Home>Finance>What Are The Fundamentals Of The Accounting Process

Finance

What Are The Fundamentals Of The Accounting Process

Published: October 12, 2023

Learn the fundamentals of the accounting process and how it relates to finance. Gain insights into financial statements, budgeting, and cash flow management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of the Accounting Process

- The Role of Accountants

- Financial Statements and Reports

- Double-Entry Accounting

- Understanding Debits and Credits

- General Ledger and Chart of Accounts

- Recording Transactions

- Adjusting Entries

- Trial Balance

- Financial Statement Preparation

- Closing Entries

- Post-Closing Trial Balance

- Accounting Cycle

- Importance of Accurate Accounting

- Conclusion

Introduction

Accounting is a fundamental aspect of every business, providing the essential framework for managing financial transactions and records. It is the process of recording, organizing, analyzing, and reporting financial information to stakeholders, enabling them to make informed decisions. Whether you are running a small business or managing a multinational corporation, understanding the fundamentals of the accounting process is crucial for financial success.

In this article, we will explore the key components of the accounting process, from the role of accountants to the preparation of financial statements. Whether you have a background in finance or are new to the world of accounting, this guide will provide you with a comprehensive overview of the fundamental principles and practices.

Accounting serves a dual purpose – to track the financial performance of a business and provide insight into its financial health. This information is vital for internal management, as well as for external stakeholders such as investors, creditors, and regulatory bodies. By accurately recording and analyzing financial data, businesses can assess profitability, manage cash flow, and ensure compliance with accounting standards.

The accounting process involves a systematic series of steps that allow for the recording and monitoring of financial transactions, which culminate in the preparation of financial statements. These statements, such as the balance sheet, income statement, and cash flow statement, provide a snapshot of a company’s financial position and performance over a specific period.

Throughout this article, we will explore the various stages of the accounting process, from the initial recording of transactions to the final reporting and analysis. We will cover concepts such as double-entry accounting, debits and credits, general ledger, adjusting entries, trial balance, and the accounting cycle.

Whether you are a business owner, an aspiring accountant, or simply interested in learning more about the financial world, understanding the fundamentals of the accounting process will empower you to make informed decisions and contribute to your organization’s success.

Overview of the Accounting Process

The accounting process is a systematic and logical approach to recording, analyzing, and reporting financial transactions of a business. It provides a clear framework for maintaining accurate financial records and generating meaningful reports that aid in decision-making. Understanding the key components and steps involved in the accounting process is essential for efficient and effective financial management.

At its core, the accounting process can be broken down into several key steps:

- Recording Transactions: The first step in the accounting process is recording financial transactions. This involves documenting all monetary exchanges, such as sales, purchases, expenses, and payments, in a systematic manner. Transactions are typically recorded in journals or electronic accounting software.

- Posting to the General Ledger: Once transactions are recorded, they are then posted to the general ledger. The general ledger is a comprehensive record of all accounts in a company’s chart of accounts. It provides a centralized location for tracking the balances and activity of each account.

- Preparing Adjusting Entries: Adjusting entries are made at the end of an accounting period to ensure that financial statements reflect accurate and up-to-date information. These entries adjust for items such as accrued expenses, prepaid expenses, unearned revenue, and depreciation.

- Preparing Financial Statements: After adjusting entries are made, financial statements are prepared. The three main financial statements are the balance sheet, income statement, and cash flow statement. These statements provide a snapshot of a company’s financial position, profitability, and liquidity.

- Closing Entries: At the end of an accounting period, temporary accounts, such as revenue and expense accounts, are closed out to zero. This process involves transferring their balances to the appropriate permanent accounts. The closing entries help to prepare the accounts for the next accounting period.

- Post-Closing Trial Balance: After the closing entries are made, a post-closing trial balance is prepared. This trial balance includes only permanent accounts and ensures that debits and credits are equal, providing a starting point for the next accounting period.

The accounting process is cyclical, with each accounting period building upon the previous one. It provides a logical and structured approach to managing financial transactions and generating accurate financial statements.

Having a solid understanding of the accounting process is crucial for business owners, accountants, and any individual involved in financial decision-making. It ensures that financial information is reliable, consistent, and useful for analyzing performance, making strategic decisions, and meeting regulatory requirements.

Now that we have an overview of the accounting process, let’s dive deeper into each step and explore the nuances and significance of each component.

The Role of Accountants

Accountants play a crucial role in the accounting process, serving as financial experts who ensure the accuracy and integrity of a company’s financial records. They are responsible for analyzing, interpreting, and reporting financial information, providing valuable insights to help organizations make informed decisions. The role of accountants extends beyond basic bookkeeping tasks, encompassing various responsibilities and areas of expertise.

One of the primary responsibilities of accountants is to maintain accurate and up-to-date financial records. This involves recording and classifying financial transactions, reconciling accounts, and ensuring adherence to accounting principles and standards. Accountants utilize accounting software and tools to efficiently manage financial data, reducing the risk of errors and facilitating accurate reporting.

Accountants are also involved in the analysis and interpretation of financial data. They analyze financial statements, identify trends, and provide insights into a company’s financial performance. By evaluating financial ratios and key performance indicators (KPIs), accountants can help businesses make strategic decisions, such as budgeting, cost reduction, and investment strategies.

