Home>Finance>What Licensing Is Needed To Consult To Pension Funds?

Finance

What Licensing Is Needed To Consult To Pension Funds?

Published: January 23, 2024

Learn about the essential licensing requirements for consulting with pension funds in the finance industry. Understand the qualifications needed to provide expert financial advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Role of Licensing in Consulting to Pension Funds

Consulting to pension funds is a specialized and crucial aspect of the finance industry. Pension funds play a vital role in ensuring financial security for individuals during their retirement years. As such, the consultants who provide guidance and advice to pension funds must possess the necessary expertise and qualifications to navigate the complex landscape of retirement planning, investment strategies, and regulatory compliance.

When it comes to consulting to pension funds, obtaining the appropriate licenses and certifications is not only a legal requirement but also a demonstration of proficiency and credibility in the field. This article delves into the licensing requirements for individuals or firms seeking to provide consulting services to pension funds, the types of licenses and certifications needed, as well as the steps involved in obtaining these essential credentials.

Understanding the significance of licensing in consulting to pension funds is paramount for anyone aspiring to enter this specialized area of finance. It not only ensures compliance with regulatory standards but also instills trust and confidence in clients and stakeholders, affirming the consultant’s ability to navigate the intricate landscape of pension fund management and investment strategies.

Understanding Pension Funds

Pension funds are instrumental in providing financial security for individuals during their retirement years. These funds are typically sponsored by employers or labor unions, and they receive contributions from both the employer and employees. The primary objective of a pension fund is to generate returns on investments that can be used to pay out benefits to retirees.

One of the key features of pension funds is their long-term investment horizon, as they are designed to provide income for retirees over an extended period. As such, the management of pension funds involves strategic investment decisions aimed at balancing risk and return to ensure the fund’s sustainability and ability to meet its future obligations.

Furthermore, pension funds are subject to regulatory oversight to safeguard the interests of the beneficiaries and ensure prudent management of the fund’s assets. Compliance with legal and regulatory requirements is essential in the operation of pension funds, and this is where the expertise of consultants in the field becomes invaluable.

