Finance

How To Bill Insurance As A Life Coach

Modified: December 30, 2023

Learn how to bill insurance as a life coach and boost your financial success. Master the finance aspect of your coaching business with our expert tips and strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Insurance Billing for Life Coaches

- Credentials and Licensing Requirements

- Establishing a Registered Business Entity

- Setting Up Insurance Provider Network Contracts

- Determining Reimbursement Rates

- Creating and Submitting Claims

- Required Documentation and Compliance

- Handling Denials and Appeals

- Collaborating with Clients and Insurance Companies

- Managing Payments and Reconciliation

- Conclusion

Introduction

Welcome to the world of life coaching, where you have the unique opportunity to make a meaningful impact on the lives of individuals seeking guidance and personal growth. As a life coach, you possess the skills and expertise to help others navigate challenges, set and achieve goals, and unlock their true potential. While the personal rewards of this profession are abundant, it’s essential to understand the practical aspects of running a successful coaching practice, including billing insurance.

Insurance billing for life coaches may seem daunting at first, as it involves navigating complex processes and procedures. However, by familiarizing yourself with the ins and outs of insurance billing, you can expand your client base and provide your services to a broader population.

In this article, we will guide you through the intricacies of billing insurance as a life coach. From understanding the necessary credentials and licensing requirements to setting up insurance provider network contracts and creating and submitting claims, we will cover all the essential aspects of insurance billing for life coaches. Additionally, we will provide insights on how to handle denials and appeals, collaborate effectively with clients and insurance companies, and manage payments and reconciliation.

While insurance billing can be a complex process, the benefits are numerous. By offering insurance coverage to your clients, you are not only expanding your client base but also making your services more accessible and affordable. Many individuals seeking life coaching services may have insurance coverage that can help offset the cost, making it a win-win situation for both you and your clients.

So, let’s dive into the world of insurance billing for life coaches and discover the steps you need to take to make this process seamless and successful. Whether you are just starting your coaching practice or looking to expand your existing client base, understanding insurance billing will be a valuable skill that can help you thrive in the competitive field of life coaching.

Understanding Insurance Billing for Life Coaches

Insurance billing for life coaches involves the process of submitting claims to insurance companies to receive reimbursement for the services provided to clients. While insurance coverage for life coaching services may vary depending on the insurance plan and provider, understanding the fundamentals of insurance billing is crucial for successfully navigating this aspect of your coaching practice.

One of the key factors to consider when it comes to insurance billing is understanding the specific services that can be covered by insurance. While life coaching itself may not be covered by insurance, certain components or aspects of your practice may be eligible for reimbursement. For example, if you have specialized training or certifications in areas such as mental health coaching, career coaching, or wellness coaching, there may be opportunities for insurance coverage.

It is important to conduct thorough research and familiarize yourself with the insurance companies and plans that offer coverage for the specific services you provide. This will help you determine which insurance providers to partner with and enable you to assist your clients in understanding their insurance benefits and coverage.

Another crucial aspect of understanding insurance billing is knowing the difference between in-network and out-of-network providers. In-network providers have negotiated contracts and agreed-upon reimbursement rates with insurance companies, which means that they are eligible to receive direct payment from the insurance company for the services provided. As a life coach, becoming an in-network provider can greatly streamline the reimbursement process and ensure that you receive timely payment for your services.

On the other hand, if you choose to be an out-of-network provider, you may still be able to bill insurance but often at a lower reimbursement rate and with different reimbursement procedures. It is important to assess whether becoming an out-of-network provider is a viable option for your practice based on factors such as your target client population, market demand, and the specific requirements of insurance companies in your area.

Understanding the intricacies of insurance billing for life coaches is essential for establishing a successful and sustainable practice. By familiarizing yourself with the specific services that can be covered by insurance, partnering with the right insurance providers, and determining whether to be an in-network or out-of-network provider, you can streamline the billing process and ensure that your clients can access the benefits of insurance coverage for your services.

Credentials and Licensing Requirements

When it comes to billing insurance as a life coach, it is essential to have the necessary credentials and licensing required by insurance companies. While the specific requirements may vary depending on your location and the insurance providers you work with, there are some common credentials and licenses that are generally recognized within the industry.

