Home>Finance>Equity Capital Market (ECM) Definition, How It Works, Types

Finance

Equity Capital Market (ECM) Definition, How It Works, Types

Published: November 18, 2023

Learn about equity capital market (ECM) in finance - its definition, how it works, and different types. Gain insights into this crucial aspect of financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Equity Capital Market (ECM): Definition, How It Works, Types

Welcome to our FINANCE category blog post, where we delve into the fascinating world of equity capital markets (ECM). In this post, we will explore the definition of ECM, how it works, and the different types of ECM. So, whether you are an investor, entrepreneur, or simply curious about the financial world, this article is for you!

Key Takeaways:

- Equity capital market (ECM) refers to the market where shares of companies are bought and sold.

- ECM allows companies to raise capital by selling shares to investors in exchange for ownership in the company.

What is Equity Capital Market (ECM)?

The equity capital market (ECM) is a vital component of the financial world, serving as a platform where shares of companies are bought and sold. In simpler terms, it is the place where companies raise capital by selling ownership shares to investors. The capital raised through ECM enables companies to finance their operations, expand their businesses, invest in new projects, or pay off existing debts.

The ECM offers an efficient way for companies to attract investment and grow their operations. By offering shares to the public, companies effectively distribute ownership and align the interests of shareholders with the success of the business. This can lead to increased liquidity, improved access to capital, and potential growth opportunities.

How Does Equity Capital Market (ECM) Work?

The workings of the equity capital market vary depending on the specific type of ECM. However, in general, the process involves the following steps:

- Listings: Companies interested in raising capital through ECM need to list their shares on a stock exchange. This involves fulfilling regulatory requirements and meeting specific criteria set by the exchange.

- Public Offering: To attract investors, companies often undertake an initial public offering (IPO). During an IPO, a portion of the company’s shares is sold to the public for the first time. This process enables the company to raise significant capital and establish a public market for its shares.

- Secondary Offerings: After the IPO, companies may choose to issue additional shares through secondary offerings. These offerings can take the form of a rights issue, where existing shareholders have the right to purchase a proportional amount of new shares, or a follow-on offering, which allows new investors to participate.

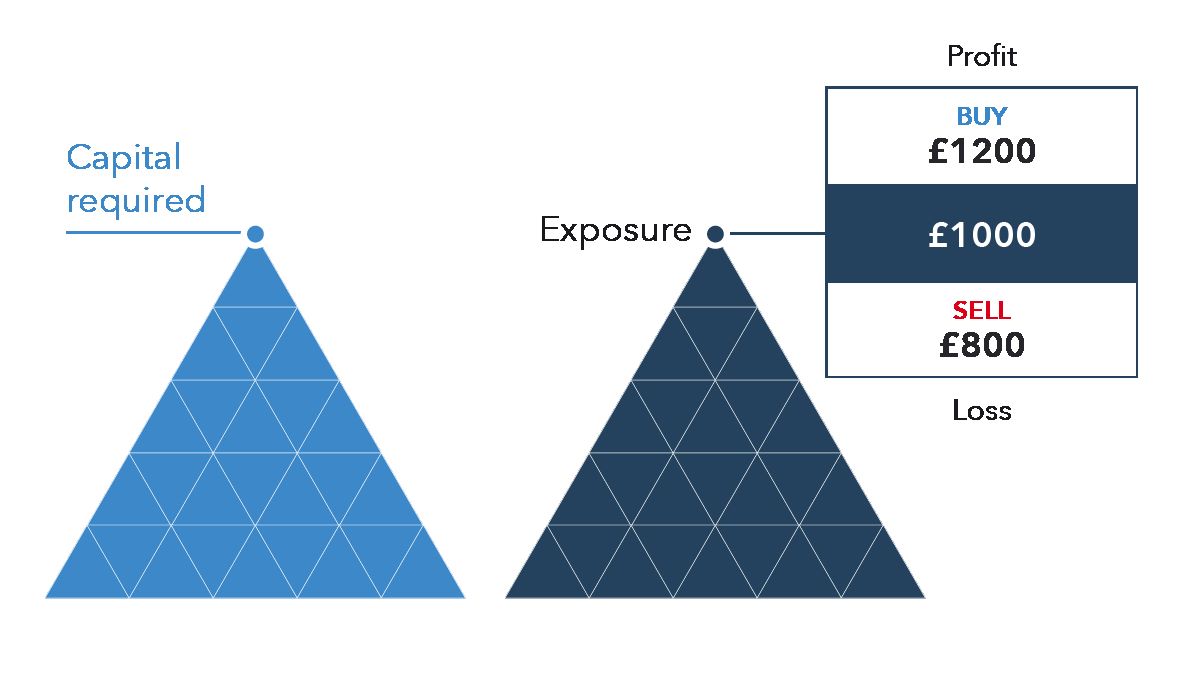

- Investor Participation: Investors participate in the ECM by purchasing shares issued by the company. They can do so through stockbrokers, online trading platforms, or other authorized intermediaries.

- Trading: Once the shares are listed and traded on the stock exchange, investors can buy and sell them freely. Prices are determined by market demand and supply, as well as the company’s performance and other factors.

Types of Equity Capital Market (ECM)

The ECM encompasses various types, each catering to specific needs and characteristics of companies. Here are some common types of ECM:

- Primary Market: This is where companies raise capital through an IPO or direct listing, providing investors with the opportunity to purchase shares directly from the company.

- Secondary Market: Also known as the stock market, the secondary market is where investors trade shares among themselves, without the involvement of the issuing company. It provides liquidity to existing shareholders and allows investors to enter or exit their positions.

- Private Placement: In some cases, companies may choose to raise capital through private placements instead of going public. Private placements involve selling shares to a select group of investors, such as institutional investors or private equity firms.

- Pre-IPO Market: Before a company goes public, there may be a pre-IPO market where shares are traded privately among investors. This market enables early investors, employees, or other stakeholders to realize some value from their investments before the IPO.

- International Equities: The equity capital market is not limited to a single country. Companies can cross-list their shares on multiple stock exchanges, allowing access to a broader base of investors and potential capital.

Understanding the workings and types of the equity capital market is essential for anyone looking to invest in shares or entrepreneurs seeking capital for their ventures. By leveraging the ECM effectively, companies can achieve their financial goals, while investors gain opportunities to grow their wealth.

We hope this article sheds light on the world of equity capital markets and provides valuable insights into this exciting realm of finance.

For more finance-related content, make sure to explore our other blog posts in the FINANCE category!