Finance

What Is The Closing Process In Accounting

Published: October 13, 2023

Learn about the important closing process in accounting and its significance in finance. Enhance your understanding of finance with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

What Is the Closing Process in Accounting

The closing process is an essential part of the accounting cycle. It refers to the steps taken at the end of a reporting period to close out temporary accounts and update the permanent accounts. The primary goal of the closing process is to summarize a company’s revenues, expenses, and net income or loss for the period and transfer this information to the balance sheet.

Temporary accounts, such as revenue and expense accounts, are used to record the company’s financial activities for a specific reporting period. These accounts are temporary because their balances reset to zero at the end of each period. In contrast, permanent accounts, such as asset, liability, and equity accounts, carry forward their balances from one period to the next.

The closing process ensures that revenue and expense accounts are closed, while the balances on temporary accounts are transferred to the income summary account. The income summary account acts as a temporary holding account that allows you to calculate the company’s net income or loss for the period.

Once the revenues and expenses are closed, the net income or loss is determined and transferred to the retained earnings account. Retained earnings reflect the cumulative profits or losses of the company since its inception. By updating the retained earnings account, you are adjusting the equity section of the balance sheet to reflect the current period’s financial performance.

The closing process typically follows a set of steps which include:

- Identifying temporary accounts that need to be closed.

- Transferring the balances of revenue and expense accounts to the income summary account.

- Closing the income summary account by transferring its balance to retained earnings.

- Closing the dividends account (if applicable) by transferring its balance to retained earnings.

- Updating the retained earnings account to reflect the current period’s net income or loss.

Overall, the closing process is crucial for generating accurate financial statements and providing a clear snapshot of a company’s financial performance at the end of a reporting period. It allows stakeholders, such as investors and creditors, to evaluate the company’s profitability and make informed decisions based on the current financial position.

Introduction

In the field of accounting, the closing process is a vital step that occurs at the end of a reporting period. It involves several procedures and adjustments to wrap up financial activities for that specific timeframe. The closing process allows businesses to accurately assess their financial performance, generate comprehensive reports, and provide stakeholders with essential information.

During the closing process, temporary accounts, such as revenues, expenses, and dividends, are closed, while the balances are transferred to permanent accounts, such as retained earnings. This ensures that each reporting period starts fresh with zero balances in temporary accounts and reflects the cumulative effects of financial activities accurately.

The closing process is crucial in providing an accurate representation of a company’s financial position. By properly closing temporary accounts and updating permanent accounts, businesses can generate precise financial statements, including income statements, balance sheets, and retained earnings statements. These financial statements enable stakeholders to evaluate the company’s performance, profitability, and overall financial health.

Furthermore, the closing process helps identify any errors or discrepancies in financial records. By reviewing and reconciling account balances during the closing process, accountants can detect and correct any inaccuracies or omissions before presenting financial statements to external parties.

It is essential to note that the closing process varies based on the accounting framework and the specific requirements of an individual company. While the general principles remain the same, different industries and jurisdictions may have specific guidelines or regulations that companies must follow during the closing process.

In the following sections, we will explore the definition of the closing process, its purpose, and the step-by-step procedures involved. Understanding the closing process is crucial for both accounting professionals and business owners to maintain accurate financial records and make informed decisions based on reliable financial information.

Definition of the Closing Process

The closing process is a series of steps taken at the end of a reporting period in accounting to finalize financial transactions and prepare accurate financial statements. It involves closing out temporary accounts and updating permanent accounts to reflect the financial activities of the period accurately. The ultimate goal of the closing process is to ensure that the company’s financial statements provide a comprehensive and accurate representation of its financial performance.

Temporary accounts, also known as nominal or income statement accounts, are utilized to record revenues, expenses, and dividends during a specific period. Examples of temporary accounts include sales revenue, salary expense, and interest income. These accounts are temporary because their balances are reset to zero at the end of each reporting period. Permanent accounts, on the other hand, are used to record assets, liabilities, and equity. They carry forward their balances from one period to the next and include accounts such as cash, accounts payable, and retained earnings.

The closing process ensures that all temporary accounts are closed at the end of the reporting period. This involves transferring the balances of revenue and expense accounts to an intermediary account called the income summary account. The income summary account acts as a temporary holding account that allows for the calculation of net income or loss for the period. If the company incurred a net income, the balance of the income summary account will be credited. Conversely, if there was a net loss, the balance will be debited.

After closing the revenue and expense accounts, the balance in the income summary account is transferred to the retained earnings account. Retained earnings represent the cumulative profits or losses of the company since its inception. By updating the retained earnings account, the closing process ensures that the equity section of the balance sheet accurately reflects the company’s financial performance for the reporting period.

