Finance

What Is A Working Capital Ratio

Published: December 19, 2023

Discover the importance of understanding the finance aspect of a working capital ratio and how it affects your business's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers and ratios hold the key to understanding the financial health of a company. One such important ratio is the working capital ratio, which provides valuable insights into a company’s ability to meet short-term financial obligations.

The working capital ratio is a fundamental measure of a company’s liquidity and operational efficiency. It represents the relationship between a company’s current assets and current liabilities, giving investors, creditors, and other stakeholders an indication of how well the company can cover its short-term debts.

This ratio is crucial because it helps assess a company’s ability to manage day-to-day operations effectively. A healthy working capital ratio is often seen as a positive sign, as it indicates that a company has enough resources to cover its short-term obligations without relying heavily on external financing.

Throughout this article, we’ll delve into the definition, calculation, interpretation, and importance of the working capital ratio. We’ll also explore the factors that affect this ratio and provide real-life examples to help illustrate its practical application.

So, whether you’re an investor looking to evaluate a potential investment or a business owner aiming to optimize your company’s financial health, understanding the working capital ratio is essential. Let’s dive in!

Definition of Working Capital Ratio

The working capital ratio, also known as the current ratio, is a financial metric that compares a company’s current assets to its current liabilities. It measures the company’s liquidity and ability to meet short-term obligations. In simpler terms, it indicates how well a company can cover its immediate financial commitments using its available assets.

The formula to calculate the working capital ratio is:

Working Capital Ratio = Current Assets / Current Liabilities

The current assets include cash, accounts receivable, inventory, and other assets expected to be converted into cash within a year, while the current liabilities include accounts payable, short-term debts, and other obligations due within a year.

A working capital ratio of 1 or higher is generally considered favorable, as it indicates that the company’s current assets are sufficient to cover its current liabilities. A ratio below 1 implies that the company may have difficulties meeting its short-term obligations.

It’s important to note that the calculation of the working capital ratio provides a snapshot of a company’s liquidity at a specific point in time. Therefore, it should be interpreted in conjunction with other financial metrics to gain a comprehensive understanding of the company’s financial health.

Next, we’ll explore why the working capital ratio is important for investors, creditors, and other stakeholders.

Importance of Working Capital Ratio

The working capital ratio is a crucial metric that holds significant importance for various stakeholders involved in assessing a company’s financial health. Here are some key reasons why the working capital ratio is important:

- Assessing Short-Term Liquidity: The working capital ratio provides insight into a company’s ability to meet its short-term obligations. By comparing current assets to current liabilities, investors and creditors can determine if a company has enough liquid resources to pay off its debts, cover inventory costs, and manage day-to-day operations.

- Evaluating Financial Health: A healthy working capital ratio indicates that a company can efficiently manage its working capital, ensuring smooth operations and reducing the risk of insolvency. It highlights the company’s ability to generate cash and finance its current liabilities without needing to rely heavily on external sources of funding.

- Identifying Operational Efficiency: By analyzing the working capital ratio over time, stakeholders can gain insights into a company’s operational efficiency. A consistent working capital ratio or gradual improvement signifies effective management of key components, such as inventory, accounts receivable, and accounts payable.

- Predicting Cash Flow: A company with a high working capital ratio may have excess cash flow, allowing it to take advantage of investment opportunities, fund growth initiatives, or return value to shareholders through dividends or share buybacks. Conversely, a low working capital ratio may imply struggling cash flow, potential liquidity issues, or the need for external financing.

- Comparing Performance: The working capital ratio is a valuable tool for benchmarking a company’s performance against industry peers or competitors. It provides a basis for comparison to evaluate if a company’s liquidity position is better or worse than its counterparts in the same sector.

Overall, the working capital ratio offers valuable insights into a company’s financial position, liquidity, and operational efficiency. It helps stakeholders make informed decisions regarding investment, lending, and assessing the short-term financial health of a company.

Next, we’ll dive into how the working capital ratio is calculated and interpreted.

