Home>Finance>What License Do I Need To Sell Medicare Insurance?

Finance

What License Do I Need To Sell Medicare Insurance?

Published: November 3, 2023

Learn about the necessary license for selling Medicare insurance to ensure your financial success in the insurance industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Medicare insurance is a vital component of the healthcare system in the United States, providing coverage for millions of Americans who are 65 years old and older, as well as individuals with certain disabilities. If you are interested in entering the insurance industry and selling Medicare plans, it is important to understand the licensing requirements involved.

Acquiring the necessary license to sell Medicare insurance involves meeting specific criteria set by the Centers for Medicare & Medicaid Services (CMS). These requirements ensure that individuals selling Medicare plans are knowledgeable about the programs and able to effectively assist clients in determining the best coverage options for their needs.

This article will guide you through the process of obtaining the proper license to sell Medicare insurance, providing a comprehensive overview of the licensing requirements, types of licenses available, and the steps involved in acquiring and maintaining your license.

Before diving into the licensing details, let’s briefly touch on what Medicare insurance is and why it is such a critical component of the healthcare system.

Medicare is a federal health insurance program that primarily serves individuals aged 65 and older, as well as individuals with certain disabilities. It helps cover the cost of medical services, hospital stays, prescription drugs, and other essential healthcare needs.

As our population continues to age, the demand for Medicare insurance is increasing. This creates opportunities for individuals who are interested in a career in insurance and want to specialize in selling Medicare plans. However, it is crucial to be aware of the licensing requirements to ensure compliance with federal regulations and to provide the best service possible to your clients.

Understanding Medicare Insurance

Before diving into the licensing requirements for selling Medicare insurance, it is essential to have a solid understanding of how Medicare works and the different coverage options available. Medicare is divided into several parts, each providing coverage for different aspects of healthcare:

- Medicare Part A: Also known as hospital insurance, Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and limited home healthcare services.

- Medicare Part B: Part B is medical insurance that covers outpatient services, doctor visits, preventive care, and medical supplies.

- Medicare Part C: Also known as Medicare Advantage, Part C is offered by private insurance companies approved by Medicare. It combines Part A and Part B coverage and often includes additional benefits such as prescription drug coverage and dental or vision care.

- Medicare Part D: Part D is prescription drug coverage that can be obtained through standalone prescription drug plans or as part of a Medicare Advantage plan.

When selling Medicare insurance, it is essential to understand the different parts and coverage options available to help clients make informed decisions about their healthcare needs.

Another crucial aspect of Medicare insurance is the enrollment periods. Medicare has specific times during the year when individuals can enroll, change, or disenroll from different parts of the program. These enrollment periods include the Initial Enrollment Period, General Enrollment Period, and Annual Enrollment Period, among others. It is essential to be familiar with these enrollment periods and educate clients on their enrollment options.

Additionally, Medicare insurance is constantly evolving and changing. Stay up to date with any new rules, regulations, and updates released by CMS to ensure you are providing the most accurate and relevant information to your clients.

By having a thorough understanding of Medicare and its various parts, coverage options, and enrollment periods, you will be better equipped to guide clients through the process of selecting the most appropriate Medicare plan for their unique needs.

License Requirements for Selling Medicare Insurance

Obtaining a license to sell Medicare insurance involves meeting specific requirements set forth by the Centers for Medicare & Medicaid Services (CMS). These requirements aim to ensure that individuals selling Medicare plans have the necessary knowledge and expertise to assist clients in making informed decisions about their healthcare coverage. Here are the key license requirements for selling Medicare insurance:

Educational Requirements: To qualify for a Medicare insurance license, individuals must complete the required pre-licensing education courses. These courses cover topics such as Medicare coverage options, rules and regulations, ethics, and sales practices. The number of hours of education required can vary by state.

State Insurance Exam: After completing the pre-licensing education, individuals must pass a state insurance exam specific to Medicare insurance. The exam tests the individual’s knowledge and understanding of Medicare programs, policies, and procedures. It is essential to study and prepare thoroughly for the exam to increase the chances of passing it successfully.

Criminal Background Check: Many states require individuals selling Medicare insurance to undergo a criminal background check. This is to ensure that agents have good moral character and do not have any disqualifying offenses.

Appointment with Insurance Companies: Once licensed, individuals must be appointed with the insurance companies they intend to represent. This appointment process involves completing the necessary paperwork and meeting the appointment requirements set by each insurance company.

Continuing Education: To maintain the Medicare insurance license, individuals are required to complete continuing education courses. This ensures that agents stay up to date with changes in Medicare policies, regulations, and best practices.