Moreover, accountants play a vital role in ensuring compliance with tax laws and regulations. They prepare and file tax returns, calculate tax liabilities, and assist in tax planning to minimize tax obligations. Accountants stay updated on tax laws and regulations to ensure accurate and timely reporting, helping businesses avoid penalties and reduce the risk of audits.

Accountants also have a role in financial forecasting and budgeting. They analyze historical financial data and market trends to develop accurate financial forecasts and budgets. This allows businesses to plan for future growth, allocate resources effectively, and make informed financial decisions.

Beyond financial reporting and analysis, accountants can provide valuable advice on various financial matters. They may provide guidance on improving financial processes, implementing internal controls, and managing cash flow. Accountants often collaborate with management teams and other stakeholders to develop strategies for business growth and financial stability.

In addition to traditional accounting roles, accountants are increasingly involved in specialized areas such as forensic accounting, sustainability accounting, and technology-driven financial analysis. These areas require advanced skills and knowledge, reflecting the evolving role of accountants in today’s business landscape.

In summary, accountants play a critical role in the accounting process, ensuring the accuracy and integrity of financial information. They provide valuable insights, help businesses make informed decisions, ensure compliance with regulations, and contribute to financial stability and growth. With their expertise and analytical skills, accountants are essential partners in achieving financial success for organizations.

Financial Statements and Reports

Financial statements are essential tools that provide a snapshot of a company’s financial performance and position. They play a crucial role in the accounting process, enabling stakeholders to make informed decisions about the business. Understanding the different types of financial statements and their purpose is essential for interpreting and analyzing financial information effectively.

The three primary financial statements are the balance sheet, income statement, and cash flow statement. Let’s take a closer look at each of them:

- Balance Sheet: The balance sheet presents the financial position of a company at a specific point in time, typically at the end of an accounting period. It provides an overview of a company’s assets, liabilities, and shareholders’ equity. The balance sheet follows the basic accounting equation: Assets = Liabilities + Equity. It represents the resources owned by the company (assets), the company’s obligations (liabilities), and the residual interest of the company’s owners (equity).

- Income Statement: The income statement, also known as the profit and loss statement, presents a company’s financial performance over a specific period, such as a month, quarter, or year. It shows the revenue generated by the company, the expenses incurred to generate that revenue, and ultimately the net profit or loss. The income statement provides insights into a company’s ability to generate revenue, control expenses, and achieve profitability.

- Cash Flow Statement: The cash flow statement provides information about the cash inflows and outflows of a company over a specific period. It categorizes cash flows into three main activities: operating, investing, and financing activities. The cash flow statement highlights the sources and uses of cash, providing insights into a company’s cash position, liquidity, and ability to meet its financial obligations.

In addition to these primary financial statements, companies may also prepare supplementary reports and disclosures, such as the statement of shareholders’ equity, notes to the financial statements, and management discussion and analysis (MD&A). These supplementary reports provide additional context and details about the financial statements, helping stakeholders gain a deeper understanding of a company’s financial performance and position.

Financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction and reporting requirements. Following these standards ensures consistency and comparability of financial information across different companies.

When analyzing financial statements, stakeholders look for key indicators of financial health and performance. They may assess liquidity ratios, profitability ratios, leverage ratios, and other metrics to evaluate a company’s financial stability and growth potential. Financial statements also serve as a basis for benchmarking against industry peers and identifying areas for improvement.

Overall, financial statements and reports are crucial tools for assessing a company’s financial position, performance, and prospects. They not only provide transparency and accountability to stakeholders but also guide decision-making and strategic planning within an organization.

Double-Entry Accounting

Double-entry accounting is a fundamental concept in the field of accounting that ensures accuracy and completeness in recording financial transactions. It is based on the principle that every transaction has two effects on a company’s financial position, with equal debits and credits recorded in the accounting system. This method not only helps in maintaining accurate records but also enables businesses to generate reliable financial statements and analyze their financial position.

In double-entry accounting, each transaction affects at least two accounts: one account is debited, and another account is credited. The debits and credits must always balance, ensuring that the accounting equation (Assets = Liabilities + Equity) is maintained. This system provides a systematic way to track the flow of resources within a business and maintains the integrity of the financial records.

The basic premise of double-entry accounting is that every transaction has two sides. For example, when a company sells a product for cash, the transaction affects the revenue account and the cash account. The revenue account is credited to reflect the increase in sales, while the cash account is debited to record the increase in cash received. This approach ensures that the total debits and credits in the transaction are equal.

Double-entry accounting provides several advantages for businesses:

- Accuracy: By recording both the debits and credits for each transaction, double-entry accounting helps minimize errors and provides a systematic way to verify the accuracy of financial records. Any discrepancies can be easily identified by ensuring that the total debits equal the total credits.

- Completeness: Double-entry accounting ensures that all transactions are recorded, leaving no room for omission or oversight. Every transaction must be balanced by an equal debit and credit, providing a comprehensive and complete record of a company’s financial activities.

- Financial Analysis: Double-entry accounting enables the generation of accurate and reliable financial statements, including the balance sheet and income statement. These statements are valuable tools for analyzing financial position, profitability, and cash flow, facilitating informed decision-making and strategic planning.

- Auditing and Compliance: The systematic nature of double-entry accounting makes it easier to audit financial records and comply with regulatory requirements. The clear documentation of transactions and the corresponding debits and credits assist auditors in verifying the accuracy and compliance of financial statements.

