Finance

What Actually Happened To KY Pension Funds?

Published: January 23, 2024

Discover the truth about the Kentucky pension funds and their financial situation. Learn what really happened and how it impacts the state's finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

The Kentucky pension fund crisis has been a topic of concern and debate for many years, sparking worries among retirees, current employees, and policymakers. Understanding the root causes and implications of this crisis is essential for anyone affected by or interested in the state's financial stability. In this article, we will delve into the history of Kentucky's pension funds, explore the factors contributing to the crisis, examine its impact on retirees and current employees, and discuss the efforts being made to address this pressing issue.

Kentucky's pension fund woes have garnered significant attention due to their potential to affect the financial well-being of thousands of individuals who have dedicated their careers to public service. As we unravel the complexities surrounding this crisis, it becomes evident that a combination of economic, political, and demographic factors has contributed to the precarious state of the pension funds. By shedding light on the historical context, underlying causes, and potential solutions, we aim to provide a comprehensive understanding of the situation and its implications for the people of Kentucky.

The intricate nature of pension fund management, coupled with the evolving economic landscape, has created a challenging environment for sustaining the financial health of these funds. As we navigate the intricacies of this crisis, it is important to recognize the real-world impact it has on retirees who rely on these funds for their livelihood, as well as current employees who are concerned about the stability of their future retirement benefits.

In the following sections, we will explore the historical trajectory of Kentucky's pension funds, identify the key factors contributing to the crisis, and assess the measures being taken to mitigate its effects. By gaining a deeper understanding of these critical issues, we can foster informed discussions and empower individuals to navigate the complexities of pension fund management in Kentucky.

History of Kentucky Pension Funds

The history of Kentucky’s pension funds is a tale of evolving financial landscapes, legislative decisions, and demographic shifts that have shaped the current state of these vital retirement systems. The roots of the pension funds can be traced back to the early 20th century, when the state established retirement plans for public employees as a means of providing financial security in their later years.

One of the earliest pension systems in Kentucky was the Kentucky Teachers’ Retirement System (KTRS), established in 1938 to ensure that educators could retire with dignity and financial stability. Over the years, additional pension systems were created to encompass various public sector employees, including state workers, law enforcement personnel, and firefighters. These pension funds were designed to serve as a reliable source of retirement income, offering a sense of security to those who dedicated their careers to public service.

However, as the decades unfolded, the pension funds faced significant challenges stemming from economic downturns, demographic changes, and evolving fiscal policies. The sustained financial health of the pension funds became increasingly intertwined with the broader economic conditions and legislative decisions that shaped the state’s fiscal landscape. The impact of these factors on the pension funds became more pronounced in the wake of economic recessions and shifting demographics, leading to growing concerns about the long-term sustainability of the retirement systems.

As the 21st century progressed, the pension funds encountered mounting pressures, prompting policymakers to grapple with the complex task of ensuring their solvency while addressing the needs of retirees and current employees. The historical trajectory of Kentucky’s pension funds reflects a dynamic interplay of economic, political, and social forces that have influenced their evolution and current challenges.

Understanding the historical context of the pension funds is crucial for comprehending the complexities of the current crisis and the efforts to address it. By examining the historical milestones, legislative developments, and economic shifts that have shaped the pension funds, we can gain valuable insights into the factors contributing to their current state and the measures being undertaken to navigate these challenges.

Factors Contributing to the Pension Fund Crisis

The pension fund crisis in Kentucky has been influenced by a confluence of complex factors that have strained the financial sustainability of these vital retirement systems. Several key elements have contributed to the emergence and exacerbation of the crisis, shedding light on the multifaceted nature of the challenges faced by the pension funds.

