Finance

What Is Tax Credit Screening Process

Modified: January 15, 2024

Learn about the tax credit screening process and how it impacts your finances. Discover how to maximize your benefits with expert guidance on finance and tax credits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Tax Credit Screening

- Purpose of Tax Credit Screening Process

- Importance of Tax Credit Screening

- Steps in the Tax Credit Screening Process

- Gathering Required Documents

- Reviewing and Verifying Eligibility Criteria

- Evaluating the Application

- Conducting Background Checks

- Notifying Applicants of Approval or Denial

- Benefits of Tax Credit Screening Process

- Challenges in Tax Credit Screening

- Conclusion

Introduction

Tax credits are a vital component of the financial landscape, offering significant benefits to individuals and businesses alike. However, ensuring that these credits are allocated to the deserving recipients requires a thorough and systematic process known as tax credit screening.

Tax credit screening is the evaluation and verification of an applicant’s eligibility for tax credits, which are deductions or incentives provided by the government to promote certain activities, such as energy efficiency, job creation, or investment in specific industries. This process plays a crucial role in maintaining fairness, transparency, and accountability in the distribution of tax credits.

The purpose of tax credit screening is to ensure that tax credits are awarded only to those who meet the predetermined criteria set by the government. It aims to prevent fraud, misallocation, and abuse of the tax credit system. By thoroughly reviewing and verifying the eligibility of applicants, the screening process helps maximize the effectiveness of tax credits and ensures that they reach their intended beneficiaries.

As the demand for tax credits continues to grow, a comprehensive and efficient tax credit screening process becomes increasingly important. It not only safeguards the integrity of the tax credit system but also protects the interests of taxpayers and ensures the responsible allocation of government resources.

This article will delve into the steps involved in the tax credit screening process, the documents required, the benefits it brings, and the challenges it faces. By understanding the intricacies of tax credit screening, individuals and businesses can navigate the process more effectively and increase their chances of obtaining the tax credits they are eligible for.

Definition of Tax Credit Screening

Tax credit screening can be defined as the systematic evaluation and verification process conducted by government agencies or financial institutions to determine an applicant’s eligibility for tax credits. It involves assessing various criteria and gathering relevant information to ensure that tax credits are allocated to individuals or businesses who meet the specified requirements.

The purpose of tax credit screening is to prevent fraud, misallocation, and abuse of the tax credit system. By thoroughly reviewing and verifying the eligibility of applicants, this process helps maintain fairness, transparency, and accountability in the distribution of tax credits.

During tax credit screening, the applicant’s financial and personal information is collected and assessed to determine their eligibility for specific tax credits. This may include factors such as income level, employment status, investments in eligible industries, energy efficiency measures, or contributions to specific projects.

The screening process typically involves a combination of reviewing documents, conducting background checks, and evaluating the applicant’s compliance with the eligibility criteria. It aims to ensure that tax credits are awarded to deserving individuals or businesses who have demonstrated their commitment to meeting the objectives and requirements set by the government.

It is important to note that tax credit screening is not a one-size-fits-all process. The specific criteria and requirements for eligibility can vary depending on the type of tax credit and the jurisdiction in which it is offered. Therefore, it is crucial for applicants to carefully review and understand the eligibility guidelines before applying for tax credits.

Overall, tax credit screening serves as a vital mechanism to protect the integrity of the tax credit system and ensure that taxpayer funds are allocated to those who truly qualify. By implementing a thorough and rigorous screening process, governments and financial institutions can mitigate the risk of fraud and ensure the responsible allocation of tax credits to support targeted initiatives and promote economic growth.

Purpose of Tax Credit Screening Process

The purpose of the tax credit screening process is to ensure that tax credits are awarded to individuals or businesses who meet the specified criteria and objectives set by the government. It serves several important purposes, contributing to the integrity, accountability, and effectiveness of the tax credit system.

1. Fairness and Equity: Tax credit screening helps ensure fairness and equity in the distribution of tax credits. By verifying eligibility and evaluating applications based on objective criteria, it prevents favoritism or bias in the allocation process. This ensures that all eligible applicants have an equal opportunity to benefit from tax credits, promoting a level playing field.

