Finance

How To Get Letter 6419 From The IRS

Published: October 31, 2023

Learn how to obtain Letter 6419 from the IRS for your finance needs. Discover the steps and requirements involved in this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

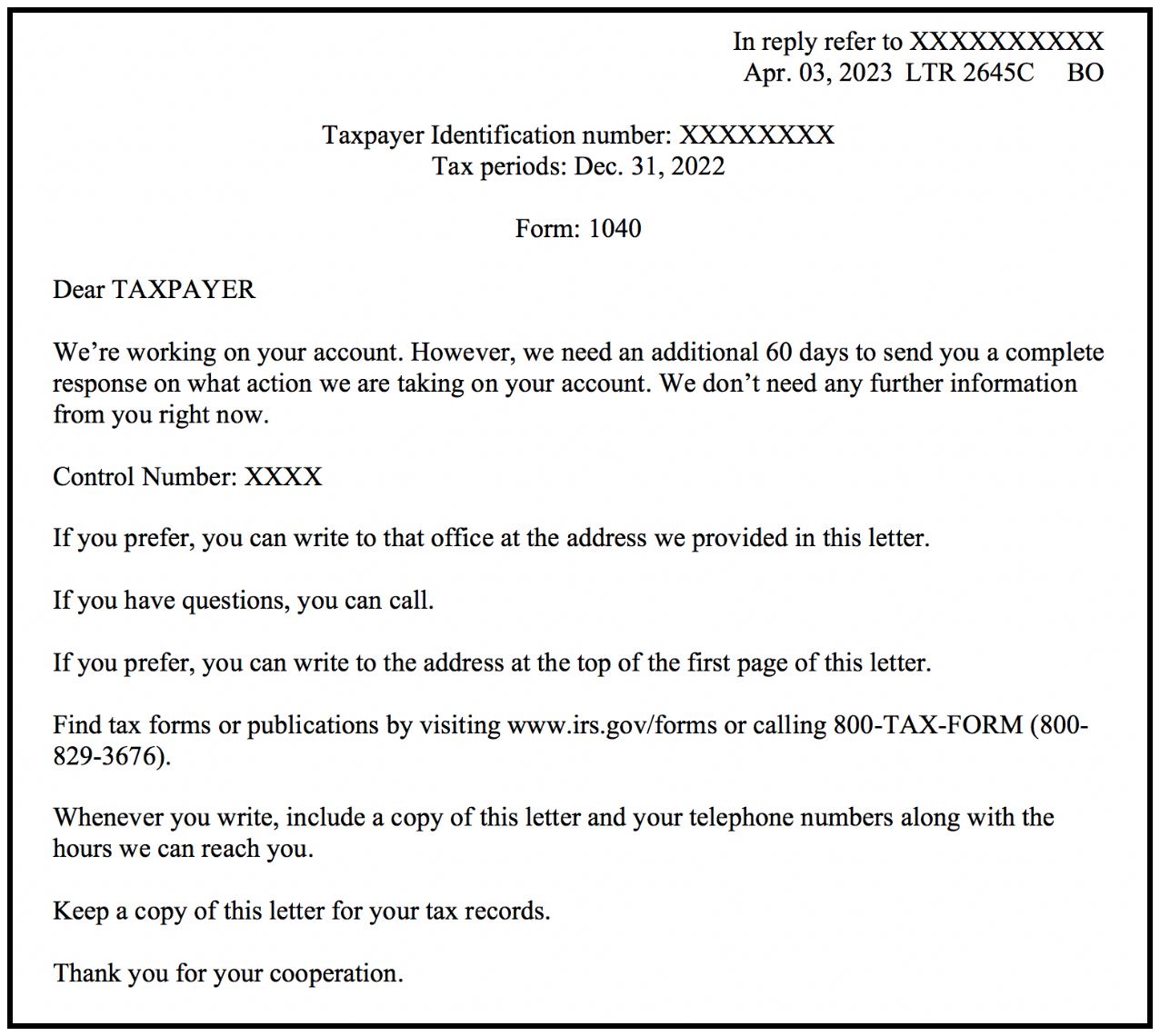

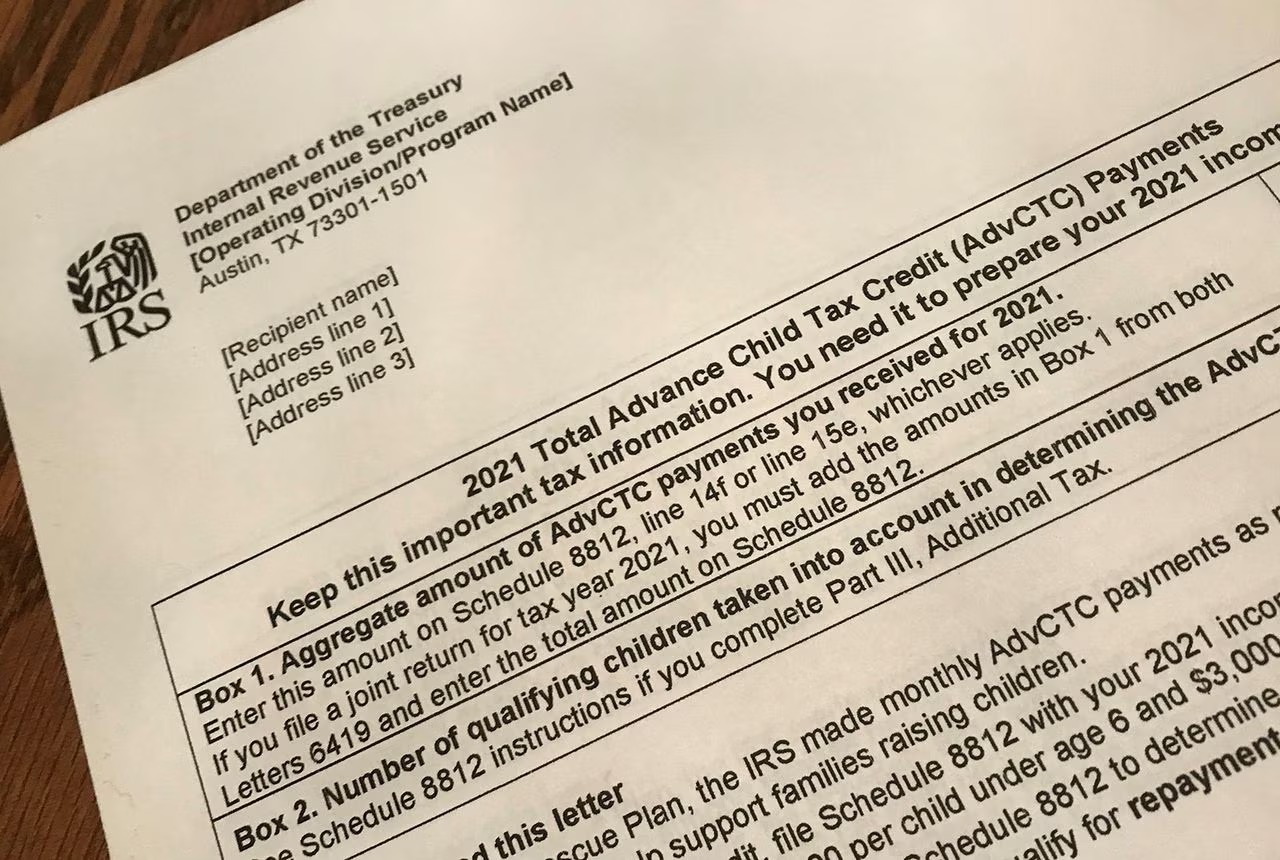

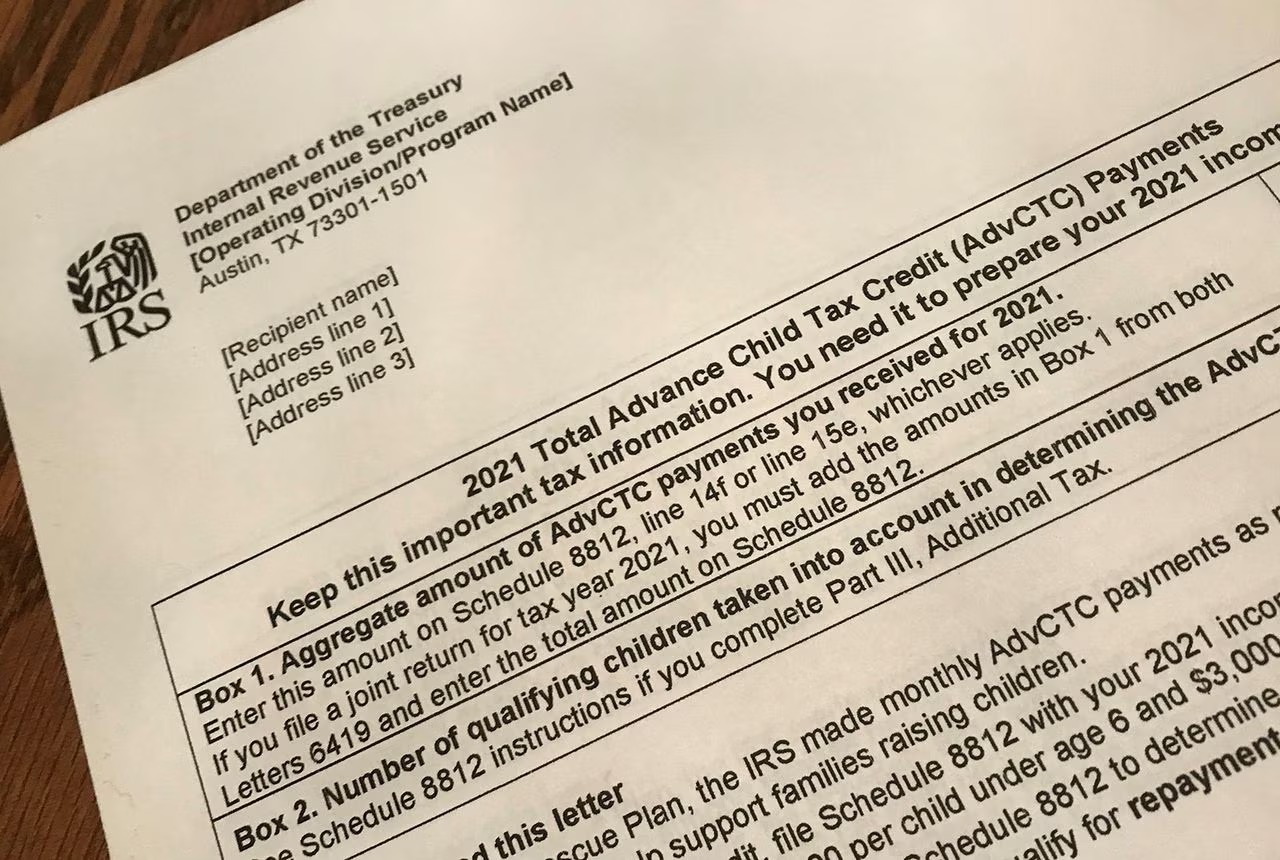

Receiving a letter from the IRS can be a cause for concern for many individuals. The Internal Revenue Service (IRS) plays a crucial role in the collection of taxes and enforcement of tax laws in the United States. One such letter that you may receive from the IRS is Letter 6419.

Letter 6419 is an important communication from the IRS, and it is essential to understand its purpose and take the necessary steps to respond to it. This letter is typically sent to taxpayers when there is a discrepancy or an issue with their tax return or financial information. It can include a range of matters, from missing documentation to potential fraud concerns.

In this article, we will guide you through the process of dealing with Letter 6419 and help you understand the necessary steps to address any concerns raised by the IRS. It is important to note that every taxpayer’s situation can be unique, so seeking professional advice is always a wise decision to ensure a proper response.

Understanding the contents of Letter 6419 and taking appropriate action is of utmost importance to avoid potential penalties or further inquiries from the IRS. Let’s dive deeper into the world of Letter 6419 and learn how to effectively navigate through it.

Understanding Letter 6419 from the IRS

Letter 6419 is a formal notification sent by the IRS to taxpayers regarding specific issues or discrepancies found in their tax returns or financial information. It serves as a communication tool between the IRS and taxpayers to address potential concerns and take appropriate action to resolve them.

When you receive Letter 6419, it is important to carefully review its contents and understand the purpose behind it. The letter will usually provide details about the specific issue or discrepancy that has been identified by the IRS. It may also include instructions on what steps you need to take to address the matter.

The key to effectively dealing with Letter 6419 is to remain calm and not panic. While it can be concerning to receive such a letter, it is essential to approach it with a level-headed mindset and gather all the necessary information before taking any action.

