Finance

Amortization Of Intangibles Definition

Published: October 6, 2023

Learn the definition and importance of amortization of intangibles in finance. Discover how this process affects businesses and their financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Basics of Amortization of Intangibles Definition: What You Need to Know

If you’re in the world of finance, you may have come across the term “amortization of intangibles.” But what does it really mean? In layman’s terms, amortization refers to the process of spreading out the cost of an intangible asset over its useful life. This accounting practice allows businesses to match the expenses of acquiring intangible assets with the revenue generated by those assets over time. In this blog post, we will delve deeper into the concept of amortization of intangibles, its importance, and how it affects a company’s financial statements.

Key Takeaways:

- Amortization of intangibles is the process of spreading out the cost of an intangible asset over its useful life.

- It allows businesses to match the expenses of acquiring intangible assets with the revenue generated by those assets over time.

Understanding Intangible Assets

Before we dive into the intricacies of amortization of intangibles, let’s first define what intangible assets are. Unlike tangible assets such as buildings or machinery, intangible assets cannot be physically touched. Examples of intangible assets include patents, trademarks, copyrights, brand names, customer lists, and software licenses. These assets are valuable because they provide competitive advantages, generate revenue, or have long-term benefits for a company.

Amortization: Matching Expenses with Revenue

When a company acquires an intangible asset, it must record the cost as an expense on its financial statements. However, rather than deducting the entire cost in the year of acquisition, the cost is spread out over the useful life of the asset. This is where amortization comes into play. By spreading out the cost, companies can better match the expenses of acquiring the intangible asset with the revenue it generates. This practice helps provide a more accurate representation of a company’s financial performance over time.

Calculating Amortization

The calculation of amortization depends on the specific intangible asset and its useful life. The useful life can be estimated based on factors such as legal or contractual terms, technological obsolescence, or expected economic benefits. Generally, the amortization expense is calculated by dividing the total cost of the intangible asset by its useful life.

Impact on Financial Statements

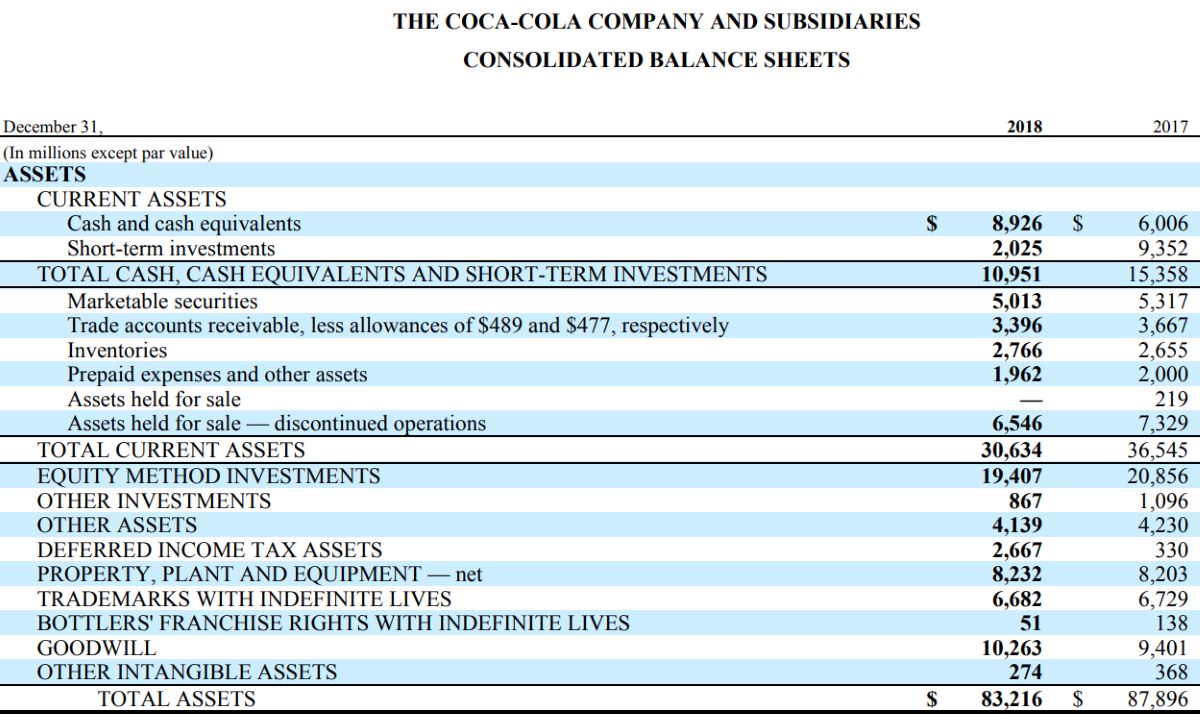

Amortization of intangibles affects a company’s financial statements in several ways:

- Balance Sheet: The accumulated amortization is subtracted from the carrying value of the intangible asset, resulting in a lower net asset value.

- Income Statement: The amortization expense is recorded as an operating expense, reducing the company’s net income and profit.

- Cash Flow Statement: Amortization is treated as a non-cash expense and is added back to net income when calculating cash flow from operations. This helps reconcile the difference between net income and cash flow.

Conclusion

Amortization of intangibles plays a crucial role in a company’s financial accounting. By spreading out the cost of intangible assets over their useful lives, businesses can better align expenses with revenue and present a more accurate financial picture. Understanding the concept of amortization and its impact on financial statements is essential for finance professionals and business owners alike.