Modern accounting software and technology have facilitated the implementation of double-entry accounting for businesses of all sizes. It automates the recording of transactions, generation of financial statements, and tracking of account balances, further enhancing the accuracy and efficiency of the process.

By adopting double-entry accounting, businesses can ensure the integrity of their financial records, gain valuable insights into their financial position and performance, and meet the requirements of stakeholders and regulatory bodies.

Understanding Debits and Credits

In the world of accounting, debits and credits are used to record the financial effects of transactions. While the terms may initially seem confusing, understanding the basic principles of debits and credits is essential for maintaining accurate financial records and following the double-entry accounting method.

In the context of accounting, debits and credits are not the same as a decrease or increase in value. Instead, they represent different sides of a transaction that affect specific accounts. Here’s a simplified explanation of how debits and credits work:

- Debits (-): Debits represent entries made on the left side of an account. Debits are used to record increases in assets and expenses, as well as decreases in liabilities and equity.

- Credits (+): Credits represent entries made on the right side of an account. Credits are used to record increases in liabilities and equity, as well as decreases in assets and expenses.

It’s important to note that debits and credits aren’t inherently positive or negative. They are simply different aspects of a transaction that must be balanced to maintain the accounting equation. The correct placement of debits and credits depends on the nature of the transaction and the specific accounts involved.

Here are some key principles to understand about debits and credits:

- Assets: Debits increase asset accounts, such as cash, accounts receivable, and inventory. Credits decrease asset accounts.

- Liabilities and Equity: Credits increase liability accounts, such as accounts payable and loans payable, as well as equity accounts, such as retained earnings and owner’s equity. Debits decrease liability and equity accounts.

- Revenue and Expenses: Revenues increase with credits and decrease with debits. Expenses increase with debits and decrease with credits.

- Normal Balances: Each type of account has a normal balance, which is the side where increases are usually recorded. For example, assets have normal debit balances, while liabilities and equity have normal credit balances. Understanding the normal balances helps ensure that debits and credits are correctly applied.

When recording a transaction, accountants analyze the nature of the transaction and determine which accounts are affected. They then make entry by debiting one account and crediting another to ensure the accounting equation remains in balance. This double-entry system ensures that the total debits always equal the total credits.

Using a simplistic example, let’s say a company purchases inventory for cash. In this case, the inventory account is debited (increased) to reflect the increase in assets, and the cash account is credited (decreased) to show the decrease in cash. By recording both the debits and credits, the transaction is accurately reflected in the company’s financial records.

While debits and credits may initially seem complex, with practice and understanding of the specific rules for different account types, they become second nature for accountants. It’s crucial to grasp the basic principles of debits and credits to ensure accurate and balanced financial records, effectively follow the double-entry accounting method, and generate reliable financial statements.

General Ledger and Chart of Accounts

The general ledger and chart of accounts are essential components of the accounting system, providing a structured framework for organizing and classifying financial transactions. They play a crucial role in maintaining accurate and reliable financial records, facilitating efficient reporting and analysis.

The general ledger is a central repository that contains all the accounts used by a company to record its financial transactions. It serves as a comprehensive record of all the company’s accounts, including assets, liabilities, equity, revenues, and expenses. Each account in the general ledger contains a running balance of the transactional activity related to that specific account.

Every financial transaction is recorded in the general ledger using a double-entry accounting method, with equal debits and credits to ensure the accounting equation remains balanced. The general ledger helps track the flow of resources within a company, allowing for accurate financial reporting and analysis.

The chart of accounts is a structured list of all the accounts used by a company, providing a standardized way to categorize and organize financial transactions. It serves as a roadmap for recording transactions in the general ledger, ensuring consistency and uniformity in financial reporting.

The chart of accounts typically includes various categories, such as assets, liabilities, equity, revenues, and expenses. Within each category, accounts may be further classified based on their specific nature. For example, under the assets category, accounts may include cash, accounts receivable, inventory, and property, plant, and equipment.

The chart of accounts is often customized to meet the specific needs and requirements of a company. It allows for a detailed breakdown of accounts to adequately capture the company’s financial activities. The chart of accounts creates a standardized structure that enables easy and efficient record-keeping and financial analysis.

Each account in the chart of accounts is assigned a unique identifier or account code. This code helps in the identification and sorting of accounts, making it easier to locate and analyze specific transactions within the general ledger. By using a consistent account code system, businesses can ensure accuracy, streamline financial processes, and facilitate efficient reporting.

Both the general ledger and chart of accounts work together to provide a clear and organized framework for recording, classifying, and summarizing financial transactions. They form the foundation of the accounting system, ensuring accurate record-keeping, supporting financial analysis, and facilitating the generation of reliable financial statements.

Understanding the general ledger and chart of accounts is crucial for accountants, bookkeepers, and anyone involved in the recording and analysis of financial transactions. Proper organization and classification of accounts through the chart of accounts, as reflected in the general ledger, are essential for generating meaningful reports and gaining insights into a company’s financial position and performance.

Recording Transactions

Recording transactions is a fundamental step in the accounting process that involves capturing and documenting the financial activities of a business. It is crucial for maintaining accurate financial records and generating meaningful reports for analysis and decision-making. The process of recording transactions follows a systematic approach to ensure consistency and reliability in financial reporting.

Every financial transaction, whether it involves a sale, a purchase, an expense, or a receipt of payment, needs to be recorded in the appropriate accounts. The recording of transactions is typically done through journals or electronic accounting software. The most common types of journals include the general journal, sales journal, purchase journal, and cash receipts journal.