In addition to closing temporary accounts and updating permanent accounts, the closing process may also involve additional adjustments and reviews to ensure the accuracy of financial statements. This includes reconciling account balances, adjusting entries, reviewing supporting documentation, and verifying the accuracy of calculations.

Overall, the closing process is a crucial component of the accounting cycle as it allows for the accurate determination of a company’s net income or loss and ensures that the financial statements reflect the financial activities of the reporting period. By following a standardized closing process, businesses can maintain reliable and transparent financial records that comply with accounting standards and regulations.

Purpose of the Closing Process

The closing process in accounting serves several important purposes that contribute to the accuracy, consistency, and transparency of a company’s financial records. Understanding the purpose of the closing process is crucial for business owners, accountants, and stakeholders to ensure reliable financial reporting and decision-making.

One of the primary purposes of the closing process is to summarize a company’s financial performance for a specific reporting period. By closing out temporary accounts, such as revenues and expenses, the closing process allows for the calculation of net income or loss. This information is then transferred to the retained earnings account, reflecting the company’s profitability or loss over the reporting period. The accurate determination of net income or loss is vital for providing stakeholders with a clear understanding of the company’s financial performance.

Another purpose of the closing process is to reset temporary accounts for the next reporting period. Temporary accounts have balances that are reset to zero at the end of each period to ensure accurate financial reporting. By closing these accounts, businesses start the next reporting period with a clean slate, ready to record new revenues, expenses, and dividends.

The closing process also ensures the accuracy and integrity of financial statements. By reviewing account balances, reconciling transactions, and making necessary adjustments, the closing process helps detect and correct errors or discrepancies in the financial records. This enhances the reliability and transparency of the financial statements, instilling confidence in the users of those statements, such as investors, lenders, and regulatory bodies.

Furthermore, the closing process provides a systematic approach to organize and present financial information. By following a standardized set of procedures, businesses can consistently create financial statements that comply with accounting standards and regulations. This facilitates comparability between periods and improves the overall understanding of financial performance and trends.

The closing process also contributes to compliance with legal and regulatory requirements. Timely and accurate financial reporting is essential to meet the obligations set forth by regulatory bodies and taxation authorities. By properly closing out accounts and updating financial statements, businesses can fulfill their legal requirements and avoid penalties or scrutiny from regulatory agencies.

Lastly, the closing process provides a checkpoint for internal control purposes. By reviewing account balances, verifying transactions, and ensuring the accuracy of calculations, the closing process helps identify any potential accounting irregularities or fraudulent activities. This is crucial for maintaining the integrity of a company’s financial records and safeguarding its assets.

Overall, the purpose of the closing process is to summarize and accurately present a company’s financial performance, reset temporary accounts, ensure compliance with accounting standards and regulations, and enhance internal control and transparency. By following the closing process diligently, businesses can maintain reliable financial records and provide stakeholders with clear and meaningful financial information.

Steps in the Closing Process

The closing process in accounting involves several steps that are performed at the end of a reporting period to finalize financial transactions and prepare accurate financial statements. These steps ensure that temporary accounts are closed, net income or loss is determined, and permanent accounts are updated. Let’s take a closer look at the typical steps involved in the closing process:

- Identify Temporary Accounts: The first step is to identify the temporary accounts that need to be closed. These accounts include revenues, expenses, and dividends. Temporary accounts are usually labeled as such in the chart of accounts.

- Transfer Revenues and Expenses: Once the temporary accounts are identified, the next step is to transfer their balances to the income summary account. Revenue accounts are typically closed by debiting them and crediting the income summary account, while expense accounts are closed by crediting them and debiting the income summary account. The goal is to calculate the net income or loss for the reporting period.

- Close Income Summary Account: After the revenues and expenses have been transferred to the income summary account, the income summary account itself needs to be closed. If the company has a net income, the balance of the income summary account is transferred to the retained earnings account by debiting the income summary account and crediting the retained earnings account. If there is a net loss, the process is reversed, with the retained earnings account debited and the income summary account credited.

