Home>Finance>Double Top: Definition, Patterns, And Use In Trading

Finance

Double Top: Definition, Patterns, And Use In Trading

Published: November 14, 2023

Discover the meaning of a double top pattern in finance, its significance in trading strategies, and how to identify and utilize it for profitable investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Double Top: Definition, Patterns, and Use in Trading

Welcome to our finance blog, where we provide valuable insights and information on various aspects of the financial markets. Today, we are diving into the fascinating world of technical analysis with a focus on a popular chart pattern called the Double Top. If you’ve ever wondered what a Double Top is, how to identify it, and how to use it in your trading strategy, you’ve come to the right place. Let’s explore this pattern and its significance in the world of trading.

Key Takeaways:

- A Double Top is a bearish reversal chart pattern that signals a potential trend reversal from an uptrend to a downtrend.

- To identify a Double Top, look for two peaks that reach a similar price level, separated by a low in between.

Understanding the Double Top Pattern

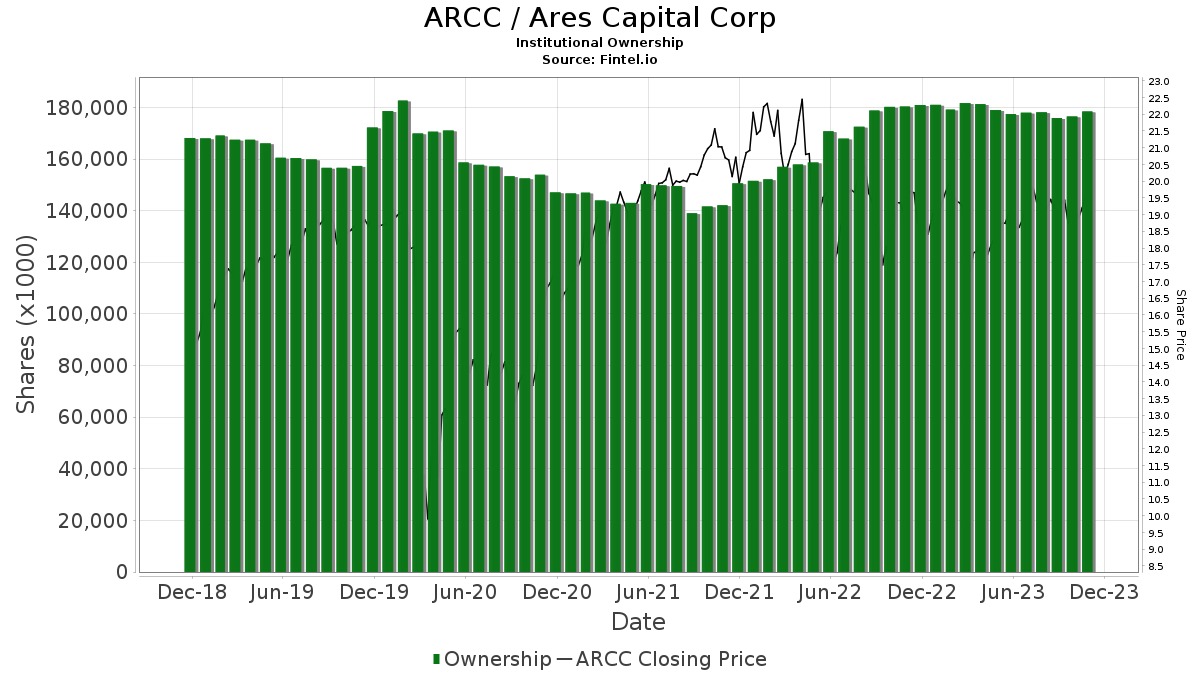

The Double Top pattern is one of the most well-known and widely recognized chart patterns used by traders to predict trend reversals. As the name suggests, it consists of two price peaks that resemble the shape of the letter “M.” This pattern forms after an extended uptrend, indicating that buying pressure is weakening, and sellers might be gaining control of the market.

To identify a Double Top, look for the following characteristics:

- The first peak (or shoulder) represents the end of the previous uptrend.

- The subsequent decline creates a support level known as the neckline.

- The second peak (or head) reaches a similar price level as the first peak, but fails to surpass it.

- Once the price breaks below the neckline, it confirms the Double Top pattern and signals a potential trend reversal.

The psychology behind the Double Top pattern is crucial in understanding its significance. The first peak represents the last push from the buyers, leading to an exhaustion of buying pressure. The subsequent decline indicates a shift in sentiment, as sellers start to dominate the market. The failed attempt to break past the first peak further reinforces the bearish sentiment, leading to a breakdown below the neckline.

How to Use the Double Top Pattern in Trading

Now that we have a good understanding of the Double Top pattern, let’s explore how traders can utilize this pattern to make informed trading decisions.

1. Confirmation: Once the price breaks below the neckline, it is crucial to wait for confirmation before taking any trading actions. This confirmation can be in the form of a bearish candlestick pattern, increased volume, or a subsequent decline in price.

2. Entry and Stop-Loss: Traders typically set their entry levels slightly below the neckline or wait for a retest of the broken neckline as resistance. It is important to place a stop-loss order above the second peak to manage risk effectively.

3. Target and Take-Profit: To determine the target price, measure the distance from the peak to the neckline and subtract it from the breakout point. This provides an estimation of the potential price decline. Alternatively, traders can use other technical analysis tools, such as Fibonacci retracements or support levels, to identify suitable target levels.

It’s essential to remember that no trading strategy is foolproof, and the Double Top pattern is no exception. Traders should always use risk management techniques, conduct thorough analysis, and consider other factors such as market conditions, fundamental news, and timeframes when making trading decisions.

The Power of the Double Top Pattern

The Double Top pattern is an excellent tool for traders to identify potential trend reversals and capture downside price movements. By understanding its formation, characteristics, and incorporating it into their trading strategies, traders can gain an edge in the markets. However, like any pattern, it is essential to combine it with other technical analysis tools and market indicators for comprehensive analysis.

In conclusion, the Double Top pattern is a powerful tool within the realm of technical analysis and can help traders make informed trading decisions. By recognizing its formation, understanding its significance, and implementing it strategically, traders can navigate the financial markets with increased confidence.

Thank you for reading our blog post on the Double Top pattern. We hope you found it informative and interesting. Please stay tuned for more valuable insights and information on finance and trading!