Home>Finance>At What Point Are Death Proceeds Paid In A Joint Life Insurance Policy?

Finance

At What Point Are Death Proceeds Paid In A Joint Life Insurance Policy?

Modified: December 29, 2023

Find out when death proceeds are paid in a joint life insurance policy. Get expert insights on finance and learn how this policy can benefit you.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to ensuring financial security for you and your loved ones, life insurance is a valuable tool. It provides a financial safety net in the event of your untimely passing, helping your beneficiaries cover expenses such as mortgage payments, education costs, and daily living expenses. However, deciding on the right life insurance policy to fit your needs can be overwhelming with the various options available in the market. One common type of policy is a joint life insurance policy.

Joint life insurance policies are specifically designed to cover the lives of two individuals, usually spouses or partners. These policies typically offer coverage for both individuals under a single policy, combining the benefits of individual life insurance policies into one. This can be a convenient and cost-effective option for couples or business partners.

In a joint life insurance policy, the death proceeds, also known as the death benefit, are the amount paid out to the beneficiaries upon the death of one of the insured individuals. However, the timing of when the death proceeds are paid out in a joint life insurance policy can vary based on several factors.

In this article, we will delve into the ins and outs of how death proceeds work in a joint life insurance policy. We will explore different types of joint life insurance policies, factors influencing the timing of death benefit payouts, and present specific scenarios and examples to help you better understand this financial instrument. Finally, we will discuss the pros and cons of joint life insurance policies to help you make an informed decision.

Understanding Joint Life Insurance Policies

Joint life insurance policies are specifically designed to provide coverage for two individuals, typically spouses or partners. These policies offer a combined coverage for both individuals under a single policy, allowing them to share the benefits and costs associated with life insurance. This type of policy is particularly beneficial for couples or business partners who rely on each other financially and want to ensure their loved ones are protected in the event of their passing.

With a joint life insurance policy, the death benefit is paid out upon the death of one of the insured individuals. This means that the policy continues to provide coverage for the surviving individual after the death of their partner. The death benefit can be used by the surviving individual to cover financial obligations and expenses, such as mortgage payments, loans, and everyday living costs.

It’s important to note that joint life insurance policies come in various forms, with different terms and conditions. Some policies provide a level death benefit, where the payout remains the same throughout the policy term. Others offer decreasing death benefits, where the payout decreases over time. The type of joint life insurance policy you choose will depend on your specific needs and circumstances.

Joint life insurance policies can also be classified as either first-to-die or second-to-die policies. A first-to-die policy pays out the death benefit upon the death of the first insured individual, while a second-to-die policy pays out the benefit only upon the death of the second insured individual. Second-to-die policies are commonly used in estate planning to help cover estate taxes and ensure the financial well-being of the surviving spouse or beneficiaries.

Overall, joint life insurance policies offer a convenient and cost-effective way for couples or business partners to obtain life insurance coverage. By combining coverage under one policy, these policies provide added flexibility and ease of management. However, it’s essential to carefully consider your needs and consult with a financial advisor to determine if a joint life insurance policy is the right choice for you.