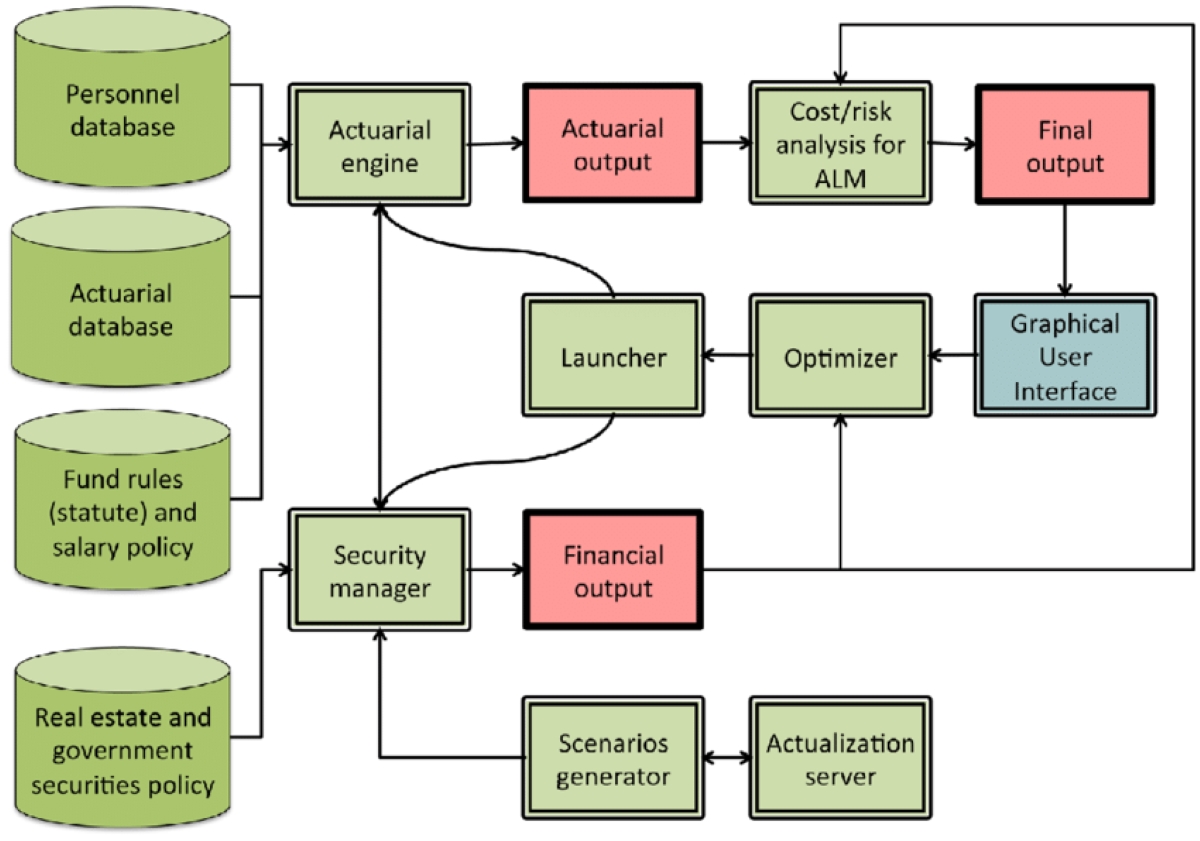

Consulting to pension funds encompasses a wide array of activities, including investment analysis, risk management, asset allocation, and compliance with regulatory frameworks such as the Employee Retirement Income Security Act (ERISA) in the United States. Consultants in this field play a critical role in advising pension fund managers on investment strategies, fund performance evaluation, and adherence to legal and ethical standards.

Understanding the intricacies of pension funds is crucial for consultants aiming to provide valuable guidance and support in this specialized area of finance. It requires a deep comprehension of investment principles, risk management strategies, and regulatory requirements specific to pension fund management.

Licensing Requirements for Consulting to Pension Funds

Consulting to pension funds is a highly regulated field, and individuals or firms offering such services are typically required to obtain specific licenses and certifications. These requirements are in place to ensure that consultants possess the necessary expertise, adhere to professional standards, and comply with regulatory guidelines when providing advice and guidance to pension funds.

The licensing requirements for consulting to pension funds may vary depending on the jurisdiction and the nature of the services offered. In the United States, for example, consultants providing investment advice to pension funds are subject to the regulatory framework of the Securities and Exchange Commission (SEC) and may need to register as investment advisers. Additionally, compliance with the guidelines set forth by the Financial Industry Regulatory Authority (FINRA) is essential for individuals engaged in securities-related activities within the pension fund consulting domain.

Furthermore, consultants may be required to obtain specific licenses or certifications related to retirement planning, asset management, or fiduciary responsibilities, depending on the scope of their services. These credentials demonstrate a consultant’s proficiency in areas critical to pension fund management and instill confidence in clients regarding their ability to navigate the complexities of retirement planning and investment strategies.

It is important to note that licensing requirements may also extend to the firm employing the consultants, particularly if the firm is engaged in activities that fall within the regulatory purview of governing bodies overseeing pension funds and investment management. Compliance with these requirements is essential to operate lawfully and maintain the trust and confidence of clients and stakeholders.

Understanding and fulfilling the licensing requirements for consulting to pension funds is a fundamental aspect of establishing credibility and competence in the field. It not only demonstrates a consultant’s commitment to upholding professional standards but also ensures adherence to legal and regulatory frameworks governing pension fund management and investment advisory services.

Types of Licenses and Certifications Needed

Obtaining the necessary licenses and certifications for consulting to pension funds entails meeting specific criteria and demonstrating expertise in relevant areas of finance, investment, and retirement planning. The types of licenses and certifications needed may vary based on the nature of the services provided and the regulatory requirements of the jurisdiction in which the consultant operates.

One of the key credentials often required for individuals engaged in providing investment advice to pension funds is registration as an investment adviser with the appropriate regulatory authorities. In the United States, this may involve registration with the Securities and Exchange Commission (SEC) or state securities regulators, depending on the assets under management and the scope of the advisory services.

Additionally, consultants involved in securities-related activities within the pension fund consulting domain may need to obtain licenses such as the Series 65, which qualifies individuals to act as investment adviser representatives. This license is administered by the Financial Industry Regulatory Authority (FINRA) and is a prerequisite for providing investment advice and managing client accounts.

Furthermore, certifications specific to retirement planning and fiduciary responsibilities are highly valuable in the pension fund consulting arena. For instance, the Certified Financial Planner (CFP) certification signifies expertise in comprehensive financial planning, including retirement planning, investment management, tax planning, and estate planning. Consultants holding this certification demonstrate a high level of proficiency in advising clients on retirement-related matters, making it a sought-after credential in the industry.