Take the time to read the letter thoroughly and make note of any deadlines or specific instructions provided. Understanding the nature of the issue or discrepancy stated in the letter is crucial in determining the appropriate course of action.

In some cases, the issue could be a simple mistake, such as a typographical error or a forgotten document. In other instances, it could be a more serious matter, such as suspected tax fraud or inaccurate reporting. Regardless of the situation, it is important not to ignore the letter and promptly address the concerns raised by the IRS.

It is worth mentioning that Letter 6419 may request additional documentation or evidence to support your tax return. This could include bank statements, receipts, or any other relevant financial records. Failure to provide the requested information in a timely manner can result in further inquiries, penalties, or even an audit.

If you do not understand the contents of the letter or have concerns about how to proceed, it is advisable to seek professional assistance. Tax professionals, such as certified public accountants (CPAs) or enrolled agents, can provide expert guidance and support in handling the matter effectively.

Now that we have a basic understanding of Letter 6419, let’s move on to the step-by-step process of addressing and responding to this correspondence from the IRS.

Step 1: Gathering the Necessary Information

When you receive Letter 6419 from the IRS, the first step is to gather all the necessary information related to your tax return and financial records. Having all the relevant documentation handy will enable you to address the concerns raised in the letter more effectively.

Start by collecting your tax return for the year in question, as well as any supporting documents you used to complete it. This includes W-2 forms, 1099 forms, receipts, and other records of income and deductions. It’s important to have a clear understanding of the financial information you provided on your tax return and how it may relate to the issue mentioned in the IRS letter.

Next, carefully review the specific issue or discrepancy outlined in Letter 6419. Look for any specific details provided, such as the tax year, the specific line item or form that is in question, or any other relevant information. This will help you narrow down your search for the relevant documentation and focus on the areas of concern.

If the letter requests additional information or documentation, be sure to gather those as well. This could include bank statements, investment statements, or any other records that can support the accuracy and completeness of your tax return.

Organize the gathered information in a systematic manner. Create a folder or file for all the documents related to the issue raised in Letter 6419. This will ensure that you have everything in one place, making it easier to refer back to when needed.

In addition to gathering physical or digital copies of the necessary documentation, take the time to jot down any questions or concerns you may have. It’s important to have a clear idea of the information you’re missing or the inquiries you need to make before responding to the IRS. This will help streamline your communication and ensure that you address all the points effectively.

Remember, the more detailed and accurate your information is, the better equipped you will be to address the concerns raised by the IRS. Taking the time to gather the necessary information at the beginning will save you time and stress later in the process.

Now that you have gathered all the necessary information, it’s time to move on to the next step: reviewing the contents of Letter 6419.

Step 2: Reviewing the Contents of Letter 6419

Once you have gathered all the necessary information, the next step is to carefully review the contents of Letter 6419 from the IRS. This step is crucial in understanding the specific issue or discrepancy that has been identified and determining the appropriate course of action.

Start by reading the letter attentively from beginning to end. Take note of any key details provided, such as the tax year or the specific line item or form that is being questioned. Pay close attention to any deadlines mentioned in the letter, as prompt action may be required to address the IRS’s concerns.

Letter 6419 will typically state the reason for the correspondence and outline the specific issue identified by the IRS. It may mention that certain information is missing, incomplete, or inconsistent with their records. The letter may also provide instructions on how to resolve the matter, including any additional documentation or evidence that needs to be provided.

While reading the letter, make sure to comprehend the IRS’s perspective and determine whether you agree with their assessment. Compare the details mentioned in the letter with your own records and tax return to identify any discrepancies or errors that may have occurred.

If you find that the information in the letter is accurate and the issue raised by the IRS is valid, take ownership of the mistake and start thinking about the best way to rectify it. This may involve filing an amended tax return or providing the missing documentation as requested.

On the other hand, if you believe that the information in the letter is incorrect or that there has been a misunderstanding, gather any evidence or documentation that can support your position. This can include bank statements, receipts, or any other relevant records that demonstrate the accuracy of your tax return.

If there are any terms or concepts in the letter that you do not understand, take the time to research and educate yourself on the matter. The IRS website, publications, or seeking professional advice can help clarify any confusing aspects.

