Finance

How To Find Total Assets On Balance Sheet

Modified: December 30, 2023

Discover how to calculate the total assets on a balance sheet and gain a deeper understanding of financial assessment. Enhance your finance knowledge today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how to find total assets on the balance sheet. The balance sheet is a crucial financial statement that provides valuable insights into a company’s financial position. It offers a snapshot of a company’s assets, liabilities, and shareholders’ equity at a particular point in time.

Knowing how to analyze the balance sheet can be beneficial for various reasons. Whether you are an investor, a business owner, or a financial professional, understanding the components of the balance sheet can help you evaluate a company’s financial health, make investment decisions, or assess the performance of your own business.

In this guide, we will focus on the calculation of total assets on the balance sheet. Total assets represent the combined value of all the resources owned by a company, both tangible and intangible, that can generate future economic benefits. These assets play a vital role in determining the overall value and financial strength of a business.

We will explore different methods that can be employed to find the total assets on a balance sheet. We’ll walk you through a direct approach, where the total assets figure is explicitly provided. Additionally, we will delve into an indirect approach that involves analyzing the various components of the balance sheet to arrive at the total assets value.

To gain a comprehensive understanding, we will discuss two sub-methods within the indirect approach: analyzing current assets and analyzing non-current assets. We will also touch upon the use of financial ratios to estimate total assets.

By the end of this guide, you will have a solid grasp of how to find the total assets on a balance sheet through different approaches. This knowledge will equip you with the necessary skills to evaluate a company’s financial position and make informed decisions based on the information at hand.

Understanding the Balance Sheet

Before diving into how to find total assets on the balance sheet, it’s essential to understand the purpose and structure of this financial statement. The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial position at a specific point in time.

The balance sheet follows a basic equation: Assets = Liabilities + Shareholders’ Equity. This equation represents the fundamental principle of double-entry bookkeeping, where every transaction recorded on the balance sheet must be balanced out between the assets, liabilities, and shareholders’ equity.

The balance sheet is divided into three main sections: assets, liabilities, and shareholders’ equity. Assets represent the resources owned by the company, while liabilities are the company’s obligations or debts. Shareholders’ equity, also known as owners’ equity, reflects the residual interest in the company after deducting liabilities from assets.

Within the asset section, assets are further categorized into current assets and non-current assets. Current assets are those expected to be converted into cash or used up within one year, while non-current assets are long-term assets held for more than one year.

On the other side of the balance sheet, liabilities are categorized into current liabilities and non-current liabilities. Current liabilities are obligations expected to be settled within one year, while non-current liabilities are long-term obligations that extend beyond one year.

Shareholders’ equity represents the ownership interest in the company. It includes items such as common stock, preferred stock, retained earnings, and additional paid-in capital. Shareholders’ equity reflects the residual value that shareholders would receive if all the company’s assets were liquidated and all liabilities were paid off.

The balance sheet provides valuable insights into a company’s financial health, liquidity, and solvency. It helps investors and analysts assess a company’s ability to meet short-term obligations and fund long-term growth. By analyzing the components of the balance sheet, stakeholders can make informed decisions and evaluate the financial strength and stability of a company.

Now that we have a solid understanding of the balance sheet and its importance, let’s move on to exploring how to find the total assets on this financial statement.

Overview of Total Assets

Total assets represent the combined value of all the resources owned by a company, both tangible and intangible, that can generate future economic benefits. It is a crucial figure that helps assess a company’s financial position and overall value.

Assets can be broadly classified into two categories: current assets and non-current assets.

- Current assets: These are assets that are expected to be converted into cash or used up within one year. Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. Current assets provide a measure of a company’s liquidity and its ability to meet short-term obligations.

- Non-current assets: Also known as long-term assets, non-current assets are held for more than one year. These assets provide long-term value to the company and include items such as property, plant, and equipment, investment in subsidiaries, patents, trademarks, and goodwill. Non-current assets help evaluate a company’s long-term growth potential and its ability to generate future cash flows.

