Finance

What Credit Card Is SYNCB/PPC

Modified: March 10, 2024

Discover the best credit card options for your finance needs. Find out what SYNCB/PPC credit cards are available and choose the one that suits you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where convenience meets financial freedom. In today’s digital age, credit cards have become an integral part of our financial lives, offering us flexibility, security, and rewards. If you’re someone who is in search of a new credit card and have come across the term “SYNCB/PPC,” you might be wondering what it is and how it can benefit you.

SYNCB/PPC, also known as Synchrony Bank/PPC, is a popular financial institution that issues a range of credit cards to consumers. Whether you are looking for a card that offers cash back rewards, travel benefits, or low-interest rates, SYNCB/PPC has a variety of options to suit your needs.

When it comes to credit cards, it’s important to have a good understanding of how they work and what factors to consider before choosing one. In this article, we will delve into the world of SYNCB/PPC credit cards, exploring their benefits, application process, fees, and more.

So, if you’re curious about what SYNCB/PPC has to offer in terms of credit cards, buckle up and let’s explore the world of financial possibilities together.

What is SYNCB/PPC?

SYNCB/PPC, or Synchrony Bank/PPC, is a collaboration between Synchrony Bank and Payment Processing Center (PPC), a leading provider of credit processing services. Synchrony Bank is a well-established financial institution with a proven track record in the credit card industry.

SYNCB/PPC offers a variety of credit cards that cater to different financial needs and lifestyles. These credit cards are widely accepted by a vast network of merchants, making it convenient for cardholders to make purchases both online and offline.

One of the key benefits of SYNCB/PPC credit cards is their partnership with major retail brands. This partnership allows cardholders to enjoy exclusive rewards, discounts, and special financing options when shopping at their favorite retailers. From furniture and electronics to clothing and home improvement, there is a SYNCB/PPC credit card tailored to match specific retail brands.

SYNCB/PPC credit cards also come with a range of features that provide added convenience and security. These features may include online account management, mobile banking apps, fraud protection, and zero liability for unauthorized charges. With these features, cardholders can have peace of mind knowing their financial transactions and personal information are safeguarded.

SYNCB/PPC credit cards are designed to cater to a wide range of consumers, including those with various credit scores. Whether you have excellent credit, limited credit, or less-than-perfect credit, there may be a SYNCB/PPC credit card option available that suits your needs. It’s important to review the specific card details, including interest rates, fees, and rewards, to ensure you select the most suitable card for your financial situation.

Now that you have an understanding of what SYNCB/PPC is, let’s dive deeper into the world of credit cards and explore the various benefits they offer.

Understanding Credit Cards

Before we delve into the specifics of SYNCB/PPC credit cards, it’s important to have a solid understanding of how credit cards work and their role in our financial lives.

At its core, a credit card is a financial tool that allows you to borrow money from a bank or credit card issuer to make purchases. Instead of using your own funds, you use the credit provided by the issuer and agree to repay the borrowed amount, usually with interest, at a later date.

One of the key benefits of using a credit card is the ability to make purchases conveniently, whether in-store or online, without the need for physical cash. Credit cards also offer advantages such as building credit history, earning rewards, and providing a safety net in case of emergencies.

When you use a credit card to make a purchase, you are essentially entering into a short-term loan agreement with the credit card issuer. Each month, you will receive a statement that outlines the transactions you made, any interest charges incurred, and the minimum amount due for payment. It’s important to note that carrying a balance from month to month will result in interest charges being applied to the unpaid amount, which is something to consider when managing your credit card usage.

Credit cards also come with a credit limit, which is the maximum amount you can borrow at any given time. This limit is determined by the credit card issuer based on factors such as your income, credit history, and overall creditworthiness.

It’s essential to use credit cards responsibly and within your means. Making timely payments, paying off balances in full, and keeping credit utilization low are key factors in maintaining a healthy credit score and avoiding unnecessary debt.

Now that we have a basic understanding of credit cards, let’s explore the application process for SYNCB/PPC credit cards and how you can get started on your financial journey.

