Finance

How To Check Derogatory Marks On Credit

Published: January 7, 2024

Learn how to check derogatory marks on your credit and take control of your finances. Get valuable insights and tips to improve your credit score.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Derogatory Marks on Credit

- Types of Derogatory Marks

- Importance of Checking Derogatory Marks on Credit

- Steps to Check Derogatory Marks on Credit

- Method 1: Obtaining a Free Credit Report

- Method 2: Requesting Credit Reports from Major Credit Bureaus

- Method 3: Utilizing Online Credit Monitoring Services

- Method 4: Seeking Assistance from Credit Counseling Agencies

- Method 5: Monitoring Credit Card Statements and Monthly Bills

- Additional Tips for Checking and Addressing Derogatory Marks

- Conclusion

Introduction

Having a good credit score is crucial for financial stability and future opportunities, such as obtaining loans or securing better interest rates. However, sometimes unforeseen circumstances or financial missteps can lead to derogatory marks on your credit report. These marks can significantly impact your creditworthiness, making it challenging to access credit in the future.

Derogatory marks, also known as negative marks, are entries on your credit report that indicate a history of late payments, defaults, bankruptcies, or accounts sent to collections. These marks can stay on your credit report for several years and can result in a lower credit score. It is essential to regularly check your credit report to identify any derogatory marks and take appropriate measures to address and rectify them.

In this article, we will discuss the different types of derogatory marks you may encounter on your credit report, why it is important to check for these marks, and various methods you can use to check your credit report for derogatory marks.

By understanding how to check for derogatory marks on your credit, you can take proactive steps to improve your creditworthiness, address any negative marks, and regain control of your financial future.