When recording a transaction, accountants follow the double-entry accounting method. This method requires that each transaction be recorded with at least two entries, one as a debit and one as a credit, to ensure the accounting equation remains in balance. The specific accounts debited and credited will depend on the nature of the transaction and the accounts involved.

For example, when a company sells a product to a customer for cash, the transaction would be recorded by debiting the cash account, increasing the cash balance, and crediting the revenue account, recognizing the increase in sales. On the other hand, if a company purchases inventory on credit, the transaction would be recorded by debiting the inventory account, increasing the inventory balance, and crediting the accounts payable account, reflecting the increase in the company’s liabilities.

Recording transactions accurately is crucial for maintaining reliable financial records and producing accurate financial statements. It ensures that all financial activities are properly documented, leaving no room for omission or oversight. This accurate recording of transactions allows for transparency, accountability, and compliance with accounting principles and standards.

Advancements in technology have greatly streamlined the process of recording transactions. Electronic accounting software and cloud-based platforms provide tools that automate much of the transaction recording process. They offer features such as automatic posting to the appropriate accounts, real-time updates, and built-in checks for errors and inconsistencies, making the recording process more efficient and less prone to mistakes.

In addition to the initial recording of transactions, it is essential to maintain supporting documentation, such as invoices, receipts, and purchase orders. This documentation provides evidence of the transaction and serves as a reference for future audits or inquiries.

Ultimately, the process of recording transactions is the foundation of accurate and reliable financial reporting. It enables businesses to track their financial activities, analyze performance, make informed decisions, and fulfill reporting requirements. By following standardized procedures and utilizing appropriate tools, businesses can ensure that their financial records are complete, accurate, and compliant with accounting principles and regulations.

Adjusting Entries

Adjusting entries are an integral part of the accounting process that ensures the accuracy of financial statements by appropriately reflecting the financial position and performance of a business. These entries are made at the end of an accounting period to account for transactions or events that have occurred but have not yet been recorded.

The purpose of adjusting entries is to align the financial statements with the accrual basis of accounting, which recognizes revenues when earned and expenses when incurred, regardless of when the cash is received or paid. Adjusting entries account for revenues or expenses that are not yet recorded and for prepaid or accrued items that need to be properly recognized.

There are four types of adjusting entries:

- Accrued Revenues: Accrued revenues are revenues that have been earned but not yet recorded or received. An adjusting entry is made to recognize the revenue and the corresponding accounts receivable or revenue account.

- Accrued Expenses: Accrued expenses are expenses that have been incurred but not yet recorded or paid. An adjusting entry is made to recognize the expense and the corresponding accounts payable or expense account.

- Prepaid Expenses: Prepaid expenses are expenses paid in advance but not yet used or consumed. An adjusting entry is made to recognize the expense as it is incurred, reducing the prepaid expense and increasing the corresponding expense account.

- Unearned Revenues: Unearned revenues are revenues received in advance but not yet earned. An adjusting entry is made to recognize the revenue as it is earned, reducing the unearned revenue liability and increasing the corresponding revenue account.

Adjusting entries ensure that revenues and expenses are appropriately matched to the accounting period in which they occur, providing a more accurate representation of a company’s financial performance. These entries also ensure that assets and liabilities are properly stated on the balance sheet, reflecting the economic reality of the business.

Adjusting entries are typically made by accountants or bookkeepers at the end of each accounting period, before the preparation of financial statements. They require an analysis of accounts, evaluation of prepaid or accrued items, and calculations to determine the appropriate adjustments.

Accounting software often automates the adjusting entry process, making it more efficient and reducing the likelihood of errors. With the click of a button, the software can generate the necessary adjusting entries based on predefined rules and parameters.

Adjusting entries are crucial for producing accurate financial statements. Without these entries, financial statements would not reflect the true financial position and performance of a company. Adjusting entries ensure that the results are reported in the appropriate period and comply with accounting standards and principles.

It is important to note that adjusting entries do not impact cash flow, as they involve the recognition of revenues and expenses only. They are solely made to reflect the economic reality of a business and provide a more accurate assessment of its financial health.

In summary, adjusting entries are necessary to ensure that financial statements are accurate, complete, and in accordance with accounting principles. They align financial reporting with the accrual basis of accounting and reflect the economic events that have occurred, bridging the gap between cash transactions and the recognition of revenues and expenses.

Trial Balance

The trial balance is a crucial component of the accounting process that ensures the accuracy of financial records and serves as a preliminary step towards preparing the financial statements. It provides a summary of all the balances in the general ledger accounts, allowing accountants to verify the equality of debits and credits and identify any potential errors or discrepancies before generating financial statements.

The trial balance is prepared as a listing of all the general ledger accounts, with their respective debit and credit balances. The total debits and credits should be equal, reflecting the principle of double-entry accounting, where every transaction has an equal debit and credit amount. The trial balance acts as a “check” to ensure that the books are in balance.

While the trial balance confirms the equality of debits and credits, it is important to note that it does not guarantee the absence of errors or inaccuracies in the financial records. The trial balance only ensures that the accounting equation (Assets = Liabilities + Equity) is balanced. Errors such as transpositions, omissions, or misclassifications may still exist despite a balanced trial balance.

Preparing a trial balance involves the following steps:

- Compile a list of all the general ledger accounts and their respective balances.

