Finance

Bank Examination Definition

Published: October 13, 2023

Discover the meaning of bank examination in the world of finance. Learn how financial institutions are evaluated and monitored to ensure stability and compliance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Bank Examination: Definition and Importance

When it comes to the world of finance, there are various terms and concepts that may seem daunting to the average person. If you’ve ever wondered what bank examination is all about, you’ve come to the right place. In this blog post, we will delve into the definition and importance of bank examination, shedding light on its role in ensuring the stability and security of financial institutions.

Key Takeaways:

- Bank examination is a regulatory process conducted by authorized agencies to assess the financial health and compliance of banks.

- It is essential for detecting vulnerabilities, preventing fraud, and safeguarding the interests of depositors and the overall financial system.

Now, let’s dive into the details and explore what exactly bank examination entails and why it plays a vital role in the finance industry.

The Definition of Bank Examination

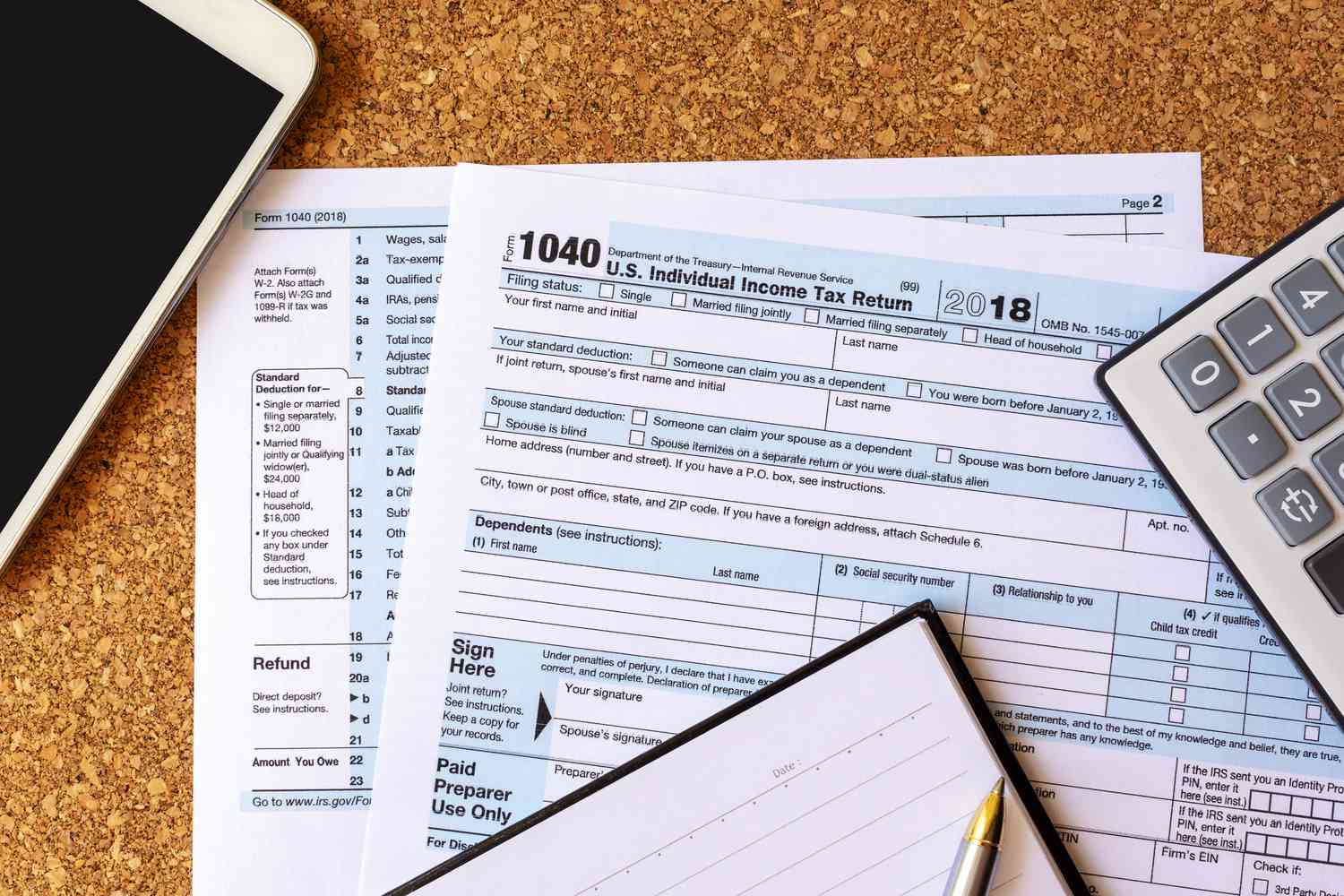

Bank examination is a comprehensive evaluation and analysis of financial institutions conducted by regulatory authorities such as the Federal Reserve, the Office of the Comptroller of the Currency (OCC), or the Federal Deposit Insurance Corporation (FDIC). Its primary purpose is to assess the financial condition, risk management practices, and compliance with laws and regulations of the banks being examined.