2. Fraud Prevention: Tax credit screening plays a crucial role in preventing fraud and abuse of the tax credit system. By thoroughly reviewing documents, conducting background checks, and evaluating the compliance of applicants with eligibility criteria, it helps identify and deter fraudulent individuals or businesses attempting to illegitimately claim tax credits. This enhances the integrity and reliability of the tax credit system.

3. Targeted Allocation: Tax credits are often designed to promote specific activities, such as job creation, research and development, or environmental sustainability. The screening process ensures that tax credits are allocated to individuals or businesses that align with the intended objectives. By evaluating applicants against the designated criteria, the screening process maximizes the effectiveness and impact of tax credits in driving targeted economic and social outcomes.

4. Resource Optimization: Tax credits represent a significant expenditure for governments. The screening process helps optimize the allocation of resources by directing tax credits to applicants who genuinely qualify. By ensuring that tax credits are awarded only to those who have met the eligibility criteria, the process minimizes wastage and directs resources towards initiatives that effectively utilize them.

5. Accountability and Transparency: Tax credit screening enhances the accountability and transparency of the tax credit system. By establishing clear eligibility criteria and conducting a systematic evaluation of applicants, it provides a transparent framework for determining who qualifies for tax credits. This fosters public trust in the process and ensures that tax credits are awarded based on merit and compliance with the established guidelines.

In summary, the purpose of the tax credit screening process is to promote fairness, prevent fraud, target allocation, optimize resource utilization, and uphold accountability and transparency. By adhering to a robust screening process, governments can ensure that tax credits are awarded to deserving recipients who contribute to the intended goals of the tax credit program.

Importance of Tax Credit Screening

Tax credit screening is of utmost importance in maintaining the integrity and effectiveness of the tax credit system. It serves several critical purposes that contribute to responsible and efficient allocation of tax credits.

1. Preventing Fraud and Misallocation: Tax credit screening helps prevent fraud and misallocation of tax credits. By conducting thorough evaluations and verifications, it ensures that only eligible individuals or businesses receive the benefits. This reduces the risk of false claims or improper use of tax credits, protecting taxpayers’ funds and preserving the integrity of the system.

2. Maximizing Effectiveness: The screening process ensures that tax credits are allocated to applicants who meet the specific objectives of the program. By targeting eligible individuals or businesses that contribute to desired outcomes, such as job creation, energy efficiency, or investment in specific industries, it maximizes the impact and effectiveness of tax credits in promoting economic growth and societal objectives.

3. Fairness and Equity: Tax credit screening promotes fairness and equity in the distribution of benefits. By establishing clear eligibility criteria and conducting a consistent evaluation process, it ensures that all eligible applicants have an equal opportunity to receive tax credits. This fosters trust in the system and avoids favoritism or bias in the allocation process.

4. Accountability and Transparency: Conducting tax credit screening demonstrates a commitment to transparency and accountability. It provides a structured and documented process for evaluating applications and making award decisions, which can be reviewed and audited to ensure compliance with regulatory requirements. This helps maintain public trust and confidence in the tax credit system.

5. Resource Optimization: Tax credits represent a significant expenditure for governments. By screening applicants and awarding tax credits based on eligibility and compliance, the screening process helps optimize the allocation of resources. This ensures that tax credits are directed towards projects, investments, or activities that have a higher likelihood of yielding positive economic or social outcomes.

6. Encouraging Compliance: Tax credit screening promotes compliance with the established guidelines and regulations. By requiring applicants to submit relevant documents and fulfill eligibility requirements, it encourages individuals and businesses to maintain accurate records and follow the necessary protocols. This contributes to a culture of compliance and responsible use of tax credits.

Overall, tax credit screening is essential for maintaining the effectiveness, fairness, and accountability of the tax credit system. It helps prevent fraud, maximize the impact of tax credits, ensure fairness in the distribution of benefits, optimize resource allocation, foster compliance, and enhance trust in the system. By implementing and adhering to a rigorous screening process, governments can effectively promote economic growth, incentivize desired behaviors, and protect taxpayers’ interests.