One of the most widely recognized credentials for life coaches is the International Coach Federation (ICF) certification. The ICF is a globally recognized organization that provides accreditation for professional coaches. Attaining an ICF credential demonstrates your commitment to the highest professional standards and can lend credibility to your practice when working with insurance companies.

It is important to research the specific requirements of the insurance providers you plan to work with to ensure that you fulfill their credentialing criteria. Some insurance companies may also accept alternative certifications or licenses, such as those related to counseling, therapy, or psychology.

In addition to credentials, it is crucial to be aware of any licensing requirements that may apply to your practice. Depending on your jurisdiction, you may need to obtain a specific license or registration to offer life coaching services. This is especially true if your coaching practice encompasses areas such as mental health or counseling.

Research the licensing requirements in your region and ensure that you fulfill all the necessary obligations. This may include acquiring a state-specific coaching license, registering as a practicing coach, or obtaining relevant certifications in specialized areas of coaching.

By obtaining the appropriate credentials and fulfilling licensing requirements, you not only meet the standards set by insurance companies but also enhance your professional credibility and demonstrate your commitment to maintaining high ethical standards in your coaching practice.

Remember to keep your credentials and licenses up to date and stay informed about any changes or updates in the requirements. This will ensure that you are always in compliance with insurance provider criteria and can continue billing insurance seamlessly.

Having the right credentials and licenses is a crucial step towards successful insurance billing as a life coach. It not only allows you to confidently partner with insurance providers but also gives your clients peace of mind, knowing that they are working with a qualified and accredited professional. Take the time to understand the credentialing and licensing requirements that apply to your practice and invest in your professional development to set yourself up for success in the insurance billing process.

Establishing a Registered Business Entity

When billing insurance as a life coach, it is important to establish a registered business entity to ensure legal and financial compliance. Registering your coaching practice as a formal business entity not only provides a professional appearance but also protects your personal assets and simplifies the insurance billing process.

The first step in establishing a registered business entity is choosing the right business structure. The most common options for small businesses include sole proprietorship, partnership, limited liability company (LLC), and corporation. Each structure has its own advantages and requirements, so it is important to consult with a legal professional or business advisor to determine the best fit for your coaching practice.

Once you have decided on a business structure, you will need to register your business with the appropriate government authorities. This typically involves filing the necessary paperwork and paying the required fees. The process may vary depending on your location, so it is advisable to research the specific registration requirements in your jurisdiction.

In addition to registering your business, you may also need to obtain a tax identification number, such as an Employer Identification Number (EIN), to facilitate the insurance billing process. An EIN helps separate your personal and business finances and ensures that you can accurately report your income and expenses to the relevant tax authorities.

Some insurance providers may require proof of your registered business entity and tax identification number before allowing you to become an in-network provider. By taking the necessary steps to establish a registered business entity, you can provide the documentation required by insurance companies, thereby increasing your chances of being accepted into their provider networks.

Establishing a registered business entity also allows you to comply with any local, state, or federal regulations that may apply to your coaching practice. This includes obtaining any necessary permits or licenses specific to your industry or location.

By treating your coaching practice as a registered business entity, you demonstrate your professionalism and commitment to operating within the legal framework. It instills trust in both insurance companies and clients, giving them confidence in your ability to handle insurance billing and deliver quality services.

Remember, consulting with legal professionals and business advisors can provide valuable guidance throughout the process of establishing a registered business entity. Their expertise can help ensure that you fulfil all the necessary legal and financial obligations, allowing you to focus on what you do best – helping and supporting your clients as a life coach.

Setting Up Insurance Provider Network Contracts

As a life coach seeking to bill insurance, one of the crucial steps is establishing contracts with insurance provider networks. Joining these networks allows you to become an in-network provider, which not only expands your client base but also simplifies the insurance billing process and increases the likelihood of receiving timely payments for your services.

Start by researching and identifying the insurance provider networks that align with your target client population and the services you offer. Reach out to these networks to express your interest in becoming a contracted provider. Most insurance companies have specific procedures and requirements for joining their network, so it is important to follow their guidelines closely.

One of the key factors that insurance companies consider when reviewing applications is your credentials and experience in the relevant coaching field. Ensure that you highlight your qualifications and any specialized training or certifications you possess that are relevant to the services covered by insurance.

