Home>Finance>Back Pay: Definition, Eligibility, And How To Calculate

Finance

Back Pay: Definition, Eligibility, And How To Calculate

Published: October 12, 2023

Learn about back pay in finance, including its definition, eligibility criteria, and how to calculate it. Understand how this concept can impact your financial situation and ensure you are aware of your rights.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Back Pay: Definition, Eligibility, and How To Calculate

Financial matters are a crucial aspect of everyone’s life, and it is important to stay informed about various aspects of personal finance. One such critical aspect that often affects individuals is back pay. Back pay refers to the wages or salary that an employee is owed but hasn’t received due to a variety of reasons, such as incorrect calculations, missed payments, or disputes. In this article, we will explore the concept of back pay in depth, covering its definition, eligibility criteria, and how to calculate it accurately.

Key Takeaways

- Back pay refers to unpaid wages or salary owed to an employee for work that has already been performed.

- Eligibility for back pay depends on various factors, such as employment status, labor laws, and any relevant employment contracts.

Defining Back Pay

Back pay essentially represents the amount of money that an employer owes to an employee for work already completed but not yet compensated for. It can arise from different scenarios, such as a labor dispute, an incorrect payroll calculation, a delayed payment, or a violation of employment contracts. In essence, back pay is a way to rectify any financial shortfall experienced by an employee due to their employer’s oversight or error.

Eligibility for Back Pay

Eligibility for back pay depends on several factors, including local labor laws, employment status, and any applicable employment contracts. Generally, employees who have experienced any of the following situations may be eligible for back pay:

- Incorrect wage or salary calculations

- Missed or delayed payments

- Overtime or holiday pay not received

- Unfair wage deductions

- Unlawful termination

- Discrimination in pay

- Unpaid commissions

It is important to consult local labor laws or seek professional advice to understand the specific eligibility criteria for back pay in your jurisdiction.

Calculating Back Pay

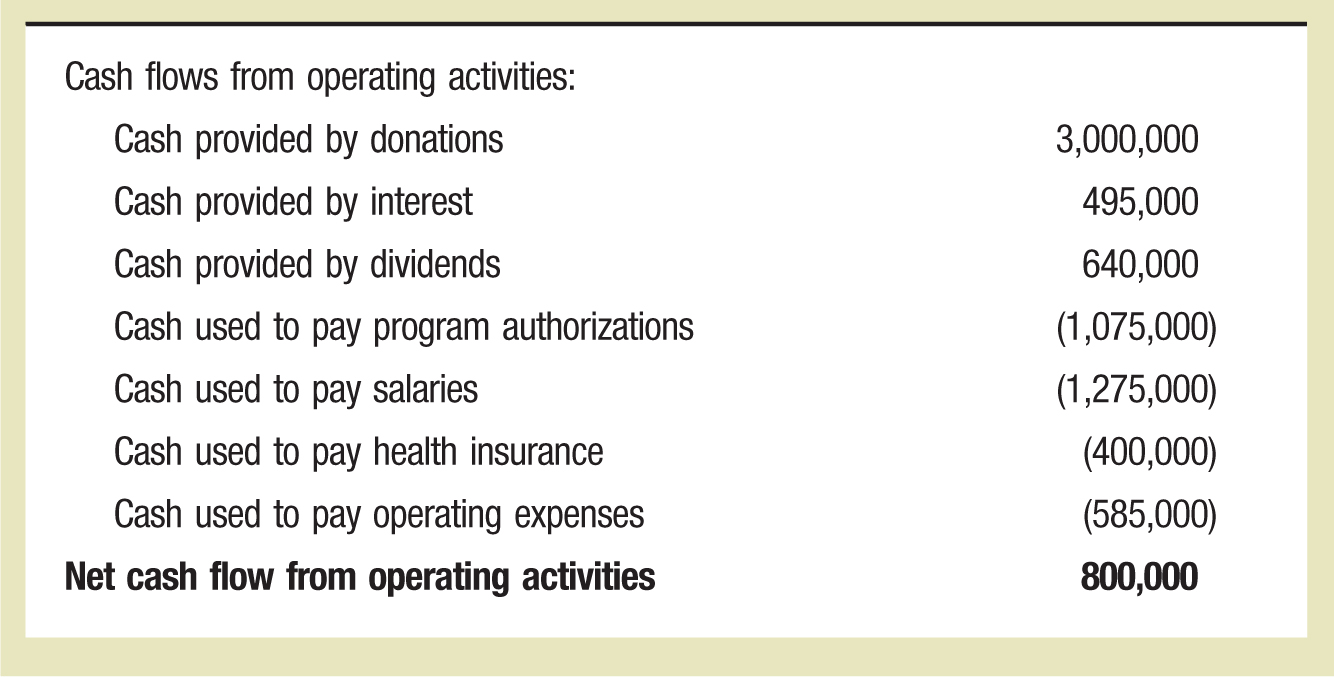

Accurately calculating back pay can be a complex process, as it involves taking into account various factors, such as the employee’s regular wage or salary, overtime, bonuses, deductions, and any applicable interest or penalties. The calculation method may differ depending on the specific circumstances and labor laws of the jurisdiction. However, a general approach for calculating back pay includes the following steps:

- Determine the employee’s regular rate of pay.

- Identify any unpaid hours or periods for which the employee is owed compensation.

- Calculate any applicable overtime pay or premium rates if relevant.

- Consider additional elements like bonuses, commissions, or any deductions that were not rightfully made.

- Add any interest or penalties that may be applicable under labor laws.

To ensure accuracy, it is advisable to consult legal or financial professionals who specialize in employment matters or seek guidance from your local labor department.

The Importance of Back Pay

Back pay plays a vital role in preserving fair compensation for employees and maintaining a healthy employer-employee relationship. It ensures that workers receive their rightful earnings and are adequately compensated for the work they have performed. Additionally, it acts as a deterrent against employers who might attempt to exploit their employees or violate labor laws. By providing a way to rectify any financial losses, back pay contributes to a more equitable workplace and fosters a sense of trust and fairness between employers and employees.

Conclusion

Understanding back pay is essential not only for employees who believe they are owed compensation but also for employers who want to maintain compliance with labor laws and establish a positive work environment. By staying informed about the definition, eligibility criteria, and calculation methods of back pay, both employers and employees can ensure fair treatment and avoid potential disputes. Remember, it’s always a good idea to consult legal or financial professionals for personalized advice or assistance when dealing with complex compensation matters.