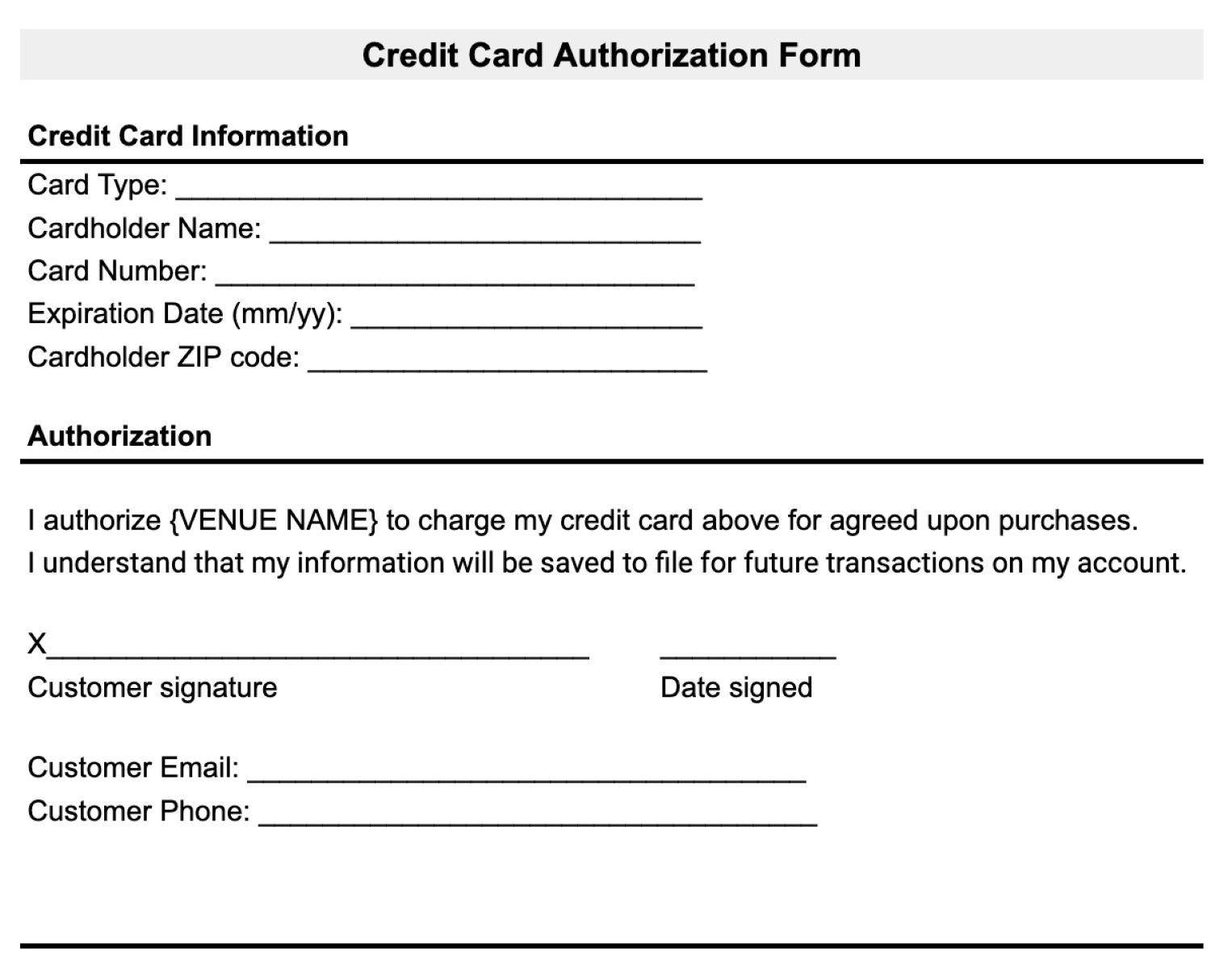

Applying for SYNCB/PPC Credit Card

If you’re interested in obtaining a SYNCB/PPC credit card, the application process is relatively straightforward. Here’s a step-by-step guide to help you navigate through the application process:

- Research and Compare: Start by researching the different SYNCB/PPC credit card options available. Consider factors such as rewards, annual fees, interest rates, and any special promotions. This will help you narrow down your options and select the card that best aligns with your needs and financial goals.

