Finance

What Is Capital Structure Ratio In Healthcare

Published: December 25, 2023

Learn about capital structure ratio in healthcare and its importance in financial management. Discover how finance plays a crucial role in managing healthcare organizations efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Capital Structure Ratio

- Importance of Capital Structure Ratio in Healthcare

- Types of Capital Structure Ratios in Healthcare

- Debt-to-Equity Ratio

- Debt Ratio

- Equity Ratio

- Times Interest Earned Ratio

- Debt Service Coverage Ratio

- Calculation and Interpretation of Capital Structure Ratios

- Benefits of Maintaining an Optimal Capital Structure Ratio in Healthcare

- Challenges in Maintaining an Optimal Capital Structure Ratio in Healthcare

- Strategies to Improve Capital Structure Ratio in Healthcare

- Conclusion

Introduction

In the ever-evolving world of healthcare, managing finances is of paramount importance. One crucial aspect of financial management in the healthcare sector is understanding and optimizing the capital structure ratio. The capital structure ratio plays a significant role in determining how a healthcare organization is financed and the level of risk it carries.

The capital structure ratio refers to the proportion of debt and equity used to finance a healthcare organization’s operations and investments. It reflects the balance between borrowed funds and the funds contributed by shareholders and owners. By analyzing this ratio, healthcare organizations can determine the stability, solvency, and overall financial health of their operations.

The capital structure ratio is a vital metric as it influences a healthcare organization’s ability to secure financing, manage debt, and make strategic decisions. It affects factors such as interest payments, creditworthiness, and operational flexibility. Understanding and managing this ratio is essential for healthcare organizations to thrive in a highly competitive and rapidly changing industry.

In this article, we will delve into the various types of capital structure ratios in healthcare, their calculations, interpretations, and the importance of maintaining an optimal capital structure ratio. We will also explore the challenges healthcare organizations face in improving their capital structure ratio and strategies to overcome them.

Definition of Capital Structure Ratio

The capital structure ratio is a financial measure that compares a healthcare organization’s debt and equity components. It provides insights into the extent to which a company relies on borrowed funds versus the funds provided by shareholders and owners. By analyzing this ratio, healthcare organizations can assess their financial stability, risk profile, and ability to meet their financial obligations.

The capital structure ratio is typically expressed as a percentage or a ratio. It helps healthcare organizations understand their financing mix, debt levels, and the impact on their overall financial health. A higher proportion of debt in the capital structure implies increased financial risk, as it requires consistent interest payments and repayment of principal amounts. On the other hand, a higher proportion of equity indicates a stronger financial position, as it represents the owners’ investment in the company.

Maintaining an optimal capital structure ratio is crucial for healthcare organizations. A well-balanced capital structure leads to improved financial stability, increased borrowing capacity, and enhanced ability to fund growth initiatives. It also influences a company’s creditworthiness and its ability to attract investors. As a result, healthcare organizations strive to manage their capital structure effectively to optimize their financial position and support long-term sustainability.

It is important to note that the ideal capital structure ratio may vary depending on the nature and size of the healthcare organization, its growth objectives, and the prevailing market conditions. Various factors, such as interest rates, industry dynamics, and regulatory requirements, can impact the optimal capital structure ratio. Healthcare organizations must regularly assess and adjust their capital structure to ensure it aligns with their strategic goals and risk tolerance.

In the next sections, we will explore the different types of capital structure ratios in healthcare, their calculations, interpretations, and the significance of maintaining an optimal ratio for financial success in the industry.

Importance of Capital Structure Ratio in Healthcare

The capital structure ratio plays a significant role in the financial management of healthcare organizations. It holds immense importance due to the following reasons:

- Financial Stability: The capital structure ratio helps healthcare organizations assess their financial stability. A well-maintained capital structure ensures that the organization has a healthy mix of debt and equity to meet its financial obligations. It provides a foundation for long-term sustainability and resilience in the face of economic downturns or unforeseen challenges.