- Classify the accounts as assets, liabilities, equity, revenues, and expenses.

- Calculate the total debits and credits for each classification.

- Verify that the total debits equal the total credits.

If the trial balance does not balance, it indicates that there may be errors in recording transactions, such as incorrect postings, missing entries, or calculation mistakes. Accountants then need to investigate and correct any discrepancies before proceeding with the preparation of financial statements.

The trial balance also serves as a reference for preparing financial statements, such as the balance sheet and income statement. The ending balances from the trial balance are transferred to the corresponding financial statement line items. However, it is important to note that adjustments may still need to be made to certain accounts after the trial balance is prepared, as part of the adjusting entry process discussed earlier.

While the trial balance is a valuable tool for detecting errors, it should not be solely relied upon as the ultimate proof of accuracy. Accountants should also perform additional checks and reviews, such as reconciling bank statements, verifying supporting documentation, and conducting further analysis to ensure the reliability of financial data.

In summary, the trial balance is a critical step in the accounting process as it confirms the equality of debits and credits and helps identify potential errors. It is an important tool for accountants to ensure the accuracy of financial records before proceeding with the preparation of financial statements. Continuing to follow proper accounting practices and performing additional checks and reviews is essential to maintain the integrity and reliability of financial information.

Financial Statement Preparation

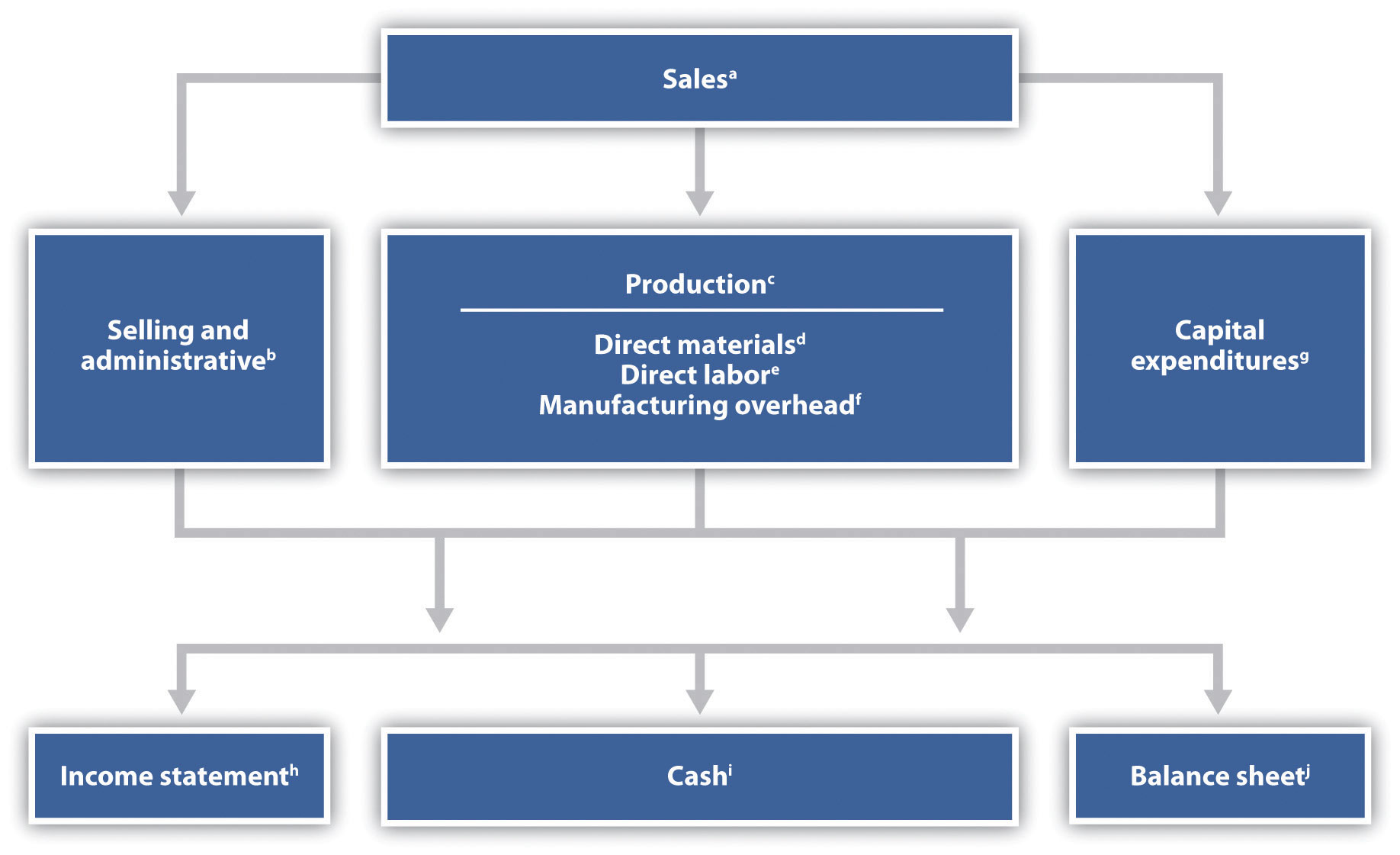

Financial statement preparation is a key stage in the accounting process that involves organizing and presenting the financial information of a business. Financial statements serve as a vital tool for stakeholders to assess a company’s financial performance, position, and cash flows. The preparation of these statements follows certain guidelines and principles to ensure accuracy, consistency, and compliance with accounting standards.

