Home>Finance>Average Revenue Per Unit (ARPU): Definition And How To Calculate

Finance

Average Revenue Per Unit (ARPU): Definition And How To Calculate

Published: October 11, 2023

Learn what Average Revenue Per Unit (ARPU) means in the world of finance and how to calculate it. Improve your financial analysis skills and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Average Revenue Per Unit (ARPU)

When it comes to managing your finances, it’s crucial to have a clear understanding of key financial metrics that can help you make informed decisions. One such metric that holds great importance in the world of business is Average Revenue Per Unit (ARPU). In this blog post, we’ll delve into the definition of ARPU and provide you with a step-by-step guide on how to calculate it.

Key Takeaways:

- ARPU is a financial indicator that measures the average revenue generated per unit, typically calculated over a specific time period.

- It is a useful metric for businesses looking to evaluate their performance and identify opportunities for growth.

What is Average Revenue Per Unit (ARPU)?

ARPU is a crucial financial metric that helps businesses understand the average revenue they are generating from each unit of a product or service. In simpler terms, it measures the average amount of money a company earns from each customer, client, or user.

This metric is especially valuable for businesses that operate on a subscription model or have variable pricing tiers. By calculating ARPU, companies can gain insights into their pricing strategies, customer retention rates, and overall revenue potential.

How to Calculate ARPU

Calculating ARPU is relatively straightforward. Follow these steps to determine the average revenue generated per unit:

- Select a specific time period you want to analyze. It can be a month, quarter, or year.

- Determine the total revenue earned during the chosen time period.

- Count the total number of units sold or customers acquired during that period.

- Divide the total revenue by the number of units sold or customers acquired.

- The resulting number will be the ARPU for the given time period.

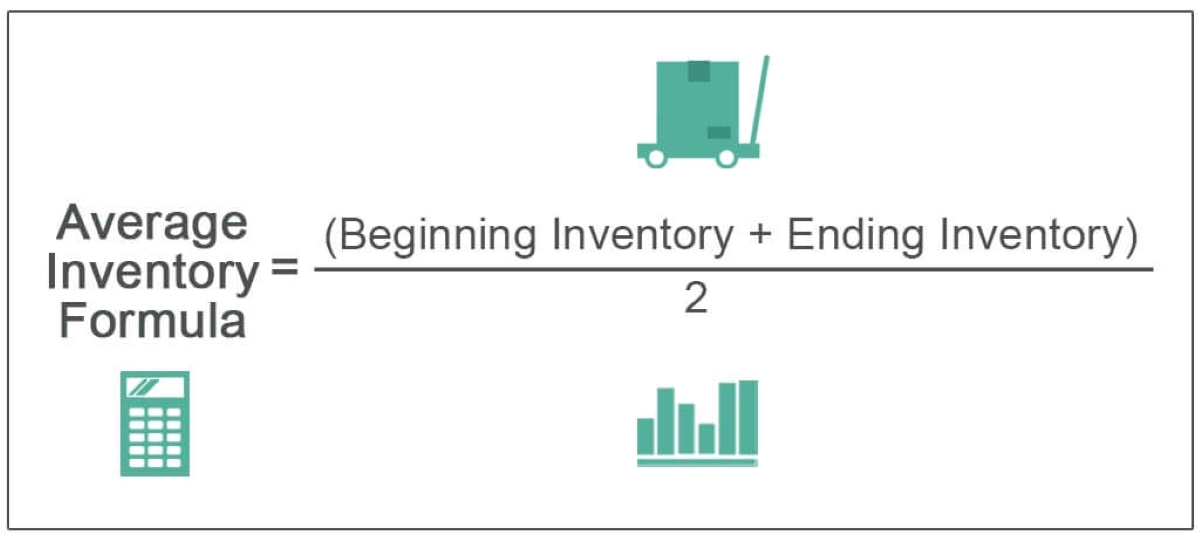

Here’s the formula for calculating ARPU:

ARPU = Total Revenue / Number of Units Sold or Customers Acquired

Why is ARPU Important?

ARPU is a vital metric for understanding the financial health of a business and its ability to generate revenue. Here are three reasons why ARPU is important:

- Performance Evaluation: ARPU allows companies to measure their performance over time. By tracking changes in ARPU, businesses can assess the impact of pricing strategies, marketing campaigns, and customer retention efforts.

- Identifying Growth Opportunities: Comparing ARPU among different customer segments or pricing tiers can help identify which areas of the business are thriving and which ones need improvement. It can highlight potential opportunities to upsell, cross-sell, or introduce new products.

- Investor Confidence: ARPU is an important metric for investors, as it provides insights into a company’s revenue potential. Higher ARPU numbers indicate a stronger ability to generate revenue and can instill confidence in potential investors.

By understanding and monitoring ARPU regularly, businesses can make informed decisions to optimize their revenue, identify growth opportunities, and attract potential investors.

Conclusion

As a business owner or financial manager, delving into key financial metrics like ARPU is essential for making informed decisions. Calculating ARPU allows you to have a better understanding of the average revenue you are generating per unit, aiding in evaluating performance, identifying growth opportunities, and building investor confidence.

So, take the time to calculate your ARPU and leverage this valuable metric to drive financial success for your business!