Home>Finance>What Does Outstanding Balance Mean On Credit Card

Finance

What Does Outstanding Balance Mean On Credit Card

Modified: December 29, 2023

Understanding the Concept: Find out the meaning of outstanding balance on credit cards and how it impacts your finances. Discover important insights on finance management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Having a credit card has become a common financial tool for many individuals and businesses. It allows for convenient payments and provides an opportunity to build credit. However, it is important to understand various aspects of credit card usage to avoid any potential pitfalls. One crucial concept to grasp is the outstanding balance on a credit card.

The outstanding balance refers to the amount you owe to the credit card issuer at a given time. It represents the total sum of all the purchases, cash advances, and balance transfers that you have made using your credit card, minus any payments or credits applied to your account. Understanding your outstanding balance is essential for managing your finances effectively, avoiding debt, and avoiding costly interest charges.

This article provides a comprehensive overview of what an outstanding balance is, how it is calculated, and its impact on your credit score. We will also explore strategies to help you effectively manage and reduce your outstanding balance, allowing you to maintain control of your financial well-being.

Definition of Outstanding Balance

The outstanding balance on a credit card refers to the total amount you owe to the credit card issuer at a specific point in time. It is the cumulative balance of all your purchases, cash advances, and balance transfers, minus any payments or credits that have been applied to your account.

Think of your outstanding balance as a snapshot of your current debt on the credit card. It includes both the principal amount borrowed and any accrued interest charges or fees. This balance is typically displayed on your monthly credit card statement, indicating the amount that needs to be paid by the due date to avoid late fees and interest charges.

It is important to note that the outstanding balance may fluctuate from month to month depending on your spending habits, payments made, and any new activity on your credit card. Therefore, it is crucial to regularly check your credit card statements and understand the components of your outstanding balance in order to stay on top of your financial obligations.

Importance of Understanding Outstanding Balance

Understanding your outstanding balance is crucial for maintaining control of your finances and avoiding unnecessary debt. Here are some key reasons why it is important to have a clear understanding of your credit card’s outstanding balance:

- Budgeting: By knowing your outstanding balance, you can accurately budget your expenses and ensure that you don’t spend beyond your means. It serves as a reminder of the amount you owe and allows you to plan your future spending accordingly.

- Interest Charges: The outstanding balance directly affects the amount of interest charged on your credit card. By closely monitoring your outstanding balance and making timely payments, you can minimize the interest charges and save money in the long run.

- Payment Deadlines: Being aware of your outstanding balance helps you meet payment deadlines. Missing payments can result in late fees, increased interest rates, and negative impacts on your credit score. Knowing your balance enables you to make timely payments and avoid penalties.

- Credit Utilization Ratio: The outstanding balance plays a significant role in determining your credit utilization ratio, which is the percentage of your available credit that you are currently using. Having a high balance relative to your credit limit can negatively impact your credit score. Monitoring your outstanding balance allows you to keep your credit utilization ratio in check.

- Financial Planning: Understanding your outstanding balance allows you to plan for your financial future. It helps you make informed decisions regarding large purchases, saving strategies, and debt management. By being aware of your balance, you can create a roadmap towards achieving your financial goals.

Overall, having a clear understanding of your outstanding balance empowers you to make responsible financial choices, avoid debt traps, and maintain a healthy credit profile. It allows you to stay in control of your credit card usage and maintain a strong financial foundation.

