Finance

Cash For Bond Lending Definition

Published: October 24, 2023

Unlock the meaning of cash for bond lending in the world of finance. Earn money by lending your bonds and explore new investment opportunities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Power of Cash for Bond Lending

Welcome to our finance category, where we explore various topics related to personal finance, investing, and money management. In this blog post, we will delve into the world of cash for bond lending, uncovering the definition and shedding light on how it can be a lucrative strategy for investors. So, let’s dive in!

Key Takeaways:

- Cash for bond lending is a financial strategy that allows investors to lend their cash to borrowers in exchange for bonds as collateral.

- This strategy provides investors with a steady stream of income through the interest earned on the bonds, while still maintaining a level of security.

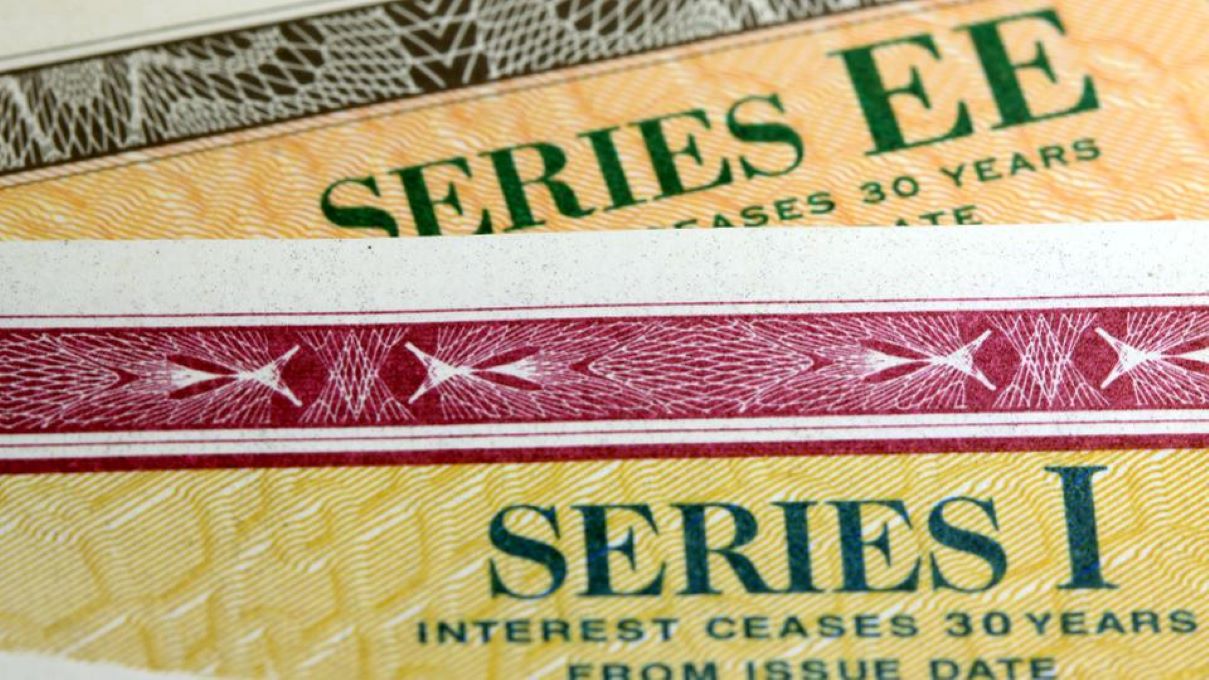

Now, let’s dig deeper into the definition of cash for bond lending. In essence, it is a transaction where an investor lends their cash to a borrower, who in turn provides bonds as collateral. This arrangement allows the borrower to access the funds they need, while the investor receives regular interest payments from the borrower. The bonds serve as a form of security for the investor, as they can be liquidated if the borrower fails to make the required payments.

One of the primary advantages of cash for bond lending is the steady income stream it provides. By investing in bonds, investors can earn interest payments on a regular basis. This can be especially beneficial for those looking for a reliable source of passive income. Additionally, the bonds serve as collateral, providing a level of security for the investor.

So, how does cash for bond lending work in practice? Let’s break it down:

- An investor decides to lend a certain amount of cash to a borrower.

- The borrower provides bonds as collateral, which are held by the investor.

- The borrower makes regular interest payments to the investor based on the terms of the agreement.

- Should the borrower fail to meet their payment obligations, the investor has the right to liquidate the bonds to recoup their investment.

While cash for bond lending can be a lucrative strategy, it is important for investors to carefully consider the risks involved. As with any investment, there is always the potential for loss, and market fluctuations can affect the value of the bonds held as collateral. It is crucial to thoroughly research and understand the terms and conditions of any cash for bond lending agreement before participating.

In conclusion, cash for bond lending is an innovative financial strategy that provides investors with a steady income stream while maintaining a level of security through collateralized bonds. By understanding the concept and conducting proper due diligence, investors can effectively utilize this strategy to grow their wealth and enhance their financial well-being.