It is important to note that the specific requirements for obtaining a license to sell Medicare insurance can vary by state. It is crucial to check with your state insurance department for the exact requirements in your area.

By meeting these license requirements and obtaining the necessary education and qualifications, you will be well-prepared to assist clients in navigating the complexities of Medicare insurance and helping them find the best coverage options for their unique needs.

Types of Licenses for Selling Medicare Insurance

When it comes to selling Medicare insurance, there are different types of licenses available depending on the specific products and services you wish to offer. Understanding these license types will help you determine the scope of your practice and the types of Medicare plans you can sell. Here are the main types of licenses for selling Medicare insurance:

Health Insurance License: This license allows you to sell health insurance policies, including Medicare Advantage plans, Medicare Supplement plans (Medigap), and standalone Medicare Part D prescription drug plans. With a health insurance license, you can assist clients in selecting and enrolling in various Medicare coverage options based on their needs and preferences.

Life Insurance License: While Medicare is primarily health insurance, it is often linked with life insurance policies. Some insurance agents choose to obtain a life insurance license in addition to their health insurance license to offer clients a broader range of services. This license allows you to sell life insurance policies that can complement Medicare coverage.

Annuity License: An annuity license enables you to sell annuity products that can provide a stream of income for individuals during retirement. Since Medicare is primarily for individuals who are 65 years old and older, many clients may have an interest in both Medicare insurance and annuity products as part of their retirement planning.

Accident and Health License: In some states, an accident and health license is required to sell Medicare insurance. This license covers a broader range of health-related insurance products, including Medicare plans, as well as other health insurance policies such as individual and group health plans.

It is important to check with your state insurance department or regulatory body to determine the specific license requirements in your state. Some states may have unique license types or additional requirements for selling Medicare insurance.

When deciding which license(s) to obtain, consider your clients’ needs and your long-term career goals. Assess the demand for different types of Medicare plans in your area and determine if you want to specialize in specific products or offer a broader range of options.

By obtaining the appropriate license(s), you will have the legal authority to sell Medicare insurance products, provide expert advice, and guide clients in choosing the right coverage to meet their healthcare and financial needs.

Preparing for the License Exam

Successfully passing the license exam is a crucial step in obtaining a license to sell Medicare insurance. The exam tests your knowledge and understanding of Medicare programs, policies, regulations, and ethical standards. Here are some tips to help you prepare for the license exam:

1. Review the Exam Content: Familiarize yourself with the exam content by obtaining the exam outline provided by your state insurance department. This will give you an overview of the topics that will be covered, allowing you to focus your study efforts.

2. Study the Material: Obtain study materials recommended by your state insurance department or reputable insurance education providers. These materials typically include textbooks, online courses, practice exams, and study guides. Dedicate sufficient time to thoroughly review and understand the material.

3. Attend Pre-Licensing Courses: Consider enrolling in pre-licensing courses specific to Medicare insurance. These courses provide in-depth knowledge and cover the exam content comprehensively. In some states, completing an approved pre-licensing course is a mandatory requirement.

4. Utilize Exam Prep Resources: Take advantage of practice exams and other exam prep resources available online. These resources can simulate the exam environment, help you gauge your knowledge level, and identify areas where you may need further study. Practice exams can also familiarize you with the format and types of questions you may encounter.

5. Create a Study Plan: Develop a study plan that outlines specific topics to cover each day or week leading up to the exam. Organize your study materials, set achievable goals, and allocate dedicated time for studying.

6. Seek Additional Assistance if Needed: If you find certain concepts challenging or need further clarification, don’t hesitate to seek additional assistance. Reach out to industry professionals, attend workshops or webinars, or join study groups to enhance your understanding.

7. Take Care of Yourself: In the weeks leading up to the exam, prioritize your physical and mental well-being. Get enough rest, eat nutritious meals, exercise, and manage stress effectively. Taking care of yourself will improve focus, memory retention, and overall performance on exam day.

Remember, adequately preparing for the license exam will not only increase your chances of passing but also equip you with a strong foundation of knowledge to serve your clients effectively. Approach your exam preparation with dedication, discipline, and a positive mindset.

Applying for the License

Once you have met the educational requirements, passed the state insurance exam, and completed any necessary background checks, it is time to apply for your license to sell Medicare insurance. The application process may vary slightly depending on your state, but here are the general steps involved:

1. Obtain the Application Form: Contact your state insurance department or visit their website to obtain the application form for the Medicare insurance license. The form may be available for download or can be requested by mail.