The three primary financial statements, which are prepared as part of the financial statement preparation process, are the balance sheet, income statement, and cash flow statement.

The balance sheet provides a snapshot of a company’s financial position, presenting its assets, liabilities, and shareholders’ equity at a specific point in time. It reflects the company’s resources (assets), obligations (liabilities), and the residual interest of the owners (equity). The balance sheet allows stakeholders to understand the solvency, liquidity, and financial health of the business.

The income statement showcases a company’s revenues, expenses, gains, and losses over a particular period. It provides insights into a company’s financial performance by calculating its net income or net loss. The income statement helps stakeholders evaluate the profitability, efficiency, and sustainability of a business.

The cash flow statement highlights a company’s cash inflows and outflows during a specific period. It categorizes cash flows into operating, investing, and financing activities. The cash flow statement is valuable for assessing a company’s ability to generate and manage cash and to meet its financial obligations.

The process of financial statement preparation involves the following steps:

- Gather Financial Data: Collect all the necessary financial data, including transaction records, general ledger balances, adjusting entries, and supporting documentation.

- Organize and Classify Accounts: Classify the accounts into the appropriate categories, such as assets, liabilities, equity, revenues, and expenses. Ensure that the records are accurate and complete.

- Apply Accounting Principles and Standards: Ensure that the financial statements adhere to relevant accounting principles and standards, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

- Prepare Balance Sheet: Compile the assets, liabilities, and shareholders’ equity information to create the balance sheet. Ensure that the equation (Assets = Liabilities + Equity) balances.

- Prepare Income Statement: Calculate and organize the revenues, expenses, gains, and losses to create the income statement. Calculate the net income or net loss by subtracting the total expenses from the total revenues.

- Prepare Cash Flow Statement: Present the cash inflows and outflows from operating, investing, and financing activities to construct the cash flow statement. Ensure that the cash flow from operating activities reconciles with the net income or net loss from the income statement.

- Analyze and Review: Perform a comprehensive analysis of the financial statements, looking for trends, ratios, and anomalies. Review the statements for accuracy, consistency, and compliance with accounting standards.

Once the financial statements are prepared and reviewed, they can be used by stakeholders, such as investors, creditors, and management, to evaluate the company’s financial performance and to make informed decisions. Financial statements provide valuable insights into a company’s profitability, liquidity, and financial stability, allowing stakeholders to assess risks, identify opportunities, and monitor progress toward financial goals.

It is important to note that financial statements are not standalone documents but are part of an ongoing reporting process. They should be prepared regularly, usually on a monthly, quarterly, and annual basis, to track a company’s financial performance over time and facilitate comparisons.

Overall, financial statement preparation is a crucial step in the accounting process, contributing to transparent and reliable financial reporting. By following established guidelines, principles, and standards, businesses can ensure the accuracy and usefulness of their financial statements, enabling stakeholders to make informed decisions based on reliable financial information.

Closing Entries

Closing entries are a necessary step in the accounting process that helps reset the temporary accounts and prepare them for the next accounting period. These entries are made at the end of the reporting period, typically at the end of a month, quarter, or year, to close out the revenue, expense, and dividend accounts. Closing entries ensure that these accounts start with zero balances in the new accounting period and facilitate the accurate calculation of net income.

The primary objectives of closing entries are:

- Resetting Revenue and Expense Accounts: By closing the revenue and expense accounts, the balances are transferred or “closed” to the income summary account, which serves as a temporary holding account for net income or net loss.

- Calculating Net Income or Net Loss: The closing entries allow accountants to calculate the net income or net loss for the accounting period. The net income is the excess of revenues over expenses, while net loss is the excess of expenses over revenues.

- Preparing Accounts for the Next Period: Closing entries reset the temporary accounts, ensuring that they start with zero balances in the new accounting period. This process provides a clean slate for recording revenues and expenses in the upcoming period.

The process of closing entries typically involves the following steps:

- Close Revenue Accounts: Debit each revenue account for the total amount and credit the income summary account. This entry transfers the revenue balances from the individual revenue accounts to the income summary account.

- Close Expense Accounts: Credit each expense account for the total amount and debit the income summary account. This entry transfers the expense balances from the individual expense accounts to the income summary account.

- Calculate Net Income or Net Loss: Calculate the difference between the total revenues and total expenses, which is represented as the net income or net loss. Record this amount as either a debit or credit in the income summary account.

- Close Income Summary Account: Transfer the net income or net loss from the income summary account to the retained earnings or owner’s equity account. If there is a net income, credit the income summary account, and debit the retained earnings or owner’s equity account. If there is a net loss, debit the income summary account, and credit the retained earnings or owner’s equity account.

- Close Dividend Account: If applicable, close the dividend account by transferring the balance to the retained earnings or owner’s equity account. Debit the retained earnings or owner’s equity account and credit the dividend account.

After the closing entries are made, the temporary accounts, such as revenue, expense, and dividend accounts, will have zero balances. The permanent accounts, such as assets, liabilities, and equity accounts, retain their balances and carry forward to the next accounting period.

Closing entries are an important step in the accounting cycle as they help ensure the accuracy of financial statements and provide a clear distinction between current and future accounting periods. They enable businesses to accurately calculate net income, properly account for dividends, and prepare for the recording of new transactions in the upcoming period.