- Risk Management: By analyzing the capital structure ratio, healthcare organizations can evaluate their risk profile. A higher proportion of debt indicates greater financial risk, as it requires regular interest payments and possible principal repayments. Understanding and managing this ratio helps healthcare organizations strike a balance between risk and reward, optimizing their financial risk exposure.

- Borrowing Capacity: The capital structure ratio has a direct impact on a healthcare organization’s borrowing capacity. Lenders and financial institutions assess this ratio to determine the creditworthiness and ability to repay debts. A strong capital structure ratio increases the organization’s borrowing capacity, allowing it to secure funds for growth initiatives, facility expansion, or investment in advanced medical technology.

- Investor Attraction: Maintaining an optimal capital structure ratio makes a healthcare organization more attractive to investors. A well-managed capital structure demonstrates financial discipline and stability, instilling confidence in potential investors. It can help attract equity investors who are seeking opportunities for long-term growth and profitability.

- Flexibility and Growth: Achieving an optimal capital structure ratio provides healthcare organizations with flexibility for future growth. It allows them to allocate resources efficiently, make strategic investments, and pursue expansion opportunities. With a balanced capital structure, organizations can navigate market fluctuations and pursue growth initiatives without putting undue strain on their financial resources.

In summary, the capital structure ratio is vital for healthcare organizations as it contributes to their financial stability, risk management, borrowing capacity, investor attraction, and flexibility for growth. By maintaining an optimal ratio, organizations can position themselves for long-term success in a rapidly evolving healthcare landscape.

Types of Capital Structure Ratios in Healthcare

There are several types of capital structure ratios that healthcare organizations use to assess their financial health and determine the proportion of debt and equity in their capital structure. These ratios provide valuable insights into the organization’s financial leverage, solvency, and ability to meet its financial obligations. Let’s explore some of the key capital structure ratios used in the healthcare industry:

- Debt-to-Equity Ratio: The debt-to-equity ratio measures the relationship between a healthcare organization’s total debt and its shareholders’ equity. It is calculated by dividing the total liabilities by the shareholders’ equity. This ratio indicates the extent to which a company relies on debt financing versus shareholder investments. A higher debt-to-equity ratio suggests greater financial risk and reliance on borrowed funds.

- Debt Ratio: The debt ratio represents the proportion of a healthcare organization’s assets that are financed by debt. It is calculated by dividing the total liabilities by the total assets. This ratio indicates the level of financial leverage and risk associated with debt financing. A higher debt ratio implies a higher level of debt and, therefore, greater financial risk.

- Equity Ratio: The equity ratio shows the proportion of a healthcare organization’s assets that are financed by shareholders’ equity. It is calculated by dividing the shareholders’ equity by the total assets. This ratio demonstrates the level of ownership and financial stability provided by shareholders’ contributions. A higher equity ratio indicates a stronger financial position and lower reliance on debt financing.

- Times Interest Earned Ratio: The times interest earned ratio measures a healthcare organization’s ability to meet its interest payment obligations. It is calculated by dividing the organization’s earnings before interest and taxes (EBIT) by its interest expense. This ratio indicates the extent to which the organization’s earnings can cover its interest payments. A higher times interest earned ratio suggests a greater ability to meet interest obligations.

- Debt Service Coverage Ratio: The debt service coverage ratio assesses a healthcare organization’s ability to meet its debt service requirements, including principal and interest payments. It is calculated by dividing the organization’s operating income by its total debt service, consisting of principal and interest payments. This ratio indicates the organization’s ability to generate sufficient cash flow to service its debts. A higher debt service coverage ratio suggests a stronger ability to meet debt obligations.

By analyzing these capital structure ratios, healthcare organizations can gain valuable insights into their financial leverage, risk profile, and ability to meet their financial obligations. These ratios are essential tools for financial management and strategic decision-making in the healthcare industry.

Debt-to-Equity Ratio

The debt-to-equity ratio is a crucial capital structure ratio that measures the relationship between a healthcare organization’s total debt and its shareholders’ equity. This ratio provides insights into the company’s financial leverage and the proportion of debt used to finance its operations.

