Finance

Why Is My Minimum Payment Due Higher At Chase

Published: February 26, 2024

Learn why your minimum payment due may be higher at Chase and how it impacts your finances. Get insights and tips to manage your payments effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, credit cards play a pivotal role in managing day-to-day expenses and building a credit history. However, for many individuals, the concept of minimum payments can be perplexing, especially when the amount due fluctuates unexpectedly. If you're a Chase credit card holder, you might have noticed variations in your minimum payment due, leaving you pondering, "Why is my minimum payment due higher at Chase?"

Understanding the nuances of minimum payments is crucial for maintaining financial health and making informed decisions. In this article, we'll delve into the factors influencing minimum payments, explore the reasons behind fluctuations, and shed light on how these changes can impact your financial well-being. By gaining insights into the intricacies of minimum payments, you'll be better equipped to navigate the world of credit cards and make sound financial choices.

Let's embark on a journey to unravel the mysteries of minimum payments and gain a deeper understanding of why your minimum payment due may vary when dealing with Chase credit cards.

Understanding Minimum Payments

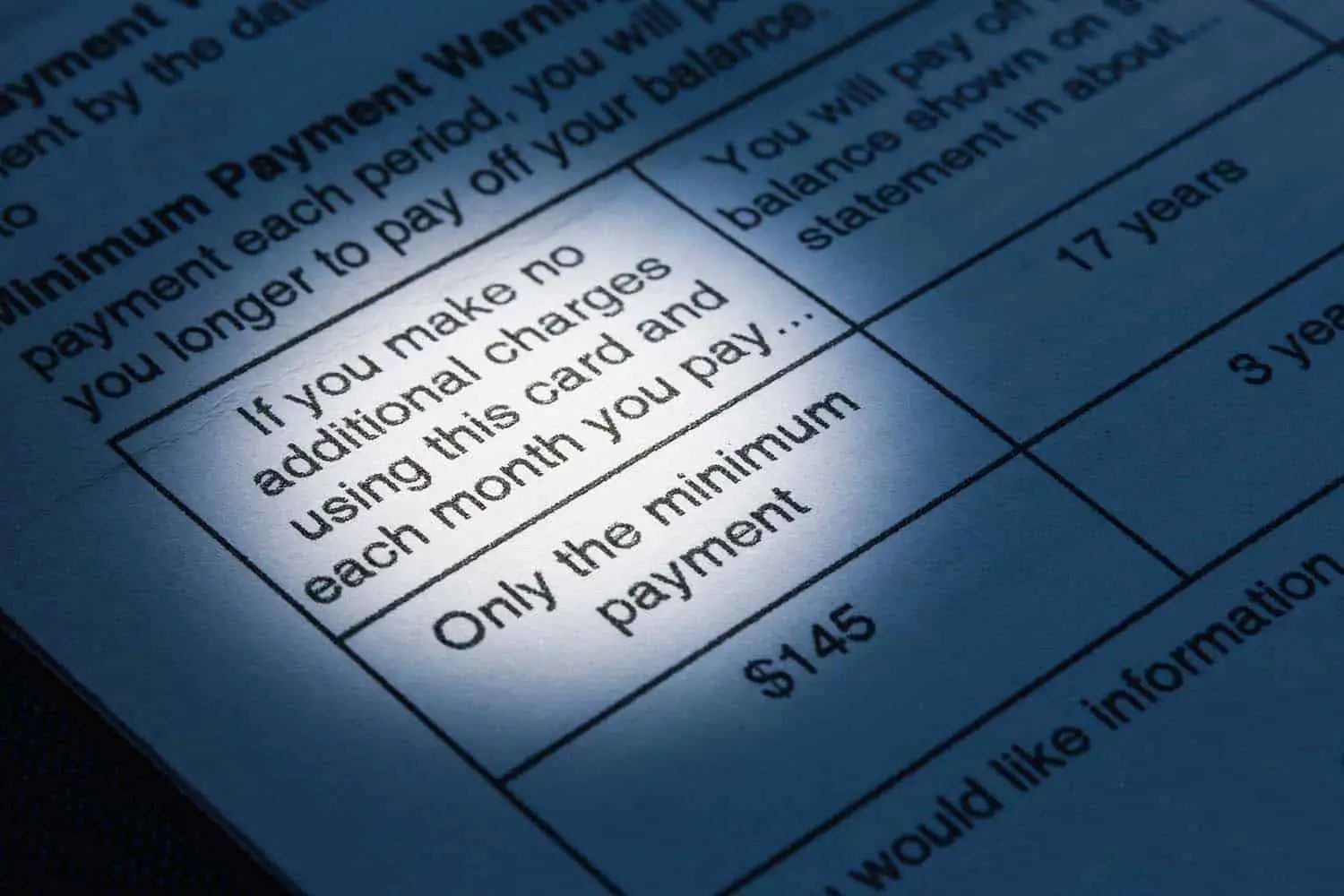

Minimum payments are the smallest amount you must pay by the due date to keep your credit card account in good standing. This essential aspect of credit card management ensures that you fulfill your financial obligations and maintain a positive credit history. Typically, the minimum payment is calculated as a percentage of your total outstanding balance, often with a minimum dollar amount specified by the credit card issuer.