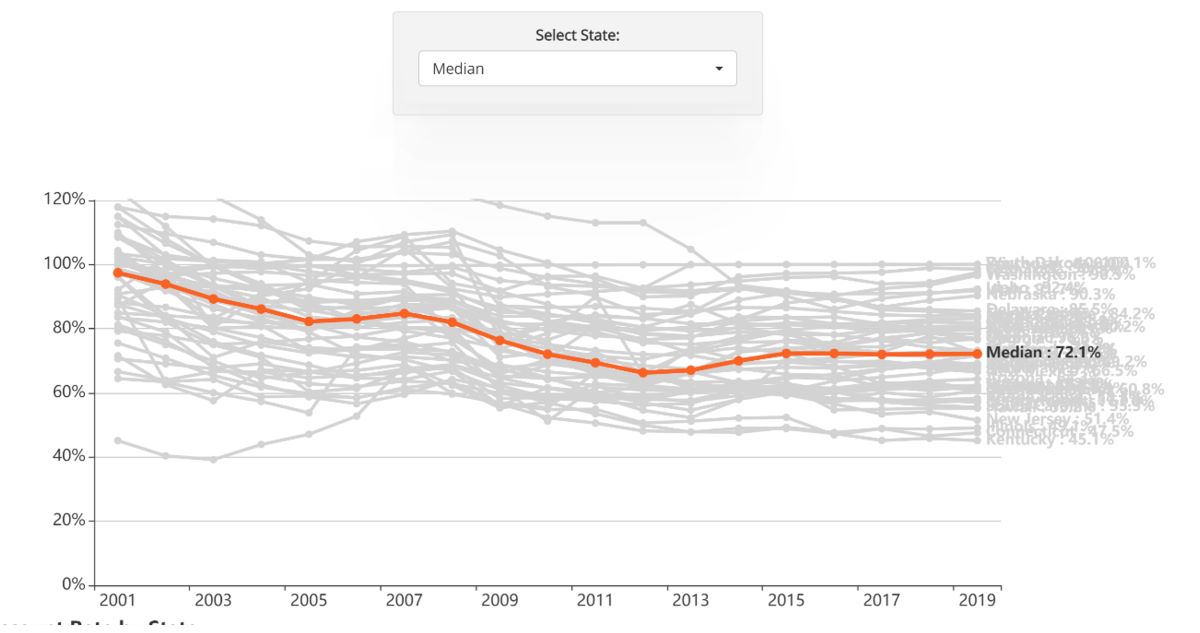

- Economic Volatility: Fluctuations in financial markets and economic downturns have significantly impacted the investment performance of the pension funds, creating hurdles for maintaining stable returns and funding obligations.

- Underfunding and Unfunded Liabilities: The pension funds have grappled with persistent underfunding and accumulating unfunded liabilities, stemming from a misalignment between contributions, investment returns, and the financial obligations to retirees.

- Demographic Shifts: Changing demographics, including an aging population and shifting workforce dynamics, have influenced the actuarial assumptions and funding requirements of the pension funds, posing challenges for long-term sustainability.

- Legislative Decisions: Policy choices, including adjustments to contribution levels, benefit structures, and funding mechanisms, have shaped the financial trajectory of the pension funds, with some decisions contributing to the current funding gaps and solvency concerns.

- Investment Strategies: The investment approaches and asset allocation strategies employed by the pension funds have encountered scrutiny, particularly in the context of achieving targeted returns, managing risk, and addressing market volatility.

These interconnected factors have collectively contributed to the pension fund crisis, underscoring the intricate interplay of economic, demographic, and policy-related dynamics that have shaped the financial landscape of the retirement systems. The implications of these factors extend beyond the realm of pension fund management, influencing the livelihoods of retirees, the financial well-being of current employees, and the broader fiscal outlook of the state.

By recognizing the multifaceted nature of the challenges faced by the pension funds, stakeholders and policymakers can engage in informed discussions and strategic decision-making aimed at addressing the root causes of the crisis and charting a path toward sustainable pension fund management in Kentucky.

Impact on Retirees and Current Employees

The pension fund crisis in Kentucky has reverberated across the lives of retirees and current employees, casting a shadow of uncertainty and concern over their financial security and future prospects. The ramifications of the crisis extend beyond fiscal metrics, profoundly affecting the individuals who rely on these retirement systems for their well-being and livelihood.

Retirees: For retirees who have dedicated their careers to public service, the stability and adequacy of their pension benefits hold immense significance. The pension fund crisis has introduced apprehensions about the long-term sustainability of these benefits, prompting retirees to grapple with the prospect of potential reductions in their retirement income and the overall security of their financial futures. The uncertainty stemming from the funding challenges has underscored the vulnerabilities faced by retirees, necessitating a deeper understanding of the implications and potential mitigating measures.

Current Employees: The impact of the pension fund crisis is also palpable among current employees, who view their retirement benefits as a cornerstone of their financial planning and future well-being. Concerns about the stability and adequacy of these benefits have permeated the workforce, influencing career decisions, financial strategies, and overall confidence in the retirement system. The evolving landscape of pension fund management has prompted current employees to navigate a climate of uncertainty, prompting a reevaluation of their retirement preparedness and expectations.

