Finance

What If I Have No Minimum Payment Due

Published: February 26, 2024

Learn about the impact of having no minimum payment due on your finances. Find out how it affects your credit score and overall financial health. Get expert advice on managing your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Minimum Payments on Credit Cards

When it comes to managing credit card payments, understanding the concept of minimum payments is crucial. Credit card companies typically require cardholders to make a minimum payment each month, which is a small percentage of the total balance. This minimum payment serves as a safeguard, ensuring that cardholders at least cover the interest and a portion of the principal balance, thereby preventing the account from falling into default.

However, there are instances where individuals find themselves in the unique situation of having no minimum payment due on their credit cards. This scenario may arise due to various factors, such as maintaining a zero balance, overpaying the previous month’s statement, or enjoying a zero-interest promotional period. While it may seem like a positive situation, it’s essential to understand the implications and potential strategies for managing a credit card when no minimum payment is due.

In this article, we will delve into the significance of minimum payments, explore the implications of having no minimum payment due, and provide actionable strategies for effectively managing your credit card under such circumstances. By gaining insights into these aspects, you can navigate your credit card responsibilities with confidence and make informed decisions to maintain your financial well-being.

Understanding Minimum Payments on Credit Cards

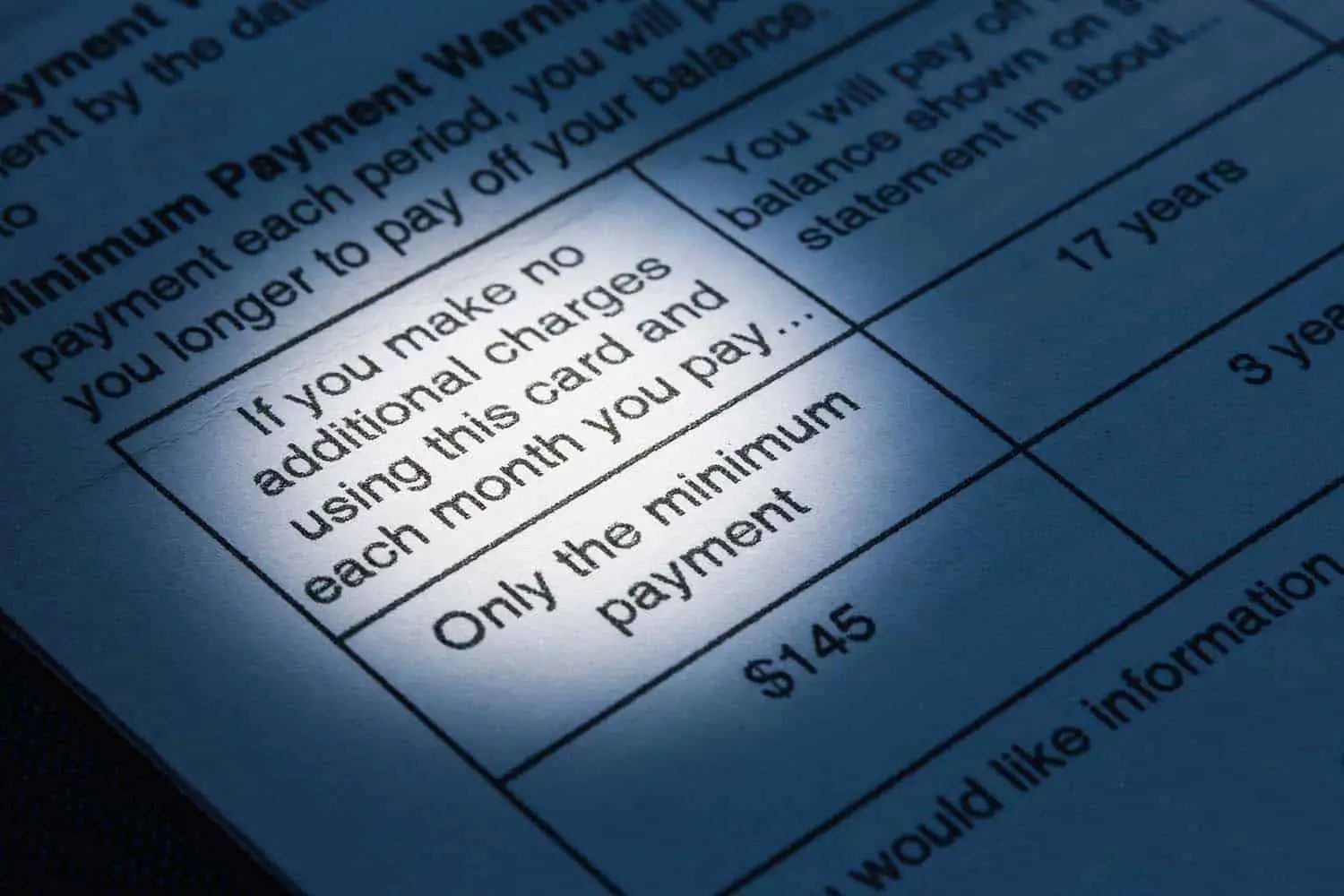

Minimum payments on credit cards are the smallest amount that cardholders must pay each month to keep their accounts in good standing. Typically, the minimum payment is calculated as a percentage of the total balance, usually around 1-3%, or a fixed amount, whichever is higher. It’s important to note that while making the minimum payment keeps the account current, it may not significantly reduce the principal balance, potentially leading to long-term debt if consistently paid over an extended period.

When cardholders only pay the minimum due, the remaining balance accrues interest, resulting in higher overall costs. This practice can prolong the time needed to pay off the debt and may negatively impact the individual’s credit utilization ratio, a key factor in credit scoring models. Understanding the implications of minimum payments is essential for maintaining healthy financial habits and managing credit effectively.

Additionally, minimum payments encompass more than just the interest accrued. They also contribute to covering a portion of the principal balance, ensuring gradual reduction of the debt over time. By understanding the dynamics of minimum payments, cardholders can make informed decisions regarding their repayment strategies and overall financial well-being.

What Happens If You Have No Minimum Payment Due

Having no minimum payment due on your credit card may initially seem like a positive situation, but it’s essential to understand the implications and potential consequences. When there is no minimum payment required, it typically indicates that the outstanding balance is either zero or that the cardholder has overpaid the previous month’s statement. This can occur when the cardholder has diligently paid off the entire balance or has made an overpayment to pre-empt future expenses.