It’s important to recognize that making only the minimum payment can lead to long-term debt and substantial interest costs. By paying only the minimum, you extend the repayment period and accrue more interest, ultimately increasing the overall amount you’ll need to repay. Understanding this fundamental concept is crucial for effectively managing your credit card debt and avoiding financial pitfalls.

When it comes to Chase credit cards, comprehending the dynamics of minimum payments empowers you to make informed decisions about your financial obligations. By grasping the significance of meeting minimum payment requirements and the potential consequences of falling short, you can navigate your credit card responsibilities with confidence and prudence.

Now that we’ve laid the groundwork for comprehending minimum payments, let’s delve deeper into the factors that can influence the minimum payment due on your Chase credit card.

Factors Affecting Minimum Payments

Several factors can influence the minimum payment due on your Chase credit card. Understanding these variables is essential for gaining clarity on why your minimum payment may fluctuate from month to month. Here are some key factors that can impact your minimum payment:

- Outstanding Balance: The total amount you owe on your credit card directly affects the minimum payment due. As your outstanding balance increases or decreases, the minimum payment will adjust accordingly.

- Interest Rate: The annual percentage rate (APR) applied to your balance plays a significant role in determining the minimum payment. Higher interest rates can lead to larger minimum payments, especially when combined with a higher outstanding balance.

- Promotional Rates: If you have benefited from promotional APRs on certain transactions, the expiration of these promotional periods can cause your minimum payment to rise, particularly if the standard APR is higher.

- Fees and Penalties: Accrued fees, such as late payment fees or over-limit charges, can impact your minimum payment, leading to an increase in the total amount due.

- Payment History: Your payment behavior and history can influence the minimum payment. If you’ve missed payments or made only the minimum payment in the past, the issuer may require a higher minimum payment to mitigate the perceived risk.

- Credit Utilization: Utilization of your available credit can affect the minimum payment due. Higher credit utilization ratios may prompt an increase in the minimum payment as a risk management measure for the issuer.

By recognizing these factors, you can gain a clearer understanding of the variables that contribute to changes in your minimum payment. It’s important to monitor these elements and their impact on your minimum payment to effectively manage your credit card obligations and maintain financial stability.

Changes in Minimum Payments

Understanding why your minimum payment due may vary is essential for effectively managing your finances. Changes in minimum payments can stem from a variety of factors, and comprehending these fluctuations is crucial for making informed decisions. Here’s a closer look at the reasons behind changes in minimum payments on your Chase credit card:

Fluctuating Balances: If your outstanding balance fluctuates from month to month due to varying spending patterns or payment behaviors, the minimum payment will adjust accordingly. Higher balances typically result in larger minimum payments, while reduced balances can lead to lower minimum payment requirements.

Interest Rate Adjustments: Changes in your credit card’s interest rate, whether due to market conditions or adjustments by the issuer, can directly impact your minimum payment. Higher interest rates result in increased minimum payments, while lower rates can lead to reduced minimum payment obligations.

Fee Incurrence: Accruing fees, such as late payment fees, over-limit fees, or other penalties, can cause your minimum payment to increase. It’s important to be mindful of fee implications and strive to avoid incurring additional charges that could elevate your minimum payment due.

Payment Behavior: Your payment history and behavior can influence changes in minimum payments. Consistently making only the minimum payment or missing payments can prompt the issuer to raise your minimum payment to mitigate perceived risk.

Utilization of Promotional Rates: If you’ve utilized promotional rates for certain transactions, changes in these rates can impact your minimum payment. Expiration of promotional periods or adjustments to promotional APRs can lead to fluctuations in the minimum payment due.

By staying attuned to these factors, you can gain insights into the reasons behind changes in your minimum payment and take proactive steps to manage your credit card obligations effectively. Monitoring your account activity, practicing prudent financial behaviors, and staying informed about your credit card terms can empower you to navigate fluctuations in minimum payments with confidence.

Conclusion

As a Chase credit card holder, understanding the dynamics of minimum payments is integral to maintaining financial stability and making informed decisions. The fluctuations in your minimum payment due may stem from various factors, including changes in your outstanding balance, interest rate adjustments, fee incurrence, payment behavior, and utilization of promotional rates. By comprehending these influences, you can gain clarity on why your minimum payment may vary from month to month.

It’s essential to approach credit card management with prudence and awareness, striving to maintain a healthy balance between meeting minimum payment obligations and proactively managing your overall credit card debt. Regularly monitoring your account activity, staying informed about your credit card terms, and practicing responsible financial behaviors can empower you to navigate changes in minimum payments with confidence and foresight.

By delving into the intricacies of minimum payments and their fluctuations, you’ve taken a proactive step toward enhancing your financial literacy and honing your ability to manage credit card obligations effectively. Armed with this knowledge, you can approach your Chase credit card responsibilities with a heightened sense of understanding and control, ultimately fostering a more secure financial future.

As you continue your financial journey, remember that staying informed, exercising prudence, and seeking guidance when needed are valuable pillars of sound financial management. By embracing these principles, you can navigate the complexities of minimum payments and credit card management with confidence and resilience.