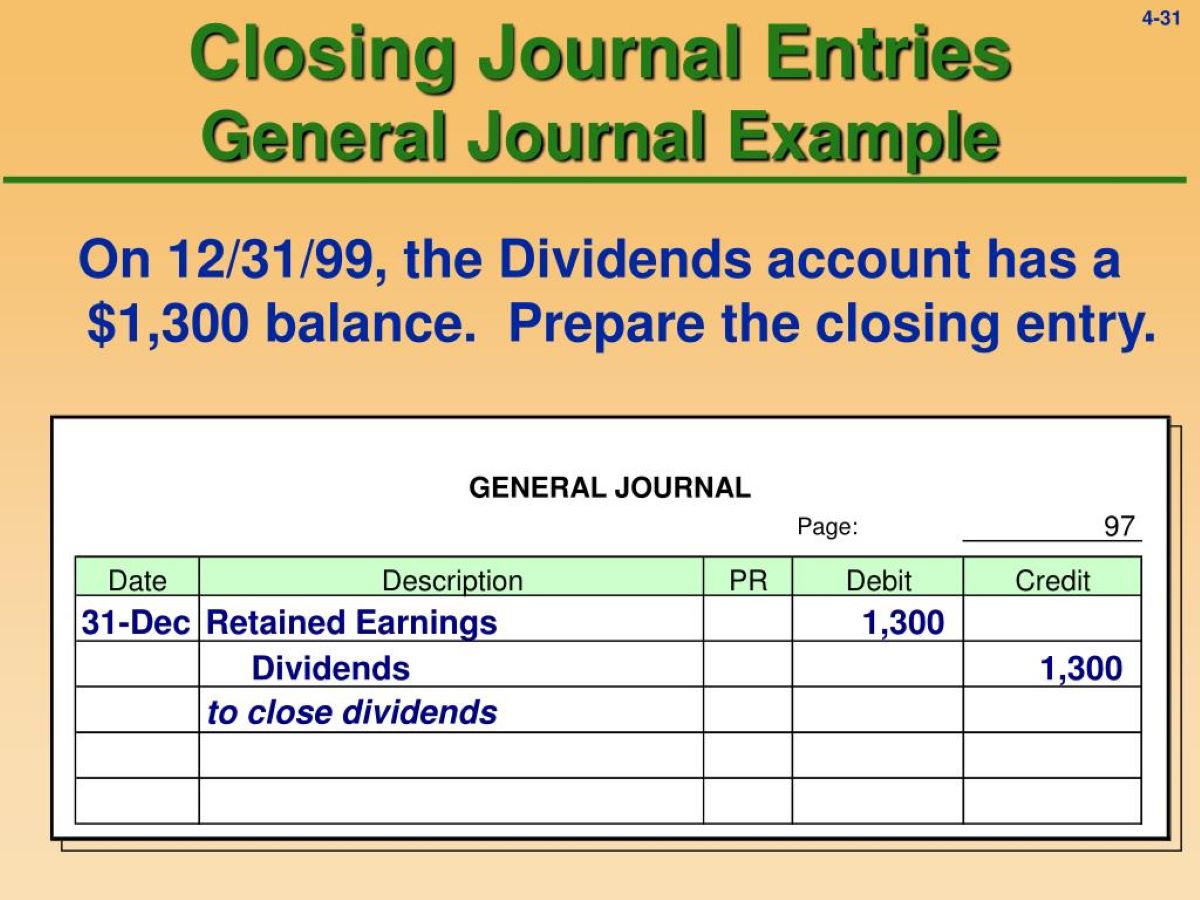

- Close Dividends Account: If the company has a dividends account, it needs to be closed as well. The dividends account represents distributions of profits to shareholders or owners. The closing entry for the dividends account involves debiting the retained earnings account and crediting the dividends account.

- Update Retained Earnings: The final step in the closing process is to update the retained earnings account. This is done by transferring the net income or loss from the income summary account and adjusting for any dividends. If there is a net income, the retained earnings account is credited, while a net loss results in a debit to the retained earnings account. This ensures that the retained earnings account reflects the retained profits or accumulated losses of the company up to the end of the reporting period.

It’s important to note that the closing process may involve additional steps or variations depending on the specific accounting framework or the company’s unique requirements. However, the above steps provide a general outline of the closing process and are essential for ensuring accurate financial reporting and maintaining reliable financial records.

Identify Temporary Accounts

The first step in the closing process is to identify the temporary accounts that need to be closed. Temporary accounts, also known as nominal or income statement accounts, are used to record revenues, expenses, and dividends for a specific reporting period. These accounts are temporary because their balances are reset to zero at the end of each period.

Common examples of temporary accounts include sales revenue, cost of goods sold, salaries expense, rent expense, and dividends declared. These accounts capture the inflows and outflows of money related to day-to-day business operations and reflect the company’s financial performance over a specific timeframe.

Identifying temporary accounts is crucial for the closing process because they need to be closed out at the end of the reporting period. By closing these accounts, their balances are transferred to the income summary account, which acts as a temporary holding account to calculate the net income or loss for the period.

