Finance

How Much Will A Car Loan Drop My Credit Score

Published: October 22, 2023

Finance your car loan wisely to minimize the impact on your credit score. Learn how much a car loan can lower your credit score and ways to mitigate it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to financing a new car, many people overlook the potential impact it can have on their credit score. A common question that arises is, “How much will a car loan drop my credit score?” Understanding the relationship between car loans and credit scores is important for anyone considering taking on this type of debt.

First, let’s clarify what a credit score is. Your credit score is a three-digit number that reflects your creditworthiness and helps lenders determine your risk level as a borrower. It is based on various factors, including your payment history, debt levels, credit mix, length of credit history, and recent credit inquiries.

When you apply for a car loan, the lender will typically check your credit history to assess your creditworthiness. This credit inquiry can have a small, temporary impact on your credit score. However, the bigger impact on your credit score comes from how you manage the car loan once you have it.

Car loans, like any other installment loan, carry both benefits and risks for your credit score. On one hand, making timely, consistent payments on your car loan can have a positive impact on your credit score. However, if you fail to make payments on time or default on the loan, it can significantly harm your credit score.

In this article, we will explore the potential effects of a car loan on your credit score. We will discuss the factors that can contribute to a decrease in your credit score when you take on a car loan and how you can manage your auto loan to minimize any negative impact. Additionally, we will provide guidance on how to rebuild your credit after a car loan to ensure a healthy credit profile.

Understanding Credit Scores

Before delving into the impact of car loans on credit scores, it’s important to have a basic understanding of how credit scores are calculated. Credit scores are generated by credit reporting agencies, such as Equifax, Experian, and TransUnion, using certain algorithms and models. The most common credit scoring model is the FICO score, developed by the Fair Isaac Corporation.

FICO scores range from 300 to 850, with a higher score indicating a better creditworthiness. The factors that determine your credit score include:

- Payment History: This accounts for approximately 35% of your credit score and looks at whether you have made your payments on time in the past.

- Amounts Owed: This factor considers the amount of debt you currently have and accounts for about 30% of your credit score.

- Length of Credit History: The length of time you have been using credit makes up around 15% of your credit score.

- New Credit: Opening new credit accounts, such as a car loan, can impact about 10% of your credit score.

- Credit Mix: The types of credit you have, such as credit cards, mortgages, or student loans, contribute to approximately 10% of your credit score.

Each credit reporting agency may use slightly different methods and calculations to determine credit scores, but they generally take these five factors into account.

While a car loan falls under the “new credit” category, it’s crucial to understand that the impact on your credit score is not solely determined by the act of taking on a car loan. Instead, the way you manage the loan and your payment history will play a significant role in shaping your credit score.

Now that we have a solid understanding of credit scores, let’s explore how car loans can affect these scores in the next section.