When analyzing the total assets on the balance sheet, it’s important to consider both current and non-current assets. This gives a holistic view of a company’s asset base and its potential for generating future revenue.

Understanding the composition and value of a company’s total assets is crucial for various stakeholders. Investors use this information to evaluate the financial health and value of a company before making investment decisions. Lenders and creditors assess total assets to determine the collateral available in case of default. Business owners and managers track total assets to gain insights into the financial strength and growth potential of their company.

Throughout this guide, we will explore different methods to find the total assets on the balance sheet. By mastering these techniques, you will be equipped with the necessary skills to evaluate a company’s asset base and make informed financial decisions.

Methods to Find Total Assets on the Balance Sheet

There are several methods you can employ to find the total assets on the balance sheet. These methods can provide insights into a company’s asset base and its overall financial position. In this section, we will explore three main approaches:

- Method 1: Direct Approach: This approach involves locating the total assets figure on the balance sheet itself. Many financial statements explicitly provide the total assets value, making it easy to identify. This method is straightforward and requires minimal calculation.

- Method 2: Indirect Approach: If the total assets figure is not explicitly stated, you can use an indirect approach to calculate it. This method involves analyzing the individual components of the balance sheet to arrive at the total assets value. We will further divide this method into two sub-methods: analyzing current assets and analyzing non-current assets.

- Method 3: Using Financial Ratios: Financial ratios can also be used to estimate the total assets on the balance sheet. By analyzing certain key ratios, such as the debt-to-assets ratio or the equity multiplier, you can derive an approximation of the total assets value.

Each method has its own advantages and limitations, so it’s important to consider the specific circumstances and requirements when choosing the most suitable approach. In the following sections, we will provide a detailed explanation of each method and how to apply them effectively.

With these techniques at your disposal, you will be able to accurately find the total assets on the balance sheet, enabling you to evaluate a company’s financial position and make informed decisions based on the available information.

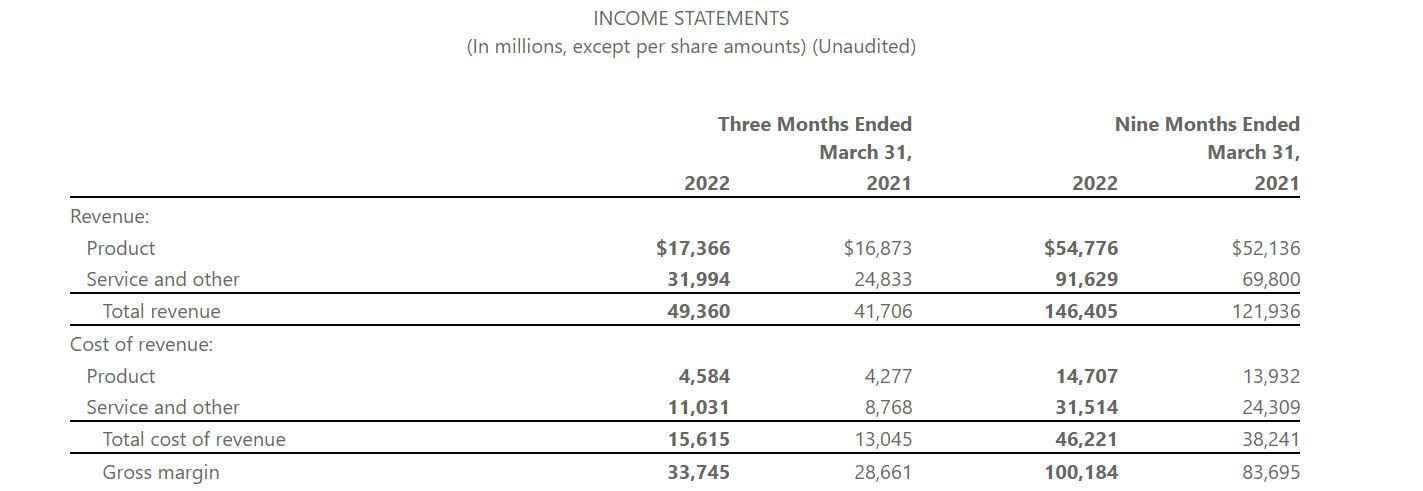

Method 1: Direct Approach

The direct approach is the most straightforward method to find the total assets on the balance sheet. This approach involves locating the total assets figure directly on the financial statement. Many companies explicitly state the total assets value on their balance sheet, making it easy to identify.