- Visit the SYNCB/PPC Website: Once you’ve identified the SYNCB/PPC credit card you want to apply for, visit the SYNCB/PPC website. Navigate to the credit card section and click on the “Apply Now” button for the specific card you’ve chosen.

- Fill out the Application: The application will typically require personal information including your name, address, social security number, and employment details. Make sure to complete all sections accurately and honestly. Providing false information could result in your application being rejected.

- Read and Agree to Terms and Conditions: As with any credit card application, it’s important to read and understand the terms and conditions associated with the SYNCB/PPC credit card. Take your time to carefully review the agreement, including the interest rates, fees, and any other relevant details.

- Submit the Application: Once you’ve filled out the application and reviewed the terms and conditions, submit your application online. Alternatively, you may have the option to apply over the phone or through mail, depending on the specific SYNCB/PPC credit card.

- Wait for a Decision: After submitting your application, the credit card issuer will evaluate your information and determine whether to approve or deny your application. This process typically takes a few days to a couple of weeks. Be patient and avoid applying for multiple credit cards during this time, as it can negatively impact your credit score.

- Receive and Activate Your Card: If your application is approved, you will receive your SYNCB/PPC credit card by mail. Follow the instructions provided to activate your card, which may involve calling a specified phone number or activating it online.

- Start Using Your Card: Once you’ve activated your SYNCB/PPC credit card, you can start using it to make purchases, earn rewards, and enjoy the benefits offered by the specific card you’ve chosen.

Remember, the approval of your credit card application is not guaranteed and is subject to the credit card issuer’s evaluation of your creditworthiness. It’s essential to maintain good credit habits, such as making timely payments and keeping your credit utilization low, to improve your chances of approval.

Now that you know how to apply for a SYNCB/PPC credit card, let’s explore the benefits you can enjoy as a cardholder.

Benefits of SYNCB/PPC Credit Card

SYNCB/PPC credit cards come with a range of benefits that make them a popular choice for individuals seeking financial flexibility and rewards. Here are some key benefits you can enjoy as a SYNCB/PPC credit cardholder:

- Rewards Program: Many SYNCB/PPC credit cards offer rewards programs that allow you to earn points, cash back, or other incentives for every dollar you spend. These rewards can be redeemed for various options such as travel, merchandise, gift cards, or even statement credits. Review the specific rewards program for the SYNCB/PPC credit card you choose to maximize your earning potential.

- Special Financing Options: SYNCB/PPC credit cards often provide special financing options for certain purchases made with participating retailers. This can include zero or low-interest promotional periods, deferred interest, or fixed monthly payment plans. These options can help you manage large purchases or unexpected expenses while minimizing the cost of interest.

- Exclusive Discounts and Offers: SYNCB/PPC credit cards are often associated with major retail brands, which means you may have access to exclusive discounts, offers, and promotions when shopping at their partner merchants. These discounts can range from percentages off your purchases to free shipping or other exclusive perks.

- Convenience and Security: With a SYNCB/PPC credit card, you can enjoy the convenience of making purchases both in-store and online without the need for physical cash. Additionally, credit cards offer enhanced security measures such as fraud protection, zero liability for unauthorized charges, and the ability to dispute transactions if necessary.

- Building Credit History: Responsibly using a SYNCB/PPC credit card can help you build and improve your credit history. Making timely payments and keeping your credit utilization low demonstrates responsible credit management, which can positively impact your credit score over time.

- Access to Online Account Management: SYNCB/PPC credit cards typically come with online account management features that allow you to easily monitor your transactions, view statements, make payments, and set up alerts. Having access to your account online makes it convenient to stay on top of your finances and track your credit card activity.

Remember, each SYNCB/PPC credit card may have its own unique set of benefits, so it’s important to review the particulars of the card you choose. Take the time to understand the rewards structure, fees, and any limitations or restrictions associated with the specific card.

Now that you know about the benefits of SYNCB/PPC credit cards, let’s explore how to effectively manage your credit card and avoid unnecessary fees and charges.

