bodies as part of risk management guidelines for financial institutions. It assists in ensuring compliance with regulatory capital requirements and supervision of risk exposure.

However, it is important to note that VaR has limitations and assumptions. VaR relies on historical data, and its accuracy is dependent on the quality and relevance of the data used. Additionally, VaR assumes that market conditions remain relatively stable, which may not always be the case during extreme market events or unforeseen crises.

To address the limitations of VaR, risk managers often use complementary risk measures and stress testing. Stress testing assesses the impact of extreme market scenarios on a portfolio, providing insights into potential losses beyond what VaR captures.

Overall, VaR is a valuable tool in the measurement and management of market risk. It provides investors and financial institutions with a quantitative estimate of potential losses, aiding in risk assessment, control, and optimization. To effectively use VaR, it should be accompanied by other risk management techniques and regular monitoring of portfolio exposures.

Stress Testing

Stress testing is a risk management technique used to assess the resilience of portfolios, financial institutions, or the entire financial system under extreme scenarios or adverse market conditions. It involves subjecting investments, financial institutions, or the overall market to severe stress events to evaluate their ability to withstand potential shocks.

The purpose of stress testing is to identify vulnerabilities, weaknesses, and potential risks that may not be captured by traditional risk measures such as Value at Risk (VaR) or sensitivity analysis. By simulating extreme scenarios, stress testing helps assess the potential impact on portfolios and financial institutions, both in terms of losses and overall financial stability.

Stress testing can take various forms:

- Sensitivity-Based Stress Testing: This form of stress testing involves adjusting specific key risk factors, such as interest rates, exchange rates, or commodity prices, to assess their impact on the portfolio or institution. By evaluating the sensitivity of investments to different factors, stress testing helps identify potential vulnerabilities.

- Scenario-Based Stress Testing: Scenario-based stress tests involve simulating specific hypothetical adverse scenarios to assess their impact on portfolios or financial institutions. These scenarios may simulate events such as severe economic recessions, market crashes, or geopolitical crises. By estimating potential losses and examining the resilience of the portfolio or institution in extreme conditions, scenario-based stress testing provides valuable insights into risk exposures.

- Reverse Stress Testing: Reverse stress testing involves identifying extreme scenarios that would lead to severe losses or failures in the portfolio or institution and working backward to understand the conditions that would need to be present for such outcomes. By uncovering the specific triggers and vulnerabilities that could cause significant distress, reverse stress testing helps inform risk mitigation strategies.

Stress testing serves several important purposes:

- Risk Identification: Stress testing helps identify potential risks and vulnerabilities that may not be apparent under normal market conditions. It allows investors and financial institutions to understand their exposure to extreme events and take necessary risk management actions.

- Capital Planning and Adequacy: Stress testing assists in evaluating the adequacy of capital reserves and liquidity buffers. By understanding potential losses under severe scenarios, financial institutions can ensure they have sufficient capital to absorb losses and maintain solvency. Stress testing also aids in capital planning and risk mitigation strategies.

- Regulatory Compliance: Regulatory authorities often require financial institutions to perform stress tests as part of their risk management practices. Compliance with stress testing guidelines helps ensure the stability and resilience of the financial system.

- Contingency Planning: Stress testing helps financial institutions develop contingency plans and risk management strategies to address potential adverse scenarios. It helps identify weaknesses, implement necessary risk controls, and establish appropriate responses to mitigate potential losses.

It’s important to note that stress testing has limitations. The effectiveness of stress testing relies on the quality and relevance of the scenarios simulated, the accuracy of assumptions made, and the availability of historical data. Additionally, stress testing cannot predict future events with certainty, and unexpected market events may still pose challenges that were not fully captured by stress tests.

Despite these limitations, stress testing remains a valuable tool for risk management. Continuous stress testing and scenario analysis play a crucial role in enhancing risk awareness, developing robust risk management frameworks, and ensuring the stability and resilience of portfolios and financial institutions in the face of potential adverse market conditions.