To use the direct approach, you need to look for the specific line item on the balance sheet that represents the total assets. The line item may be labeled as “Total Assets” or “Assets.” It is typically located at the bottom of the assets section, just above the liabilities and shareholders’ equity sections.

Once you have located the total assets line item, you can simply note down the value provided. This value represents the combined worth of all the assets owned by the company, both current and non-current, at that particular point in time.

The direct approach is efficient and requires minimal calculation since the total assets value is readily available on the balance sheet. It is especially helpful when you need a quick overview of a company’s asset base or when comparing total assets between different companies.

However, it’s important to note that not all balance sheets may explicitly provide the total assets value. In such cases, you will need to employ an indirect approach, which involves analyzing the individual components of the balance sheet to derive the total assets value. We will explore this method in detail in the following sections.

In the next section, we will discuss the indirect approach, specifically analyzing current assets, to find the total assets on the balance sheet.

Method 2: Indirect Approach

If the total assets figure is not explicitly provided on the balance sheet, you can use an indirect approach to calculate it. This method involves analyzing the individual components of the balance sheet to derive the total assets value.

Within the indirect approach, we will discuss two sub-methods: analyzing current assets and analyzing non-current assets. By examining these categories, we can estimate the total assets value.

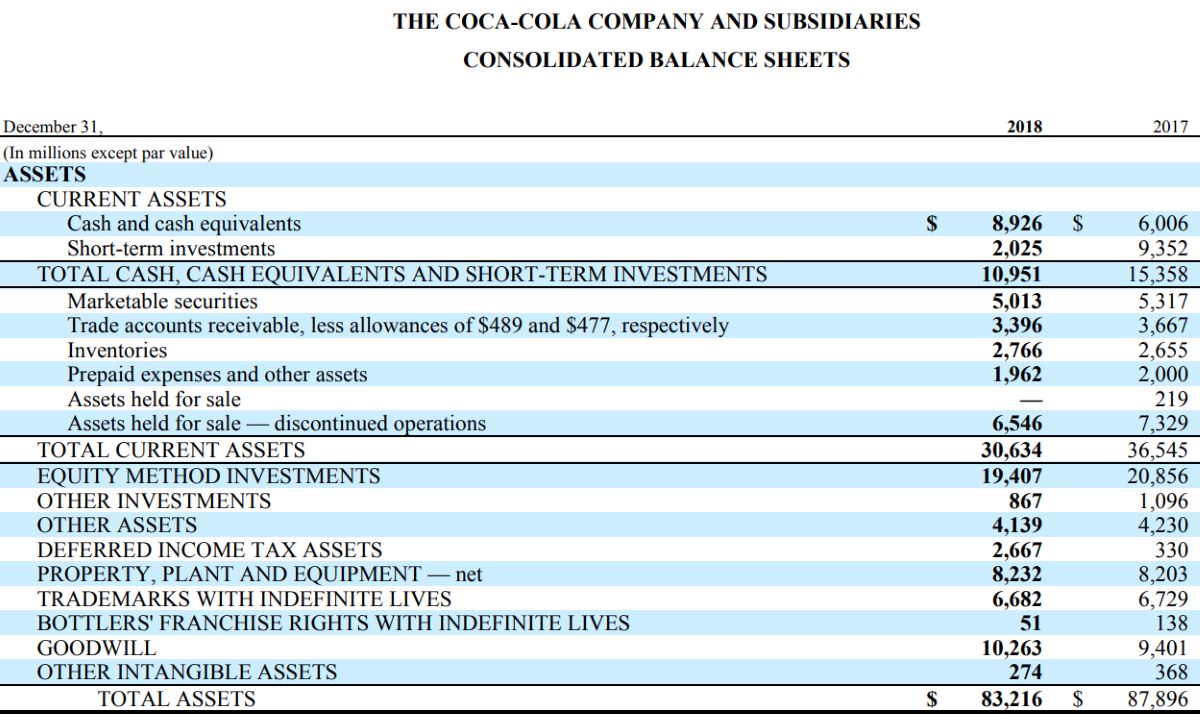

Method 2.1: Analyzing Current Assets

Start by identifying the current assets section on the balance sheet. Common examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments.