Steps in the Tax Credit Screening Process

The tax credit screening process involves several sequential steps to evaluate the eligibility of applicants for tax credits. Each step plays a vital role in ensuring that tax credits are awarded to deserving individuals or businesses. Here are the key steps in the tax credit screening process:

- Gathering Required Documents: Applicants are required to submit specific documents and information as part of the screening process. This may include tax returns, financial statements, employment records, project plans, or any other documents relevant to the eligibility criteria for the tax credit. These documents help assess the applicant’s qualification for the tax credit.

- Reviewing and Verifying Eligibility Criteria: The screening process involves a comprehensive review of the eligibility criteria set by the government or relevant authority. This step ensures that the applicant meets the necessary requirements, such as income thresholds, investment criteria, or project specifications. Cross-referencing the submitted documents with the eligibility criteria helps determine the applicant’s eligibility.

- Evaluating the Application: The screening process involves a detailed evaluation of the applicant’s application. This may include assessing factors such as the viability of the proposed project, the potential impact of the investment, or the adherence to specific industry guidelines. Evaluators examine the application to ensure its alignment with the objectives of the tax credit program.

- Conducting Background Checks: Background checks are typically conducted to verify the accuracy of the applicant’s information and assess their overall credibility. This may include verifying employment history, contacting references, or conducting financial checks. Background checks help identify any red flags or fraudulent activities that may disqualify the applicant from receiving the tax credit.

- Notifying Applicants of Approval or Denial: Once the screening process is complete, applicants are notified of the outcome, whether they have been approved or denied for the tax credit. Approved applicants are informed of the details related to the amount and conditions of the tax credit, while denied applicants are provided with reasons for the denial. Clear communication ensures transparency and accountability throughout the screening process.

It is important to note that the specific steps and procedures may vary depending on the jurisdiction and the type of tax credit being screened. However, these fundamental steps form the basis of most tax credit screening processes, facilitating fair and effective distribution of tax credits to eligible individuals or businesses.

Gathering Required Documents

Gathering the required documents is an essential step in the tax credit screening process. These documents serve as evidence to support the applicant’s eligibility for the tax credit they are seeking. The specific documents requested may vary depending on the type of tax credit and the jurisdiction. However, there are some common documents that are typically required. Here are some examples of the documents that applicants may need to provide during the tax credit screening process:

- Tax Returns: Applicants are often required to submit their tax returns for the relevant tax year. This allows tax authorities to verify the applicant’s income and determine their eligibility for income-based tax credits.