It is important to note that closing entries differ based on the specific accounting framework being used. For example, in a sole proprietorship or partnership, the income summary account is closed to the owner’s capital account, while in a corporation, it is closed to the retained earnings account.

In summary, closing entries play a vital role in the accounting process by resetting temporary accounts, calculating net income or net loss, and preparing accounts for the next accounting period. By following proper closing procedures, businesses can ensure the accuracy of their financial statements, maintain transparency in reporting, and facilitate smooth transitioning from one accounting period to another.

Post-Closing Trial Balance

The post-closing trial balance is a crucial step in the accounting process that follows the closing entries. It is prepared after the temporary accounts, such as revenue, expense, and dividend accounts, have been closed out at the end of the accounting period. The post-closing trial balance ensures the accuracy of the permanent accounts and serves as the starting point for the next accounting period.

The primary objectives of the post-closing trial balance are:

- Verify Balance Sheet Accuracy: The post-closing trial balance confirms that the balances of the permanent accounts, such as assets, liabilities, and retained earnings, are accurate and properly carried forward to the next accounting period. It ensures that the accounting equation (Assets = Liabilities + Equity) remains in balance.

- Identify Errors or Discrepancies: If there are any errors or discrepancies in the permanent accounts, the post-closing trial balance helps to identify them. If the trial balance does not balance, it indicates that errors may have occurred in the closing entries or the transfer of balances to the permanent accounts.

- Facilitate Financial Statement Preparation: The post-closing trial balance provides the necessary account balances for the preparation of financial statements, such as the balance sheet, income statement, and cash flow statement, for the next accounting period.

The process of preparing the post-closing trial balance involves the following steps:

- Retrieve Account Balances: Gather the ending balances for all the permanent accounts, which include assets, liabilities, and capital accounts, from the general ledger.

- Organize the Trial Balance: List the account names and their respective balances in a trial balance format. Separate the accounts by category, such as assets, liabilities, and equity, to better analyze the financial position.

- Verify Account Balances: Calculate the total debits and credits for each category and verify that they are equal. This balance validation ensures that the trial balance is error-free and accurately reflects the financial position.

- Review for Accuracy: Carefully review the trial balance for any abnormalities or inconsistencies. Double-check the account balances to identify any potential errors that may impact the accuracy of financial statements.

If the post-closing trial balance does not balance, it indicates that errors may have occurred during the closing process or that the transfer of balances was not accurately recorded. In such cases, accountants need to investigate and correct any discrepancies before preparing the financial statements for the next accounting period.

It is important to note that the post-closing trial balance only includes permanent accounts, as temporary accounts have been closed out. Permanent accounts carry their balances from one accounting period to another, while temporary accounts start with zero balances in each new accounting period.

The post-closing trial balance provides a reliable snapshot of the company’s financial position after adjusting and closing entries have been made. It sets the stage for accurate financial reporting in the upcoming period and assists in analyzing the financial health, liquidity, and solvency of the business.

In summary, the post-closing trial balance ensures the accuracy of the permanent accounts and acts as a platform for generating financial statements for the next accounting period. It serves as a valuable tool for identifying errors or discrepancies, verifying the balance sheet’s accuracy, and maintaining the integrity of financial information.

Accounting Cycle

The accounting cycle is a series of steps that businesses follow to accurately record, classify, and report their financial transactions. It represents the entire process from the initial recording of transactions to the preparation of financial statements and finalizing the books for the next accounting period. The accounting cycle ensures that financial records are complete, accurate, and compliant with accounting principles and standards. It typically encompasses the following steps:

- Identify and Analyze Transactions: The first step in the accounting cycle is identifying and analyzing financial transactions. This involves examining and interpreting the source documents, such as receipts, invoices, and contracts, to determine the impact on the financial statements.

- Record Transactions in Journals: Once the transactions are analyzed, they are recorded in the appropriate journals, such as the general journal, sales journal, or cash receipts journal. Each transaction is recorded using the double-entry accounting method, where debits and credits are entered to maintain balance and accuracy.

- Post to the General Ledger: After recording transactions in the journals, the account balances are transferred or posted to the general ledger. The general ledger serves as the central repository of all accounts, and it provides a comprehensive record of the company’s financial transactions.

- Prepare and Analyze Trial Balance: At the end of the accounting period, a trial balance is prepared to verify the equality of debits and credits. The trial balance lists all the accounts and their respective balances, ensuring that the accounting equation (Assets = Liabilities + Equity) balances.

- Make Adjusting Entries: Adjusting entries are made to account for transactions or events that have occurred but have not yet been recorded. These entries ensure that revenues and expenses are properly matched to the accounting period and that assets and liabilities are accurately reported in the financial statements.

- Prepare Financial Statements: Based on the adjusted account balances, the financial statements are prepared. These statements include the balance sheet, income statement, and cash flow statement. The financial statements provide insights into the company’s financial position, performance, and cash flow.

- Close Temporary Accounts: Temporary accounts, such as revenue, expense, and dividend accounts, are closed at the end of the accounting period. Closing entries are made to transfer their balances to the appropriate permanent accounts, ensuring that the temporary accounts start with zero balances in the next accounting period.

- Prepare Post-Closing Trial Balance: After the closing entries, a post-closing trial balance is prepared. This trial balance includes only the permanent accounts and serves as the starting point for the next accounting period.