How Death Proceeds Work in a Joint Life Insurance Policy

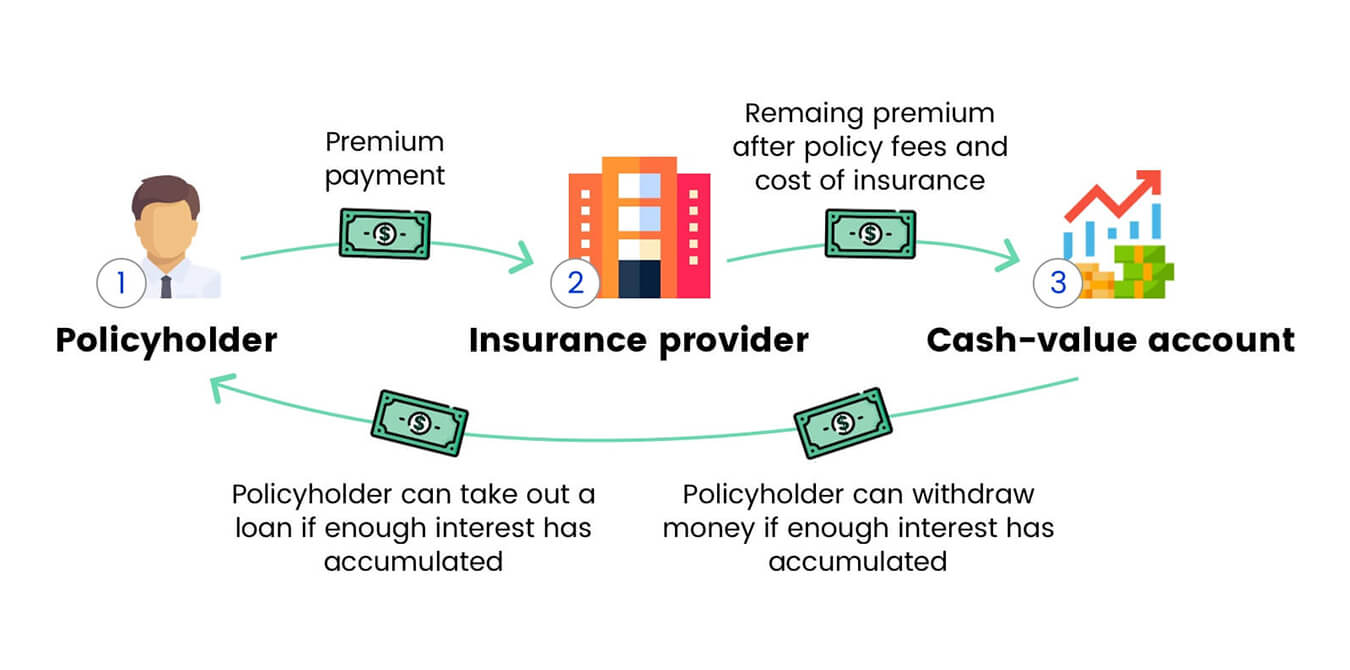

In a joint life insurance policy, the death proceeds, also known as the death benefit, are the amount paid out to the beneficiaries upon the death of one of the insured individuals. This payout is typically made to the surviving partner or beneficiary, and it can help provide a financial safety net during a time of loss and transition.

There are two main ways in which death proceeds can work in a joint life insurance policy:

- First-to-Die Policies: In a first-to-die policy, the death benefit is paid out upon the death of the first insured individual. This means that if either spouse or partner passes away, the surviving individual will receive the full death benefit. Once the death benefit is paid out, the policy typically ends, and no further benefits are available. First-to-die policies are commonly used to provide immediate financial support to the surviving individual, covering expenses such as funeral costs, outstanding debts, and ongoing living expenses.

- Second-to-Die Policies: In a second-to-die policy, the death benefit is paid out upon the death of the second insured individual. This means that both individuals must pass away before the death benefit is distributed to the beneficiaries. Second-to-die policies are often utilized for estate planning purposes, as the death benefit can help cover estate taxes or provide a financial legacy to future generations. The surviving partner or beneficiary may still receive some benefits from the policy, such as cash value or the option to convert it into a new policy.

It’s important to review the terms and conditions of your specific joint life insurance policy to understand how the death proceeds are structured. The payout amount is typically based on the coverage amount selected at the time of purchase, which could vary depending on factors such as the insured individuals’ ages, health conditions, and desired level of coverage.

Upon the death of one of the insured individuals, the surviving partner or beneficiary will need to submit a claim to the insurance company. This involves providing the necessary documentation, such as a death certificate and proof of relationship, to initiate the payout process. The insurance company will review the claim and, once approved, will disburse the death proceeds to the designated beneficiaries. The beneficiaries can then use the funds to cover immediate expenses, settle debts, invest, or take any other actions that align with their financial goals and needs.

It’s crucial to keep the policy details, including the names of beneficiaries and contact information for the insurance company, easily accessible in the event of a death. This will help streamline the claims process and ensure a smooth transition for the surviving individual and beneficiaries.

Different Types of Joint Life Insurance Policies

Joint life insurance policies come in various forms, each offering unique features and benefits. Understanding the different types can help you choose the policy that aligns with your needs and goals. Here are some common types of joint life insurance policies:

- Level Death Benefit: In a level death benefit policy, the payout remains the same throughout the policy term. This means that the beneficiaries will receive a fixed amount of death benefit regardless of when the insured individual passes away. Level death benefit policies provide a sense of stability and can be particularly useful for ensuring financial security and covering large expenses, such as a mortgage or children’s education.