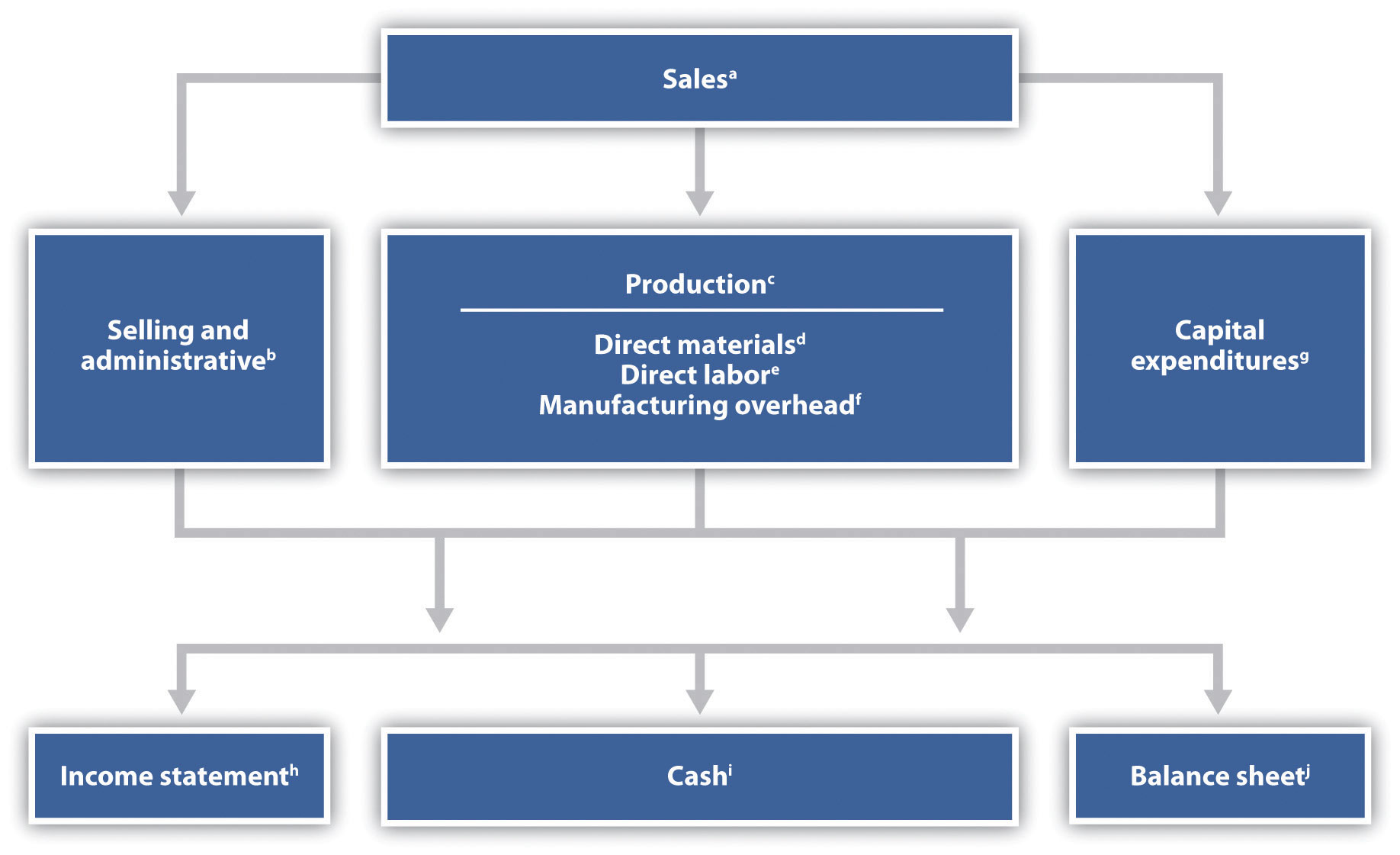

- Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, may be required to assess the financial health of businesses or individuals seeking tax credits. These statements provide insight into the applicant’s financial viability and ability to utilize the tax credit effectively.

- Project Plans: For tax credits related to specific projects or investments, applicants may be asked to provide detailed project plans or investment proposals. These plans outline the goals, objectives, timelines, and expected outcomes of the project. They help evaluators assess the viability and potential impact of the proposed project.

- Proof of Investment: In cases where tax credits are tied to investments in specific industries or sectors, applicants may need to provide documentation to prove their investment. This could include receipts, invoices, or contracts related to the investment, showcasing the financial commitment made by the applicant.

- Certifications and Licenses: Applicants may be required to provide certifications or licenses related to the specific eligibility criteria set for the tax credit. For example, energy efficiency tax credits may require applicants to provide certification from approved energy auditors or contractors.

- Employee Records: For tax credits related to job creation or employee retention, applicants may need to provide employee records, such as payroll documents, employment contracts, or proof of hiring. These documents demonstrate the applicant’s compliance with the employment-related eligibility criteria.

- Other Supporting Documentation: Depending on the specific requirements, applicants may need to provide additional supporting documentation. This could include invoices for eligible business expenditures, proof of residency or citizenship, documentation of research and development activities, or any other relevant information supporting their eligibility for the tax credit.

It is important for applicants to carefully review the requirements provided by the tax credit authority or government agency and ensure that all requested documents are submitted accurately and in a timely manner. Failure to provide the necessary documentation may result in delays or denial of the tax credit.

By gathering the required documents, applicants are able to present a comprehensive and substantiated case for their eligibility for the tax credit, increasing their chances of a successful outcome in the tax credit screening process.

Reviewing and Verifying Eligibility Criteria

Reviewing and verifying the eligibility criteria is a crucial step in the tax credit screening process. It involves assessing whether the applicant meets the specific requirements set by the government or relevant authority for the tax credit being sought. This step ensures that tax credits are awarded to individuals or businesses who qualify and adhere to the established guidelines. Here’s an overview of how the reviewing and verifying process takes place:

1. Examination of Documentation: The screening team carefully reviews the documents submitted by the applicant. These documents could include tax returns, financial statements, project plans, certifications, licenses, and any other relevant evidence. Reviewing these documents helps evaluate whether the applicant meets the initial eligibility criteria.