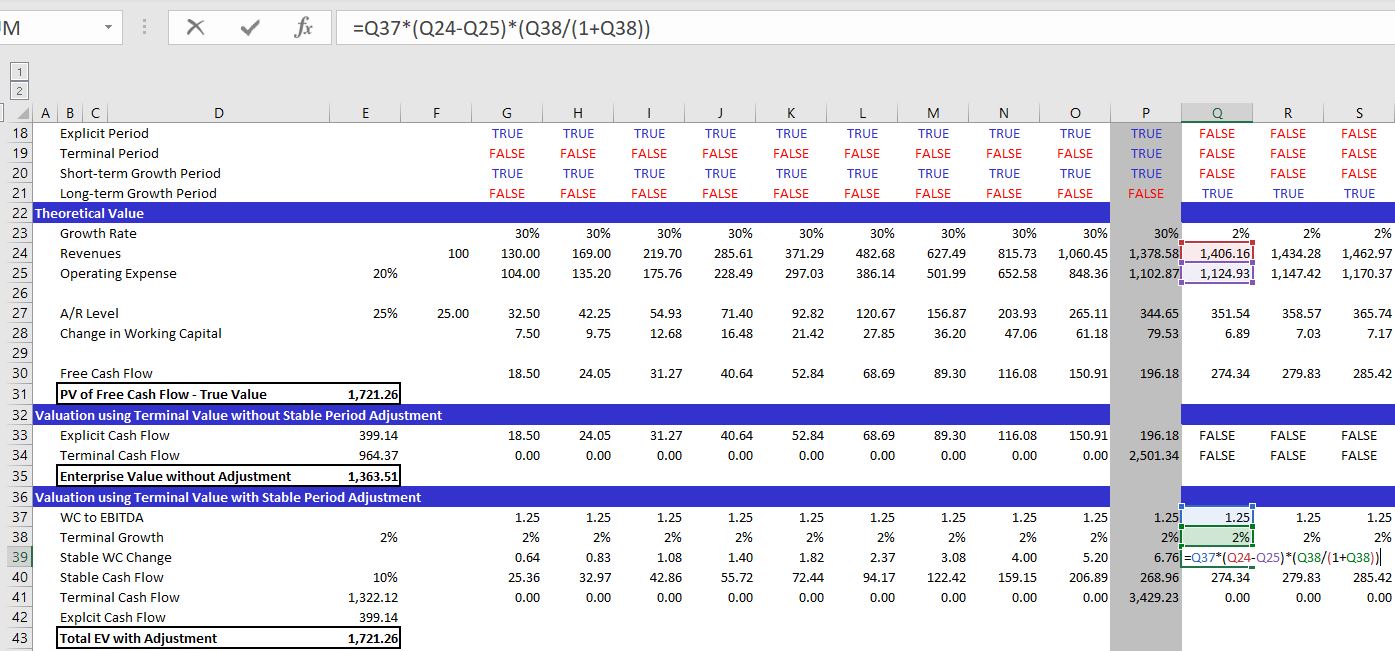

Calculation of Working Capital Ratio

The working capital ratio, also known as the current ratio, is calculated by dividing a company’s current assets by its current liabilities. The formula for calculating the working capital ratio is as follows:

Working Capital Ratio = Current Assets / Current Liabilities

To calculate the working capital ratio, you need to gather the relevant financial information from a company’s balance sheet. Current assets include cash, accounts receivable, inventory, and other assets that are expected to be converted to cash within a year. Current liabilities include accounts payable, short-term debts, and other obligations that are due within a year.

Let’s consider an example:

- Company XYZ has current assets of $200,000

- Company XYZ has current liabilities of $100,000

Using the formula, we can calculate the working capital ratio:

Working Capital Ratio = $200,000 / $100,000 = 2

In this example, Company XYZ has a working capital ratio of 2, indicating that it has $2 in current assets for every $1 of current liabilities. This suggests that the company has sufficient liquidity to meet its short-term obligations.

It’s important to note that the working capital ratio provides a snapshot of a company’s liquidity at a specific point in time. For a more accurate assessment, it’s advisable to calculate and analyze the working capital ratio over multiple periods, considering trends and industry benchmarks.

Next, we’ll explore how to interpret the working capital ratio and what it reveals about a company’s financial health.

Interpreting Working Capital Ratio

The working capital ratio, or current ratio, provides insights into a company’s financial health and liquidity position. It is important to understand how to interpret the ratio to make informed decisions regarding a company’s financial situation. Here are some key points to consider when analyzing the working capital ratio:

- Working Capital Ratio < 1: A working capital ratio below 1 indicates that a company may have difficulty meeting its short-term obligations using its current assets alone. This may signal a potential liquidity problem or an inefficient management of working capital. It is important to further investigate the reasons for the low ratio, such as high levels of debt or ineffective cash management.