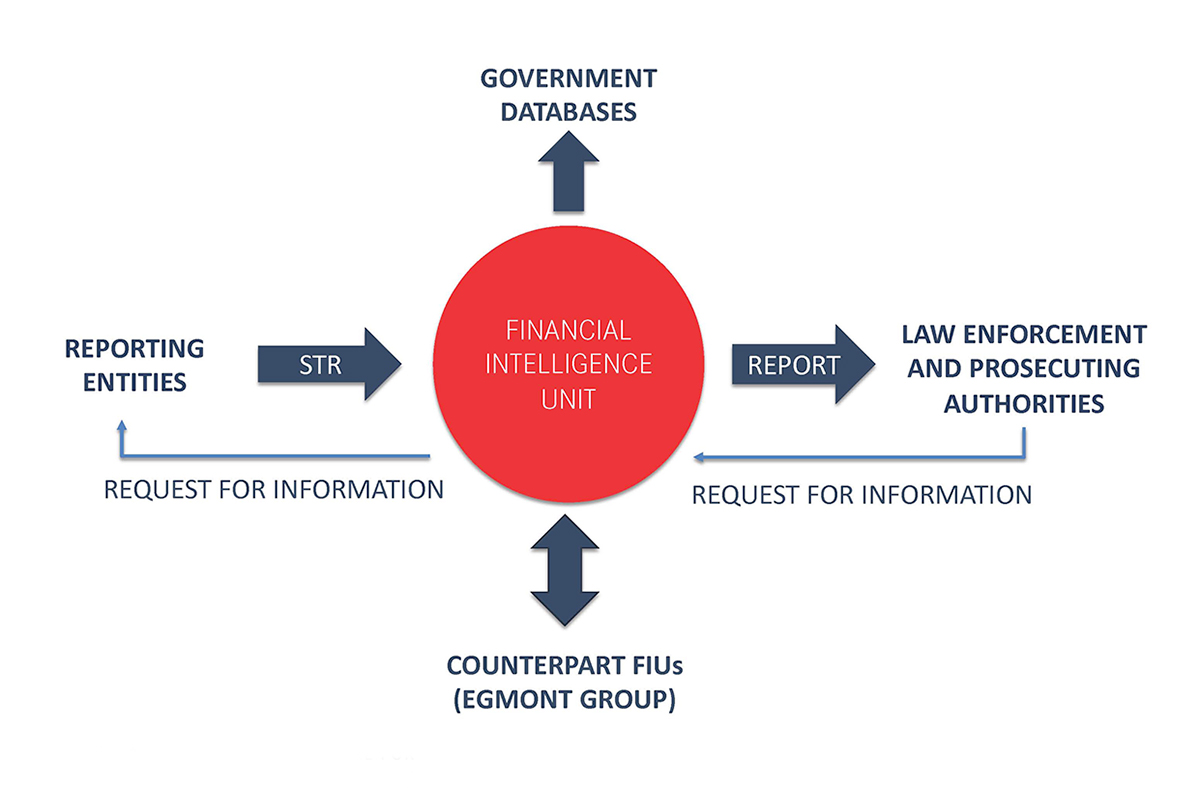

Bank examiners, who are typically employed by these regulatory agencies, meticulously review various aspects of a bank’s operations, including its financial records, risk management frameworks, lending practices, internal controls, and compliance with anti-money laundering and consumer protection laws. Their aim is to identify potential risks, weaknesses, or irregularities that may pose a threat to the stability and integrity of the financial system.

The Importance of Bank Examination

Now you might be wondering, why is bank examination such an important process? Here are two key reasons:

- Ensuring Financial Stability: Bank examinations play a pivotal role in promoting the stability and resilience of the financial system. By assessing the financial soundness of banks, examiners can identify potential risks or weak points that might jeopardize the overall health of the banking system. This, in turn, enables regulatory authorities to take timely actions to mitigate these risks and restore stability.

- Safeguarding Depositors’ Interests: One of the primary objectives of bank examination is to protect the interests of depositors. By monitoring banks’ compliance with regulations, examiners strive to ensure that banks are operating in a safe and secure manner, minimizing the likelihood of fraud, mismanagement, or malpractice. This oversight helps to instill confidence among depositors and contributes to maintaining the public’s trust in the banking system.

In addition to these key reasons, bank examinations also serve as a supervisory mechanism to enforce regulatory compliance, detect and prevent money laundering and terrorist financing activities, and promote fair and transparent banking practices.

Conclusion

In conclusion, bank examination is a crucial process for maintaining the stability and integrity of the financial system. Through comprehensive evaluations and assessments, regulatory authorities can identify potential risks and weaknesses in banks’ operations. This enables them to take proactive measures to prevent adverse events and protect depositors’ interests. So the next time you hear about bank examination, you’ll have a clearer understanding of its role in ensuring the safety and security of our banking institutions.