Finance

How To Find No Credit Check Apartments

Modified: January 10, 2024

Looking for no credit check apartments? Learn how to find affordable options without the hassle of credit checks. Finance your next rental with ease.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of no credit check apartments! If you’re someone who has experienced financial difficulties or has a less-than-stellar credit history, finding a suitable place to live can often be a stressful and challenging process. Many landlords and property management companies rely heavily on credit checks as a means of assessing an individual’s financial responsibility and rental eligibility. However, not everyone has a perfect credit score or a lengthy credit history to showcase. This is where no credit check apartments come into the picture.

No credit check apartments provide an alternative solution for individuals who may have a low credit score, no credit history, or previous financial hardships that have impacted their creditworthiness. These types of apartments place less emphasis on credit checks and focus more on other factors such as employment history, income stability, and references from previous landlords. This opens up opportunities for people who would otherwise struggle to secure suitable housing.

While no credit check apartments can offer a lifeline for those in need, it’s essential to have a thorough understanding of how they work, their advantages, disadvantages, and alternatives available in case they don’t meet your needs. In this article, we will delve into the ins and outs of no credit check apartments, providing you with valuable insights and tips to help you navigate this unique housing option.

The Importance of No Credit Check Apartments

No credit check apartments play a crucial role in providing housing opportunities for individuals who may face challenges due to their credit history. They offer a glimmer of hope for those who have been turned away by traditional landlords and rental agencies solely based on their credit scores. Here are some reasons why no credit check apartments are important:

- Equal access to housing: No credit check apartments offer equal access to housing for people with less-than-perfect credit scores or no credit history. This is especially important for individuals who have encountered financial hardships or are starting fresh after bankruptcy or foreclosure.

- Opportunity to rebuild credit: By providing an opportunity to secure housing despite credit challenges, no credit check apartments can be a stepping stone towards rebuilding one’s credit. Timely rent payments and responsible tenancy can help improve creditworthiness over time.

- Empowers individuals with financial difficulties: No credit check apartments empower individuals who may have faced financial setbacks by giving them a chance to secure a stable place to live. This stability can be a crucial factor in regaining financial stability and creating a better future.

- Alternative for people with limited credit history: For individuals who are just starting their independent lives and have limited credit history, no credit check apartments can provide an opportunity to rent a home without having to rely solely on credit scores. This can be particularly beneficial for students or young professionals.

Overall, the significance of no credit check apartments lies in their ability to level the playing field and provide housing options for people who may have been marginalized by traditional rental practices. By offering an alternative approach to evaluating rental eligibility, they give individuals a fair chance to secure a place to call home.

How No Credit Check Apartments Work

No credit check apartments operate differently from traditional rental properties when it comes to evaluating potential tenants’ eligibility. Instead of relying heavily on credit scores, these apartments consider other factors that demonstrate financial stability and rental suitability. Here’s how no credit check apartments typically work:

Income Verification: No credit check apartments often prioritize income verification as a primary criterion for evaluating applicants. They may require proof of a steady source of income, such as pay stubs or employment verification, to ensure that prospective tenants can afford the rent.

References and Rental History: Along with income verification, references from previous landlords and a positive rental history can play a significant role in the application process. No credit check apartments value reliable and responsible tenancy, and positive references can help demonstrate an applicant’s ability to fulfill their rental obligations.

Security Deposits: Like traditional rentals, no credit check apartments generally require a security deposit. This deposit serves as protection for the landlord in case of damages or unpaid rent. The amount of the deposit can vary, but it is typically equal to one or two months’ rent.

Shorter Lease Terms: In some cases, no credit check apartments may offer shorter lease terms compared to traditional rentals. This flexibility can benefit individuals who may need to move or make changes to their living arrangements more frequently.

Higher Rent or Additional Fees: It’s important to note that no credit check apartments may compensate for the higher risk they assume by charging higher rent or additional fees. This helps offset potential financial concerns and ensures that the property remains profitable for the landlord.