As the pension fund crisis continues to unfold, retirees and current employees find themselves at the intersection of financial intricacies and personal implications, emphasizing the human dimension of the challenges faced by the retirement systems. The need to address the impact on retirees and current employees extends beyond financial considerations, encompassing the broader sense of security, well-being, and trust in the retirement systems that underpin their livelihoods.

Recognizing the profound impact on retirees and current employees is pivotal in shaping discussions, policies, and initiatives aimed at addressing the pension fund crisis. By acknowledging the human dimensions of the challenges faced by individuals reliant on these retirement systems, stakeholders and policymakers can foster empathy, understanding, and a collective commitment to charting a path toward sustainable pension fund management that safeguards the financial security and well-being of retirees and current employees in Kentucky.

Efforts to Address the Pension Fund Crisis

The pension fund crisis in Kentucky has prompted concerted efforts aimed at addressing the challenges and charting a sustainable path forward for the state’s retirement systems. Policymakers, stakeholders, and financial experts have engaged in multifaceted initiatives and reforms designed to mitigate the impact of the crisis and bolster the long-term viability of the pension funds.

Legislative Reforms: Legislative measures have been introduced to address the funding gaps and sustainability of the pension funds. These reforms encompass adjustments to contribution levels, benefit structures, and funding mechanisms, aiming to align the financial obligations with the long-term funding requirements and actuarial soundness of the retirement systems.

Financial Oversight and Governance: Enhanced financial oversight and governance mechanisms have been implemented to ensure prudent management of the pension funds. This includes rigorous monitoring of investment strategies, risk management practices, and transparency in reporting to uphold the fiduciary responsibilities associated with managing retirement assets.

Collaborative Stakeholder Engagement: Stakeholders, including retirees, current employees, and advocacy groups, have actively participated in discussions and initiatives addressing the pension fund crisis. Their input and perspectives have played a pivotal role in shaping reform efforts and fostering a shared understanding of the challenges faced by the retirement systems.

Investment and Funding Strategies: Strategic adjustments to investment and funding strategies have been pursued to optimize returns, manage risk, and address the funding shortfalls. These strategies aim to strike a balance between achieving sustainable long-term growth and mitigating the vulnerabilities associated with market volatility and economic uncertainties.

By recognizing the multifaceted nature of the challenges faced by the pension funds, stakeholders and policymakers can engage in informed discussions and strategic decision-making aimed at addressing the root causes of the crisis and charting a path toward sustainable pension fund management in Kentucky.

These collective efforts underscore a commitment to navigating the complexities of the pension fund crisis and safeguarding the financial security and well-being of retirees and current employees. By fostering collaboration, transparency, and proactive reforms, Kentucky is striving to address the pension fund crisis and uphold its commitment to the individuals who rely on these vital retirement systems.

Conclusion

The Kentucky pension fund crisis stands as a testament to the intricate interplay of economic, demographic, and legislative factors that have shaped the financial landscape of the state’s retirement systems. The historical trajectory of the pension funds, influenced by evolving economic conditions and policy decisions, has culminated in a complex web of funding challenges and sustainability concerns.

As the crisis unfolds, its impact on retirees and current employees underscores the human dimensions of the challenges faced by the retirement systems. The uncertainties surrounding the stability and adequacy of pension benefits have permeated the lives of individuals who have dedicated their careers to public service, prompting a collective call for sustainable solutions that safeguard their financial security and well-being.

Amidst the challenges, concerted efforts have been undertaken to address the pension fund crisis, encompassing legislative reforms, enhanced financial oversight, collaborative stakeholder engagement, and strategic adjustments to investment and funding strategies. These initiatives reflect a commitment to navigating the complexities of the crisis and charting a sustainable path forward for Kentucky’s retirement systems.

Looking ahead, the journey toward mitigating the pension fund crisis necessitates a holistic approach that acknowledges the multifaceted nature of the challenges and the human impact on retirees and current employees. By fostering empathy, understanding, and proactive reforms, Kentucky is poised to uphold its commitment to the individuals reliant on these vital retirement systems, ensuring their financial security and well-being in the years to come.

As the state continues its endeavor to address the pension fund crisis, the collective resolve to navigate the complexities and uphold the long-term sustainability of the retirement systems remains steadfast, embodying a commitment to the individuals who have contributed to the fabric of public service in Kentucky.