2. Cross-Referencing Eligibility Guidelines: The screening team cross-references the applicant’s information with the eligibility guidelines provided by the tax credit authority. This step ensures that the applicant fulfills the specific criteria, such as income thresholds, investment requirements, or compliance with industry standards.

3. Assessing Financial Viability: In some cases, the screening process may involve evaluating the financial viability of applicants. This assessment helps determine whether the applicant has the financial capacity to utilize the tax credit effectively or to ensure the success of the project associated with the tax credit.

4. Industry-Specific Evaluation: For tax credits related to specific industries or sectors, additional evaluation may be required. This evaluation ensures that the applicant’s activities align with the objectives and goals of the tax credit program. It may involve assessing the applicant’s compliance with environmental standards, technological advancements, or other industry-specific requirements.

5. Compliance Review: The screening team ensures that the applicant has met all regulatory and compliance requirements. This includes verifying adherence to tax laws, employment regulations, and any other relevant legal obligations. Applicants must demonstrate that they have complied with all necessary regulations to be eligible for the tax credit.

6. Communication and Clarification: Throughout the reviewing process, the screening team may communicate with applicants to seek clarification or request additional information. This helps ensure that all necessary details are thoroughly verified, and any potential discrepancies are addressed before a final determination is made.

7. Determination of Eligibility: Based on the results of the reviewing and verification process, a determination is made regarding the applicant’s eligibility for the tax credit. This determination is communicated to the applicant, including any conditions or requirements that need to be fulfilled to receive the tax credit.

By carefully reviewing and verifying the eligibility criteria, the tax credit screening process ensures that tax credits are awarded to deserving individuals or businesses who meet the specified requirements. It strengthens the integrity and effectiveness of the tax credit system, promoting fairness, transparency, and accountability in the allocation of these valuable incentives.

Evaluating the Application

Evaluating the application is a critical step in the tax credit screening process. It involves a thorough assessment of the applicant’s proposal or project to determine its alignment with the objectives and requirements of the tax credit program. The evaluation process helps ensure that tax credits are awarded to projects or initiatives that have the potential to make a positive impact. Here are the key aspects involved in evaluating the application:

1. Alignment with Program Objectives: The evaluation assesses whether the applicant’s proposal or project aligns with the objectives and goals of the tax credit program. This includes reviewing the intended outcomes, such as job creation, energy efficiency, research and development, or community development. The project should demonstrate its potential to contribute to these objectives.

2. Viability and Feasibility: The evaluation examines the viability and feasibility of the applicant’s proposal. This includes assessing the financial projections, market analysis, project timelines, and implementation plans. Evaluators analyze the applicant’s ability to successfully carry out the project, ensuring that it is realistic and achievable within the specified timeframe.

3. Economic Impact: Consideration is given to the economic impact that the project or initiative would generate. Evaluators analyze the potential job creation, investment in local communities, and economic growth that could result from the implementation of the project. The evaluation helps ensure that the tax credit is awarded to endeavors that have a positive impact on the economy.

4. Innovation and Advancement: Evaluator looks at the level of innovation and advancement associated with the project. This involves assessing whether the proposal incorporates new technologies, research, or practices that can lead to industry advancements or environmental sustainability. The evaluation encourages projects that prioritize innovation and contribute to long-term benefits.

5. Environmental and Social Responsibility: The evaluation considers the environmental and social impact of the project. This includes reviewing the applicant’s commitment to sustainable practices, resource conservation, and social responsibility. Projects that demonstrate a positive influence on the environment and society are given favorable consideration in the evaluation process.

6. Budgetary Considerations: Evaluators assess the budget and financial aspects of the proposed project. This includes reviewing the cost estimates, funding sources, and planned use of the tax credit. The evaluation ensures that the budget aligns with the goals and requirements of the tax credit program, and that the requested tax credit amount is reasonable and justified.

7. Compliance with Regulations: The evaluation ensures that the applicant’s project complies with all relevant regulations and guidelines. This includes adherence to zoning requirements, building codes, environmental laws, and any other applicable regulations. Evaluators assess the applicant’s compliance history and their commitment to operating within the legal framework.