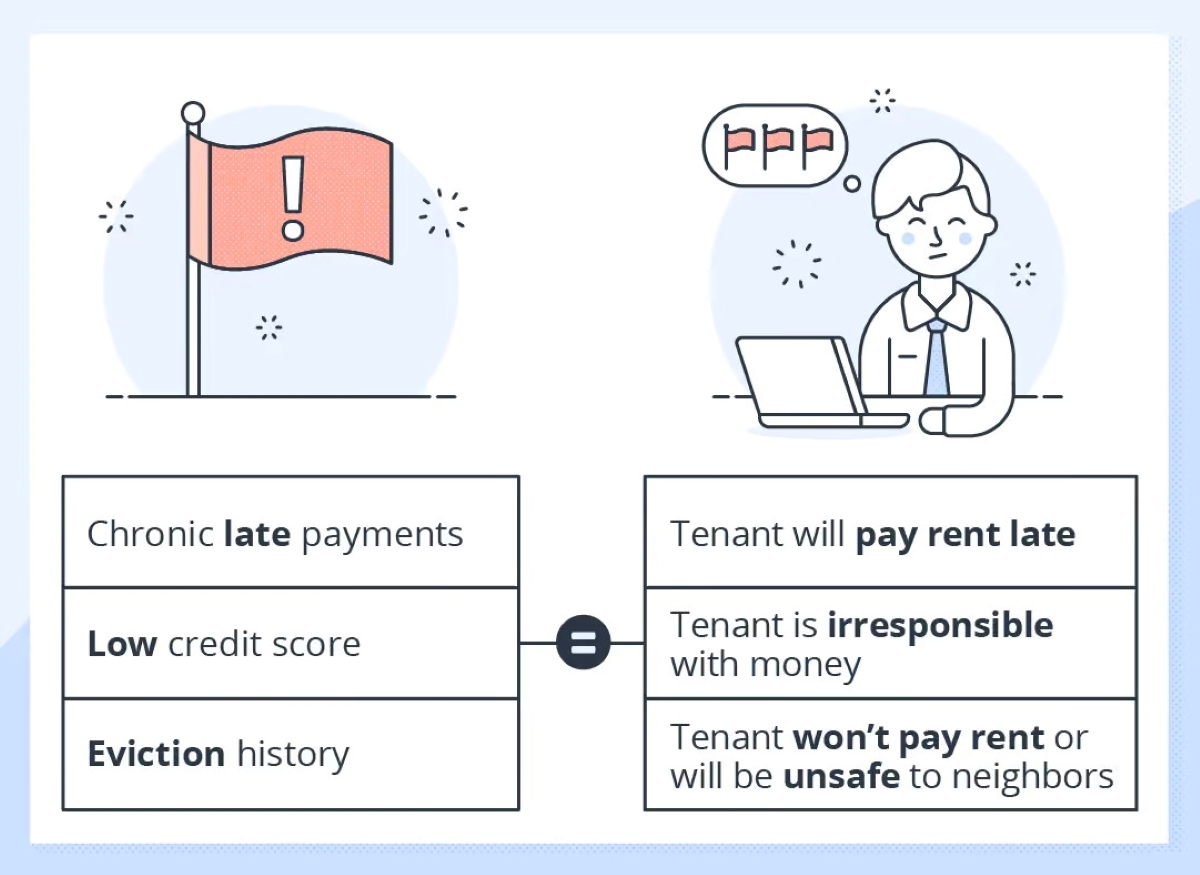

Less Strict Credit Requirements: While no credit check apartments may not perform a formal credit check, they may still review an applicant’s credit report or consider other factors such as outstanding debts or eviction history. However, their evaluation process is typically more lenient compared to traditional rentals.

Overall, the operation of no credit check apartments revolves around alternative evaluation methods and a focus on factors beyond credit scores. By taking a more holistic approach to tenant eligibility, these apartments offer a lifeline to individuals who may have been excluded from the rental market due to their credit history.

Pros and Cons of No Credit Check Apartments

No credit check apartments offer a unique housing option for individuals who may have difficulties due to their credit history. However, like any housing alternative, they come with their own set of advantages and disadvantages. Let’s explore the pros and cons of no credit check apartments:

Pros:

- Accessible housing: No credit check apartments provide housing opportunities for individuals who may have been denied by traditional landlords due to their credit scores or financial history. This accessibility allows them to secure a place to live and avoid potential homelessness.

- Opportunity to rebuild credit: By consistently paying rent on time and demonstrating responsible tenancy, individuals residing in no credit check apartments have the chance to improve their creditworthiness over time. This can open up doors to better housing options in the future.

- Flexibility in application process: No credit check apartments often have a more lenient application process compared to traditional rentals. They consider other factors like income, references, and rental history, giving applicants with imperfect credit scores a fair chance to prove their suitability.

- Potential for shorter lease terms: Some no credit check apartments offer flexible lease terms that cater to individuals who may need temporary or shorter-term housing arrangements. This can be beneficial for students, professionals on short-term assignments, or those in transitional phases of their lives.

Cons:

- Higher rent or additional fees: No credit check apartments may charge higher rent or additional fees to compensate for the increased risk associated with tenants who have credit challenges. This can put a strain on the tenant’s budget and limit their housing options in terms of affordability.

- Limited availability: No credit check apartments may not be as prevalent as traditional rentals, making them less available in certain locations. This limited availability can decrease the chances of finding suitable housing in desired neighborhoods or areas with specific amenities.

- Potential for predatory practices: In some cases, unscrupulous landlords or rental agencies may take advantage of individuals who are desperate for housing and have poor credit. It is important for tenants to be cautious and research the reputation and credibility of the landlord or agency before entering into a rental agreement.

- Restrictions on tenant rights and protections: Depending on the specific regulations in the area, no credit check apartments may not be subject to the same tenant rights and protections as traditional rentals. This can leave tenants vulnerable to unfair practices or inadequate maintenance of the property.

It’s essential to carefully weigh the pros and cons of no credit check apartments before making a decision. Consider your unique situation, budget, and long-term housing goals to determine if this alternative housing option aligns with your needs.