Other certifications, such as the Chartered Financial Analyst (CFA) designation, may also be relevant for consultants involved in investment analysis, asset allocation, and portfolio management for pension funds. The CFA designation is well-regarded globally and signifies a deep understanding of investment principles and financial analysis, essential for guiding pension funds in making sound investment decisions.

Ultimately, the types of licenses and certifications needed for consulting to pension funds are geared towards validating a consultant’s expertise, ethical conduct, and ability to provide sound financial advice and guidance in the realm of retirement planning and investment management.

Steps to Obtain the Necessary Licenses

Obtaining the necessary licenses and certifications for consulting to pension funds involves a series of steps aimed at meeting the regulatory requirements and demonstrating proficiency in the relevant areas of finance and investment. The process may vary based on the jurisdiction and the specific licenses or certifications sought, but there are general steps that individuals or firms can follow to obtain the essential credentials for pension fund consulting.

1. Educational Requirements: Many licenses and certifications in the finance and investment industry have educational prerequisites. Individuals aspiring to become pension fund consultants may need to complete relevant academic programs or courses to fulfill these requirements. This may include obtaining a bachelor’s degree in finance, economics, or a related field, and in some cases, pursuing advanced degrees or specialized training in retirement planning and investment management.

2. Professional Experience: Gaining practical experience in the finance industry, particularly in areas related to retirement planning, investment advisory, and asset management, is often a prerequisite for obtaining licenses and certifications. This may involve working in roles that provide exposure to pension fund management, regulatory compliance, and client advisory services under the supervision of experienced professionals.

3. Examination: Many licenses and certifications require individuals to pass rigorous examinations that assess their knowledge and understanding of relevant financial concepts, regulatory guidelines, and ethical standards. For example, the Series 65 examination is a standard requirement for individuals seeking to register as investment adviser representatives, testing their proficiency in investment advisory practices and legal regulations.

4. Registration and Application: Once the educational and experience requirements are met, individuals may need to register with the appropriate regulatory authorities and submit applications for the desired licenses or certifications. This process often involves providing documentation of qualifications, professional history, and compliance with regulatory standards.

5. Continuing Education: After obtaining initial licenses and certifications, consultants in the pension fund industry are typically required to engage in ongoing professional development and continuing education to maintain their credentials. This may involve completing specified coursework, attending seminars, or obtaining additional certifications to stay abreast of industry developments and regulatory changes.

6. Compliance with Regulatory Standards: Throughout the licensing and certification process, it is essential for individuals and firms to ensure strict adherence to regulatory standards and ethical guidelines governing pension fund consulting. This includes maintaining transparency in client dealings, upholding fiduciary responsibilities, and complying with reporting and disclosure requirements as mandated by regulatory authorities.

By following these steps and diligently fulfilling the requirements set forth by regulatory bodies and professional organizations, individuals and firms can obtain the necessary licenses and certifications to engage in consulting to pension funds, demonstrating their competence and commitment to upholding industry standards.

Conclusion

Consulting to pension funds is a specialized and vital aspect of the finance industry, requiring consultants to possess the requisite licenses and certifications to provide expert guidance in retirement planning, investment strategies, and regulatory compliance. The significance of licensing in this field cannot be overstated, as it not only ensures compliance with legal and regulatory standards but also instills trust and confidence in clients and stakeholders.

Understanding the licensing requirements for consulting to pension funds is essential for individuals and firms seeking to establish credibility and proficiency in this domain. From registration as investment advisers to obtaining certifications in retirement planning and investment management, the process of acquiring the necessary credentials involves meeting educational, experiential, and examination-based criteria, as well as ongoing compliance with regulatory standards.

By obtaining licenses and certifications tailored to the intricacies of pension fund consulting, professionals demonstrate their commitment to upholding ethical standards, providing sound financial advice, and navigating the complexities of retirement planning and investment management. These credentials not only validate expertise but also serve as a testament to a consultant’s dedication to serving the best interests of pension funds and their beneficiaries.

Ultimately, the pursuit of licensing and certifications in the field of pension fund consulting underscores the importance of professionalism, competence, and regulatory adherence in guiding pension funds toward sustainable and prudent investment strategies. As the landscape of retirement planning continues to evolve, consultants equipped with the necessary credentials are poised to make meaningful contributions to the financial security and well-being of retirees, ensuring that pension funds fulfill their crucial role in providing income during post-employment years.

In conclusion, the journey toward obtaining the essential licenses and certifications for consulting to pension funds is a testament to the commitment of consultants to uphold industry standards, serve clients with integrity, and contribute to the long-term financial security of retirees.