To calculate the debt-to-equity ratio, you divide the total liabilities of the organization by its shareholders’ equity. The total liabilities include both short-term and long-term liabilities, such as bank loans, bonds, and other forms of debt. Shareholders’ equity represents the ownership interest of the shareholders and is the residual value after deducting liabilities from total assets.

The debt-to-equity ratio indicates the level of financial risk associated with a healthcare organization’s capital structure. A higher ratio suggests a greater reliance on debt financing, which can increase the organization’s vulnerability to financial instability. On the other hand, a lower ratio indicates a more conservative approach with a greater proportion of equity funding.

A high debt-to-equity ratio may raise concerns about the company’s ability to meet its financial obligations, as it may have a significant interest burden. It increases the risk of defaulting on loans or missing interest payments, potentially damaging the organization’s creditworthiness and reputation. This can make it more challenging to secure financing in the future and may result in higher interest rates due to increased lending risk.

Conversely, a low debt-to-equity ratio implies a more conservative capital structure, where the organization relies more on equity funding, reducing its financial risk. It suggests that the organization has a greater ability to weather financial downturns and meet its financial obligations comfortably.

The ideal debt-to-equity ratio varies depending on the industry, the specific healthcare organization, and its strategic goals. While some companies may tolerate higher levels of debt to support growth and expansion, others may prioritize a lower ratio to minimize financial risk. It is important for healthcare organizations to regularly monitor and analyze their debt-to-equity ratio to maintain a balanced capital structure that aligns with their financial objectives.

In summary, the debt-to-equity ratio is a valuable measure of a healthcare organization’s capital structure and financial risk. By keeping this ratio in check, organizations can ensure a healthy balance between debt and equity financing, reducing their vulnerability and maintaining financial stability.

Debt Ratio

The debt ratio is a financial metric that evaluates the proportion of a healthcare organization’s assets that are financed through debt. It provides valuable insights into the level of financial leverage and the organization’s ability to cover its debts.

To calculate the debt ratio, you divide the total liabilities of the organization by its total assets. The total liabilities include both short-term and long-term debts, such as loans, bonds, and other financial obligations. Total assets encompass all the resources owned by the organization, including cash, investments, property, and equipment.

The debt ratio indicates the extent to which the healthcare organization relies on borrowed funds to finance its operations and investments. A higher debt ratio suggests a greater level of financial risk, as it indicates a larger proportion of debt in relation to the organization’s assets. This can increase the organization’s vulnerability to economic downturns or changes in interest rates.

A high debt ratio can impose significant interest and principal repayment obligations on the healthcare organization, potentially straining its cash flow and limiting its financial flexibility. It may also lead to higher interest costs, as lenders will demand compensation for the increased risk associated with higher debt levels.

Conversely, a low debt ratio indicates that the organization relies less on debt financing and has a more conservative capital structure. A lower debt ratio suggests financial stability and the ability to cover debts comfortably, reducing the risk of default or financial distress.

The ideal debt ratio varies depending on factors such as the industry, the specific healthcare organization, and its strategic goals. Different organizations may have different risk tolerance levels and capital structure preferences. Some healthcare organizations may choose to have a higher debt ratio to finance expansion projects or make strategic investments, while others may favor a lower ratio to minimize financial risk.

It is important for healthcare organizations to carefully monitor their debt ratio and strike a balance between borrowing to support growth and maintaining a sustainable level of debt. Regularly assessing this ratio allows organizations to make informed financial decisions, manage risk, and ensure long-term financial stability.

In summary, the debt ratio is a critical metric that provides insights into a healthcare organization’s level of financial leverage and risk associated with debt financing. By maintaining an optimal debt ratio, organizations can effectively manage their debt obligations and achieve financial stability in a dynamic healthcare industry.

Equity Ratio

The equity ratio is a financial indicator that measures the proportion of a healthcare organization’s assets that are financed through shareholders’ equity. It provides insights into the organization’s financial stability, ownership structure, and the level of risk associated with equity financing.

To calculate the equity ratio, you divide the shareholders’ equity of the organization by its total assets. Shareholders’ equity represents the residual value of the company’s assets after deducting liabilities, and it reflects the ownership interest of the shareholders.