- Working Capital Ratio = 1: A working capital ratio of 1 implies that a company’s current assets are equal to its current liabilities. While it may seem ideal, it is important to consider the industry norms and the specific circumstances of the company. If the industry typically has higher working capital ratios, a ratio of 1 may indicate subpar liquidity. Additionally, a ratio of exactly 1 may leave little room for unexpected expenses, so caution should be exercised.

- Working Capital Ratio > 1: A working capital ratio above 1 is generally considered favorable, as it suggests that a company has more current assets than current liabilities. It indicates that the company can cover its short-term obligations and has a cushion of liquidity. However, a very high working capital ratio may imply that the company is holding too much cash or has inefficient utilization of working capital that could be put to better use.

- Working Capital Ratio Trends: It’s important to analyze the working capital ratio over time to identify any trends. Consistently improving or stable ratios indicate efficient management of working capital and a strong financial position. Conversely, a declining or volatile ratio may point to potential financial challenges or inefficiencies in managing short-term obligations.

- Industry Comparison: Comparing a company’s working capital ratio to industry peers or competitors can provide valuable insights. Different industries have different working capital requirements, so it’s crucial to consider the industry norms while making comparisons. A significantly lower or higher ratio than competitors could indicate a potential advantage or weakness.

It’s important to note that the working capital ratio should be used in conjunction with other financial metrics and qualitative factors to gain a comprehensive understanding of a company’s financial health and liquidity position.

Next, let’s explore the factors that can influence a company’s working capital ratio.

