Home>Finance>Market Risk Definition: How To Deal With Systematic Risk

Finance

Market Risk Definition: How To Deal With Systematic Risk

Modified: December 30, 2023

Understand market risk and learn how to effectively manage systematic risk in finance. Gain insights on dealing with potential uncertainties and protecting your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Market Risk Definition: How to Deal with Systematic Risk

Welcome to the FINANCE category of our blog, where we share valuable insights and information about various aspects of the financial world. In this blog post, we will explore the concept of market risk, specifically systematic risk, and discuss effective strategies to cope with it. If you’ve ever wondered what market risk is and how it can impact your investments, then you’ve come to the right place.

Key Takeaways:

- Market risk refers to the potential for an investment to experience losses due to various external factors that affect the entire market.

- Systematic risk is a component of market risk and cannot be diversified away by investing in a single company or sector.

Before delving deeper into the topic, let’s start by understanding what market risk actually means. Market risk is the likelihood that an investment’s value will decrease due to factors such as economic downturns, geopolitical events, interest rate fluctuations, and other external influences. It is an integral part of investing and affects all types of assets, including stocks, bonds, commodities, and even real estate.

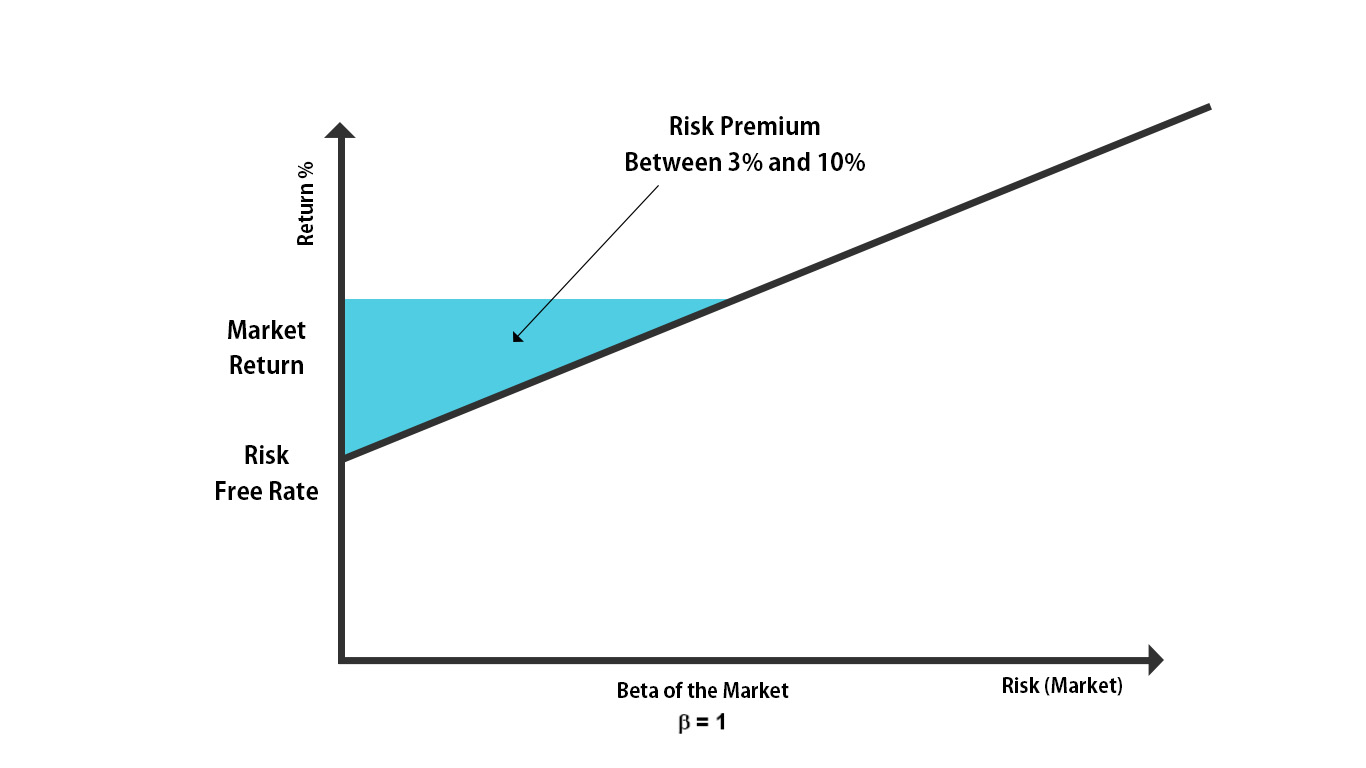

One important aspect of market risk is systematic risk. Unlike unsystematic risk (also known as specific risk), which can be reduced through diversification, systematic risk is inherent in the entire market and cannot be eliminated through portfolio allocation. It represents the risk that cannot be diversified away by investing in a specific company or sector. Understanding systematic risk is crucial as it allows investors to assess how their portfolios may be impacted by broader market conditions.

So, how can you deal with systematic risk? While it may not be possible to completely eliminate systematic risk, there are strategies that can help mitigate its impact on your investments:

- Diversify your portfolio: While diversification cannot eliminate systematic risk, it can help reduce the impact of volatility on your overall investment portfolio. By investing in a variety of asset classes, sectors, and geographic regions, you spread your risk and potentially mitigate the impact of market fluctuations.

- Use hedging techniques: Hedging involves using financial instruments such as options, futures, or derivatives to protect your portfolio against potential losses. These tools can help you offset the negative impact of market downturns by creating positions that benefit from declining prices.

- Stay informed: Keeping yourself updated with the latest market trends, economic indicators, and geopolitical events can help you make informed investment decisions. Understanding the factors that contribute to systematic risk can help you anticipate potential market movements and adjust your investment strategy accordingly.

- Consider long-term investing: Instead of trying to time the market and make short-term gains, adopting a long-term investment strategy allows you to ride out market fluctuations and potentially benefit from the compounding effect of long-term growth.

It’s important to remember that market risk is an inherent part of investing, and no strategy can completely eliminate it. However, by understanding and effectively managing systematic risk, you can potentially reduce its impact on your investment portfolio.

In conclusion, market risk, particularly systematic risk, poses challenges for investors. By diversifying your portfolio, using hedging techniques, staying informed, and adopting a long-term investment approach, you can enhance your ability to navigate market fluctuations and potentially achieve your financial goals. Remember, knowledge and careful consideration of risk are essential as you traverse the unpredictable yet rewarding world of finance.