The equity ratio indicates the degree to which a healthcare organization relies on shareholder contributions to fund its operations. A higher equity ratio suggests a greater proportion of funding from owners and shareholders, indicating a stronger financial position and lower reliance on debt financing. This signifies a lower level of financial risk, as the organization has a cushion of equity to absorb potential losses.

A high equity ratio can be seen as a positive indicator, as it implies a greater ownership stake in the organization and a solid financial foundation. It provides a sense of stability and resilience, making the organization more attractive to potential investors or lenders.

Conversely, a low equity ratio may indicate a higher level of debt financing and increased financial risk. It suggests a lower level of ownership and a greater reliance on borrowed funds, which could pose challenges if the organization encounters financial difficulties or economic downturns.

The ideal equity ratio varies depending on factors such as the industry, the specific healthcare organization, and its strategic goals. Different organizations may have different risk tolerance levels and capital structure preferences. Some healthcare organizations may aim for a higher equity ratio to demonstrate financial stability and attract investors, while others may choose a lower ratio to leverage the benefits of debt financing for expansion or investment opportunities.

Monitoring and managing the equity ratio is essential for healthcare organizations to maintain a balanced capital structure and ensure long-term financial stability. By analyzing this ratio, organizations can make informed decisions regarding equity issuance, dividend policy, and overall financial management.

In summary, the equity ratio is a vital financial metric that provides insights into a healthcare organization’s ownership structure, financial stability, and risk profile associated with equity financing. A well-managed equity ratio can help healthcare organizations navigate the challenges of the industry and position themselves for sustainable growth and success.

Times Interest Earned Ratio

The times interest earned (TIE) ratio is a financial metric that measures a healthcare organization’s ability to meet its interest payment obligations. It provides insights into the organization’s capacity to cover its interest expenses using its operating income.

To calculate the times interest earned ratio, you divide the earnings before interest and taxes (EBIT) of the healthcare organization by its interest expense. EBIT represents the organization’s profitability before deducting interest and taxes, while interest expense represents the total cost of borrowing for the organization.

The times interest earned ratio indicates how many times the organization’s earnings can cover its interest payments. A higher TIE ratio implies a greater ability to meet interest obligations, suggesting financial strength and stability. It signifies that the organization generates sufficient income to comfortably cover its interest expenses, reducing the risk of default on debt payments.

On the other hand, a lower TIE ratio may suggest a higher risk of the organization being unable to meet its interest obligations. It indicates a weaker capacity to generate income relative to its interest expenses, which could be a signal of financial strain and potential liquidity issues.

Lenders and investors often assess the times interest earned ratio to evaluate the healthcare organization’s financial health and its ability to service its debts. A higher TIE ratio may increase the organization’s creditworthiness, leading to better borrowing terms and lower interest rates. It demonstrates the organization’s ability to manage debt obligations and indicates a lower risk of default.

It is important to note that the ideal TIE ratio varies across different industries and depends on the financial goals and risk tolerance of the healthcare organization. The specific benchmark for a healthy TIE ratio may vary, but a generally accepted guideline is to have a TIE ratio of at least 2 or higher, indicating that the organization’s earnings can cover its interest expenses twice over.

Monitoring the times interest earned ratio is crucial for healthcare organizations to ensure financial sustainability and effective debt management. By maintaining a healthy TIE ratio, organizations can demonstrate their ability to meet interest obligations, build investor confidence, and enhance their overall financial position.

In summary, the times interest earned ratio is a key financial metric that measures a healthcare organization’s ability to meet its interest payments. By closely monitoring and managing this ratio, organizations can assess their financial health and ensure they have sufficient income to cover their interest expenses, fostering stability and mitigating the risk of default.

Debt Service Coverage Ratio

The debt service coverage ratio (DSCR) is a financial metric used by healthcare organizations to assess their ability to meet their debt service requirements, including principal and interest payments. It provides insights into the organization’s ability to generate sufficient cash flow to service its debts.

To calculate the debt service coverage ratio, you divide the organization’s operating income by its total debt service. The operating income includes earnings before interest, taxes, depreciation, and amortization (EBITDA), while the total debt service represents the principal and interest payments on the organization’s outstanding debts.

