Home>Finance>Average Daily Balance Method: Definition And Calculation

Finance

Average Daily Balance Method: Definition And Calculation

Published: October 11, 2023

Learn about the Average Daily Balance Method in finance and how to calculate it. Understand its definition and its significance in financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking Financial Wisdom: The Average Daily Balance Method

Greetings, fellow financial enthusiasts! In the vast and complex world of personal finance, it’s crucial to understand the various methods and concepts that govern our monetary interactions. Today, we’re diving deep into the realm of the Average Daily Balance Method. So, grab your calculators and join us as we explore the intricacies of this financial tool.

Key Takeaways:

- The Average Daily Balance Method is a widely used technique for calculating interest charges and fees on financial accounts.

- This method requires the calculation of the average balance in an account over a specific period of time.

What is the Average Daily Balance Method?

The Average Daily Balance Method is a technique commonly utilized by financial institutions to calculate interest charges and fees on various types of accounts. Whether it’s a credit card, loan, or savings account, this method helps determine the average balance in an account over a specified period of time. Now, you might be wondering, how does this method differ from other calculations? Well, let’s delve further into its calculation process.

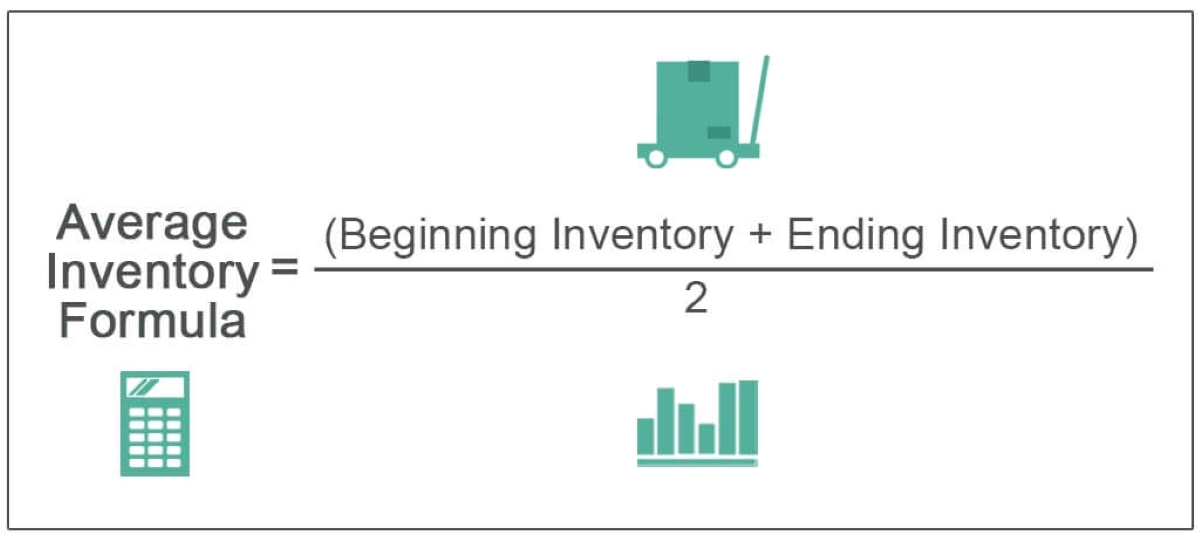

The Calculation Process

Calculating the average daily balance may seem overwhelming at first, but fear not! We’re here to break it down into digestible steps:

- Recording Daily Balances: To calculate the average daily balance, financial institutions typically record the balance in your account each day.

- Summing Daily Balances: Once the daily balances are recorded, the institution then adds up these balances over the specified period.

- Determining the Number of Days: The next step involves counting the number of days within the specified period, excluding any intervening transactions.

- Calculating Average Balance: Finally, by dividing the sum of the daily balances by the number of days, we arrive at the average daily balance.

This average daily balance serves as the foundation for computing various financial charges, such as interest, fees, or even minimum balance requirements.

Why It Matters

The Average Daily Balance Method is a crucial concept to comprehend as it directly impacts your financial obligations and potential savings. Understanding how this calculation works allows you to make informed decisions about your accounts and plan your financial moves effectively. Whether you want to optimize your savings, reduce interest charges, or maintain minimum balance requirements, a grasp of the Average Daily Balance Method will prove invaluable.

In Conclusion

Phew! We’ve embarked on a journey to unravel the mysteries of the Average Daily Balance Method, and we’ve successfully reached our destination. By grasping this financial tool and its calculation process, you are now better equipped to navigate your monetary realm and make financial decisions that align with your goals.

Remember, understanding the nuances of various financial concepts is the key to unlocking financial success. Stay tuned for more empowering discussions on our Finance category, where we shed light on complex financial topics in an accessible and insightful manner.