Temporary accounts can typically be identified through their categorization in the company’s chart of accounts. Many accounting software systems provide the option to designate accounts as temporary or permanent, making it easier to identify them during the closing process.

It’s important to note that not all companies may have the same set of temporary accounts. The number and nature of these accounts will vary depending on the specific industry, business model, and accounting framework applied. It is important for businesses to carefully review their chart of accounts to determine the appropriate temporary accounts that need to be closed.

By identifying temporary accounts at the start of the closing process, accountants and business owners ensure that the necessary steps are taken to close out these accounts correctly. This helps maintain accurate financial records and prepares the groundwork for generating precise financial statements that reflect the financial performance of the reporting period.

Once the temporary accounts are identified, the next steps of the closing process can be undertaken, which involve transferring the balances to the income summary account, closing the income summary account, closing the dividends account (if applicable), and updating the retained earnings account to accurately reflect the financial results of the reporting period.

Transfer Revenues and Expenses

Once the temporary accounts have been identified in the closing process, the next step is to transfer the balances of the revenue and expense accounts to the income summary account. This step helps summarize and consolidate the financial activities related to revenues and expenses for the reporting period.

Revenue accounts, such as sales revenue, interest income, or service fees, represent the inflow of economic benefits to the company. These accounts are closed by debiting them and crediting the income summary account. By transferring the revenue balances, the income summary account reflects the total revenue earned during the reporting period.

Similarly, expense accounts, such as salaries expense, rent expense, or cost of goods sold, represent the outflow of economic resources from the company. These accounts are closed by crediting them and debiting the income summary account. The balances of the expense accounts are transferred to the income summary account, reflecting the total expenses incurred during the reporting period.

The objective of transferring revenues and expenses to the income summary account is to calculate the net income or loss for the period. If the total revenues exceed the total expenses, the result is a net income. Conversely, if the total expenses exceed the total revenues, the result is a net loss.

By accumulating all the revenues and expenses in the income summary account, businesses can easily determine the net income or loss for the reporting period. This net income or loss figure will be used in subsequent steps of the closing process to update the retained earnings account and generate accurate financial statements.

Accounting software or manual journal entries can be used to transfer the balances of revenue and expense accounts to the income summary account. It is crucial to ensure accuracy during this transfer to prevent any errors or misstatements in the financial records.

Once the transfer of revenue and expense balances to the income summary account is complete, the next steps in the closing process can be carried out. This includes closing the income summary account, closing the dividends account (if applicable), and updating the retained earnings account to reflect the net income or loss for the reporting period.

Close Income Summary Account

In the closing process of accounting, once the revenue and expense balances have been transferred to the income summary account, the next step is to close the income summary account itself. This step is important in finalizing the determination of net income or loss for the reporting period and updating the retained earnings account.

The income summary account serves as a temporary holding account that accumulates the revenue and expense balances from the temporary accounts. Its purpose is to facilitate the calculation of the net income or loss for the reporting period. The balance in the income summary account represents the difference between the total revenues and the total expenses.

If the company has generated a net income for the reporting period, the balance of the income summary account is typically credited. This transfer is done by debiting the income summary account and crediting the retained earnings account. By doing so, the net income is added to the retained earnings account, increasing the company’s accumulated profits.

Conversely, if the company has experienced a net loss, the balance of the income summary account is typically debited. This transfer involves crediting the income summary account and debiting the retained earnings account. As a result, the net loss is deducted from the retained earnings account, reducing the company’s accumulated profits.

It’s important to note that the closing entry for the income summary account varies depending on whether the company generated a net income or a net loss. In both cases, the objective is to adjust the retained earnings account to reflect the financial performance for the reporting period.

This closing entry effectively clears the income summary account and transfers the net income or loss to the retained earnings account. The retained earnings account represents the accumulated profits or losses of the company since its inception.

The final balance in the income summary account after this closing entry should ideally be zero. Any remaining balance may indicate an error in the closing process or an incomplete transfer of revenue and expense balances.

By closing the income summary account, businesses ensure that the financial statements accurately reflect the net income or loss for the reporting period. This information is essential for stakeholders, such as investors, creditors, and management, to evaluate the company’s financial performance and make informed decisions.

After closing the income summary account, the subsequent steps in the closing process involve closing the dividends account (if applicable) and updating the retained earnings account to reflect the net income or loss for the reporting period.

Close Dividends Account

In the closing process of accounting, if a company has a dividends account, the next step is to close it. The dividends account is used to record distributions of profits to shareholders or owners of the company. By closing the dividends account, the company finalizes the allocation of profits and updates the retained earnings account correctly.

