Finance

Accumulated Dividend Definition

Published: September 28, 2023

Learn about the accumulated dividend in finance and its definition. Discover how this concept impacts investors and their dividend earnings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Accumulated Dividend: Definition and Examples

Welcome to our finance blog! In this article, we will dive into the topic of accumulated dividends, providing you with a comprehensive definition and real-world examples. We will explore what accumulated dividends are, how they work, and the implications they can have on investors and businesses. So, let’s get started and unravel the world of accumulated dividends!

Key Takeaways:

- Accumulated dividends are a type of dividend payment that remains unpaid by a company but accrues and accumulates over time.

- These dividends are usually owed to preferred shareholders and must be paid before common shareholders can receive any dividends.

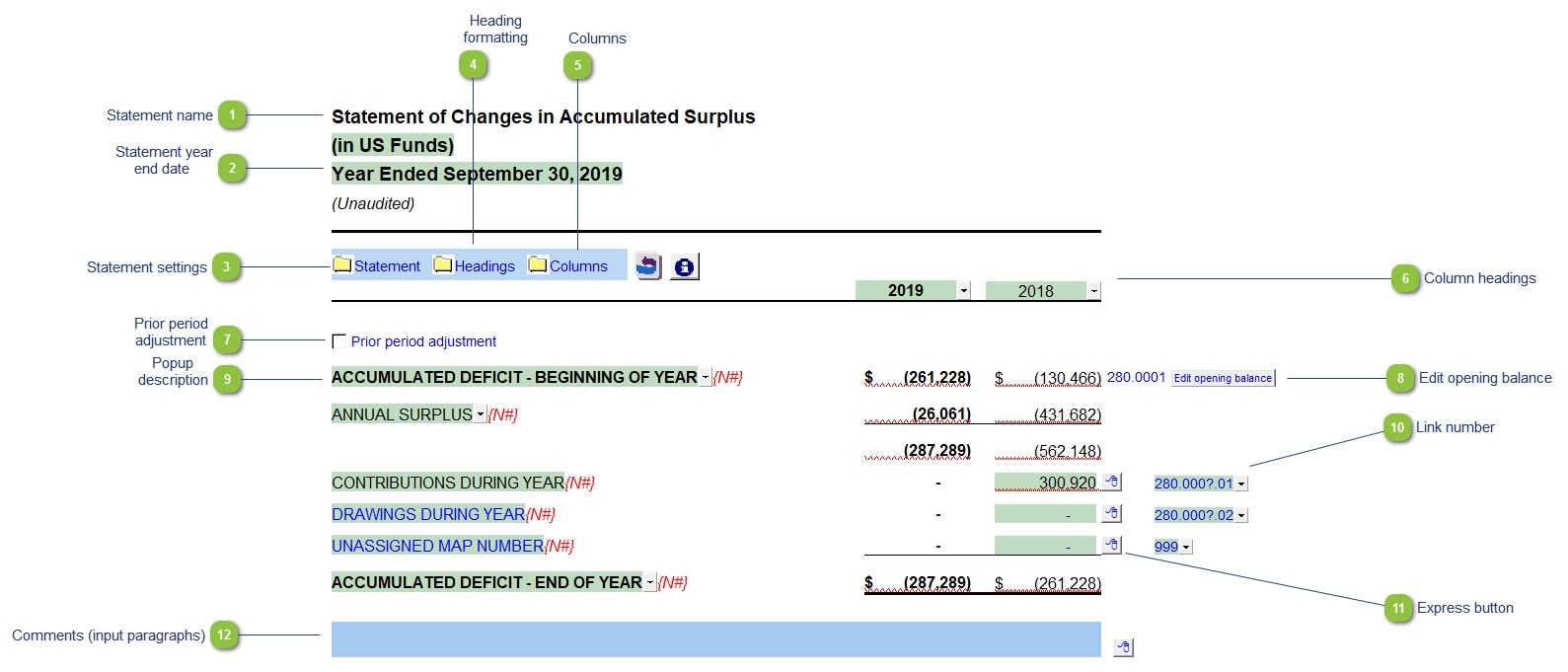

Now, let’s delve into the explanation of accumulated dividends. Simply put, accumulated dividends refer to dividends that a company has not paid out to its shareholders at the designated dividend payout dates. Instead of being distributed to shareholders, these dividends are accumulated and added to a specific account, often called an “accumulated dividends account” or “dividends in arrears.”

Accumulated dividends typically come into play when a company is unable to meet its dividend obligations due to financial constraints. In such cases, the unpaid dividends are accumulated as an outstanding liability until the company can fulfill its payment obligations.

It’s important to note that accumulated dividends are mostly associated with preferred stockholders. Preferred stock carries a predetermined dividend rate, and if the company fails to pay the stated dividend, the unpaid amount accumulates over time.

Let’s illustrate the concept with an example. Imagine Company XYZ issues preferred stock with a dividend rate of 5%. If the company fails to pay the dividend, the 5% dividend will accumulate and be added to the accumulated dividends account for each period it remains unpaid.

Accumulated dividends generally have the following implications:

- Prioritize Preferred Shareholders: Accumulated dividends must be paid to preferred shareholders before common shareholders can receive any dividends. This ensures that preferred shareholders receive their due dividends and have a higher claim on the company’s earnings.

- Increased Obligations: Companies that accumulate dividends face an increased financial obligation in the long run. These obligations can impact the company’s ability to invest in growth opportunities or meet other financial obligations.

To summarize, accumulated dividends are unpaid dividends that accrue and accumulate over time until a company can meet its payment obligations. These dividends are mostly owed to preferred shareholders and carry certain implications for both investors and businesses.

We hope this article has provided you with a clear understanding of accumulated dividends. If you have any further questions or would like to delve deeper into the topic, please feel free to reach out to us. Stay tuned for more insightful articles from our finance category!