Understanding Derogatory Marks on Credit

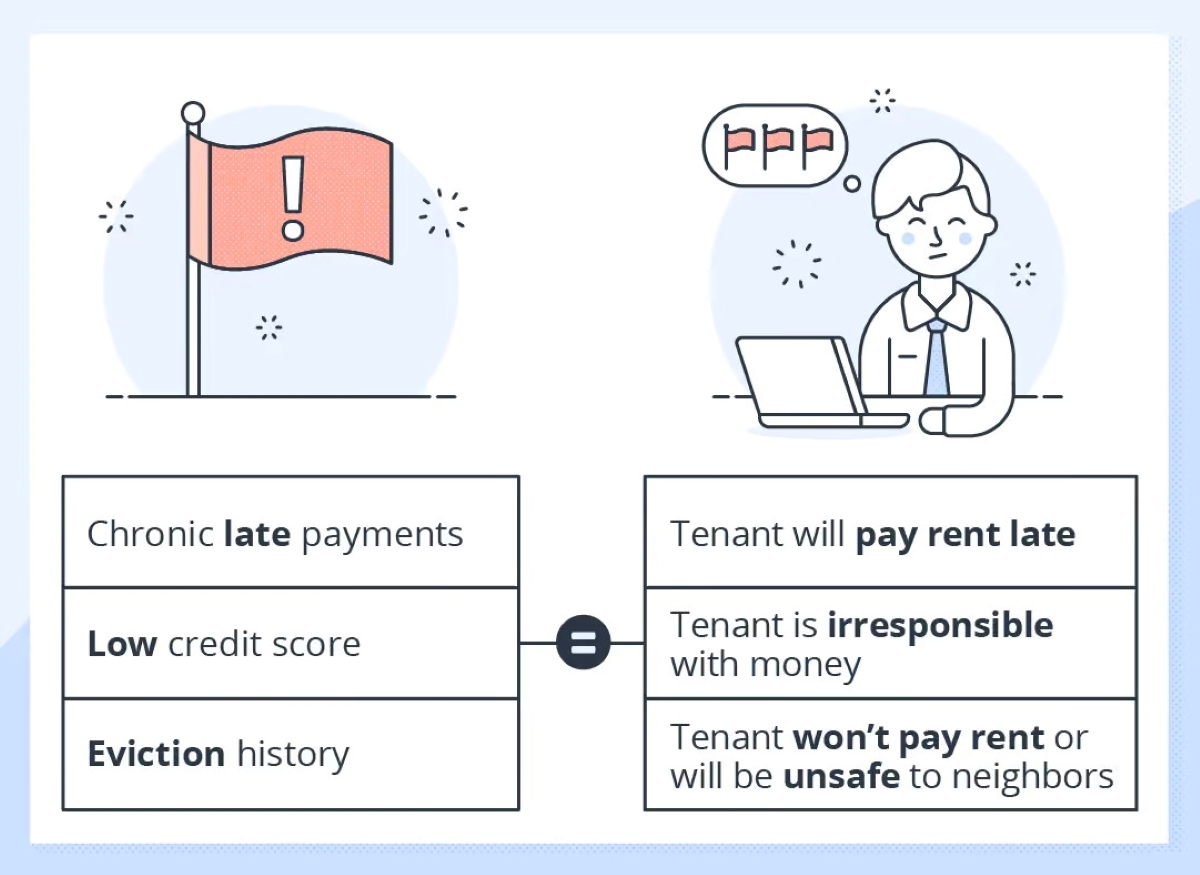

Derogatory marks are negative entries on your credit report that can have a significant impact on your creditworthiness. These marks indicate a history of financial mismanagement or irresponsibility and can lower your credit score, making it difficult to obtain loans, credit cards, or favorable interest rates.

There are several types of derogatory marks that can appear on your credit report:

- Late Payments: If you consistently make late payments on your credit accounts, it can result in a derogatory mark on your credit report. Late payments are typically reflected as 30, 60, 90, or 120+ days past due.

- Collections: When a creditor or collector has deemed your account delinquent and has taken steps to collect the debt, it can lead to a collection account on your credit report. This can adversely affect your credit score.

- Charge-offs: If a creditor determines that you are unlikely to repay a debt, they may charge off the account. A charge-off indicates that the creditor does not expect to collect the full amount owed and can significantly damage your credit.

- Bankruptcies: Filing for bankruptcy can have a severe impact on your credit. It will be noted as a derogatory mark and can remain on your credit report for several years.

- Foreclosures: If you have lost your home due to foreclosure, it can lead to a derogatory mark on your credit report. This mark can significantly impact your ability to secure future loans or credit.

- Judgments: If a creditor takes legal action against you and receives a judgment, it can result in a derogatory mark on your credit report. Judgments reflect a failure to fulfill your financial obligations.

- Tax Liens: Unpaid tax debts can result in a tax lien, which is a claim made by the government against your assets. Tax liens can have long-lasting negative consequences on your credit.

It is important to understand the different types of derogatory marks that can appear on your credit report, as they can vary in severity and impact. By being aware of these marks, you can take steps to address them and work towards improving your creditworthiness.

Types of Derogatory Marks

Derogatory marks on your credit report can come in various forms, each with its own implications for your creditworthiness. Understanding the different types of derogatory marks can help you identify and address them effectively. Here are some common types of derogatory marks:

- Late Payments: One of the most common derogatory marks, late payments occur when you fail to make payments on time. These can be reported as 30, 60, 90, or 120+ days past due. The longer the payment is overdue, the more severe the impact on your credit.

- Collection Accounts: When an account becomes significantly delinquent, it may be sent to a collection agency. The collection agency will then attempt to collect the debt on behalf of the original creditor. Having a collection account on your credit report can have a major negative impact on your credit.

- Charge-Offs: A charge-off occurs when a creditor determines that you are unlikely to repay a debt. The creditor writes off the debt as a loss and may sell it to a collection agency. Charge-offs can significantly harm your credit score and remain on your credit report for up to seven years.

- Bankruptcies: Bankruptcy is a legal process that allows individuals or businesses to eliminate or repay their debts under the supervision of the court. Bankruptcies have a severe and long-lasting impact on your credit report and can stay on your record for up to ten years.

- Foreclosures: If you fail to make mortgage payments, your lender may initiate foreclosure proceedings, leading to the loss of your property. Foreclosures have a significant negative impact on your credit and can make it challenging to obtain future loans or credit.

- Judgments: If a creditor takes legal action against you and wins a judgment, it means that the court has ordered you to repay the debt. Judgments can be entered for various types of debts, such as unpaid medical bills or outstanding loans, and can stay on your credit report for up to seven years.

- Tax Liens: When you fail to pay your federal or state taxes, a tax lien may be filed against you. Tax liens are a claim by the government on your assets and can severely damage your credit. They remain on your credit report for up to seven years.