To find the total assets using the indirect approach, add up the values of all the current assets listed on the balance sheet. This will give you the total value of the current assets. Since current assets represent assets that are expected to be converted into cash or used up within one year, they provide a significant portion of the total assets value.

Method 2.2: Analyzing Non-Current Assets

Once you have determined the value of the current assets, you can focus on analyzing the non-current assets. Non-current assets include items such as property, plant, and equipment, intangible assets, investments in subsidiaries, and long-term investments.

Identify the non-current assets section on the balance sheet and add up the values of all the non-current assets listed. This will give you the total value of the non-current assets.

The sum of the current assets and non-current assets will provide an estimation of the total assets value. However, it’s important to note that this approach assumes that all assets have been correctly accounted for and valued on the balance sheet.

Considerations

While this indirect approach can give you a good estimate of the total assets, it’s crucial to review the balance sheet in detail and consider any potential adjustments and exclusions. Different accounting practices, valuation methods, and financial disclosures can affect the reliability and accuracy of the balance sheet figures.

Additionally, it’s important to note that this approach relies on the assumption that the balance sheet is prepared correctly and accurately reflects the company’s financial position. It’s beneficial to cross-reference the balance sheet with other financial statements and conduct a thorough analysis to ensure its reliability.

In the next section, we will explore another method, using financial ratios, to estimate the total assets on the balance sheet.

Method 2.1: Analyzing Current Assets

One sub-method within the indirect approach to find the total assets on the balance sheet is by analyzing the current assets section. Current assets are the assets that are expected to be converted into cash or used up within one year.

To employ this method, you need to locate the current assets section on the balance sheet. Common examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments.

Once you have identified the current assets section, add up the values of all the individual current assets listed on the balance sheet. This summation will provide you with the total value of the current assets.

It’s important to note that current assets are valued at their expected net realizable value – the amount the asset is expected to be sold for minus any costs associated with the sale. This value represents the current worth of the assets and provides insight into a company’s liquidity and ability to meet short-term obligations.

By analyzing the current assets, you can estimate a significant portion of the total assets on the balance sheet. Keep in mind that this method assumes that all current assets have been accurately recorded and valued. It’s essential to review and validate the individual current asset values to ensure their accuracy.

While analyzing current assets gives you a good estimation of the total assets, it’s important to consider the composition of the total assets as a whole. Non-current assets, which are discussed in the next section, also contribute to the total assets value and provide insights into a company’s long-term growth potential.

By employing the method of analyzing current assets, you can gain a better understanding of the asset base of a company and make informed decisions based on its liquidity and short-term financial strength.

In the next section, we will explore another sub-method within the indirect approach to finding the total assets on the balance sheet: analyzing non-current assets.

Method 2.2: Analyzing Non-Current Assets

In the indirect approach to finding the total assets on the balance sheet, another sub-method involves analyzing the non-current assets section. Non-current assets are long-term assets held by a company for more than one year.

To employ this method, locate the non-current assets section on the balance sheet. Examples of non-current assets include property, plant, and equipment, intangible assets, investments in subsidiaries, and long-term investments.

Once you have identified the non-current assets section, add up the values of all the individual non-current assets listed. This summation will give you the total value of the non-current assets.

Non-current assets provide insights into a company’s long-term growth potential and its ability to generate future cash flows. Property, plant, and equipment represent tangible assets that enable a company to conduct its operations. Intangible assets, such as patents, trademarks, and goodwill, contribute to a company’s intellectual property and competitive advantage. Investments in subsidiaries and long-term investments reflect strategic investments made for future expansion or revenue generation.