Tips for Finding No Credit Check Apartments

Searching for no credit check apartments may require a different approach than looking for traditional rentals. Here are some helpful tips to assist you in finding and securing a suitable no credit check apartment:

- Expand your search: Look beyond the usual rental listings and websites. Explore local classified ads, community bulletin boards, social media groups, and word-of-mouth recommendations. Some smaller, independent landlords may not advertise extensively online.

- Network and ask for referrals: Reach out to friends, family, co-workers, or social service organizations for recommendations or connections to landlords who offer no credit check apartments. Personal referrals can often lead to hidden gems in the rental market.

- Check with local housing authorities: Contact your local housing authority or city government to inquire about affordable housing options and programs that do not require credit checks. They may have resources or be able to provide you with information on landlords who offer no credit check apartments.

- Prepare necessary documentation: Gather all the necessary documentation to demonstrate your income stability and rental history. This may include recent pay stubs, bank statements, employment verification letters, and references from previous landlords. Having these documents ready will expedite the application process.

- Consider alternative renting arrangements: Expand your search to include other housing options such as sublets, rooms for rent, or shared housing situations. These arrangements may have less strict credit requirements and could offer a temporary solution while you work on improving your creditworthiness.

- Have a co-signer: If you have someone with a good credit history and stable income willing to vouch for you, consider having them co-sign the lease. This provides additional reassurance to landlords and increases your chances of being approved for a no credit check apartment.

- Be honest and communicate: When contacting potential landlords or property managers, be upfront about your credit situation. Explain any extenuating circumstances that may have affected your credit and highlight your efforts to rectify your financial situation. Building trust through open and honest communication can make a positive impression.

- Perform due diligence: Before committing to a no credit check apartment, thoroughly research the landlord or company. Look for reviews, online presence, and any potential red flags. Verify that they are reputable and have a history of fair and reliable practices.

Remember, finding a no credit check apartment may require persistence and patience, but with the right approach and preparation, you can increase your chances of finding a suitable and affordable place to call home.

Alternative Housing Options for People with No Credit

While no credit check apartments can be a viable option for individuals with credit challenges, there are alternative housing options to consider as well. These alternatives may provide different benefits and accommodate varying needs. Here are some housing options for people with no credit:

- Roommates: Sharing a rental space with roommates can help alleviate the credit requirement hurdle. By splitting the rent and expenses, individuals can find more affordable housing options, regardless of their credit history.

- Sublet or Temporary Rentals: Subletting or renting on a temporary basis can be a flexible option for those with no credit. Many individuals who are traveling or have extra space in their homes are willing to sublet or rent short-term without rigorous credit checks.

- Housing Assistance Programs: Local and federal housing assistance programs provide opportunities for those in need of affordable housing. These programs often have specific eligibility criteria that focus on income and family size, rather than credit scores.

- Non-profit Organizations: There are non-profit organizations that specialize in housing assistance for individuals with credit challenges or low-income individuals and families. These organizations can offer resources, support, and guidance in finding suitable housing options.

- Rent-to-Own Contracts: Rent-to-own contracts allow individuals to rent a property with the option to purchase it in the future. This arrangement can provide stability and an opportunity to build credit while working towards homeownership.

- Private Landlords: Some private landlords may be more flexible in their rental criteria and willing to rent to individuals without extensive credit history. Building a rapport with potential landlords and demonstrating financial responsibility and stability can increase the chances of being approved.

- Co-living spaces: Co-living spaces, such as co-housing or intentional communities, provide a unique housing option where individuals share common spaces and resources. These arrangements often have more lenient credit requirements and foster a sense of community.

It’s important to research and evaluate these alternative housing options to determine which one aligns best with your needs, budget, and long-term goals. By exploring these alternatives, you can find a suitable housing solution while working towards improving your creditworthiness.

Conclusion

Securing suitable housing can be a daunting task for individuals with credit challenges, but no credit check apartments provide a glimmer of hope and a pathway to stable housing. These unique housing options prioritize factors such as income stability, rental history, and references, offering a way for individuals to find a place to call home regardless of their credit scores.

No credit check apartments play a vital role in providing equal access to housing and empowering individuals who may have faced financial difficulties. They offer an opportunity to rebuild credit, demonstrate responsible tenancy, and create a better financial future. However, it’s important to consider both the pros and cons before committing to this type of housing. Higher rent, limited availability, and potential predatory practices should be carefully evaluated.

If no credit check apartments are not the right fit, there are alternative housing options available, including shared rentals, temporary rentals, housing assistance programs, rent-to-own contracts, and non-profit organizations that specialize in providing housing support. Exploring these alternatives can provide additional options for individuals with no credit or a less-than-perfect credit history.

In conclusion, finding housing with credit challenges may require a different approach and a level of persistence. By expanding your search, networking, being prepared with necessary documentation, and communicating openly with prospective landlords, you can increase your chances of finding suitable housing. Remember to perform due diligence to ensure the credibility of landlords or rental agencies.

While the journey may be challenging, with determination and the right approach, individuals with credit challenges can find a place they can call home and work towards a brighter future.