The debt service coverage ratio indicates how many times the organization’s operating income can cover its debt service obligations. A higher DSCR, typically above 1.0, indicates a healthier financial position, as it suggests that the organization’s cash flow is sufficient to meet its debt obligations.

A DSCR below 1.0 indicates that the organization’s operating income is inadequate to cover its debt service requirements, which raises concerns about its ability to fulfill its financial obligations. It implies a higher risk of defaulting on debt payments and may hinder the organization’s access to future financing options.

Lenders and creditors use the debt service coverage ratio to assess a healthcare organization’s creditworthiness and risk level. A higher DSCR demonstrates a greater ability to service debts, which may lead to more favorable lending terms and lower interest rates. It reflects the organization’s financial stability and ability to generate sufficient cash flow to cover its obligations.

It is important for healthcare organizations to regularly monitor and maintain a healthy debt service coverage ratio. A strong DSCR ensures that the organization can service its debts without jeopardizing its financial stability or future growth initiatives. It provides a cushion against unexpected financial challenges and enhances the organization’s overall financial health.

The ideal debt service coverage ratio may vary depending on factors such as the industry, the specific healthcare organization, and market conditions. While a DSCR of 1.0 is the minimum requirement to cover debt obligations, many lenders prefer a higher ratio, typically above 1.5, to mitigate the risk of default.

In summary, the debt service coverage ratio is a vital financial metric that enables healthcare organizations to assess their ability to meet their debt service requirements. By maintaining a healthy DSCR, organizations can demonstrate their financial stability, enhance their creditworthiness, and ensure their long-term viability in the healthcare industry.

Calculation and Interpretation of Capital Structure Ratios

Calculating and interpreting capital structure ratios is essential for healthcare organizations to assess their financial health, risk profile, and the mix of debt and equity financing in their capital structure. The following are the key steps and considerations in calculating and interpreting these ratios.