It’s important to review your credit report regularly to identify any derogatory marks and address them promptly. By understanding the types of derogatory marks and their implications, you can take steps to improve your creditworthiness and regain financial stability.

Importance of Checking Derogatory Marks on Credit

Checking for derogatory marks on your credit report is crucial for maintaining a healthy financial profile and ensuring access to future credit opportunities. Here are some reasons why it’s important to regularly monitor your credit for derogatory marks:

- Identify Errors: Mistakes happen, and incorrect information can sometimes find its way onto your credit report. By regularly checking for derogatory marks, you can spot any errors or inaccuracies that may be affecting your credit score. Reporting and resolving these errors promptly can help prevent unnecessary damage to your credit.

- Protect Your Credit Score: Derogatory marks, such as late payments or collections, can significantly impact your credit score. A lower credit score can make it difficult to obtain loans, credit cards, or favorable interest rates. By checking for derogatory marks, you can take steps to address and rectify them, thereby minimizing the negative impact on your credit.

- Prevent Identity Theft: Monitoring your credit report can help you detect any signs of identity theft or fraudulent activity. If you notice unfamiliar accounts or inquiries on your report, it could indicate that someone has used your personal information without your consent. Catching identity theft early allows you to take immediate action to protect your finances and credit.

- Improve Financial Planning: By knowing the derogatory marks on your credit report, you can identify areas where you need to improve your financial habits. If you consistently have late payments, for example, it may be a sign that you need to establish a better budget or payment plan. Monitoring and addressing derogatory marks can help you develop responsible financial habits and plan for a stronger financial future.

- Track your Progress: Regularly checking for derogatory marks allows you to track your progress in repairing your credit. As you take steps to address and resolve negative marks, you can see improvements over time. It’s a motivating way to stay focused on rebuilding your credit and achieving financial goals.

Overall, checking for derogatory marks on your credit report is essential for maintaining good financial health. It helps you catch errors, protect against identity theft, improve your credit score, and track your progress. By being proactive and vigilant, you can take control of your credit and secure a more stable and promising financial future.

Steps to Check Derogatory Marks on Credit

Checking your credit report for derogatory marks is an important part of managing your finances and maintaining a good credit score. Here are the steps you can follow to check for derogatory marks on your credit:

- Method 1: Obtaining a Free Credit Report: Start by obtaining a free copy of your credit report from AnnualCreditReport.com, which provides access to reports from all three major credit bureaus—Equifax, Experian, and TransUnion. You are entitled to a free report from each bureau once every 12 months.

- Method 2: Requesting Credit Reports from Major Credit Bureaus: You can request your credit report directly from each of the major credit bureaus. Visit their websites or contact them by phone to request your report. Remember that each bureau may have slightly different information, so checking reports from all three can provide a comprehensive overview of your credit history.

- Method 3: Utilizing Online Credit Monitoring Services: Many online services offer credit monitoring tools that allow you to check your credit report regularly. These services often provide real-time updates and alerts about any changes or derogatory marks on your credit. Some may require a subscription or fee.

- Method 4: Seeking Assistance from Credit Counseling Agencies: Credit counseling agencies can help you check your credit report for derogatory marks and provide guidance on how to address them. They can also offer insights on debt management and credit repair strategies to improve your financial situation.

- Method 5: Monitoring Credit Card Statements and Monthly Bills: While not a comprehensive credit report, monitoring your credit card statements and monthly bills can help you identify any late payments or collection accounts. Regularly reviewing these statements allows you to address issues promptly, reducing the chances of derogatory marks affecting your credit.

Remember that when checking your credit report, be thorough in reviewing all sections, including personal information, account details, and payment history. Look out for any inaccuracies, unauthorized accounts, or unfamiliar derogatory marks.

If you spot any derogatory marks or errors, take appropriate steps to address them. This may involve contacting the credit bureau to dispute an error, contacting the creditor to negotiate a payment plan, or seeking professional assistance from credit repair agencies or credit attorneys.

By following these steps and staying proactive in monitoring your credit, you can stay well-informed about derogatory marks on your credit report and take necessary action to maintain a healthy credit profile.