- Decreasing Death Benefit: A decreasing death benefit policy, also known as mortgage protection insurance or decreasing term insurance, offers a decreasing payout over time. This type of policy is often used to cover a specific debt, such as a mortgage. As the debt decreases over time, the death benefit amount decreases accordingly. Decreasing death benefit policies can be cost-effective for individuals who want to ensure that their outstanding debts are covered in the event of their death.

- First-to-Die Policies: First-to-die policies provide a death benefit upon the death of the first insured individual. This policy is typically purchased by couples and can help provide immediate financial support to the surviving partner. The death benefit can be used to cover funeral expenses, outstanding debts, and ongoing living expenses.

- Second-to-Die Policies: Second-to-die policies, also known as survivorship policies, pay out the death benefit upon the death of the second insured individual. These policies are commonly used in estate planning to help cover estate taxes and ensure a financial legacy for future generations. Second-to-die policies can be particularly valuable for couples who want to leave a financial safety net for their children or beneficiaries.

- Convertible Policies: Convertible joint life insurance policies offer the flexibility to convert the coverage to individual policies at a later stage. This means that the policy can be transitioned into separate policies for each individual, providing more personalized coverage. Convertible policies offer flexibility and adaptability in the face of changing financial circumstances or needs.

It is important to carefully review the terms and conditions of each type of joint life insurance policy, considering factors such as premiums, policy duration, conversion options, and death benefit structures. Choosing the right type of joint life insurance policy requires a thorough understanding of your financial goals, needs, and circumstances.

Factors Affecting the Payout Timing of Death Proceeds

The timing of when the death proceeds are paid out in a joint life insurance policy can be influenced by several factors. Understanding these factors can help you anticipate when the beneficiaries will receive the death benefit. Here are some key considerations:

- Policy Structure: The structure of the joint life insurance policy plays a significant role in determining the payout timing. First-to-die policies pay out the death benefit upon the death of the first insured individual, while second-to-die policies pay out after the death of the second insured individual. It’s important to carefully review the policy terms to understand how the timing of the death benefit payout aligns with your needs and financial goals.

- Policy Duration: The policy duration or term length can also impact when the death proceeds are paid out. If the policy term is set for a specific number of years, the death benefit will be paid out upon the death of one of the insured individuals within that term. However, certain policies may have provisions that extend the coverage beyond the initial term, potentially delaying the payout until the end of the extended term.

- Surviving Partner’s Age and Health: The age and health of the surviving partner can affect the timing of the death benefit payout. If the surviving partner is younger and in good health, the policy may continue for a longer period before the death benefit is paid out. Conversely, if the surviving partner is older or in poor health, the death benefit may be paid out sooner as the likelihood of their passing increases.

- Conversion Options: Some joint life insurance policies offer the option to convert the coverage into individual policies. If the surviving partner chooses to convert the policy, the death benefit payout may be delayed until the conversion process is completed. This allows the surviving partner to continue the coverage under their own individual policy.

- Beneficiary Designation: The designation of beneficiaries can influence the timing of the death benefit payout. In joint life insurance policies, the surviving partner is often the primary beneficiary. However, if the surviving partner passes away before the death benefit is paid out, contingent beneficiaries, such as children or other family members, may receive the payout. This can affect the timing of when the death benefit is distributed.

It’s important to carefully review your joint life insurance policy and discuss any questions or concerns with your insurance provider. They can provide detailed information on the specific factors that may impact the timing of the death benefit payout in your particular policy.

Specific Scenarios and Examples

To better understand how the payout timing of death proceeds works in joint life insurance policies, let’s explore some specific scenarios and examples:

Scenario 1: John and Sarah have a joint life insurance policy with a first-to-die structure and a level death benefit. If John were to pass away before Sarah, the death benefit would be paid out to Sarah as the surviving partner. The payout would happen relatively quickly, allowing Sarah to cover immediate expenses such as funeral costs and outstanding debts.