In addition to your credentials, insurance providers may also require you to submit documentation such as proof of your registered business entity, liability insurance coverage, and tax identification number. Be prepared to provide any requested documentation promptly to expedite the contracting process.

Once accepted into an insurance provider network, you will receive a contract outlining the terms and conditions of your participation. Carefully review the contract and seek legal advice if needed to ensure that you understand the rights and obligations outlined in the agreement.

The contract will typically specify the reimbursement rates for your services, the procedures for submitting claims, and any additional requirements such as documentation or reporting. Familiarize yourself with these details, as they will guide you in properly billing and working with the insurance companies.

It is important to note that reimbursement rates can vary between insurance providers and may be subject to negotiation. If you believe the proposed rates are not sufficient, you can propose an adjustment based on your qualifications, experience, and the market rates for similar services. Remember that negotiations may not always be successful, but it is worth advocating for fair compensation for your professional expertise.

By setting up contracts with insurance provider networks, you position yourself to benefit from increased client referrals and streamlined insurance billing processes. Being an in-network provider increases your credibility and accessibility to a wider client base, ultimately contributing to the growth and success of your coaching practice.

Determining Reimbursement Rates

Determining the reimbursement rates for your services as a life coach is a crucial step in the insurance billing process. Reimbursement rates not only determine the amount you will be paid by insurance companies for your services but also impact your practice’s financial sustainability and competitiveness. Here are some key factors to consider when determining reimbursement rates:

Industry Standards: Research industry standards and local market rates for life coaching services. This will give you a benchmark to assess whether the proposed reimbursement rates from insurance companies align with the prevailing rates in your area.

Experience and Expertise: Take into account your level of experience, specialized training, certifications, and expertise when determining your deserved reimbursement rates. Higher qualifications and specialized skills may warrant higher rates as they reflect the value and quality of your services.

Time and Effort: Consider the amount of time and effort you invest in each client session, including preparation, follow-up, administrative tasks, and ongoing support provided. These factors should be reflected in your reimbursement rates to ensure you are adequately compensated for your time and expertise.

Insurance Provider Guidelines: Familiarize yourself with the reimbursement guidelines of each insurance provider network you are contracted with. Each network may have specific criteria and limits for reimbursement rates. Ensure that your proposed rates fall within the acceptable range to avoid potential conflicts or claim denials.

Local Cost of Living: Take into account the cost of living in your area when determining reimbursement rates. Higher living costs may justify higher rates to cover your expenses and maintain a sustainable practice.

Client Base: Understand your target client base and their ability to pay for your services. Consider the demographics and income levels of your potential clients when setting your reimbursement rates. You want to strike a balance between fair compensation for your services and accessibility for your target market.

Negotiation: In some cases, insurance providers may be open to negotiation regarding reimbursement rates. If you believe the proposed rates are not sufficient, you can present a persuasive case based on industry standards, your credentials, and the value you bring to clients. However, it’s important to recognize that negotiations may not always be successful, so be prepared to carefully evaluate the terms offered.

By carefully considering these factors, you can determine fair and competitive reimbursement rates for your life coaching services. Remember, finding the right balance is key to ensuring financial sustainability for your practice while providing accessible and affordable services to your clients.