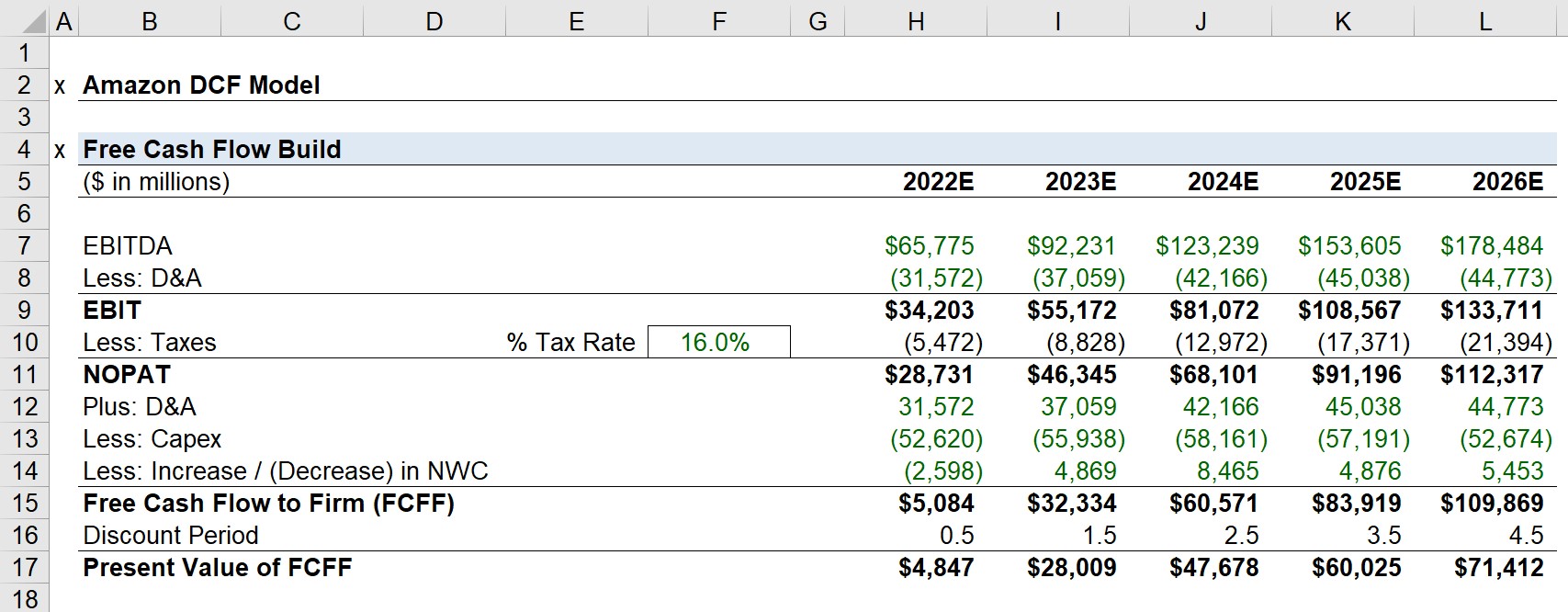

1. Gather Financial Information: Collect the necessary financial information, including the organization’s balance sheet, income statement, and statement of cash flows. These statements contain vital data such as total liabilities, shareholders’ equity, interest expenses, and operating income.

2. Choose Relevant Ratios: Select the capital structure ratios that are most relevant to the organization’s financial goals, industry norms, and risk tolerance. Common ratios include the debt-to-equity ratio, debt ratio, equity ratio, times interest earned ratio, and debt service coverage ratio.

3. Perform the Calculations: Use the appropriate formulas to calculate each capital structure ratio. For example, the debt-to-equity ratio is calculated by dividing total liabilities by shareholders’ equity. The debt ratio is determined by dividing total liabilities by total assets. The equity ratio is obtained by dividing shareholders’ equity by total assets.

4. Interpret the Ratios: Once the ratios are calculated, interpret their results within the context of the organization’s financial goals and industry benchmarks. Compare the ratios against historical data, industry averages, and the organization’s predetermined targets.

· A higher debt-to-equity ratio may indicate higher financial risk, as it suggests a larger reliance on borrowed funds. However, it may also indicate potential leverage for growth and investment opportunities.

· A higher debt ratio implies a greater reliance on debt financing, reflecting higher financial leverage. It may signal higher risk, especially if the organization’s cash flow is insufficient to cover debt obligations.

· A higher equity ratio indicates a larger proportion of financing coming from shareholders’ equity, suggesting a more stable financial position and a reduced reliance on debt.

· A higher times interest earned ratio indicates a stronger ability to meet interest payment obligations, as the organization’s earnings comfortably cover the interest expenses.

· A higher debt service coverage ratio demonstrates the organization’s ability to generate enough cash flow to cover its debt obligations, ensuring financial stability and minimizing the risk of default.

It is important to note that the interpretation of capital structure ratios may vary based on industry norms, specific organizational goals, and market conditions. What may be considered an optimal ratio in one industry may differ in another.

Regularly reviewing and analyzing these ratios allows healthcare organizations to better understand their financial health, identify areas of improvement, and make informed decisions on debt management, equity financing, and risk mitigation strategies.

In summary, calculating and interpreting capital structure ratios provides healthcare organizations with valuable insights into the composition and risk profile of their capital structure. It enables organizations to make informed financial decisions, manage risk effectively, and maintain a balanced capital structure that supports their long-term financial health and strategic objectives.

Benefits of Maintaining an Optimal Capital Structure Ratio in Healthcare

Maintaining an optimal capital structure ratio is crucial for healthcare organizations as it offers several significant benefits. Achieving the right balance between debt and equity financing can positively impact the organization’s financial health, operational flexibility, and ability to attract investment. Here are some key benefits of maintaining an optimal capital structure ratio in the healthcare industry:

- Financial Stability: Maintaining a balanced capital structure helps to ensure financial stability for healthcare organizations. By managing the ratio of debt to equity effectively, organizations are better equipped to withstand economic downturns and unforeseen financial challenges.

- Lower Financial Risk: An optimal capital structure ratio mitigates financial risk. Too much debt can increase risk exposure and the organization’s vulnerability to financial distress. By maintaining a healthy mix of debt and equity, healthcare organizations can reduce their reliance on borrowing and minimize the potential consequences of default or insolvency.