While it may be a relief to see “no payment due” on your statement, it’s important to recognize the broader implications. One potential consequence is that the lack of a minimum payment may lead to a temporary decrease in reported credit utilization, which is the ratio of credit card balances to credit limits. While this can have a positive impact on credit scores in the short term, it’s crucial to maintain responsible credit utilization habits to support long-term financial health.

Furthermore, having no minimum payment due does not eliminate the responsibility of managing the credit card effectively. Cardholders should continue to monitor their spending, review their statements for accuracy, and proactively manage their overall financial well-being. It’s also important to stay informed about any changes in the account terms and conditions, as well as any upcoming expenses that may require budgeting and planning.

Overall, while having no minimum payment due may provide a momentary sense of relief, it’s imperative to remain vigilant and proactive in managing your credit card responsibilities. By staying informed and maintaining healthy financial habits, you can navigate the nuances of credit card management with confidence and foresight.

Strategies for Managing Your Credit Card Without a Minimum Payment Due

When faced with the unique situation of having no minimum payment due on your credit card, it’s essential to consider strategic approaches to effectively manage your financial responsibilities. While the absence of a minimum payment may offer a temporary respite, proactive measures can contribute to long-term financial well-being and responsible credit management.

1. Maintain Responsible Spending Habits: Despite the absence of a minimum payment, it’s crucial to continue practicing responsible spending habits. Avoid unnecessary or impulsive purchases, and strive to maintain a healthy balance between your credit utilization and available credit limit. By exercising restraint and mindful spending, you can strengthen your financial position and minimize the risk of accumulating excessive debt.

2. Allocate Funds for Future Payments: Consider setting aside the funds that would have been allocated for the minimum payment. By proactively budgeting for future credit card payments, you can build a financial cushion and ensure that you are prepared for upcoming expenses. This approach fosters a proactive and disciplined approach to managing your credit obligations.

3. Monitor Your Credit Card Statements: Even when no minimum payment is due, it’s essential to regularly review your credit card statements for accuracy and to track your spending patterns. Monitoring your statements allows you to detect any unauthorized charges, identify opportunities for optimizing your budget, and stay informed about your financial activity.

4. Consider Making Additional Payments: If you have the financial capacity, consider making additional payments towards your credit card balance, even when no minimum payment is due. This proactive approach can contribute to reducing your overall debt and interest costs, ultimately accelerating your journey toward financial freedom.

5. Utilize Interest-Free Periods Wisely: If your credit card offers an interest-free promotional period, leverage this opportunity to make strategic purchases or allocate funds towards existing balances. By maximizing the benefits of interest-free periods, you can optimize your financial resources and make meaningful progress in managing your credit card effectively.

By implementing these strategies and maintaining a proactive approach to credit management, you can navigate the absence of a minimum payment due on your credit card with confidence and foresight. Embracing responsible financial habits and strategic planning empowers you to seize control of your financial journey and build a solid foundation for long-term prosperity.