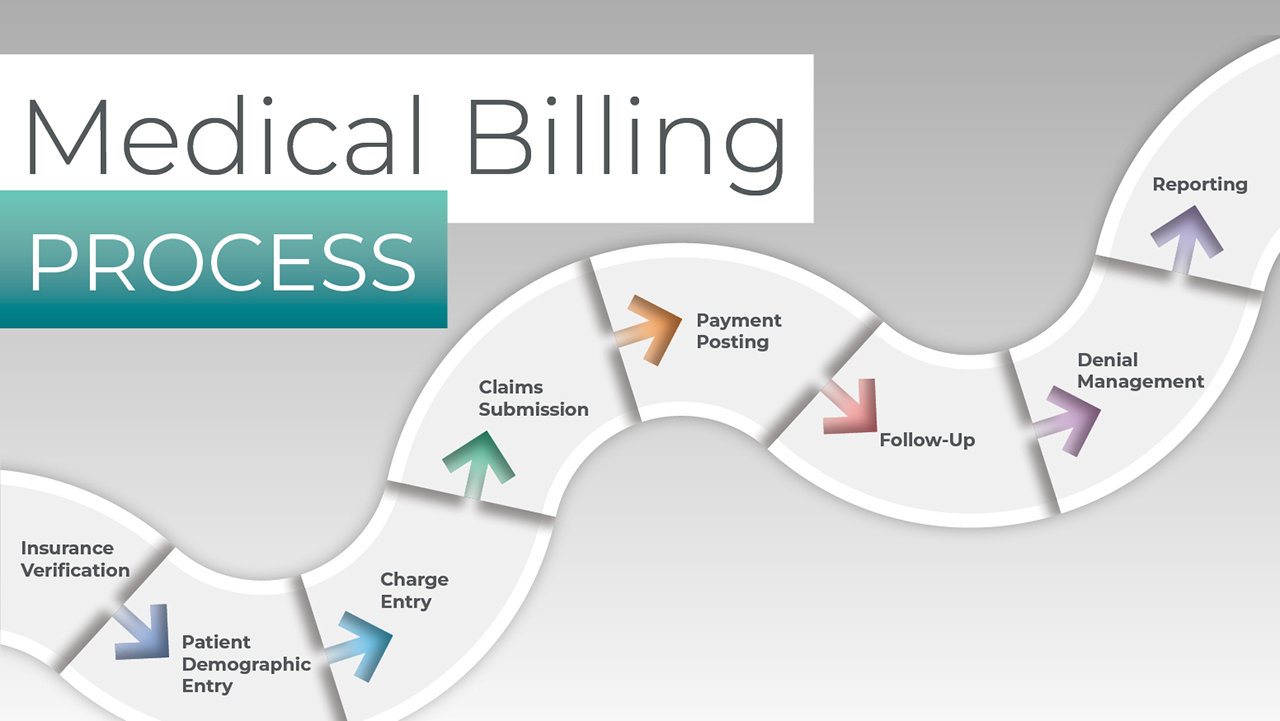

Creating and Submitting Claims

Creating and submitting claims is a crucial step in the insurance billing process for life coaches. It involves accurately documenting the services provided to clients and submitting the necessary information to insurance companies for reimbursement. Here are some important considerations when creating and submitting claims:

Documentation: Keep thorough and accurate records of each client session, including the date, duration, and a detailed description of the services provided. Documentation should also include relevant progress notes, treatment plans, and any other required information specified by the insurance provider.

Coding: Assign the appropriate billing codes to each service rendered. Commonly used codes for life coaching services include CPT codes (Current Procedural Terminology) for evaluation and management, as well as ICD-10 codes (International Classification of Diseases) for any relevant diagnoses or conditions being addressed in the coaching sessions. Proper coding ensures that insurance companies can process claims accurately and efficiently.

Electronic Claims Submission: Many insurance companies now require electronic claims submission, which simplifies and expedites the process. Ensure that you have the necessary electronic billing software or systems in place to meet the submission requirements of the insurance providers you work with.

Timeliness: Submit claims in a timely manner to ensure prompt reimbursement. Familiarize yourself with the specific deadlines and submission requirements of each insurance provider network you are contracted with. Failure to submit claims within the specified timeframe may lead to claim denials or delayed payments.

Clean Claims: Double-check the accuracy and completeness of the information provided in the claim form to prevent claim rejections or delays. Ensure that all required fields are properly filled out, and verify that the documentation and coding align with the services rendered.

Follow-Up: Keep track of submitted claims and follow up with insurance companies on a regular basis to ensure that they are being processed. Inquire about the status of claims that have not been paid or denied and take appropriate action, such as submitting additional documentation or appealing denials if necessary.

Claim Tracking: Implement a systematic method for tracking claims, payments, and outstanding balances. This will help you stay organized and ensure that all claims are processed and paid in a timely manner. Consider utilizing billing software or practice management systems that can streamline this process.

By adhering to these guidelines and implementing efficient systems for creating and submitting claims, you can navigate the insurance billing process smoothly. Accurate and timely claims submission will increase the likelihood of reimbursement, thereby contributing to the financial stability and growth of your life coaching practice.