Method 1: Obtaining a Free Credit Report

Obtaining a free credit report is an excellent starting point for checking derogatory marks on your credit. The Fair Credit Reporting Act (FCRA) entitles you to one free credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—once every 12 months.

Here’s how you can obtain your free credit report:

- Visit AnnualCreditReport.com: This is the official website authorized by the Federal Trade Commission (FTC) for obtaining your free annual credit report. It is the most reliable and secure way to access your credit report.

- Select “Request Your Free Credit Reports”: On the homepage, you will find a button or link that says “Request Your Free Credit Reports.” Click on it to proceed with the request.

- Fill in Your Personal Information: You will be required to provide personal information such as your name, address, Social Security number, and date of birth. The credit bureaus use this information to verify your identity.

- Choose the Credit Bureaus: Select which credit bureaus you would like to receive your credit reports from. You can select one or all three bureaus.

- Verify Your Request: The website will prompt you to answer some identity verification questions, such as previous address information or mortgage payments. This step helps ensure that only you can access your credit reports.

- Obtain and Review Your Credit Reports: Once your request is verified, you will be able to view and download your credit reports from each selected bureau. Take the time to carefully review each report.

While obtaining your free credit report, carefully examine the sections that detail your personal information, accounts, payment history, and any derogatory marks. Look for any inaccuracies or unfamiliar derogatory marks that should not be on your report.

If you spot any errors or derogatory marks that you believe are incorrect, you have the right to dispute them with the credit bureaus. They are required to investigate the disputed items and make any necessary corrections if the information is indeed inaccurate.

By utilizing this method and obtaining your free credit reports, you can gain valuable insights into your credit history and identify any derogatory marks that may require attention.

Method 2: Requesting Credit Reports from Major Credit Bureaus

In addition to obtaining your free credit report, you can also request credit reports directly from the major credit bureaus: Equifax, Experian, and TransUnion. This method allows you to access your credit reports beyond the once-a-year free report.

Here’s how you can request credit reports from the major credit bureaus:

- Equifax: Visit the Equifax website (equifax.com) and navigate to the “Credit Report Assistance” section. Look for the option to request your credit report. You will be required to provide personal and identifying information to access your report.

- Experian: Go to the Experian website (experian.com) and locate their “Get a Credit Report” section. Follow the instructions to request your credit report. Similarly, you will need to provide personal information and answer security questions to access your report.

- TransUnion: Visit the TransUnion website (transunion.com) and find their “Credit Report Assistance” or “Get Your Credit Report” section. Follow the prompts to request your credit report. As with the other bureaus, you will need to provide personal information for verification purposes.

Each credit bureau’s website will guide you through the process of requesting your credit report. You may be asked to create an account or go through additional identity verification steps to ensure the security of your information.

It’s important to note that credit reports from each bureau may contain slightly different information, as not all creditors report to all three bureaus. By obtaining credit reports from multiple bureaus, you can get a more comprehensive view of your credit history and any derogatory marks that may be present.

Once you receive your credit reports, carefully review each one to identify any derogatory marks or errors. Pay close attention to the sections that detail your personal information, accounts, payment history, and any negative entries. If you spot any inaccuracies or unfamiliar derogatory marks, you can take steps to dispute them or address them directly with the credit bureaus or respective creditors.

Requesting credit reports directly from the major credit bureaus allows you to obtain up-to-date and detailed information about your credit history, making it easier to monitor for derogatory marks and take necessary actions for credit improvement.

Method 3: Utilizing Online Credit Monitoring Services

Another effective way to check for derogatory marks on your credit is by utilizing online credit monitoring services. These services provide you with real-time access to your credit report and can send you alerts whenever there are changes or new derogatory marks on your credit.

Here’s how you can utilize online credit monitoring services:

- Research and Choose a Reliable Service: There are many online credit monitoring services available, so it’s important to do some research and choose a reputable and reliable service. Look for services that offer comprehensive credit monitoring, timely alerts, and easy-to-use interfaces.

- Create an Account: Once you’ve chosen a service, visit their website and create an account. You will typically need to provide some personal and identifying information.

- Link Your Credit Accounts: To effectively monitor your credit, you will need to link your credit accounts to the service. This allows the service to gather information from the credit bureaus and provide you with accurate updates on your credit report.