2. Complete the Application: Fill out the application form accurately and provide all the requested information. This may include personal details, education and training information, employment history, and any other relevant information required by your state insurance department.

3. Include Supporting Documents: Along with the application form, you may need to provide supporting documents such as proof of completion of pre-licensing education courses, exam results, and proof of a clean criminal background (if required).

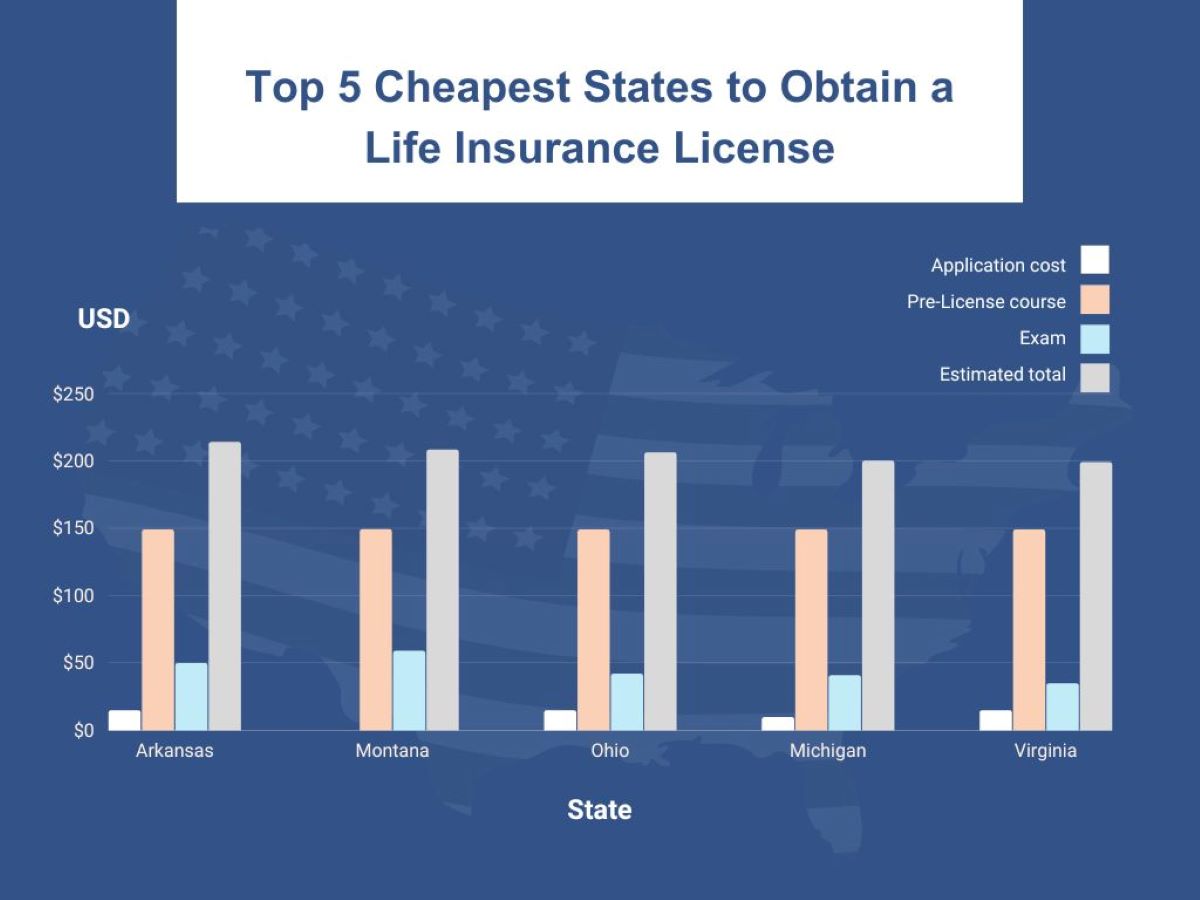

4. Pay the Application Fee: Most states require an application fee when applying for a Medicare insurance license. Ensure that you include the appropriate payment with your application. The fee amount can vary, so check with your state insurance department for the current fee schedule.

5. Submit the Application: Once you have completed the application form, attached the necessary supporting documents, and paid the fee, submit the application to your state insurance department. Some states may allow online submission, while others may require you to mail the application.

6. Wait for Processing: After submitting your application, the state insurance department will review your application and supporting documents. The processing time may vary, but it typically takes a few weeks to receive a response. Be patient during this stage and avoid contacting the department for updates unless necessary.

7. Receive Your License: If your application is approved, you will receive your Medicare insurance license. The license will specify the types of products and services you are authorized to sell, any limitations or restrictions, and the license expiration date.