Managing SYNCB/PPC Credit Card

Effective management of your SYNCB/PPC credit card is essential in order to make the most of its benefits and avoid any potential pitfalls. Here are some tips to help you manage your credit card responsibly:

- Create a Budget: Start by creating a budget that outlines your income, expenses, and financial goals. Having a clear understanding of your financial situation will enable you to use your SYNCB/PPC credit card wisely and avoid overspending.

- Pay on Time: Making timely credit card payments is crucial to maintaining a good credit score and avoiding late payment fees. Set up reminders or automatic payments to ensure you never miss a payment due date.

- Pay in Full: Whenever possible, try to pay off your SYNCB/PPC credit card balance in full each month. This allows you to avoid interest charges and keep your credit utilization low, which can positively impact your credit score.

- Monitor Your Statements: Regularly review your credit card statements to verify the accuracy of transactions and detect any unauthorized charges. Report any discrepancies or fraudulent activity to SYNCB/PPC immediately.

- Manage Your Credit Utilization: Aim to keep your credit utilization ratio, which is the percentage of your available credit that you are using, below 30%. Higher credit utilization can negatively impact your credit score. If possible, consider keeping your credit utilization ratio even lower to demonstrate responsible credit management.

- Avoid Cash Advances: While SYNCB/PPC credit cards may offer cash advance options, it’s generally advisable to avoid using this feature. Cash advances often come with high-interest rates and fees that can quickly add up.

- Review Rewards and Offers: Stay up-to-date with the rewards and offers available with your SYNCB/PPC credit card. Take advantage of any promotions, discounts, or cash back opportunities that align with your spending habits.

- Manage and Redeem Rewards: If your SYNCB/PPC credit card comes with a rewards program, be sure to understand how it works and keep track of your rewards balance. Regularly redeem your rewards to maximize their value and prevent them from expiring.

- Communicate with SYNCB/PPC: If you encounter any issues with your SYNCB/PPC credit card, such as a change in personal information or a dispute over a charge, reach out to their customer service as soon as possible. Effective communication can help resolve issues and prevent any negative impacts on your credit history.

By following these guidelines, you can effectively manage your SYNCB/PPC credit card, build good credit habits, and make the most of the benefits offered.

Next, let’s explore the fees and charges associated with SYNCB/PPC credit cards, so you can have a clear understanding of the potential costs involved.

SYNCB/PPC Credit Card Fees and Charges

While SYNCB/PPC credit cards offer a range of benefits and rewards, it’s important to be aware of the fees and charges associated with these cards. Here are some common fees and charges to consider:

- Annual Fee: Some SYNCB/PPC credit cards may have an annual fee, which is a yearly cost for maintaining the card. The specific amount of the annual fee will depend on the card you choose. Consider whether the benefits and rewards outweigh the cost of the annual fee.

- Interest Charges: If you carry a balance on your SYNCB/PPC credit card, you will be subject to interest charges. The interest rate, often referred to as the Annual Percentage Rate (APR), varies based on the card and your creditworthiness. It’s important to pay off your balance in full each month to avoid accruing interest charges.

- Late Payment Fee: Failing to make the minimum payment by the due date will result in a late payment fee. This fee can vary depending on the card and the outstanding balance. To avoid late payment fees and potential damage to your credit score, always make payments on time.

- Foreign Transaction Fee: If you use your SYNCB/PPC credit card for purchases made in a foreign currency or while traveling abroad, you may be subject to a foreign transaction fee. This fee typically ranges from 1% to 3% of the transaction amount.

- Cash Advance Fee: If you utilize the cash advance feature on your SYNCB/PPC credit card, you will likely be charged a cash advance fee. This fee is usually a percentage of the cash advance amount and carries a higher interest rate compared to regular purchases. It’s best to avoid cash advances whenever possible due to the associated fees.

- Balance Transfer Fee: If you decide to transfer a balance from another credit card to your SYNCB/PPC credit card, you may be charged a balance transfer fee. This fee is typically a percentage of the transferred balance.