Hedging Strategies for Market Risk

Hedging is a risk management technique that involves taking positions in assets or derivatives to offset potential losses in one investment with gains in another. It is commonly used to mitigate market risk and protect against adverse movements in asset prices or market factors. Here are some popular hedging strategies employed by investors and financial institutions:

- Using Futures Contracts: Futures contracts are commonly used in hedging strategies. By taking an opposite position in a futures contract, investors can offset potential losses in the underlying asset. For example, if an investor holds a stock portfolio and expects a decline in the stock market, they can sell stock index futures to hedge against potential losses.

- Utilizing Options: Options provide the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe. Investors can use options to hedge against market risk. For instance, buying put options can protect against a potential decline in the value of an asset, while buying call options can provide protection against potential losses from a short position.

- Implementing Swaps: Swaps involve the exchange of cash flows or liabilities between parties. Interest rate swaps and currency swaps are common hedging instruments used to offset interest rate or currency-related risks. By entering into a swap agreement, market participants can protect themselves against unfavorable interest rate or currency fluctuations.

- Employing Diversification: Diversification is a fundamental hedging strategy that involves spreading investments across different assets, sectors, or geographic regions. By diversifying their portfolios, investors reduce their exposure to the performance of any single investment or market factor. This helps mitigate the impact of adverse market movements and potential losses.

- Using Forward Contracts: Forward contracts are agreements to buy or sell an asset at a specified price on a future date. They help manage market risk by locking in the price of an asset, reducing uncertainty associated with future price fluctuations. Forward contracts are often used to hedge foreign currency risk or to lock in prices of commodities.

- Implementing Natural Hedges: For multinational companies with operations in different countries, natural hedging involves matching the revenues and expenses in the local currency. By aligning currency inflows and outflows, companies can reduce the impact of exchange rate fluctuations on their financial performance.

It’s important to note that while hedging strategies can provide protection against market risk, they also come with their own costs and risks. Hedging strategies may involve transaction costs, such as fees associated with derivative instruments, and they may limit potential gains if the anticipated market movements do not materialize. Additionally, hedging cannot eliminate market risk entirely, but it aims to reduce its impact on portfolios.

Hedging strategies should be tailored to an individual’s risk tolerance, investment objectives, and time horizon. Assessing the specific risks to be hedged, understanding the characteristics of different hedging instruments, and considering the costs and potential benefits are crucial steps in implementing effective hedging strategies.

It’s important to note that while hedging strategies can provide protection against market risk, they also come with their own costs and risks. Hedging strategies may involve transaction costs, such as fees associated with derivative instruments, and they may limit potential gains if the anticipated market movements do not materialize. Additionally, hedging cannot eliminate market risk entirely, but it aims to reduce its impact on portfolios.

Hedging strategies should be tailored to an individual’s risk tolerance, investment objectives, and time horizon. Assessing the specific risks to be hedged, understanding the characteristics of different hedging instruments, and considering the costs and potential benefits are crucial steps in implementing effective hedging strategies.

Conclusion

Market risk is an integral part of investing and managing financial portfolios. Understanding different types of market risk, such as interest rate risk, equity risk, currency risk, commodity risk, credit risk, and systemic risk, is crucial for investors and financial institutions to make informed decisions and effectively manage their risk exposure.

Measurement and management techniques like Value at Risk (VaR), stress testing, sensitivity analysis, and correlation analysis aid in quantifying and assessing market risk. These tools provide insights into potential losses and help investors set risk tolerance levels and implement appropriate risk management strategies.

Hedging strategies serve as a risk mitigation tool against market risk. Utilizing instruments like futures contracts, options, swaps, and forward contracts enable investors to offset potential losses in one investment with gains in another. Diversification and natural hedging are also effective strategies that reduce risk exposure across different assets, sectors, and currencies.

While hedging strategies can provide protection, it is important to recognize that they come with costs and limitations. Implementing a well-rounded risk management approach involves a combination of hedging, diversification, and ongoing monitoring of market conditions and portfolio performance.

In conclusion, awareness and effective management of market risk are essential for achieving investment goals and safeguarding portfolios. By understanding the different types of market risk, implementing appropriate risk measurement and management techniques, and utilizing hedging strategies, investors and financial institutions can navigate market uncertainties and optimize risk-adjusted returns.