Finance

Deficiency Balance Definition

Published: November 9, 2023

Learn the definition of deficiency balance in finance and understand how it affects your financial situation. Gain insights on managing and resolving deficiency balances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Deficiency Balance: A Key to Financial Stability

When it comes to managing your finances effectively, having a solid understanding of key terms and concepts is vital. One such concept that is often misunderstood is the deficiency balance. If you’re wondering what a deficiency balance is and how it can affect your financial situation, you’ve come to the right place. In this blog post, we will dive into the world of deficiency balances, explaining what they are, why they matter, and how to navigate them.

Key Takeaways:

- A deficiency balance occurs when the proceeds from the sale of an asset are not enough to cover the outstanding debt.

- Understanding deficiency balances can help you make informed decisions if you find yourself in a situation where you owe more than the value of your assets.

So, What Exactly is a Deficiency Balance?

A deficiency balance arises when the amount generated from the sale of a repossessed asset, such as a home or a vehicle, falls short of the outstanding debt. In simpler terms, it’s the difference between what you owe and what your asset is worth at the time of repossession or foreclosure.

Imagine you purchased a car using a loan, and due to unexpected circumstances, you can no longer afford the monthly payments. In a unfortunate situation where your car gets repossessed, the lender will sell it to recover their funds. However, if the sale proceeds are less than the remaining balance on your loan, you will be left with a deficiency balance – an additional debt to fulfill.

Why Understanding Deficiency Balances Matters

Having a clear grasp of deficiency balances is crucial for several reasons:

- Legal Implications: In some cases, lenders might pursue legal action to collect the deficiency balance. Understanding the potential legal consequences can help you assess your options and take appropriate steps to protect your financial well-being.

- Credit Score Impact: Defaulting on a loan and owing a deficiency balance can negatively impact your credit score. Knowing how this can affect your financial standing can help you take proactive measures to minimize the damage.

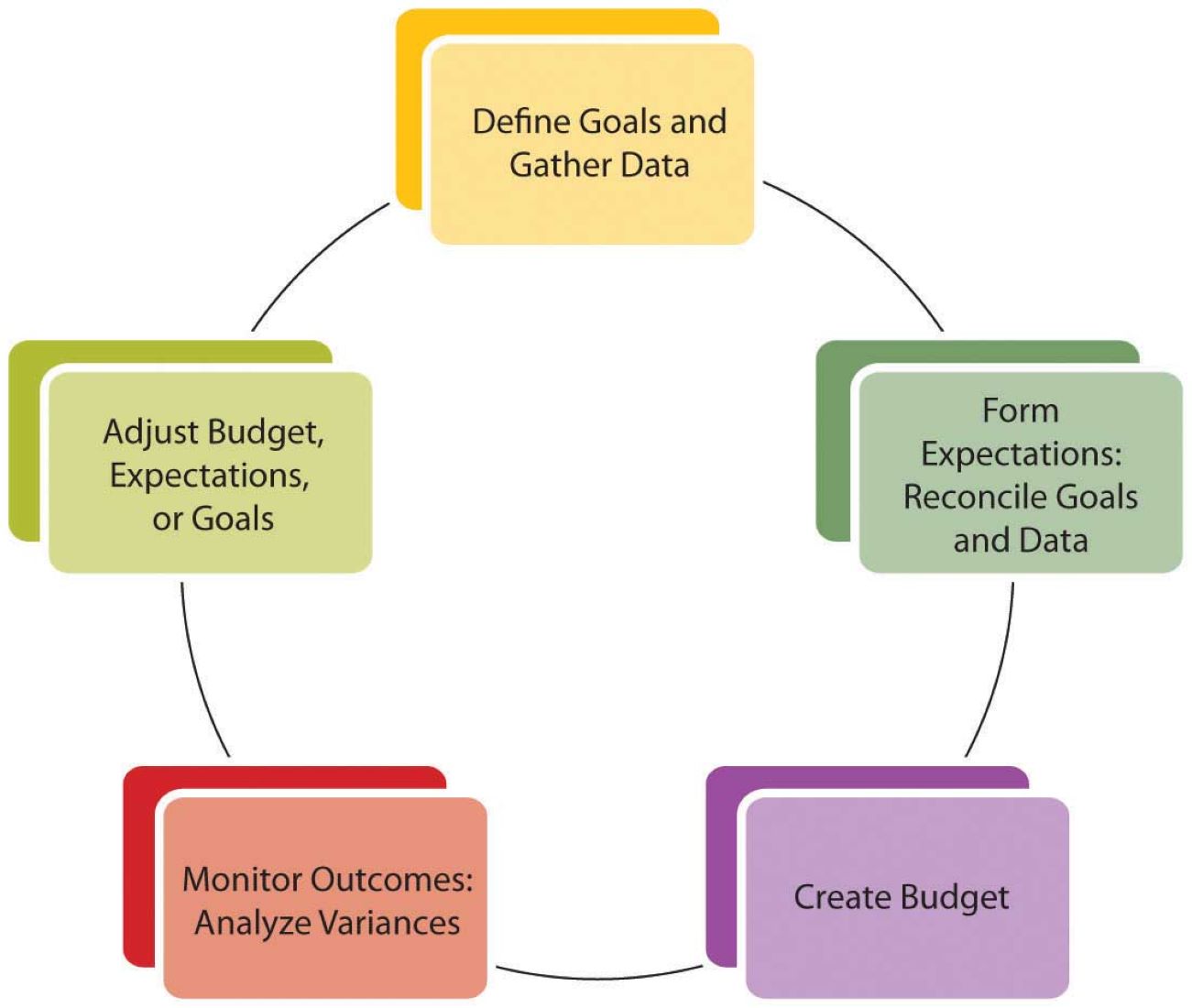

- Financial Planning: Being aware of potential deficiency balances can help you plan your finances accordingly. By factoring in the possibility of a deficiency balance, you can prepare for potential repayment obligations and explore strategies to mitigate its impact.

Now that you understand the significance of deficiency balances, let’s discuss a few steps you can take to navigate this situation effectively:

Steps to Navigate a Deficiency Balance

- Review Documentation: Carefully review the loan documentation, including terms and conditions, to understand your rights and obligations in case of a deficiency balance.

- Seek Professional Guidance: Consider consulting a financial advisor or an attorney specializing in debt resolution to explore your options and understand the best course of action for your specific situation.

- Explore Negotiation: Reach out to the lender and try to negotiate a payment plan or settlement that works for both parties. Sometimes, lenders are willing to work with borrowers to find a mutually beneficial solution.

- Consider Bankruptcy: In extreme cases, bankruptcy may be an option to discharge or restructure your debts, including deficiency balances. However, this should be carefully evaluated with the help of a professional.

Conclusion

While it’s always advisable to stay on top of your financial obligations and avoid deficiency balances, unforeseen circumstances can arise. Understanding what a deficiency balance is, and how it can impact your financial stability is crucial in navigating such situations effectively. By educating yourself, seeking professional guidance, and exploring available options, you can work towards finding a solution that helps you move forward and regain control over your finances.