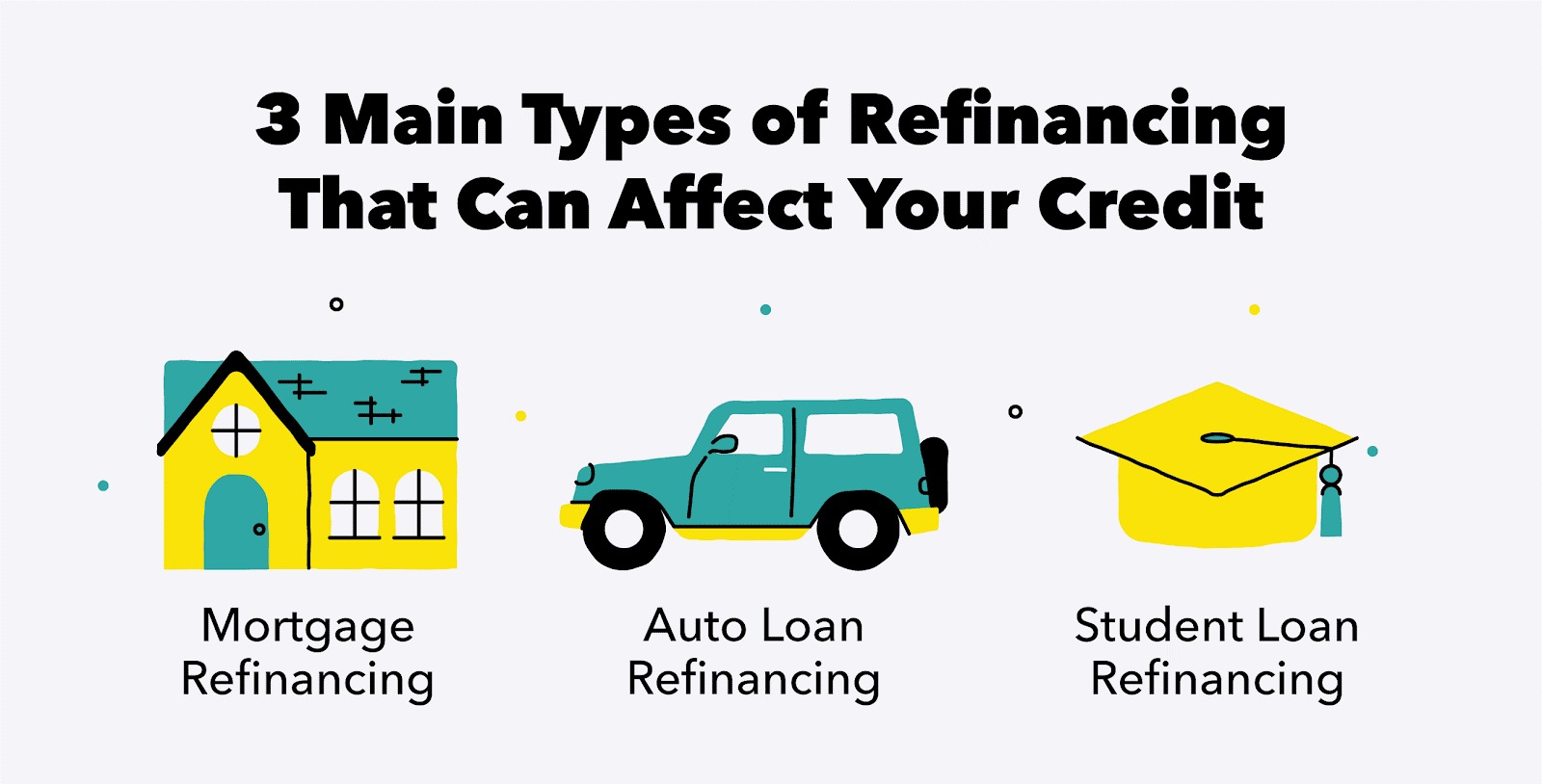

Impact of Car Loans on Credit Scores

When you take on a car loan, it can have both positive and negative impacts on your credit score, depending on how you manage the loan. Let’s explore the potential effects in more detail.

1. Credit Inquiry: When you apply for a car loan, the lender will perform a credit inquiry to assess your creditworthiness. This inquiry is known as a “hard inquiry” and can have a small, temporary negative impact on your credit score. Typically, this impact is minimal and lasts for a short period of time. It’s important to note that multiple inquiries within a short period of time, such as shopping around for the best loan rates, are treated as a single inquiry to minimize any negative impact.

2. Payment History: One of the most significant factors in determining your credit score is your payment history. Making timely payments on your car loan can have a positive impact on your credit score. Each on-time payment strengthens your payment history, showcasing your responsible borrowing behavior and improving your creditworthiness. Conversely, missing payments or making late payments can significantly harm your credit score.

3. Debt-to-Income Ratio: Taking on a car loan increases your overall debt, which can affect your debt-to-income ratio. Your debt-to-income ratio is the percentage of your monthly income that goes towards paying off debt. If you have too much debt in relation to your income, it can negatively impact your credit score. However, as long as you can afford the monthly payments and manage your debt responsibly, your credit score should not be significantly affected.

4. Length of Credit History: The length of time you have been using credit is an important factor in determining your credit score. Opening a new car loan account may initially have a small negative impact on this aspect of your credit score. However, as you continue to make on-time payments and the loan ages, it can contribute positively to the length of your credit history.

5. Credit Mix: Having a diverse mix of credit accounts, such as credit cards, student loans, and a car loan, can positively impact your credit score. By adding a car loan to your credit mix, you demonstrate your ability to manage different types of credit responsibly. This can help improve your creditworthiness in the eyes of lenders.

It’s important to remember that the impact of a car loan on your credit score will vary depending on your individual circumstances and how you manage the loan. Consistently making on-time payments, keeping your debt levels manageable, and being responsible with your overall credit usage are key factors in minimizing any potential negative impact on your credit score.