As you review the contents of Letter 6419, make use of any notes or questions you jotted down during the gathering of information phase. Ensure that you address all the points and concerns you have in a clear and organized manner when responding to the IRS.

Understanding the contents of Letter 6419 is a critical step in the process of addressing the IRS’s concerns effectively. With a thorough review under your belt, you’re now ready to move on to the next step: determining the reason for receiving Letter 6419.

Step 3: Determining the Reason for Receiving Letter 6419

After reviewing the contents of Letter 6419, it is important to determine the reason why you received this correspondence from the IRS. Understanding the underlying cause is crucial in determining the appropriate course of action to address their concerns.

Start by carefully analyzing the information provided in the letter. It may specify the specific issue or discrepancy that has been identified by the IRS. This could range from missing documentation, inconsistencies in reported income or expenses, or potential red flags such as suspected tax fraud.

Compare the information mentioned in the letter with your own tax return and financial records to identify any potential errors or discrepancies. Look for any mistakes in reporting, calculations, or overlooked details that may have caught the attention of the IRS.

If the issue is related to missing documentation, review your records to determine if you have misplaced or forgotten to include any relevant information on your tax return. It could be receipts, statements, or other documents that support the accuracy of your reported income, expenses, or deductions.

In some cases, the reason for receiving Letter 6419 may be a result of an IRS tax audit or examination. If that is the case, the letter may mention that further scrutiny of your tax return or financial information is required. It is important to assess the extent of the audit or examination and gather any additional records or evidence requested by the IRS.

Consider any life events or financial transactions that may have triggered the IRS’s attention. For example, a significant change in income, claiming substantial deductions or credits, or engaging in complex financial activities may raise red flags. Understanding these factors can help you pinpoint the reason for receiving Letter 6419.

If you are unsure about the reason behind the letter or need further clarification, consider seeking professional assistance. A tax professional, such as a certified public accountant (CPA) or an enrolled agent, can review your situation and provide valuable insights into the potential causes and the necessary steps to address them.

Remember, determining the reason for receiving Letter 6419 is vital in formulating an appropriate response. It allows you to address the specific concerns raised by the IRS and take the necessary action to resolve the issue. With a clear understanding of the reason, you can now proceed to the next step: responding to Letter 6419.

Step 4: Responding to Letter 6419

After understanding the reason for receiving Letter 6419 and gathering all the necessary information, it is time to respond to the IRS and address their concerns. A prompt and appropriate response is crucial to resolve the issue and ensure a smooth interaction with the IRS.

Begin by following any specific instructions provided in the letter. The IRS may ask for additional documentation, clarification on certain items, or a response within a specified timeframe. Adhere to these instructions to demonstrate your cooperation and willingness to resolve the matter.

When composing your response, be clear, concise, and organized. Start by acknowledging the receipt of Letter 6419 and reference it by its identification number. This will help the IRS identify your case quickly and efficiently.

Address each point raised by the IRS in a systematic manner. If there are multiple issues mentioned, respond to each one separately and provide the necessary explanation or documentation. Use clear and simple language to ensure that your response is easily understood by the IRS.

If you agree with the IRS’s findings or discovered errors in your tax return, take ownership of the mistake and offer a solution. This might involve filing an amended tax return, providing the missing documentation, or paying any outstanding taxes or penalties, if applicable. Be sure to include the necessary forms or supporting documents along with your response.

If you disagree with the IRS’s findings and believe that there has been a misunderstanding or error, provide a detailed explanation and any evidence to support your claim. Include copies of relevant documents, such as bank statements, receipts, or other records that substantiate your position. Construct a well-reasoned argument and present your case in a professional manner.

If you are unsure about how to respond or have concerns about the letter, consider seeking professional assistance. Tax professionals have experience in dealing with IRS correspondence and can provide valuable guidance throughout the process. They can help ensure that your response is comprehensive, accurate, and effectively addresses the concerns raised by the IRS.

Once you have prepared your response, make copies of all the documents for your records. Address the envelope to the correct IRS address provided in the letter and send it via certified mail with a return receipt requested. This will provide proof of delivery and ensure that your response reaches the IRS.

Keep a record of the date you sent the response and the tracking number for future reference. This will help you track the progress of your case and serve as documentation in case of any further inquiries or developments.