- Better Borrowing Capacity: A favorable capital structure ratio enhances the borrowing capacity of healthcare organizations. Lenders consider the ratio when assessing a company’s creditworthiness. A well-maintained ratio increases the organization’s ability to secure financing at favorable terms and interest rates, providing opportunities for growth and investment.

- Improved Creditworthiness: A higher creditworthiness is a valuable asset for healthcare organizations. A strong capital structure ratio demonstrates financial discipline and stability, which enhances the organization’s reputation and strengthens its creditworthiness. This can lead to better access to capital markets and more favorable partnerships or joint ventures.

- Enhanced Flexibility: An optimal capital structure ratio allows healthcare organizations to maintain flexibility in their financial decisions. It provides the ability to allocate resources efficiently, accommodate changes in business needs, and pursue growth opportunities without being overly constrained by high levels of debt or inadequate equity.

- Attracting Investors: Maintaining an optimal capital structure ratio makes healthcare organizations more attractive to potential investors. Investors seek organizations with a solid financial foundation and an acceptable level of risk. A well-managed ratio signals financial stability, instilling confidence and attracting equity investors looking for long-term growth prospects.

Healthcare organizations must continually assess and optimize their capital structure ratios to derive these benefits. Regular monitoring, financial analysis, and adjustments to debt and equity levels ensure that the capital structure ratio remains aligned with the organization’s strategic goals and risk tolerance.

In summary, maintaining an optimal capital structure ratio in the healthcare industry offers several advantages, including financial stability, reduced risk, increased borrowing capacity, improved creditworthiness, enhanced flexibility, and attraction of investors. By managing their capital structure ratio effectively, healthcare organizations can navigate the dynamic healthcare landscape and position themselves for long-term success.

Challenges in Maintaining an Optimal Capital Structure Ratio in Healthcare

Maintaining an optimal capital structure ratio in the healthcare industry comes with several challenges. These challenges can arise from various internal and external factors that impact the organization’s financial health and capital management practices. Understanding and addressing these challenges is crucial for healthcare organizations to maintain a balanced and sustainable capital structure. Some key challenges include:

- Cyclical Nature of Healthcare: The healthcare industry experiences cyclical patterns, with fluctuations in demand, reimbursement rates, and regulatory changes. These dynamics can impact the financial stability of healthcare organizations, making it challenging to maintain an optimal capital structure ratio over time.

- Increasing Cost of Healthcare Delivery: The rising cost of delivering quality healthcare services poses a challenge for healthcare organizations. To invest in advanced technologies, equipment, and infrastructure, organizations may have to rely on significant debt. Balancing the need for investment and the associated debt burden can be a delicate task.

- Uncertain Regulatory Environment: The ever-changing regulatory landscape in healthcare can pose challenges in maintaining an optimal capital structure ratio. New regulations, reimbursement changes, and compliance requirements can significantly impact the financial operations of healthcare organizations, influencing their debt levels and funding sources.

- Limited Access to Capital: Access to capital can be restricted for healthcare organizations, particularly for smaller healthcare providers and those servicing underserved areas. Limited access to capital can make it difficult to optimize the capital structure ratio, as organizations may be forced to rely on less favorable financing options with higher interest rates or less favorable terms.

- Volatility in Interest Rates: Changes in interest rates can impact the cost of borrowing for healthcare organizations, affecting their debt service costs and overall capital structure. Organizations must navigate the uncertainty of interest rate fluctuations and proactively manage their debt levels to mitigate potential risks.

- Economic Downturns: During economic downturns, healthcare organizations may face decreased patient volumes, lower reimbursements, and financial challenges. This can strain their ability to meet debt obligations and potentially impact their capital structure ratios. Maintaining financial stability and managing debt during such periods can be particularly challenging.

To address these challenges, healthcare organizations must maintain a forward-looking approach to financial management. This includes conducting frequent financial assessments, developing contingency plans, considering alternative funding sources, and proactively managing debt levels. Adapting to industry changes, leveraging technological advancements, and pursuing partnerships or collaborations can also help mitigate some of the challenges associated with maintaining an optimal capital structure ratio.