Factors Affecting Credit Score Decrease

While taking on a car loan can impact your credit score, the decrease in your score will depend on several factors. It’s important to understand these factors to effectively manage your credit and minimize any negative impact. Here are some key factors that can contribute to a credit score decrease when you have a car loan:

- Payment History: Late or missed payments on your car loan can significantly lower your credit score. It’s crucial to make all your loan payments on time to maintain a positive payment history.

- Loan Default: If you default on your car loan, meaning you fail to make payments for an extended period, it will severely harm your credit score. Lenders may repossess the vehicle, and the loan will be marked as a default on your credit report.

- High Credit Utilization: Car loans add to your overall debt, which affects your credit utilization ratio. If you have high levels of debt in relation to your available credit, it can lower your credit score. Strive to keep your credit utilization ratio below 30% to maintain a good credit score.

- Multiple Credit Inquiries: Each time you apply for a car loan, it results in a hard inquiry on your credit report. While one or two inquiries may have a minimal impact, having multiple inquiries within a short period of time can lower your credit score. It’s advisable to limit the number of loan applications and try to consolidate them within a short timeframe.

- New Credit Accounts: Taking on a car loan adds a new credit account to your credit profile. This new account can initially lower your credit score, as it reduces the average age of your credit history. However, with responsible management and on-time payments, it can contribute positively to your credit score in the long run.

It’s important to note that the exact impact of these factors will vary depending on the individual’s credit history and overall credit profile. Some individuals may experience a more significant decrease in their credit score due to these factors, while others may see a minimal impact.

To minimize the negative impact on your credit score, it’s crucial to make on-time payments, keep your credit utilization low, limit the number of credit inquiries, and practice responsible credit management. By doing so, you can maintain a healthy credit score while enjoying the benefits of car ownership.

The Importance of On-Time Payments

When it comes to managing a car loan and maintaining a healthy credit score, one of the most crucial factors is making on-time payments. On-time payments have a significant impact on your credit score and can shape your creditworthiness in the eyes of lenders. Here are several reasons why on-time payments are essential:

- Credit Score Impact: Payment history is a major component of your credit score, comprising approximately 35% of the calculation. Making payments on time demonstrates responsible financial behavior and contributes positively to your credit score. Conversely, late or missed payments can result in a significant decrease in your credit score.

- Financial Discipline: Consistently making on-time payments requires financial discipline and effective budgeting. By developing the habit of making timely payments, you establish a strong foundation for your overall financial health.

- Reduced Interest Costs: Late payments can result in additional fees and interest charges, increasing the overall cost of your car loan. By making on-time payments, you avoid unnecessary expenses and save money in the long run.

- Lender Relationship: Building a positive relationship with your lender is important for future credit opportunities. On-time payments demonstrate your reliability as a borrower and can pave the way for better loan terms and conditions in the future.

- Long-Term Creditworthiness: Your payment history stays on your credit report for several years, impacting your creditworthiness and future borrowing opportunities. A history of on-time payments enhances your reputation as a responsible borrower, making it easier to secure loans and obtain favorable interest rates in the future.

To ensure your payments are made on time, consider setting up reminders or automating payments through your bank or the lender’s online portal. By taking proactive steps, you can stay on track and avoid any late payment issues.

If you find yourself facing financial difficulties that make it challenging to make on-time payments, it’s crucial to communicate with your lender. They may be willing to work with you to find a suitable solution, such as adjusting your payment schedule or exploring alternative payment options.

Remember, maintaining a good credit score requires consistent effort and responsible financial behavior. By making on-time payments, you demonstrate your commitment to honoring your financial obligations, which can lead to increased financial opportunities in the future.

Managing Multiple Auto Loans and Credit Scores

Managing multiple auto loans can be a complex task, but it is possible to do so while maintaining and even improving your credit scores. Here are some key strategies to help you effectively manage multiple auto loans:

- Plan and Budget: Before taking on multiple auto loans, carefully assess your financial situation and create a comprehensive budget. Understand how much you can comfortably afford in terms of monthly payments, taking into consideration your other financial obligations. Planning and budgeting will help you avoid overextending yourself financially.

- Maintain a Good Payment History: Timely payments are crucial for every loan you have, including multiple auto loans. Make sure to prioritize your payments and ensure that all installments are paid on time. A consistent history of on-time payments will positively impact your credit scores for each of the auto loans.

- Monitor Your Credit Utilization: Having multiple auto loans can impact your credit utilization ratio, which is the amount of credit you are using compared to the total credit available to you. It’s important to keep your overall credit utilization low by diligently managing your debts across all loans. Avoid taking on excessive additional debt that could negatively affect your credit scores.