By analyzing the non-current assets section, you can estimate a significant portion of the total assets on the balance sheet. However, it’s important to note that the valuation and depreciation of non-current assets can impact their reported value on the balance sheet.

It’s crucial to review the non-current asset values and consider any adjustments, such as depreciation or impairment charges, to ensure the accuracy of the total assets estimate. Additionally, it’s beneficial to analyze any disclosure notes related to non-current assets to gain a deeper understanding of their specific nature and valuation methodologies.

By employing the method of analyzing non-current assets, you can gain valuable insights into a company’s long-term asset base and growth prospects. Combining the analysis of current assets and non-current assets provides a more comprehensive understanding of the total assets on the balance sheet.

In the next section, we will explore an alternative method, using financial ratios, to estimate the total assets on the balance sheet.

Method 3: Using Financial Ratios

Another approach to estimate the total assets on the balance sheet is by using financial ratios. Financial ratios provide a way to analyze the relationship between different financial elements and can be used to derive an approximation of the total assets value.

Several financial ratios can be helpful in estimating total assets. Here are a few commonly used ratios:

- Debt-to-Assets Ratio: The debt-to-assets ratio measures the proportion of a company’s assets that are financed with debt. By rearranging the formula, you can estimate the total assets by dividing the total liabilities by the debt-to-assets ratio. This assumes that the owner’s equity remains constant.

- Equity Multiplier: The equity multiplier, also known as the leverage ratio, measures the proportion of a company’s assets that are financed with equity. By rearranging the formula, you can estimate the total assets by dividing the total equity by the equity multiplier. This assumes that the total liabilities remain constant.

- Return on Assets: The return on assets ratio measures how effectively a company is utilizing its assets to generate profits. By rearranging the formula, you can estimate the total assets by dividing the net income by the return on assets ratio. This assumes that the return on assets remains constant.

It’s important to note that using financial ratios to estimate the total assets value is an approximation and relies on certain assumptions. The accuracy of the estimation depends on the quality and reliability of the financial data used to calculate the ratios.

Financial ratios can provide valuable insights into a company’s financial health and performance. However, it’s crucial to consider other factors, such as industry norms, company-specific circumstances, and the limitations of financial ratios, when interpreting the estimated total assets value.

While this method provides an alternative approach to estimate total assets, it is recommended to combine it with the direct or indirect approach to gain a more accurate understanding of the balance sheet and the company’s financial position.

In the next section, we will summarize the key points discussed and conclude our guide on how to find total assets on the balance sheet.

Conclusion

In conclusion, understanding how to find the total assets on the balance sheet is essential for evaluating a company’s financial position and making informed decisions. The total assets represent the combined value of all the resources owned by a company that can generate future economic benefits.

There are several methods you can utilize to find the total assets on the balance sheet. The direct approach involves locating the total assets figure explicitly provided on the financial statement. The indirect approach includes analyzing the individual components of the balance sheet, such as current assets and non-current assets, to estimate the total assets value. Additionally, financial ratios can be used to derive an approximation of the total assets value.

By incorporating these methods into your analysis, you can gain a comprehensive understanding of a company’s asset base and its financial standing. However, it’s crucial to consider the limitations and assumptions associated with each method and verify the accuracy and reliability of the balance sheet data used.

Whether you are an investor, business owner, or financial professional, the ability to analyze the balance sheet and accurately estimate the total assets provides valuable insights into a company’s financial health, liquidity, and growth potential.

Remember to review other financial statements and disclosures to corroborate your analysis and consider industry benchmarks and company-specific factors when interpreting the total assets value.

Armed with the knowledge gained from this guide, you are now better equipped to evaluate a company’s financial position, assess its asset base, and make informed financial decisions based on the available information.

Continue to refine your skills in analyzing balance sheets and keep up with changes in accounting standards and financial reporting practices to stay ahead in the dynamic world of finance.