Required Documentation and Compliance

When billing insurance as a life coach, adhering to the necessary documentation and compliance requirements is essential. Insurance companies have specific guidelines and regulations that must be followed to ensure successful claims and reimbursement. Here is a list of key documentation and compliance considerations:

Treatment Plans: Develop comprehensive treatment plans for each client that outline their goals, objectives, and the intended duration of the coaching services. These plans provide a roadmap for the coaching process and establish the basis for insurance coverage and reimbursement.

Progress Notes: Maintain detailed and organized progress notes for each client session. Progress notes should include the date of the session, a summary of what was discussed or accomplished, any insights gained, and the next steps planned. Thorough progress notes serve as evidence of the services provided and support the necessity and effectiveness of the coaching process.

Privacy and Confidentiality: Ensure that you maintain strict privacy and confidentiality standards when handling client information. Comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States, or the applicable privacy laws in your country. Obtain appropriate consent forms from clients for the release of information to insurance companies as needed.

Informed Consent: Obtain informed consent from clients, informing them about the nature and limitations of insurance coverage for life coaching services. Clearly communicate the potential costs and benefits associated with using insurance, as well as any limitations on confidentiality that may arise due to insurance billing requirements.

Compliance with Insurance Policies: Familiarize yourself with the policies and procedures of each insurance provider network you work with. Ensure that you understand their specific documentation requirements, claims submission processes, and any additional compliance guidelines they have in place.

“Medical Necessity” and Justification: When submitting claims, clearly demonstrate the medical necessity of the coaching services provided. Include detailed information regarding how the coaching sessions address specific conditions, symptoms, or diagnoses that warrant insurance coverage. Insurance providers often require justification for the services provided, especially if they are related to mental health or specific therapeutic interventions.

Record Retention: Maintain accurate and organized records of all client-related documentation for the required retention period. This includes progress notes, treatment plans, consent forms, insurance claims, and any other relevant documents. Retain these records in a secure manner and ensure compliance with legal and regulatory requirements regarding record retention.

Continuing Education and Professional Development: Stay up-to-date with the latest industry standards, best practices, and regulatory changes through ongoing professional development. Attend workshops, conferences, and training programs to enhance your knowledge and skills. Compliance with continuing education requirements not only ensures your competency but also aligns with insurance company expectations.

By understanding and adhering to the required documentation and compliance guidelines, you can navigate the insurance billing process with confidence. This ensures that you maintain compliance with applicable regulations, support successful claims submission, and foster a professional and ethical approach to your life coaching practice.

Handling Denials and Appeals

As a life coach billing insurance, it is essential to be prepared for the possibility of claim denials. Insurance companies have specific criteria and policies that must be met for claims to be approved. However, if your claim is denied, there are steps you can take to navigate the appeals process and potentially reverse the decision. Here are some key considerations for handling denials and appeals:

Review the Denial: Carefully review the denial notice provided by the insurance company. Understand the reason for the denial, whether it is due to missing information, insufficient documentation, or a disagreement about the medical necessity of the services provided. Analyze the denial letter to identify specific requirements that need to be addressed in the appeals process.

Understand Insurance Policies: Familiarize yourself with the insurance company’s policies and coverage guidelines. This will help you identify any potential gaps or inconsistencies in their decision and determine the best approach for the appeal. Understanding the specific criteria insurance companies use to determine medical necessity can be particularly helpful in building your case.

Gather Supporting Documentation: Compile any additional documentation or information that supports the medical necessity and effectiveness of the coaching services provided. This may include progress notes, treatment plans, letters of support from other healthcare professionals, or any relevant research or literature that validates the approaches used in your coaching practice. Strong supporting documentation can significantly strengthen your appeal.

Communicate with the Client: Inform your client about the denial and involve them in the appeals process. Explain the reasons for the denial and discuss potential next steps. Clients can provide input and additional information that may support the appeal. Keeping them informed and involving them in the process maintains transparency and strengthens the client-coach relationship.

Follow Appeals Procedures: Each insurance company has specific procedures for filing appeals. Ensure that you understand these procedures and submit the appeal within the allotted timeframe. Pay attention to any required forms, documentation, or additional information that needs to be provided.