- Stay Organized: Managing multiple auto loans requires staying organized and keeping track of payment due dates, loan balances, and other important details. Utilize organizational tools such as spreadsheets or financial management apps to stay on top of your loan obligations and avoid missing any payments.

- Communicate with Lenders: If you encounter any financial difficulties or anticipate challenges in making payments for any of your auto loans, proactively communicate with the lenders involved. They may be willing to work with you to find a suitable solution, such as modifying payment terms or creating a repayment plan that fits your current financial situation.

- Consider Loan Consolidation: If managing multiple auto loans becomes overwhelming, it may be worth exploring loan consolidation options. Consolidating your loans into a single loan can simplify your payment process, potentially lower your interest rate, and make it easier to manage your overall debt.

Remember, successfully managing multiple auto loans requires careful planning, disciplined financial habits, and open communication with your lenders. By staying organized, making timely payments, and being proactive in managing your debt, you can navigate the challenges of multiple auto loans while maintaining and improving your credit scores.

Rebuilding Credit After a Car Loan

Rebuilding credit after a car loan can be a gradual process, but with patience and diligence, you can restore your creditworthiness. Here are some steps you can take to rebuild your credit:

- Review Your Credit Report: Start by obtaining a copy of your credit report from each of the major credit reporting agencies. Review the report carefully, checking for any errors or discrepancies that may be negatively impacting your credit score. Dispute any inaccuracies you find to ensure your credit report is accurate and up to date.

- Make On-Time Payments: Consistently making on-time payments is crucial for rebuilding credit. If you had any late or missed payments during your car loan, focus on making timely payments for all your current debts, including credit cards, student loans, and other installment loans. Over time, your payment history will improve, positively impacting your credit score.

- Pay Down Debt: Reduce your overall debt burden by paying down your outstanding balances. Focus on high-interest debts first, such as credit cards, to lower your credit utilization ratio and improve your credit score. Prioritize paying off debts with the highest interest rates while making the minimum payments on other debts.

- Diversify Your Credit Mix: Having a healthy mix of different types of credit can improve your credit score. If you don’t have other credit accounts besides your car loan, consider opening a secured credit card or a small personal loan to demonstrate responsible credit management. Make sure to use credit sparingly and make timely payments on these new accounts.

- Limit New Credit Inquiries: Avoid applying for multiple new credit accounts within a short period of time, as each application results in a hard inquiry on your credit report. A high number of inquiries can lower your credit score. Only apply for credit when necessary and try to consolidate your applications within a condensed timeframe to minimize the impact on your credit score.

- Monitor Your Progress: Regularly check your credit score and monitor the changes as you rebuild your credit. This allows you to track your progress and see the effects of your efforts. There are numerous resources available, both paid and free, that offer credit monitoring services and tools to help you understand and improve your credit.

Rebuilding credit takes time, as positive changes in credit behavior gradually outweigh any negative history. Be patient and consistent in implementing these strategies, and over time, you will see an improvement in your credit score. Remember, building good credit habits is a long-term commitment that requires discipline and responsible financial behavior.

Conclusion

Financing a car through a loan can have a significant impact on your credit score. While taking on a car loan may initially result in a minor decrease in your credit score due to factors like credit inquiries, the way you manage the loan and make payments will ultimately determine the long-term impact on your creditworthiness. On-time payments are crucial for maintaining a good credit score and demonstrating responsible financial behavior.

Factors such as payment history, debt-to-income ratio, length of credit history, credit mix, and new credit all play a role in the impact of a car loan on your credit score. It is important to maintain a positive payment history, avoid defaulting on the loan, and keep your debt levels manageable. By doing so, you can minimize any negative impact on your credit score and even strengthen it over time.

If you find yourself managing multiple auto loans, it’s essential to plan, budget, and stay organized to ensure you make timely payments and avoid excessive debt. This will help you maintain a good credit utilization ratio and build a positive relationship with lenders.

If you’ve had a car loan and experienced a decrease in your credit score, don’t despair. Rebuilding credit is possible by reviewing your credit report, making on-time payments, paying down debt, diversifying your credit mix, and monitoring your progress. It’s a gradual process that requires patience, discipline, and responsible financial habits.

In conclusion, understanding the impact of car loans on credit scores and actively managing your debts and payments are vital steps to maintain and improve your creditworthiness. By taking a proactive approach to financial management, you can navigate the world of car loans while protecting and enhancing your credit score for a bright financial future.