Remember, addressing Letter 6419 requires careful attention and a well-prepared response. By following the instructions provided, providing the necessary information, and seeking professional assistance if needed, you can effectively respond to the IRS and work towards resolving the issue.

With your response submitted, it’s time to move on to the next step: seeking professional assistance if necessary.

Step 5: Seeking Professional Assistance if Needed

Dealing with Letter 6419 from the IRS can be complex and overwhelming, especially if you are unsure about the best course of action or if the situation is more complex than anticipated. In such cases, it is wise to seek professional assistance from a tax professional.

A certified public accountant (CPA) or an enrolled agent is well-versed in tax laws and regulations. They have the expertise to navigate through IRS correspondence and can provide valuable guidance in responding to Letter 6419. If you are unsure about how to address the concerns raised by the IRS or if you need assistance in understanding the complexities of your tax situation, consulting a tax professional can help alleviate your concerns and ensure you are on the right path.

A tax professional can review the contents of Letter 6419, the supporting documentation, and the information provided in your response. They can assess the validity of the IRS’s findings, identify any errors or discrepancies, and help you develop an appropriate course of action.

Tax professionals can offer advice on the best way to respond to the IRS, whether it involves filing an amended tax return, providing additional documentation, or seeking resolution through other means. They can ensure that your response is comprehensive, accurate, and addresses all the concerns raised by the IRS.

In addition to providing guidance in your response, tax professionals can also represent you in communications with the IRS. If the situation escalates, they can handle negotiations and act as your advocate to protect your rights and interests.

It is important to choose a reputable and experienced tax professional. Consider their qualifications, experience dealing with similar issues, and client reviews. Consultations with tax professionals are typically confidential and can help you evaluate the specific expertise and services they can offer.

While seeking professional assistance may come at a cost, it can potentially save you time, stress, and, in some cases, even money. The knowledge and expertise of a tax professional can provide peace of mind knowing that your case is in capable hands.

Ultimately, the decision to seek professional assistance depends on your comfort level, the complexity of the situation, and the potential consequences involved. If you are unsure about how to proceed or if you need additional guidance, consulting a tax professional can provide the support you need to address Letter 6419 effectively.

With the option of seeking professional assistance explored, you are now equipped with the necessary knowledge and steps to address Letter 6419 from the IRS. By remaining proactive and taking the appropriate action, you can work towards resolving any concerns raised by the IRS and ensure compliance with tax regulations.

As a final note, it’s important to remember that every taxpayer’s situation is unique. The information provided in this article serves as general guidance and should not replace personalized advice from a tax professional.

Conclusion

Dealing with Letter 6419 from the IRS can be daunting, but by following the steps outlined in this article, you can address the concerns raised by the IRS in an effective and timely manner.

Start by gathering all the necessary information related to your tax return and the specific issue mentioned in the letter. Review the contents of Letter 6419 carefully, understanding the reason for receiving it and determining the appropriate course of action. Respond to the IRS in a clear, concise, and organized manner, providing any additional documentation or evidence needed.

If the situation becomes complex or overwhelming, seeking professional assistance from a tax professional can provide guidance, expertise, and advocacy throughout the process.

Remember, effective communication and timely action are key when responding to Letter 6419. Take ownership of any mistakes, provide the necessary information, and cooperate with the IRS to resolve the issue. By doing so, you can mitigate any potential penalties or further inquiries and ensure compliance with tax laws.

It’s important to approach the situation with a calm and level-headed mindset. Understand that receiving Letter 6419 does not necessarily mean you have done something wrong. It is simply a means for the IRS to communicate and address any discrepancies or issues with your tax return.

Keep documentation of all communication with the IRS, including copies of letters, forms, and any other relevant records. This will help you keep track of the progress and serve as evidence in case of any future inquiries.

Lastly, be proactive and take steps to prevent similar situations in the future. Ensure accurate and thorough record-keeping, review your tax return before submitting it, and seek professional assistance if needed.

Remember, every taxpayer’s situation is unique, and this article provides general guidance. When in doubt or facing complex issues, it is always advisable to consult with a tax professional who can provide personalized advice and assistance based on your specific circumstances.

By following the steps outlined in this article, maintaining open and honest communication with the IRS, and seeking professional assistance if needed, you can navigate through the process of addressing Letter 6419 from the IRS successfully.