Home>Finance>Average Inventory: Definition, Calculation Formula, Example

Finance

Average Inventory: Definition, Calculation Formula, Example

Published: October 11, 2023

Learn about the definition, calculation formula, and example of average inventory in finance. Gain insights into inventory management and optimization.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to our finance category, where we dive deep into various financial concepts and topics that are essential for both individuals and businesses. In this article, we will explore the concept of average inventory – its definition, how to calculate it, and provide you with a practical example to help you understand its importance and implementation.

When it comes to managing finances, understanding inventory is critical for businesses across all industries. It allows organizations to make informed decisions about purchasing, production, and forecasting. One of the key metrics used in inventory management is average inventory.

Key Takeaways:

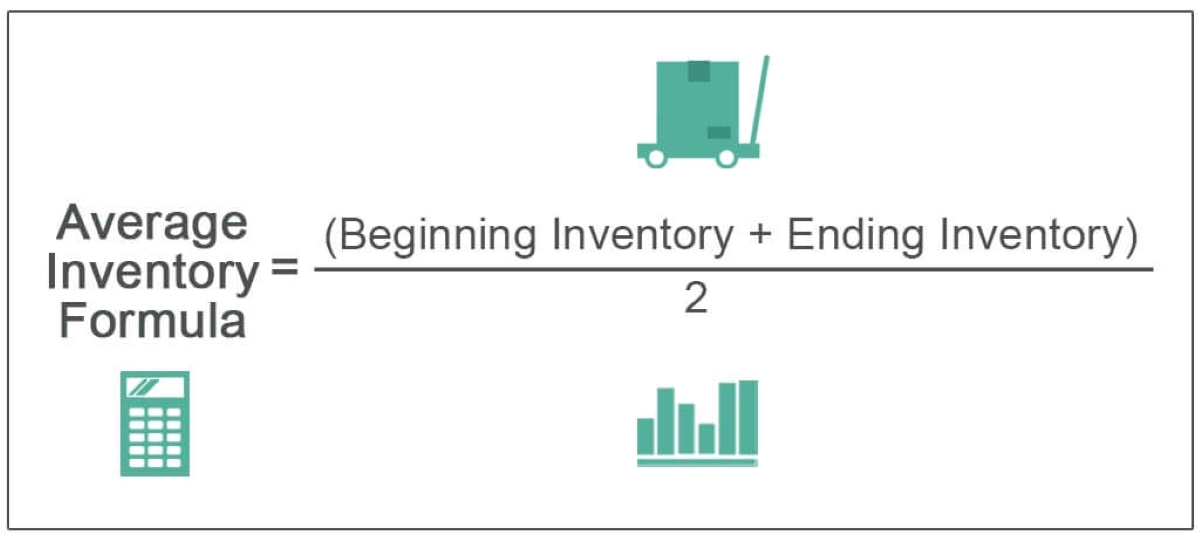

- Average inventory is the mean value of a company’s stock over a specific period of time, often a year.

- It is calculated by adding the beginning inventory to the ending inventory and dividing the sum by 2.

So, what exactly is average inventory? In simple terms, it represents the average value of a company’s inventory over a specific period. This period is typically a year but can vary depending on the company’s reporting cycle. Average inventory is a useful measure as it provides a more accurate representation of inventory levels compared to just looking at the beginning or ending inventory in isolation.

The calculation of average inventory is straightforward. To find the average, you add the beginning inventory to the ending inventory and divide the sum by 2. This formula provides a balanced representation of the inventory value, considering the fluctuations that may occur throughout the year. By calculating the average inventory, companies can gain insights into their stock levels, turnover rates, and ultimately optimize their inventory management practices.

Let’s illustrate this concept with an example. Imagine a retail store that sells clothing. At the beginning of the year, the store has $50,000 worth of inventory, and at the end of the year, it has $70,000 worth of inventory. To find the average inventory, we would add $50,000 and $70,000, resulting in $120,000. Dividing this sum by 2 gives us an average inventory value of $60,000.

Now that we understand how to calculate average inventory, you might be wondering, why is it important? Here are a few key reasons:

- Effective inventory management: Average inventory helps businesses identify excess stock or stock shortages, enabling them to anticipate demand fluctuations and optimize their inventory levels accordingly.

- Pricing decisions: Average inventory plays a role in determining the cost of goods sold (COGS) and pricing strategies. By understanding the average inventory value, businesses can accurately calculate COGS and set competitive prices for their products.

To conclude, average inventory is a crucial metric for businesses of all sizes, providing insights into stock levels, turnover rates, and effective inventory management. By calculating the average inventory, companies can make more informed decisions, minimize costs, and optimize their overall financial performance. So, don’t overlook the power of average inventory – it can be the key to your financial success!