By rigorously evaluating the application, the tax credit screening process ensures that tax credits are awarded to projects or initiatives that meet the desired objectives and exhibit a strong probability of success. This evaluation helps optimize the impact and effectiveness of the tax credit program, supporting economic growth, innovation, and responsible development.

Conducting Background Checks

Conducting background checks is an important step in the tax credit screening process. These checks help verify the accuracy of the applicant’s information and assess their credibility and eligibility for the tax credit. By conducting thorough background checks, potential red flags and fraudulent activities can be identified, ensuring that tax credits are awarded to deserving individuals or businesses. Here is an overview of how background checks are conducted during the tax credit screening process:

1. Employment Verification: Background checks may include verifying the applicant’s employment history. This can involve contacting previous employers to confirm the accuracy of the applicant’s work experience, position held, and employment dates. Employment verification helps validate the applicant’s qualifications and their eligibility for tax credits tied to job creation or retention.

2. Financial Checks: Evaluators may conduct financial checks to assess the applicant’s financial standing and credibility. This can involve reviewing credit reports, assessing debt-to-income ratios, or examining past financial transactions. Financial checks help ensure that the applicant has a solid financial track record and can responsibly utilize the tax credit.

3. Criminal Background Checks: Background checks often include criminal history checks to identify any criminal records or convictions. This helps assess the applicant’s character and integrity. Depending on the nature and severity of the offense, a criminal history may disqualify an applicant from receiving the tax credit.

4. Reference Checks: Contacting the listed references provided by the applicant is another common background check. Reference checks allow evaluators to gather additional information about the applicant’s character, professionalism, and reliability. Insights from reliable references can help determine the applicant’s suitability for the tax credit.

5. Regulatory Compliance: Background checks may include evaluating the applicant’s compliance with various regulations and laws relevant to the tax credit program. This ensures that the applicant has maintained a good compliance record, adhering to all legal obligations and requirements. Non-compliance with relevant regulations may affect the eligibility for the tax credit.

6. Past Performance: Background checks can also involve reviewing the applicant’s past performance in relation to previous applications for tax credits or other government-supported initiatives. This allows evaluators to assess the applicant’s consistency in meeting program requirements and the overall success of their past projects.

7. Identity Verification: Confirming the identity of the applicant is a critical aspect of background checks. Validating the applicant’s identity helps prevent identity theft and ensures that the tax credit is awarded to the correct individual or entity. This can involve verifying government-issued identification documents and comparing them against other provided information.

By conducting comprehensive background checks, the tax credit screening process seeks to identify any inconsistencies, potential risks, or fraudulent activities. These checks contribute to maintaining the integrity and credibility of the tax credit system, ensuring that tax credits are awarded to deserving and trustworthy entities.

Notifying Applicants of Approval or Denial

Notifying applicants of the decision regarding their tax credit application is a crucial step in the tax credit screening process. It ensures transparency, accountability, and effective communication between the tax credit authority and the applicants. The notification process provides clarity on the outcome of the screening process and informs applicants whether they have been approved or denied for the tax credit. Here is an overview of how the notification process takes place:

1. Timely Communication: Once the tax credit application has undergone review and evaluation, the tax credit authority or screening team should strive to provide timely notifications to the applicants. Timely communication helps applicants stay informed and enables them to plan accordingly, whether they are approved for the tax credit or need to explore alternative options.

2. Approvals: If the applicant is approved for the tax credit, they will receive an official notification informing them of the approval. This notification may include the details of the approved tax credit amount, any specific conditions or requirements, and the procedures for claiming the tax credit. The approval notification provides a clear path forward for the applicant to access the benefits of the tax credit program.

3. Denials: If the applicant is denied the tax credit, the notification will outline the reasons for the denial. It may include specific factors that led to the denial, such as incomplete documentation, failure to meet eligibility criteria, or the availability of limited funds. The denial notification should be provided in a professional and respectful manner, allowing the applicant to understand the decision and explore other potential options.