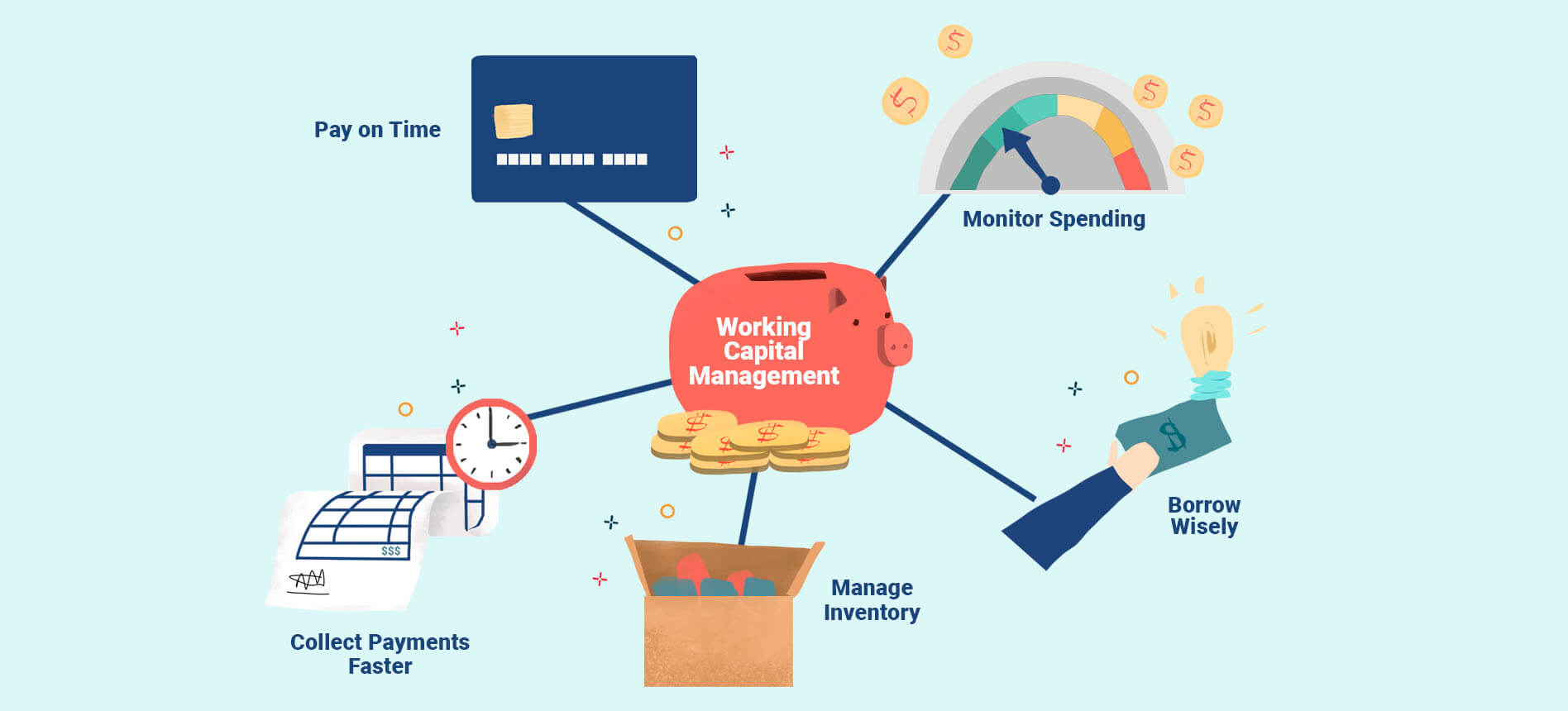

Factors Affecting Working Capital Ratio

Several factors can influence a company’s working capital ratio, impacting its liquidity and financial health. It’s essential to consider these factors when analyzing the working capital ratio to gain a comprehensive understanding of a company’s financial position. Here are some key factors that can have an impact:

- Business Seasonality: Industries or businesses with seasonal fluctuations in revenue and expenses may experience significant variations in working capital requirements. For example, a retail business may require higher inventory levels during peak seasons, leading to a temporary decrease in its working capital ratio.

- Industry Dynamics: Different industries have distinct working capital needs. For instance, companies in manufacturing may have higher inventory levels and longer receivables cycles, affecting their working capital ratio. Understanding the working capital requirements specific to the industry is crucial for accurate interpretation.

- Business Growth: Rapidly expanding businesses often require additional working capital to support increased operations. Investing in new equipment or hiring more employees may increase current assets, resulting in a lower working capital ratio. It’s important to assess whether the company’s growth is sustainable and if it can effectively manage its working capital needs.

- Efficiency of Working Capital Management: The efficiency with which a company manages its working capital can impact its working capital ratio. Effective management of inventory levels, accounts receivable, and accounts payable can optimize the ratio. Timely collection of receivables, negotiating favorable credit terms, and maintaining lean inventory levels can positively influence the working capital ratio.

- Debt and Financing: The use of debt and financing options can affect a company’s working capital ratio. High levels of short-term debt or excessive reliance on external financing may increase current liabilities, leading to a lower ratio. It’s important to assess the company’s ability to cover its financial obligations and manage its debt effectively.

- Supplier and Customer Relationships: The terms and relationships with suppliers and customers can impact the working capital ratio. Longer payment terms from suppliers or delayed payments from customers can tie up cash and increase accounts payable, having a negative effect on the ratio. Strong supplier relationships and prompt payment from customers can optimize the working capital position.

Considering these factors helps provide a holistic view of a company’s working capital ratio and its overall financial situation. It’s important to analyze these factors in conjunction with the ratio to accurately assess a company’s liquidity position and financial health.

Next, let’s explore an example to see how working capital ratio analysis can be applied in a real-life scenario.

Example of Working Capital Ratio Analysis

Let’s consider a hypothetical example to illustrate how working capital ratio analysis can be applied in a real-life scenario. We’ll examine the financial statements of Company ABC, a manufacturing company, and calculate its working capital ratio to gain insights into its liquidity position.

Company ABC’s financial statements reveal the following information:

- Current assets: $500,000

- Current liabilities: $400,000

Using the formula, we can calculate the working capital ratio:

Working Capital Ratio = $500,000 / $400,000 = 1.25

In this example, Company ABC has a working capital ratio of 1.25, indicating that it has $1.25 in current assets for every $1 of current liabilities. This suggests that the company has a favorable liquidity position, with sufficient assets to cover its short-term obligations.

However, to gain a comprehensive understanding of the company’s financial health, it’s important to consider various factors. For instance:

- The industry average working capital ratio is 1.5. Company ABC’s ratio of 1.25 may indicate that it has lower liquidity than its competitors or peers. Further analysis is required to determine if this is a cause for concern.

- The company may have a seasonal business cycle or inventory management issues that result in a lower working capital ratio. It would be beneficial to assess the company’s historical ratio trends and compare them with industry benchmarks.