It is important to review your license carefully to ensure all the information is accurate. If there are any discrepancies or errors, notify your state insurance department promptly for correction.

Always keep a copy of your license in a safe and accessible place. You will need to provide proof of your license status when working with insurance companies and clients.

By following these steps and completing your license application accurately and promptly, you will be on your way to becoming a licensed Medicare insurance agent, ready to assist clients in navigating the complexities of Medicare coverage.

Continuing Education and Renewal Requirements

Obtaining a license to sell Medicare insurance is just the beginning of your journey as an agent. To maintain your license and stay current in the ever-evolving world of Medicare, you must fulfill continuing education requirements and renew your license periodically. Here’s what you need to know about continuing education and renewal requirements:

Continuing Education (CE): Most states require Medicare insurance agents to complete a certain number of continuing education hours on an ongoing basis. The purpose of continuing education is to ensure that agents stay updated on changes in Medicare policies, regulations, and best practices. CE courses cover a range of topics related to Medicare programs, ethics, compliance, sales techniques, and industry updates.

Number of Hours: The number of CE hours required can vary by state. Typically, agents must complete a specific number of hours within a designated time period, such as every one or two years. It is essential to check with your state insurance department to determine the exact number of hours and any specific CE course requirements.

Approved Providers: When selecting CE courses, ensure that they are offered by approved providers recognized by your state insurance department. Approved providers meet certain education standards and offer courses that comply with state regulations.

Renewal Process: Medicare insurance licenses have expiration dates. To continue operating as a licensed agent, you must renew your license before it expires. The renewal process typically involves submitting a renewal application, paying a renewal fee, and fulfilling any additional requirements, such as completion of continuing education credits.

Continuing Education Reporting: Once you complete your continuing education courses, you may need to report the completion to your state insurance department. This may involve submitting documentation or reporting your CE credits online through a designated portal. Be sure to follow the instructions provided by your state insurance department to ensure proper reporting.

Failure to meet the continuing education requirements or renew your license on time can result in the suspension or revocation of your license. It is crucial to stay on top of your renewal deadlines and complete your CE requirements in a timely manner.

Continuing education is not only a requirement but also an opportunity to enhance your knowledge and skills as a Medicare insurance agent. By staying informed about changes in the industry and expanding your expertise, you can provide better service to your clients and stay competitive in the market.

Keep track of your continuing education records, including certificates of completion, for future reference or audits. Stay proactive in pursuing continuing education opportunities to stay ahead of the curve in the Medicare insurance industry.

Conclusion

Obtaining a license to sell Medicare insurance is a crucial step for individuals interested in a career in the insurance industry. By meeting the necessary requirements and obtaining the proper license, you gain the knowledge and authority to guide clients through the complex world of Medicare coverage.

Throughout this article, we have explored the various aspects of licensing for selling Medicare insurance. We covered the importance of understanding Medicare and its different parts, as well as the enrollment periods for individuals to enroll in or change Medicare coverage. We discussed the specific license requirements, including educational prerequisites, state insurance exams, background checks, and appointments with insurance companies.

Additionally, we examined the different types of licenses available for selling Medicare insurance, such as health insurance licenses, life insurance licenses, annuity licenses, and accident and health licenses. We highlighted the importance of selecting the appropriate license type based on your clients’ needs and career goals.

We also provided guidance on preparing for the license exam, emphasizing the significance of reviewing exam content, studying the material thoroughly, attending pre-licensing courses, utilizing exam prep resources, creating a study plan, seeking assistance if needed, and taking care of oneself during the preparation process.

Lastly, we discussed the application process for the license, emphasizing the importance of completing the application accurately, including supporting documents, paying the application fee, and submitting the application to the state insurance department for review and processing.

To maintain the license, we covered the continuing education requirements and renewal process, highlighting the necessity of staying updated with changes in Medicare policies and regulations, completing a designated number of continuing education hours, and renewing the license before it expires.

By understanding and fulfilling these requirements, agents can provide valuable assistance to clients seeking Medicare coverage and navigate the various options available to them.

Selling Medicare insurance offers not only a fulfilling career but also an opportunity to positively impact the lives of individuals as they navigate their healthcare decisions during their retirement years. Stay committed to ongoing learning, stay informed about industry updates, and continue to provide exceptional service to your clients.

Remember, the journey does not end with obtaining a license. It is an ongoing commitment to excellence in knowledge, service, and professionalism as a licensed Medicare insurance agent. Embrace this opportunity to make a difference in the lives of others and build a successful career in the insurance industry.