Craft a Persuasive Appeal: Use your knowledge, expertise, and supporting documentation to construct a compelling appeal letter. Clearly outline the reasons why the denial should be overturned, referencing relevant policy provisions, and providing evidence of medical necessity. Articulate how the coaching services address the client’s specific needs and contribute to their overall well-being.

Document and Track the Appeal: Keep a record of all correspondence and documentation related to the appeal. This includes copies of the appeal letter, any supporting evidence or reports, as well as any responses or communications from the insurance company. Maintain a systematic approach to track the progress of the appeal and ensure that all necessary steps are taken within the defined timelines.

Consider Seeking Professional Help: If navigating the appeals process becomes overwhelming or complex, consider seeking assistance from a healthcare attorney, billing specialist, or consultant experienced in insurance reimbursement. These professionals can provide guidance, expertise, and support in handling claim denials and appeals.

Remember to remain patient and persistent throughout the appeals process. Appeals can sometimes take time to be resolved, but your efforts can result in the approval of the claim and reimbursement for the services provided. By understanding the denial, gathering strong supporting documentation, and following the appeals procedures, you can effectively handle claim denials and increase the chances of a successful appeal.

Collaborating with Clients and Insurance Companies

Collaboration with both clients and insurance companies is crucial for a smooth insurance billing process as a life coach. Building strong relationships and effective communication with both parties can enhance the overall experience and ensure successful reimbursement. Here are some key considerations for collaborating with clients and insurance companies:

Client Education: Be proactive in educating your clients about insurance coverage for life coaching services. Clearly explain the benefits, limitations, and potential costs associated with using insurance. Provide information about the specific insurance plans you accept and help clients navigate the complexities of using their insurance benefits.

Verification of Insurance Benefits: Assist clients in verifying their insurance benefits and coverage before the start of coaching sessions. Help them understand the details of their plan, including copayments, deductibles, and any limitations or restrictions on coverage. This ensures transparency and helps manage client expectations regarding costs and reimbursement.

Pre-Authorization: Determine whether pre-authorization or pre-certification is required by the insurance company for life coaching services. Work with your clients to complete the necessary paperwork and obtain the required authorizations prior to starting the coaching sessions. This helps facilitate the reimbursement process and minimizes the risk of claim denials.

Collaborative Treatment Planning: Involve clients in the development of treatment plans and goal-setting processes. Encourage their active participation and input, as this not only fosters a sense of ownership and commitment but also ensures that the coaching services align with their needs and expectations. Collaboration with clients enhances the effectiveness of the coaching process and strengthens the case for insurance reimbursement.

Communication and Documentation: Maintain open and clear communication with clients throughout the coaching journey. Regularly update progress notes, treatment plans, and any other required documentation. Keep clients informed about the documentation and reporting requirements specific to insurance billing and explain how their information will be handled to ensure privacy and confidentiality.

Coordinating with Insurance Companies: Establish efficient lines of communication with the insurance companies you work with. Understand their preferred method of communication, documentation submission, and any specific requirements they have for claim processing. Keeping abreast of any changes or updates in their policies or procedures helps streamline the billing process.

Advocacy for Clients: Serve as an advocate for your clients when interacting with insurance companies. Be prepared to provide additional information, clarification, or appeal denials on their behalf. Your expertise and understanding of the coaching profession can help insurance companies better comprehend the value and effectiveness of life coaching services.

Professionalism and Ethical Conduct: Maintain high standards of professionalism and ethical conduct in all interactions with both clients and insurance companies. Treat all parties with respect, empathy, and integrity. Adhere to the applicable codes of ethics and professional guidelines established by coaching associations and licensing bodies.

By fostering collaborative relationships with both clients and insurance companies, you can navigate the insurance billing process more effectively. Collaboration ensures that clients understand their insurance coverage, feel supported in their journey, and receive the reimbursement they are entitled to. Effective communication and coordination with insurance companies contribute to smoother claims processing and reimbursement for your life coaching services.

Managing Payments and Reconciliation

Efficiently managing payments and reconciliation is essential when billing insurance as a life coach. It involves tracking, processing, and reconciling payments received from insurance companies and clients. An organized approach to managing payments ensures financial stability and keeps your practice running smoothly. Here are some key considerations for effectively managing payments and reconciliation:

Clear Payment Policies: Establish clear payment policies that outline your expectations and procedures for payment. Communicate these policies to clients from the outset of the coaching relationship, including information about insurance billing, copayments, deductibles, and any out-of-pocket costs they may incur. Transparency about financial matters fosters trust and minimizes confusion.

