Finance

Box Size Definition

Published: October 18, 2023

Learn about the box size definition and its importance in finance. Discover how this concept affects financial markets and trading strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Exploring the Box Size Definition: Understanding Its Significance in Finance

When it comes to navigating the realm of finance, it’s crucial to have a solid understanding of various concepts and terminologies. One such concept that plays a significant role in financial analysis is the box size definition. In this blog post, we will delve into the depths of box size definition, its relevance in finance, and how it impacts traders and investors.

Key Takeaways:

- Box size definition is a crucial aspect of technical analysis.

- It determines the minimum price movement required for a new box to be created on a chart.

What is Box Size Definition and Why Does It Matter?

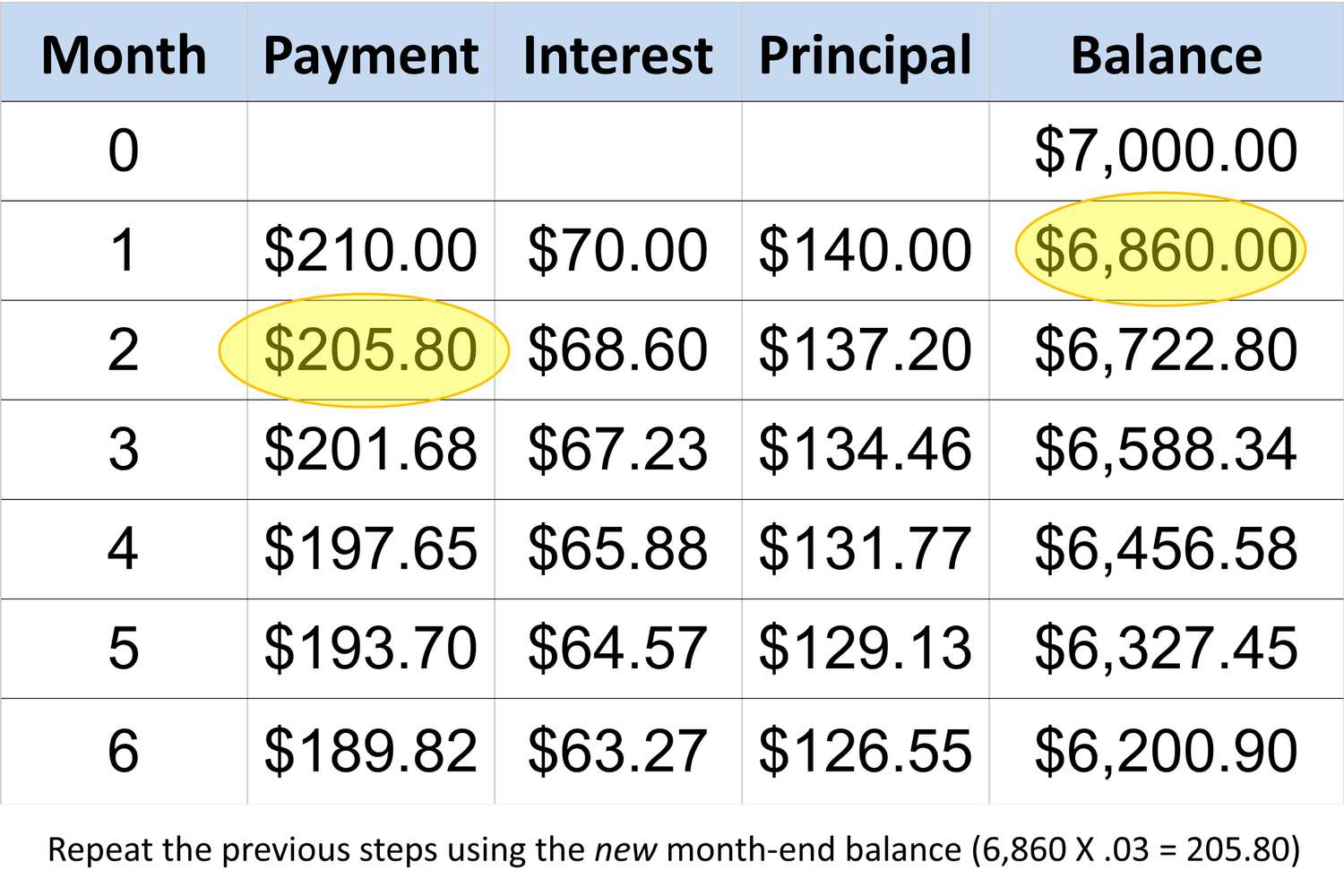

In technical analysis, box size definition refers to the minimum price movement required for a new box to be created on a chart. This concept is particularly relevant in financial markets where charts are used to analyze price movements and identify patterns. By defining the box size, traders and investors can gain insights into market trends, potential breakout points, and trend reversals.

Here are the two key takeaways:

- Box size definition is a crucial aspect of technical analysis.

- It determines the minimum price movement required for a new box to be created on a chart.

How Does Box Size Definition Impact Trading Strategies?

The box size definition has a direct impact on trading strategies, especially for those using point and figure charts. Point and figure charts are a type of graphical representation that eliminates the noise of insignificant price movements and focuses solely on significant price changes.

The box size determines the sensitivity of these charts and affects how quickly a new box is formed. A smaller box size creates more boxes and provides a detailed view of price movements. On the other hand, a larger box size results in fewer boxes and offers a broader perspective, highlighting significant price shifts.

Traders can customize the box size based on their preferred level of sensitivity and the time frame they are analyzing. Short-term traders might opt for smaller box sizes to capture quick price fluctuations, while long-term investors may choose larger box sizes to focus on major market movements.

The Importance of Box Size Definition in Trend Identification

Box size definition plays a vital role in trend identification, particularly in technical analysis techniques such as box counting. With box counting, traders analyze the number of boxes required for a specific price movement, allowing them to identify support and resistance levels, breakouts, and trend reversals.

By adjusting the box size, traders can fine-tune their analysis and gain deeper insights into market trends. A smaller box size helps identify shorter-term trends and potential short-term trading opportunities, while a larger box size enables the identification of long-term trends and significant price levels.

Conclusion

Understanding box size definition is essential for anyone involved in financial analysis and trading. By defining the minimum price movement needed for a new box to be formed on a chart, traders and investors can effectively interpret price movements and identify trends. Whether you are a short-term trader or a long-term investor, customizing the box size based on your preferred level of sensitivity can greatly enhance your decision-making process. So, next time you analyze price charts, remember the significance of box size definition in shaping your financial strategies.