In summary, maintaining an optimal capital structure ratio in the healthcare industry is not without its challenges. Healthcare organizations must navigate the dynamic nature of the industry, rising costs, regulatory complexities, limited access to capital, interest rate fluctuations, and economic downturns. By proactively addressing these challenges, organizations can optimize their capital structure and ensure long-term financial sustainability.

Strategies to Improve Capital Structure Ratio in Healthcare

Improving the capital structure ratio in healthcare organizations is a key financial objective that can enhance financial stability, reduce risk, and support long-term growth. Here are some effective strategies for improving the capital structure ratio in the healthcare industry:

- Debt Repayment: Prioritize debt repayment to reduce the overall debt burden. Use excess cash flow to pay off high-interest debt and focus on retiring outstanding loans, which will lower the organization’s debt levels and improve the capital structure ratio.

- Equity Financing: Consider equity financing as a means to strengthen the organization’s capital base. This can be achieved through issuing new shares to existing shareholders or attracting new equity investors. Increasing equity in the capital structure can improve the ratio by reducing reliance on debt financing.

- Operational Efficiency: Improve operational efficiency and profitability to generate higher cash flow. Identify and implement cost reduction measures, streamline processes, optimize resource allocation, and enhance revenue collection. Increased profitability translates into an improved debt repayment capacity and a strengthened capital structure ratio.

- Optimize Working Capital: Focus on achieving efficient working capital management. This involves carefully managing cash flow, accounts receivable, accounts payable, and inventory levels. Optimizing working capital can free up cash that can be used for debt reduction or investment in high-return projects, positively impacting the capital structure ratio.

- Capital Expenditure Planning: Implement a disciplined approach to capital expenditure planning. Evaluate investment opportunities based on their potential return on investment and their impact on the capital structure. Prioritize projects that have the potential to increase cash flow and profitability without significantly increasing debt levels.

- Debt Refinancing: Explore options for refinancing debt to take advantage of favorable interest rates and terms. Refinancing can help lower interest costs, extend debt maturity dates, and improve cash flow, thereby positively affecting the capital structure ratio.

- Strong Financial Planning and Forecasting: Implement robust financial planning and forecasting processes to anticipate future financial needs and identify potential areas of risk. This allows healthcare organizations to proactively manage their capital structure and make informed decisions regarding debt and equity financing.

It is important for healthcare organizations to assess their specific financial situation and risk profile when implementing strategies to improve the capital structure ratio. Each organization’s circumstances may differ, and a tailored approach is required for optimal results.

By strategically managing debt, optimizing operations and working capital, and balancing debt and equity financing, healthcare organizations can improve their capital structure ratio. These efforts ultimately enhance financial stability, reduce risk, and provide a solid foundation for sustained growth and success in the healthcare industry.

Conclusion

In the dynamic and ever-evolving healthcare industry, maintaining an optimal capital structure ratio is vital for the financial health and sustainability of organizations. The capital structure ratio, comprising various debt and equity measures, provides insights into a healthcare organization’s financing mix, risk profile, and ability to meet financial obligations.

By carefully managing the capital structure ratio, healthcare organizations can reap numerous benefits. These include increased financial stability, reduced financial risk, improved borrowing capacity, enhanced creditworthiness, operational flexibility, and attraction to potential investors.

However, maintaining an optimal capital structure ratio is not without challenges. The cyclical nature of healthcare, rising costs, regulatory complexities, limited access to capital, interest rate fluctuations, and economic downturns can all pose significant hurdles. To overcome these challenges, healthcare organizations must adapt to industry changes, proactively manage debt, optimize operations, consider equity financing, and maintain strong financial planning and forecasting practices.

In conclusion, healthcare organizations must prioritize the assessment and optimization of their capital structure ratio to ensure financial stability, mitigate risk, and support long-term growth. By navigating the challenges and implementing effective strategies, healthcare organizations can position themselves for success in an increasingly competitive landscape while delivering high-quality care to patients and communities.