- It’s important to analyze other liquidity and financial metrics, such as the quick ratio (which excludes inventory from current assets) and cash flow statement, to gain a more comprehensive picture of the company’s financial health.

By considering these factors and conducting a thorough analysis, investors, creditors, and other stakeholders can make informed decisions about Company ABC’s financial health and liquidity position.

It’s important to note that this example is for illustrative purposes only, and every company’s working capital ratio analysis will vary based on its specific circumstances, industry, and market conditions.

Next, let’s explore the advantages and limitations of using the working capital ratio as a financial metric.

Advantages and Limitations of Working Capital Ratio

The working capital ratio is a widely used financial metric that provides valuable insights into a company’s liquidity and short-term financial health. However, like any financial ratio, it has its advantages and limitations. Let’s explore them:

Advantages:

- Simplicity: The working capital ratio is relatively easy to calculate and understand, making it accessible to a wide range of stakeholders, including investors, creditors, and analysts.

- Liquidity Assessment: The ratio provides a snapshot of a company’s liquidity, indicating its ability to meet short-term obligations. It helps stakeholders evaluate if a company has enough working capital to cover its liabilities, manage day-to-day operations, and seize opportunities.

- Comparative Analysis: The working capital ratio allows for benchmarking and comparison among companies within the same industry or sector. It provides a basis for evaluating liquidity positions, operational efficiency, and financial health relative to industry peers.

- Short-Term Financial Planning: The ratio assists in short-term financial planning by highlighting the need for optimizing working capital management. It can identify areas of potential improvement, such as reducing inventory levels, improving accounts receivable collection, or negotiating favorable payment terms with suppliers.

Limitations:

- Time-Specific Snapshot: The working capital ratio provides a snapshot of a company’s liquidity position at a specific point in time. It may not fully reflect ongoing changes in the business or sudden fluctuations in working capital needs. It’s important to consider the ratio in conjunction with historical trends and other financial metrics.

- Industry Variations: Different industries have varying working capital requirements and liquidity norms. Comparing the working capital ratio across industries may not provide an accurate assessment of a company’s financial health. It’s crucial to consider industry benchmarks and specific operational dynamics when interpreting the ratio.

- Exclusion of Non-Cash Items: The ratio only considers current assets and liabilities, excluding non-cash items like long-term assets and debt. While this simplifies the calculation, it may limit the ratio’s ability to provide a comprehensive view of a company’s overall financial health.

- Manipulation: Companies can manipulate the working capital ratio by adjusting their accounting practices, such as inflating or deflating current assets or liabilities. Therefore, it’s important to analyze the ratio in conjunction with other financial statements and qualitative factors to ensure accuracy.

Understanding the advantages and limitations of the working capital ratio allows stakeholders to make informed decisions and perform a comprehensive analysis of a company’s financial position.

Next, let’s wrap up our discussion on the working capital ratio.

Conclusion

The working capital ratio is a critical financial metric that provides valuable insights into a company’s liquidity and short-term financial health. It showcases the relationship between a company’s current assets and current liabilities, offering a snapshot of its ability to meet short-term obligations.

By calculating and analyzing the working capital ratio, investors, creditors, and other stakeholders can assess a company’s liquidity position, efficiency in managing working capital, and overall financial health. A ratio above 1 indicates a relatively strong liquidity position, while a ratio below 1 may signal potential liquidity challenges.

However, it is important to consider various factors when interpreting the working capital ratio, such as industry norms, business seasonality, growth prospects, and efficient working capital management. Comparative analysis, trend analysis, and consideration of other financial metrics are critical for a comprehensive assessment.

The working capital ratio has several advantages, such as its simplicity, ability to assess liquidity, enable comparative analysis, and aid in short-term financial planning. However, it also has limitations, including its time-specific nature, industry variations, exclusion of non-cash items, and the potential for manipulation.

Ultimately, the working capital ratio is an essential tool in evaluating a company’s financial health, but it should be used in conjunction with other financial metrics to paint a complete picture. By effectively analyzing the working capital ratio and understanding its implications, stakeholders can make informed decisions and better navigate the financial landscape.

Now that you have a solid understanding of the working capital ratio, its calculation, interpretation, and application, you can confidently incorporate it into your financial analysis toolkit.