- Set Up Monitoring and Alerts: Once your accounts are linked, you can set up monitoring preferences and alerts. Customize the settings to receive notifications whenever there are changes or derogatory marks on your credit report. This can include new accounts, late payments, collections, or other negative entries.

- Regularly Review Your Credit Report: Take the time to regularly review your credit report within the monitoring service. This will help you stay informed about any derogatory marks and take prompt action if necessary.

Online credit monitoring services are beneficial because they provide you with continuous access to your credit information. You can easily track changes to your credit report and proactively address any derogatory marks that appear.

It’s important to note that while some credit monitoring services require a subscription or fee, there are also free options available. Free services may offer basic monitoring features, while paid services often provide more comprehensive monitoring and identity theft protection.

By utilizing online credit monitoring services, you can stay vigilant in checking for derogatory marks on your credit report and take immediate action to rectify any potential issues. These services offer convenience and peace of mind, allowing you to stay on top of your credit health.

Method 4: Seeking Assistance from Credit Counseling Agencies

If you need professional guidance in checking derogatory marks on your credit report and addressing them effectively, seeking assistance from credit counseling agencies can be a valuable option. Credit counseling agencies provide expert advice and support to help you navigate the complexities of your credit situation.

Here’s how you can seek assistance from credit counseling agencies:

- Research and Find Reputable Credit Counseling Agencies: Start by researching and identifying reputable credit counseling agencies. Look for agencies that are non-profit, accredited, and have a track record of helping individuals manage their credit effectively.

- Schedule an Appointment: Contact the credit counseling agency you have chosen to schedule an appointment. Many agencies offer free initial consultations to evaluate your financial situation and determine the best course of action.

- Provide Relevant Documentation: During your appointment, be prepared to provide the credit counseling agency with relevant financial documentation, such as your credit reports, bank statements, and any communication from creditors or collection agencies. This information will help the agency assess your situation accurately.

- Discuss Your Credit Situation: Engage in a thorough discussion with the credit counselor about your credit situation and any derogatory marks you may have on your credit report. They will help you understand the impact of these marks and guide you through the necessary steps to address them.

- Receive a Personalized Plan: After evaluating your credit situation, the credit counselor will provide you with a personalized plan to address the derogatory marks on your credit report. This may include strategies for debt repayment, negotiation with creditors, or enrolling in a debt management program.

- Follow the Recommendations: It is crucial to follow the recommendations provided by the credit counseling agency. This may involve making payments on time, negotiating with creditors, or implementing a disciplined financial plan. Stay in regular communication with the agency for ongoing support and guidance.

Working with a credit counseling agency can provide you with expert insights and strategies to effectively address derogatory marks on your credit. They can help you understand your options, negotiate with creditors, and create a practical plan to improve your creditworthiness.

Be cautious when choosing a credit counseling agency and ensure they are reputable and trustworthy. Look for agencies affiliated with reputable organizations such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA).

Remember, credit counseling agencies are there to assist you in managing your credit effectively and improving your financial situation. Utilizing their expertise can help you address derogatory marks on your credit more efficiently and set you on the path towards better financial stability.

Method 5: Monitoring Credit Card Statements and Monthly Bills

Monitoring your credit card statements and monthly bills is a simple yet effective method to check for derogatory marks on your credit. While it may not provide a comprehensive credit report, reviewing these statements allows you to identify any potential issues in a timely manner.

Here’s how you can utilize this method:

- Keep Track of Your Statements: Ensure you receive your credit card statements and monthly bills regularly. This might include credit card statements, utility bills, loan statements, or any other accounts that contribute to your credit history.

- Review Payment History: Carefully review the payment history section of each statement. Check if there are any late payments or missed payments that may lead to derogatory marks on your credit report. Late payments could indicate potential issues that need to be addressed.

- Check for Collections or Legal Notices: Pay attention to any indications of collections or legal notices on your statements. These may appear as settlement offers, notices of delinquency, or mentions of accounts being sent to collections. Such indications can signal derogatory marks or potential credit problems.

- Address Any Issues Promptly: If you notice any discrepancies or potential derogatory marks, take immediate action. Contact the respective creditor to discuss the situation, clarify any misunderstandings, and seek solutions to rectify the issue. Promptly addressing these issues can help prevent them from appearing on your credit report.