- Analyze and Interpret Financial Data: Throughout the accounting cycle, financial data is analyzed and interpreted to gain insights into the company’s financial performance, identify trends, and make informed decisions. Financial ratios and key performance indicators may be used to assess profitability, liquidity, and solvency.

The accounting cycle is a continuous process that repeats for each accounting period, usually on a monthly, quarterly, or annual basis. It ensures the accurate recording of transactions, proper adjustment for timing differences, and the generation of reliable financial statements.

Advancements in technology have greatly streamlined the accounting cycle. Accounting software and automation tools automate many of the steps, enhancing accuracy, efficiency, and data security. They provide features such as real-time data updates, automatic posting, and built-in checks and validations.

By following the accounting cycle, businesses can maintain accurate financial records, comply with accounting standards, and provide stakeholders with reliable and transparent financial information. It serves as a systematic framework for managing financial transactions and enables informed decision-making and effective financial management.

Importance of Accurate Accounting

Accurate accounting is of utmost importance for businesses of all sizes, as it serves as the foundation for effective financial management and decision-making. Accurate accounting ensures that financial records are reliable, transparent, and compliant with accounting principles and regulations. The significance of accurate accounting can be seen in several key areas:

- Financial Decision-Making: Accurate accounting provides the necessary financial information for stakeholders to make informed decisions. It enables business owners, managers, and investors to assess the financial health, profitability, and liquidity of a company. Accurate financial data helps in evaluating investment opportunities, determining pricing strategies, forecasting cash flow, and identifying cost-saving measures.

- Compliance with Reporting Requirements: Accurate accounting ensures that businesses comply with regulatory standards and reporting requirements. It enables businesses to meet legal obligations, file tax returns accurately, and fulfill statutory reporting obligations. Non-compliance with accounting standards and regulations can lead to legal issues, penalties, and damaged reputation.

- Investor Confidence: Accurate accounting strengthens investor confidence in a business. Reliable financial statements based on accurate accounting provide transparency and demonstrate the financial stability and profitability of a company. Investors rely on accurate financial information to assess the risks and rewards associated with investing in a particular business.

- Access to Financing: Lenders and financial institutions require accurate financial statements to evaluate the creditworthiness of a business and determine its eligibility for loans or other forms of financing. Accurate accounting increases the chances of securing favorable financing terms and borrowing rates.

- Monitoring Financial Performance: Accurate accounting allows businesses to monitor and evaluate their financial performance over time accurately. By comparing financial statements from different periods, businesses can identify trends, analyze key performance indicators, and track progress towards financial goals. Accurate accounting facilitates effective financial analysis and planning.

- Business Valuation: In cases of selling a business, accurate accounting is crucial for determining its value. Potential buyers rely on accurate financial information to assess a company’s financial position, profitability, and growth potential. Accurate accounting enables fair and accurate business valuations.

- Internal Controls and Fraud Prevention: Accurate accounting includes robust internal controls that help prevent fraud and detect errors. Proper checks and balances ensure that financial transactions are properly authorized, recorded, and documented. Accurate accounting practices contribute to a strong internal control environment, reducing the risk of fraud and misappropriation of assets.

- Legal and Regulatory Compliance: Accurate accounting plays a critical role in adhering to legal and regulatory requirements. It ensures compliance with tax laws, labor regulations, financial reporting requirements, and industry-specific rules. Accurate records facilitate audits, investigations, and inspections by regulatory bodies.

Accurate accounting is not just important for the success of individual businesses, but it also contributes to the overall stability of the economy. Reliable financial information is the backbone of economic decision-making, fostering trust among businesses, investors, and the general public.

In summary, accurate accounting serves as a cornerstone for effective financial management, decision-making, and compliance. It provides stakeholders with reliable financial information, facilitates informed decision-making, and ensures legal and regulatory compliance. Accurate accounting enhances transparency, investor confidence, and access to financing, contributing to the overall success and sustainability of businesses.

Conclusion

The accounting process is a fundamental aspect of financial management for businesses of all sizes. Understanding the principles, practices, and importance of accurate accounting is essential for making informed decisions, ensuring compliance, and achieving financial success. From the recording of transactions to the preparation of financial statements, each step in the accounting cycle contributes to transparent and reliable financial reporting.

Accurate accounting provides stakeholders with the necessary information to assess the financial health, profitability, and liquidity of a business. It enables effective financial decision-making, ensures compliance with regulatory standards, and fosters investor confidence. Accurate financial records are essential for obtaining financing, monitoring financial performance, and identifying opportunities for growth.

The accounting cycle, including activities such as recording transactions, preparing adjusting entries, and generating financial statements, provides a systematic framework for managing financial data and accounting tasks. The use of double-entry accounting ensures accuracy and completeness, while the post-closing trial balance verifies the equality of debits and credits. Through each step in the accounting process, businesses maintain integrity in financial reporting and comply with accounting principles and regulations.

Technology has accelerated and streamlined the accounting process with the advent of accounting software and automation tools. These tools enhance accuracy, efficiency, and data security, freeing up time for accountants to analyze financial data and provide valuable insights to stakeholders.

In conclusion, accurate accounting is vital to the success, transparency, and credibility of businesses. By following proper accounting practices, businesses can provide reliable information to stakeholders, make informed decisions, and navigate the complexities of financial management effectively. Embracing accurate accounting practices ensures compliance, fosters investor confidence, and guides businesses towards achieving their financial goals.