4. Explanation of Decisions: In both approval and denial notifications, it is important to provide clear and concise explanations of the decision. This helps the applicant understand why their application was successful or why it did not meet the necessary criteria. Clear explanations enable applicants to evaluate their future actions and potentially reapply for the tax credit program with improved documentation or eligibility qualifications, if applicable.

5. Additional Support and Guidance: The notification may also provide additional support and guidance to the applicants. This can include information on resources, workshops, or consultations available to help them better understand the tax credit program, address any concerns, or improve their chances of success in future applications. Offering support and guidance demonstrates a commitment to assisting applicants in navigating the tax credit process effectively.

6. Appeals Process: In cases where the tax credit program allows for appeals, the notification should clearly outline the steps and procedures for appealing the decision. This provides applicants with recourse if they believe there has been an error or if they have additional information to support their eligibility for the tax credit. The appeals process ensures that applicants have an opportunity to rectify any misunderstandings or address any discrepancies that may have occurred during the screening process.

Properly notifying applicants of approval or denial is essential for maintaining transparency and trust in the tax credit screening process. It allows applicants to have a clear understanding of the outcome and helps them make informed decisions going forward. Effective communication during this stage contributes to a fair, accountable, and efficient tax credit system.

Benefits of Tax Credit Screening Process

The tax credit screening process offers several significant benefits for both the government and the applicants. It ensures fairness, accountability, and effective utilization of tax credits. Here are some key benefits of the tax credit screening process:

1. Fairness and Equity: By conducting a thorough screening process, tax credits are allocated based on merit and adherence to eligibility criteria. This promotes fairness and equity in the distribution of tax credits, preventing favoritism or biased decision-making. Applicants who meet the required criteria have an equal opportunity to access tax credits, ensuring a level playing field for all.

2. Fraud Prevention: The screening process plays a vital role in preventing fraud and abuse of the tax credit system. By verifying the authenticity of the applicant’s information, conducting background checks, and thoroughly evaluating applications, potential fraudulent activities can be detected and deterred. This helps protect taxpayer funds and maintain the integrity of the tax credit system.

3. Targeted Allocation: Tax credits are often designed to incentivize specific activities or industries. The screening process ensures that tax credits are allocated to applicants who meet the predefined objectives. This targeted allocation maximizes the impact of tax credits by directing resources towards initiatives that contribute to desired outcomes, such as job creation, environmental sustainability, or innovation.

4. Resource Optimization: Screening applicants for tax credits helps optimize the allocation of resources. By evaluating the feasibility and potential impact of proposed projects or activities, resources can be directed to initiatives that have a higher likelihood of success. This ensures that tax credits are utilized effectively, minimizing wastage and maximizing the return on investment for both the applicant and the government.

5. Transparency and Accountability: The tax credit screening process enhances transparency and accountability in the allocation of tax credits. By establishing clear eligibility criteria, thoroughly reviewing applications, and providing explanations for approval or denial, the process fosters trust and confidence in the tax credit system. Applicants and the public can better understand the decision-making process, promoting transparency and ensuring that tax credits are awarded based on merit.

6. Compliance and Regulation Adherence: The screening process reinforces compliance with regulations and legal obligations. By evaluating applicants for their adherence to specific eligibility criteria and conducting background checks, the process encourages applicants to maintain compliance, follow regulations, and act responsibly within the tax credit program. This ensures that tax credits are awarded to individuals or businesses that uphold their obligations and responsibilities.

7. Enhanced Economic Growth: The tax credit screening process, by supporting well-targeted allocation and promoting the viability of projects, contributes to economic growth. By incentivizing activities such as job creation, research and development, or investment in specific industries, tax credits can stimulate economic activity, attract investments, and foster innovation. This, in turn, leads to increased productivity, job opportunities, and overall economic development.

The tax credit screening process plays a fundamental role in ensuring the responsible and effective deployment of tax credits. By promoting fairness, transparency, fraud prevention, and economic growth, it creates a framework that benefits both the government and the applicants. Through a robust screening process, tax credits can be channeled toward initiatives that align with government priorities, encourage productive activities, and generate positive outcomes for society as a whole.