Dividends are typically declared by the company’s board of directors and are paid out to shareholders as a reward for their investment. The dividends account tracks these distributions and helps to keep a record of the company’s dividend payments.

When closing the dividends account, the balance of the account needs to be transferred to the retained earnings account. This transfer is done by debiting the retained earnings account and crediting the dividends account. By doing so, the amount of dividends paid out to shareholders is deducted from the retained earnings.

It’s important to note that not all companies may have a dividends account. Some companies may choose to reinvest their profits back into the business rather than distributing them as dividends. In such cases, the closing process would not involve a dividends account.

The closing entry for the dividends account reduces the retained earnings, reflecting the distribution of profits to the owners or shareholders. As a result, the retained earnings account accurately reflects the cumulative profits or losses of the company since its inception.

By closing the dividends account, businesses ensure that the financial statements reflect the correct balance in the retained earnings account. This is essential for providing an accurate snapshot of the company’s financial performance and accumulated profits or losses.

It’s worth mentioning that the closing of the dividends account is not applicable to all companies. Only companies that distribute dividends to shareholders will have this step in the closing process. Conversely, companies that reinvest their profits or have not yet declared any dividends would not need to close a dividends account.

After closing the dividends account, the final step in the closing process involves updating the retained earnings account to accurately reflect the net income or loss for the reporting period.

Update Retained Earnings

In the closing process of accounting, the final step is to update the retained earnings account. The retained earnings account represents the cumulative profits or losses of a company since its inception. By updating the retained earnings account, the company ensures that the balance reflects the net income or loss for the reporting period, considering any dividends distributed.

Updating the retained earnings account involves transferring the net income or loss from the income summary account and adjusting for any dividends declared and closed. If the company has generated a net income, the retained earnings account is credited with the amount of net income. On the other hand, if the company has incurred a net loss, the retained earnings account is debited by the amount of the net loss.

The calculation to update the retained earnings account is as follows:

Beginning Retained Earnings + Net Income or Loss – Dividends = Ending Retained Earnings

Beginning Retained Earnings represents the balance in the retained earnings account at the start of the reporting period. Net Income or Loss is the calculated amount from the income summary account, representing the difference between revenues and expenses for the period. Dividends represent the distributions of profits to shareholders.

The closing entries for the income summary account and the dividends account, as discussed in the previous steps, play a crucial role in updating the retained earnings account correctly. These entries ensure that the net income or loss and the dividends are accurately reflected in the retained earnings account.

Updating the retained earnings account is essential for providing an accurate picture of a company’s financial performance and accumulated profits or losses. It allows stakeholders, such as investors, creditors, and management, to evaluate the financial health and profitability of the company.

The closing process finalizes the determination of net income or loss and ensures that the retained earnings account is adjusted accordingly. It establishes the starting point for the next reporting period, as the updated retained earnings account balance will be carried forward as the beginning balance for the subsequent period.

By completing the update of the retained earnings account, the closing process concludes. The financial statements can now be generated, providing stakeholders with valuable information about the company’s financial performance and retained profits or accumulated losses.

Conclusion

The closing process in accounting is a crucial part of the overall accounting cycle. It provides the necessary steps to wrap up financial transactions for a reporting period and prepare accurate financial statements. Through the closing process, temporary accounts are closed, net income or loss is determined, and permanent accounts are updated.

The purpose of the closing process is to ensure the accuracy, consistency, and transparency of a company’s financial records. By properly closing temporary accounts and updating permanent accounts, businesses can generate comprehensive and reliable financial statements that reflect the financial performance for the reporting period.

The steps involved in the closing process include identifying temporary accounts, transferring revenues and expenses to the income summary account, closing the income summary account, closing the dividends account (if applicable), and updating the retained earnings account. Each step plays an integral role in finalizing the financial activities and properly allocating profits or losses.

The closing process serves several important purposes. It summarizes a company’s financial performance, resets temporary accounts for the next reporting period, ensures compliance with accounting standards and regulations, enhances internal control and transparency, and provides a platform for accurate financial reporting and decision-making.

By following a standardized closing process, businesses can maintain reliable financial records, meet legal obligations, and provide stakeholders with meaningful financial information. The closing process is a critical component in maintaining the integrity of financial statements, allowing stakeholders to evaluate a company’s financial health, profitability, and overall performance.

In conclusion, understanding and implementing the closing process is essential for accountants, business owners, and stakeholders to ensure accurate financial reporting, compliance with regulations, and informed decision-making. By diligently performing the closing process, businesses can present reliable financial statements and gain valuable insights into their financial performance.