Verification and Confirmation of Insurance Coverage: Verify insurance coverage and benefits before each session to ensure that the client’s policy is active and covers the services rendered. Confirm co-payment requirements, deductibles, and any other cost-sharing obligations with both the insurance company and the client. This helps avoid payment discrepancies and surprises.

Timely Claims Submission: Submit claims promptly to insurance companies to expedite the reimbursement process. Electronic claims submission is often the preferred method, as it reduces errors and allows for faster processing. Timely claims submission contributes to reliable cash flow and reduces the risk of delayed payments.

Tracking Payments and Reimbursements: Implement a systematic approach to track payments and reimbursements. Use practice management software or accounting tools to record and monitor the status of each claim, payment, and outstanding balance. This enables you to identify any discrepancies or outstanding payments that need attention.

Reconciliation of Payments: Regularly reconcile payments received from insurance companies with the expected reimbursement amounts. Check that payments align with the submitted claims and the contracted reimbursement rates. Review and resolve any discrepancies to ensure accurate financial records and to address any potential billing errors or underpayments.

Client Invoicing and Payment Reminders: For any outstanding client payments required after insurance reimbursement, send clear and prompt invoices to clients detailing the remaining balance. Implement payment reminder systems to minimize delays in receiving client payments. Maintain professionalism and empathy in your communication while ensuring that your payment expectations are clear.

Financial Policies and Agreements: Have clear financial policies and agreements in place that outline your approach to billing, payments, and any applicable late fees or penalties. Share these policies with clients and obtain their acknowledgment and agreement in writing to avoid any misunderstandings or disputes.

Regular Financial Reviews: Conduct regular financial reviews to assess the overall financial health and performance of your coaching practice. Analyze and track metrics such as revenue, reimbursement rates, outstanding balances, and collection rates. This information can help you identify areas for improvement and make informed financial decisions.

Professional Support: Consider engaging the services of a professional bookkeeper or accountant specializing in healthcare billing. They can assist you in managing payments, ensuring accurate financial records, and navigating any challenges or complexities that may arise with insurance billing and reimbursement.

By efficiently managing payments and reconciliation, you can maintain the financial stability of your life coaching practice. Clear payment policies, timely claims submission, diligent tracking of payments and reimbursements, and professional support contribute to a streamlined payment process and increased revenue. Effective financial management allows you to focus on what you do best – providing transformative coaching services to your clients.

Conclusion

Billing insurance as a life coach can open new doors and opportunities for your practice, allowing you to reach a wider client base and provide accessible services. However, navigating the intricacies of insurance billing requires a solid understanding of the process, documentation requirements, and collaboration with both clients and insurance companies.

In this comprehensive guide, we have explored the key steps involved in billing insurance as a life coach. From understanding the necessary credentials and licensing requirements to establishing a registered business entity and setting up insurance provider network contracts, each stage is crucial in ensuring a successful insurance billing process.

We discussed the importance of determining fair reimbursement rates based on industry standards, your qualifications, and the unique factors that influence your practice. Properly creating and submitting claims, along with maintaining the necessary documentation and compliance requirements, significantly increases the likelihood of successful reimbursement.

Handling claim denials and appeals can be challenging, but it is an essential part of the insurance billing process. Building strong relationships with clients and collaborating effectively with insurance companies can make a significant difference in addressing denials and increasing the chances of successful appeals.

Managing payments and reconciliation is vital for the financial stability of your practice. By establishing clear payment policies, tracking and reconciling payments, and implementing reliable systems, you can ensure a smooth and efficient payment process.

As you embark on your journey to bill insurance as a life coach, remember to stay informed, maintain professionalism, and seek support when necessary. Stay up-to-date with industry regulations, connect with professional networks, and consider working with experts in insurance billing and financial management.

By mastering the ins and outs of insurance billing, you can enhance the accessibility of your services, increase your client base, and contribute to the growth and success of your life coaching practice. Embrace the opportunity to make a difference in the lives of others while building a thriving business as a valued provider in the insurance landscape.