- Returned Payment Fee: If a payment you make on your SYNCB/PPC credit card is returned due to insufficient funds or other reasons, you may incur a returned payment fee. This fee can vary depending on the card and the issuer’s policy.

- Overlimit Fee: If you exceed your credit limit on your SYNCB/PPC credit card, you may be charged an overlimit fee. However, it’s important to note that the Credit CARD Act of 2009 requires card issuers to obtain cardholder consent before charging overlimit fees.

It’s important to review the terms and conditions of your specific SYNCB/PPC credit card to understand all the fees and charges that may apply. Being aware of these fees will help you make informed decisions and minimize unnecessary expenses.

Now that we have explored the fees and charges, let’s discuss how to cancel a SYNCB/PPC credit card if the need arises.

How to Cancel SYNCB/PPC Credit Card

If you’ve decided to close your SYNCB/PPC credit card, it’s important to follow the proper steps to ensure a smooth and successful cancellation process. Here’s a guide on how to cancel your SYNCB/PPC credit card:

- Contact Customer Service: Start by contacting the customer service department of SYNCB/PPC. You can find the customer service number on the back of your credit card or on the SYNCB/PPC website. Inform them of your intent to close the credit card account.

- Provide Account Information: During the call, the customer service representative will ask for your account information to verify your identity. Be prepared to provide your full name, credit card number, and any other information they require to assist you.

- Ask for Confirmation: Request confirmation that your card has been canceled and that no further charges can be made on the account. It’s also a good idea to ask for written confirmation or an email documenting the cancellation for your records.

- Pay Any Outstanding Balance: If you have any outstanding balance on your SYNCB/PPC credit card, make sure to pay it off in full before canceling the card. This will ensure that you are not charged any additional interest or fees.

- Destroy or Return the Card: Once your cancellation request is confirmed and you have settled any outstanding balance, destroy the physical card by cutting it up or shredding it. If requested by the issuer, return the card by mail to the address provided.

- Monitor Your Credit Report: After canceling your SYNCB/PPC credit card, it’s a good practice to monitor your credit report to ensure that the account is closed and no unauthorized activity occurs.

It’s important to note that canceling a credit card can affect your credit score, especially if it’s one of your older accounts or if you have a high credit utilization ratio. Consider the potential impact on your credit before making the decision to cancel. If you have concerns or are unsure about closing your SYNCB/PPC credit card, it may be helpful to consult with a financial advisor.

Closing a credit card should be a well-thought-out decision. Ensure that you have alternative credit options in place and that canceling the SYNCB/PPC card aligns with your financial goals and circumstances.

Now that we have covered how to cancel a SYNCB/PPC credit card, let’s summarize what we have discussed so far.

Conclusion

In conclusion, SYNCB/PPC credit cards offer a range of benefits and rewards to help you manage your finances and make the most of your spending. By understanding what SYNCB/PPC is and how their credit cards work, you can make an informed decision when choosing a credit card that suits your needs and financial goals.

When applying for a SYNCB/PPC credit card, it’s essential to compare the different options available, carefully review the terms and conditions, and provide accurate information during the application process. Once approved, you can take advantage of the rewards program, special financing options, and exclusive discounts offered by your SYNCB/PPC credit card.

Remember to manage your SYNCB/PPC credit card responsibly by creating a budget, making timely payments, and keeping your credit utilization low. Regularly review your statements, monitor your rewards, and stay in touch with customer service for any queries or concerns.

While SYNCB/PPC credit cards can provide financial flexibility and rewards, it’s important to be aware of the potential fees and charges associated with these cards. Understanding these fees will help you make informed decisions and avoid unnecessary expenses.

If you decide to cancel your SYNCB/PPC credit card, follow the proper steps by contacting customer service, settling any outstanding balances, and properly disposing of the physical card. Keep in mind that canceling a credit card may have an impact on your credit score, so consider the implications before making a final decision.

In summary, SYNCB/PPC credit cards can be valuable financial tools when managed responsibly. By understanding the benefits, fees, and management strategies discussed in this article, you can make the most of your SYNCB/PPC credit card and achieve greater financial freedom.