Challenges in Tax Credit Screening

While tax credit screening is essential for ensuring the proper allocation of tax credits, it also presents several challenges that need to be addressed. These challenges can impact the efficiency, accuracy, and effectiveness of the screening process. Here are some common challenges faced in tax credit screening:

1. Complexity of Eligibility Criteria: Eligibility criteria for tax credits can be complex and vary depending on the type of credit and jurisdiction. Applicants may struggle to understand and interpret the requirements, leading to errors or omissions in their applications. Clear and concise guidelines, as well as accessible support resources, can help mitigate this challenge.

2. Limited Resources: The tax credit screening process requires sufficient resources, including staff, time, and funding, to effectively review and evaluate applications. Limited resources can result in delays in processing applications, backlogs, or an inability to thoroughly assess each application. Adequate resource allocation is necessary to maintain the integrity and efficiency of the screening process.

3. Fraudulent Activities: Fraudulent activities pose significant challenges in tax credit screening. Dishonest applicants may provide false information, submit fraudulent documents, or misrepresent their eligibility to obtain tax credits improperly. Robust verification methods and thorough background checks are important to detect and deter fraudulent activities.

4. Burden of Documentation: Tax credit applications often require extensive documentation to support an applicant’s eligibility. Gathering and providing the necessary documentation can be burdensome and time-consuming for applicants, especially smaller businesses or individuals without dedicated resources. Streamlining and simplifying documentation requirements can alleviate this challenge.

5. Subjectivity in Evaluation: The evaluation process may involve some level of subjectivity, as it requires individuals to assess the viability, impact, and adherence to eligibility criteria of a project or initiative. This subjectivity can introduce inconsistencies or biases in the decision-making process. Clear evaluation criteria and comprehensive training for evaluators can help minimize this challenge.

6. Lack of Awareness: Limited awareness about available tax credits and the screening process can hinder potential applicants from accessing these incentives. Additionally, applicants may not have a clear understanding of the eligibility criteria or how to navigate the application process. Public outreach and education campaigns can help address this challenge by increasing awareness and providing guidance to potential applicants.

7. Changing Regulations and Policies: Tax credit programs and eligibility criteria can change over time due to legislative updates or policy adjustments. Keeping up with these changes and ensuring alignment with current regulations can be challenging for both applicants and those responsible for administering the screening process. Regular communication and updates on any policy changes are essential to mitigate this challenge.

Addressing these challenges requires a proactive approach that focuses on clear guidelines, robust verification methods, adequate resources, training, and ongoing communication. By mitigating these challenges, tax credit screening can become more efficient, accurate, and accessible, ensuring that tax credits are allocated to eligible applicants who contribute to the desired outcomes of the program.

Conclusion

The tax credit screening process plays a crucial role in ensuring the responsible and effective allocation of tax credits. By thoroughly reviewing and verifying applicant eligibility, tax credit screening helps maintain fairness, transparency, and accountability in the distribution of these valuable incentives. Through a systematic approach, the screening process prevents fraud, targets allocation to deserving individuals or businesses, and maximizes the impact of tax credits.

Throughout the tax credit screening process, several key steps are involved. These steps include gathering required documents, reviewing and verifying eligibility criteria, evaluating the application, conducting background checks, and notifying applicants of approval or denial. Each step contributes to a comprehensive and efficient screening process that safeguards the integrity of the tax credit system.

There are many benefits to conducting tax credit screening. It promotes fairness and equity by ensuring that tax credits are awarded based on merit and eligibility. The process also helps prevent fraud and misallocation, directs resources towards targeted initiatives for maximum impact, and enhances transparency and accountability. Tax credit screening contributes to economic growth, innovation, and compliance with regulations.

However, the tax credit screening process also poses challenges such as complexity in eligibility criteria, limited resources, fraudulent activities, documentation burden, subjectivity in evaluation, lack of awareness, and changing regulations. Addressing these challenges through clear guidelines, adequate resources, robust verification methods, public outreach, and ongoing communication is crucial for optimizing the effectiveness of the screening process.

In conclusion, tax credit screening is a fundamental process that ensures tax credits are awarded to deserving applicants. It promotes fairness, accountability, and responsible resource allocation. By continuously improving and streamlining the screening process, governments and tax credit authorities can maximize the impact of tax credits, foster economic growth, and support initiatives that contribute to a better and more sustainable society.