Scenario 2: Alex and Emily have a second-to-die joint life insurance policy. They want to ensure that their children are financially protected and that estate taxes are covered. In this case, the death benefit would only be paid out when both Alex and Emily pass away. The timing of the payout would depend on their individual life expectancies, but it allows them to leave a financial legacy for their children or beneficiaries.

Scenario 3: Mark and Lisa have a convertible joint life insurance policy. Initially, they opted for this policy to benefit from lower premiums. However, as they grow older and their financial circumstances change, they decide to convert the coverage into individual policies. The death benefit payout timing in this scenario would depend on when the conversion process is completed, which may result in a slight delay from the original joint policy’s terms.

These scenarios illustrate the various possibilities and factors that can affect death benefit payouts in joint life insurance policies. It is essential to review the specific terms and conditions of your policy to understand how it applies to your unique situation.

Pros and Cons of Joint Life Insurance Policies

Like any financial product, joint life insurance policies have their own set of advantages and disadvantages. Understanding these pros and cons can help you determine if a joint life insurance policy is the right choice for you and your loved ones. Here are some key factors to consider:

Pros:

- Cost-effective: Joint life insurance policies typically offer more affordable premiums compared to purchasing separate individual policies for each insured individual. This can save you money and make life insurance coverage more accessible.

- Convenience: With a joint life insurance policy, you only need to manage and pay premiums for one policy instead of multiple individual policies. This simplifies the insurance process and reduces administrative tasks.

- Shared Coverage: Joint life insurance policies provide coverage for both individuals under a single policy. This means that you and your partner can share the benefits of the policy, ensuring financial protection for both of you.

- Estate Planning Benefits: Second-to-die joint life insurance policies can be instrumental in estate planning, helping to cover estate taxes and ensuring the financial well-being of surviving beneficiaries. This can be especially valuable for individuals with significant assets or complex financial situations.

- Fulfilling Financial Obligations: Joint life insurance policies can help ensure that financial obligations, such as paying off a mortgage or providing for children’s education, are met in the event of one partner’s death.

Cons:

- Survivor’s Longevity: If the surviving partner lives longer, they may outlive the coverage period of the joint life insurance policy. This means that they may no longer have life insurance coverage if they need it in the future.

- Benefits Limited to One Policy: With a joint life insurance policy, the death benefit is typically paid out only once, either upon the death of the first insured individual (first-to-die) or the second insured individual (second-to-die). This limits the ability to have multiple death benefit payouts for different purposes or beneficiaries.

- Loss of Individual Flexibility: When you have a joint life insurance policy, you may lose the flexibility to customize coverage to meet each person’s unique needs. This may include factors such as coverage amount, policy duration, or additional policy riders.

- Coverage Dependency: Since joint life insurance policies cover both individuals, if the relationship changes or one partner wants to cancel the policy, it can create complications or necessitate the purchase of new policies.

- Survivor’s Financial Needs: A joint life insurance policy may not adequately address the financial needs of the surviving partner in situations where they require a larger amount of coverage or have specific financial obligations.

It’s essential to carefully evaluate these pros and cons in relation to your personal circumstances, financial goals, and preferences. Consulting with a financial advisor can provide valuable insights and help you make an informed decision that suits your specific needs.

Conclusion

Joint life insurance policies can be a valuable tool in providing financial security for couples or business partners. Understanding how death proceeds work in these policies is crucial in ensuring that your loved ones are protected in the event of your passing.

By considering factors such as policy structure, duration, and conversion options, you can determine when the death benefit will be paid out and how it aligns with your goals and circumstances. Reviewing different types of joint life insurance policies, such as first-to-die and second-to-die, can help you choose the one that best fits your needs, whether it’s immediate financial support or long-term estate planning.

While joint life insurance policies offer benefits such as cost-effectiveness, convenience, and shared coverage, they may also have limitations, such as coverage dependency and reduced flexibility. It’s important to carefully weigh these pros and cons to ensure that your life insurance plan aligns with your financial objectives.

Ultimately, making informed decisions about life insurance requires a thorough understanding of your financial situation and goals. Consult with a financial advisor who specializes in insurance to assess your individual needs and explore the options available to you.

Remember, a joint life insurance policy can provide peace of mind and financial protection for both you and your loved ones. By carefully considering the factors discussed in this article, you can make an educated choice and ensure that your family’s financial future remains secure.