- Keep Track of Payment Due Dates: Make sure you are aware of the due dates for each payment. Set reminders or enroll in automatic payments when possible to avoid late payments. By staying on top of your payment schedule, you can prevent derogatory marks resulting from missed or delayed payments.

- Manage Your Finances Responsibly: It’s crucial to practice responsible financial management overall. This includes budgeting, tracking expenses, and living within your means. Responsible financial habits significantly reduce the likelihood of derogatory marks appearing on your credit report.

Monitoring your credit card statements and monthly bills allows you to identify potential issues early on. By promptly addressing any discrepancies, late payments, or collections, you can prevent them from negatively impacting your credit report and score.

Remember to review your statements regularly and thoroughly. Look for any signs of derogatory marks or potential credit problems. If you notice anything unusual or concerning, don’t hesitate to reach out to the respective creditor to gain clarity and resolve the issue proactively.

By incorporating this method into your routine financial management practices, you can take an active role in checking for derogatory marks and maintaining a healthy credit profile.

Additional Tips for Checking and Addressing Derogatory Marks

While the methods mentioned earlier provide effective ways to check and address derogatory marks on your credit report, here are some additional tips to help you navigate the process more efficiently:

- Regularly Check Your Credit: Make it a habit to routinely check your credit report to monitor for any changes or new derogatory marks. Regular monitoring allows you to catch issues early and take immediate action.

- Dispute Inaccurate Information: If you spot any errors or inaccuracies on your credit report, such as incorrect late payments or collections, you have the right to dispute them. Contact the credit bureaus in writing, provide supporting documents, and request an investigation to correct the errors.

- Follow Up with Creditors: If you are working towards resolving derogatory marks, such as paying off a collection account or negotiating a payment plan, ensure to follow up with the creditors. Get confirmation in writing that the derogatory mark will be updated or removed once the agreed-upon action is complete.

- Establish Positive Credit History: While addressing derogatory marks, focus on building positive credit history. Make all payments on time, utilize credit responsibly, and maintain low credit utilization. Over time, positive credit habits will outweigh the impact of derogatory marks.

- Seek Professional Help if Needed: If you’re overwhelmed or unsure about how to address derogatory marks, consider seeking professional help. Credit repair companies or credit attorneys can provide guidance, negotiate with creditors, and help dispute inaccurate information on your behalf.

- Be Patient: Addressing derogatory marks takes time and persistence. Understand that it may take several months or even years for derogatory marks to be removed completely from your credit report. Stay committed to the process and focus on steadily improving your credit.

Remember, improving your credit and addressing derogatory marks is a gradual process. It requires diligence, patience, and responsible financial habits. By staying proactive, understanding your rights, and utilizing the available resources, you can successfully navigate the path towards credit repair and financial stability.

Conclusion

Checking for derogatory marks on your credit report is an important part of maintaining good financial health. These negative marks can have a significant impact on your creditworthiness, making it challenging to access loans, credit cards, or favorable interest rates. By regularly monitoring your credit reports and addressing derogatory marks promptly, you can take control of your credit and work towards improving your financial future.

In this article, we explored various methods to check for derogatory marks on your credit, including obtaining a free credit report, requesting credit reports from major credit bureaus, utilizing online credit monitoring services, seeking assistance from credit counseling agencies, and monitoring your credit card statements and monthly bills. Each of these methods offers valuable insights and options for identifying and addressing derogatory marks effectively.

Remember to carefully review your credit reports, check for any errors or inaccuracies, and take necessary steps to dispute or rectify them. Promptly addressing derogatory marks and practicing responsible financial habits, such as making payments on time and managing your debt responsibly, can help you rebuild your creditworthiness and establish a positive credit history.

Additionally, don’t hesitate to seek professional assistance if needed. Credit counseling agencies, credit repair companies, or credit attorneys can provide expert guidance and support throughout the process. Stay patient, as repairing your credit and addressing derogatory marks is a gradual journey that requires persistence and commitment.

By staying proactive, staying informed, and utilizing the available resources, you can successfully navigate the process of checking and addressing derogatory marks on your credit. Remember, a healthy credit profile opens doors to favorable financial opportunities and helps you secure a stable and promising financial future.