How Outstanding Balance is Calculated

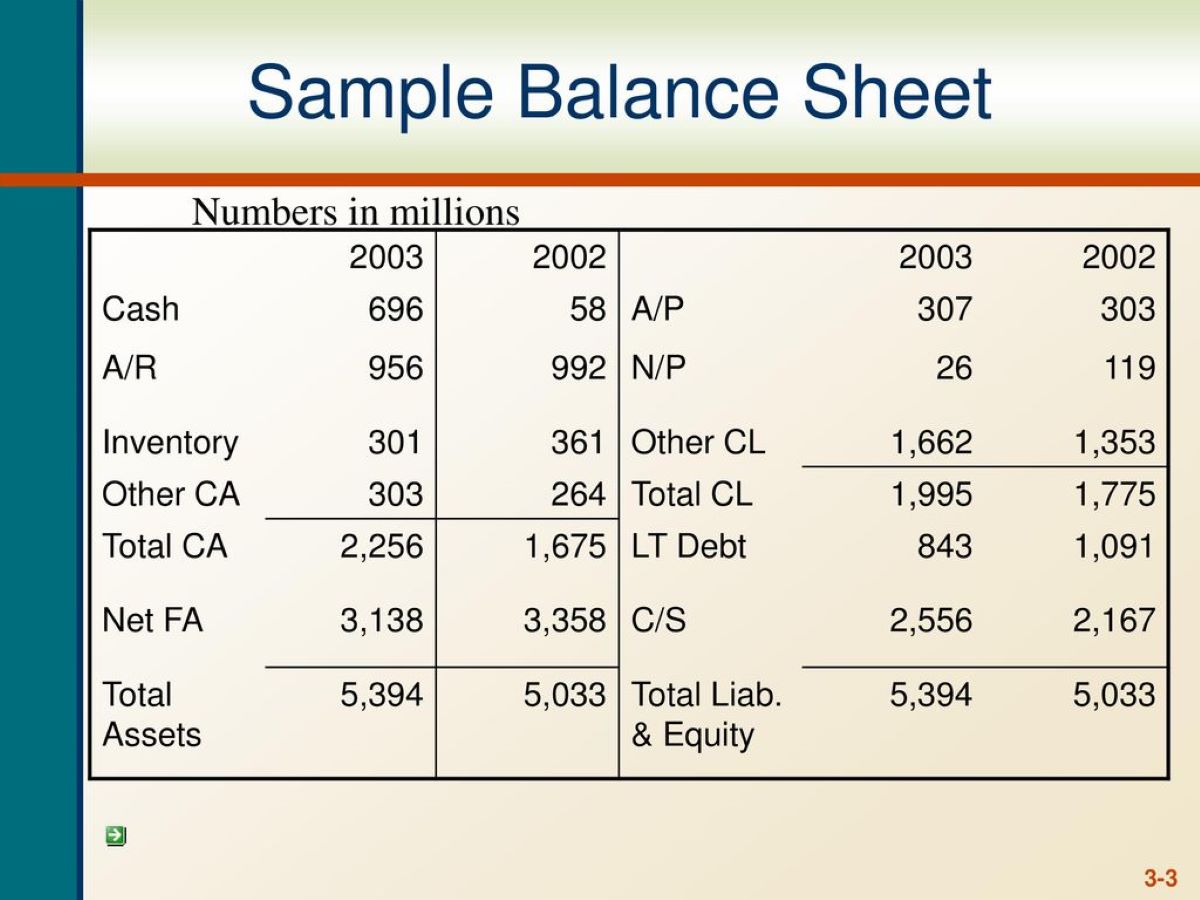

The calculation of the outstanding balance on a credit card involves considering various factors. To better understand how it is calculated, let’s break down the components:

- Purchases: Your outstanding balance includes the total amount of purchases you have made using your credit card. This includes payments for goods, services, and online transactions. The total purchase amount is added to your outstanding balance.

- Cash Advances: If you have taken out a cash advance using your credit card, that amount is also added to your outstanding balance. Cash advances typically have higher interest rates and may attract additional fees, so it is important to be cautious when using this feature.

- Balance Transfers: If you have transferred a balance from another credit card to your current credit card, the transferred amount is included in your outstanding balance. Balance transfers may have promotional interest rates for a limited period, but any unpaid transferred balance will accumulate interest over time.

- Payments and Credits: Payments made towards your credit card balance and any credit applied to your account, such as refunds or cashback rewards, are subtracted from your outstanding balance. These help reduce the overall amount you owe.

- Interest Charges: If you carry an outstanding balance on your credit card, you will likely incur interest charges. The interest rate is determined by the credit card issuer and is typically calculated based on the average daily balance. This means that interest accumulates on the outstanding balance from the date of the purchase until the payment is made in full.

- Fees: Some credit card transactions may be subject to additional fees, such as annual fees, late payment fees, or cash advance fees. These fees are added to your outstanding balance and must be paid in addition to the principal amount owed.

To calculate your current outstanding balance, you simply subtract any payments and credits from the total of your purchases, cash advances, balance transfers, interest charges, and fees. The resulting amount represents the balance that you still owe to the credit card issuer.

It is important to note that the outstanding balance can change over time due to new transactions, interest charges, fees, and payments. Regularly reviewing your credit card statements and keeping track of your outstanding balance is essential for effective financial management and avoiding debt accumulation.

Factors That Affect Outstanding Balance

Several factors can influence the outstanding balance on your credit card. Understanding these factors is crucial for managing your finances effectively. Here are some key elements that can impact your outstanding balance:

- Spending Habits: Your spending habits directly impact your outstanding balance. If you frequently make large purchases or use your credit card for everyday expenses, your outstanding balance will increase accordingly. It is important to be mindful of your spending and ensure that it aligns with your budget and financial goals.

- Interest Rates: The interest rate on your credit card determines the amount of interest that will accrue on your outstanding balance. Higher interest rates will result in more significant interest charges, increasing the total amount you owe. It is wise to carefully consider the interest rates when choosing a credit card and aim to pay off the outstanding balance in full each month to avoid excessive interest charges.

- Payment Patterns: The consistency and frequency of your payments can impact your outstanding balance. Making minimum payments or paying late can lead to higher interest charges and a longer time to pay off your balance. On the other hand, making larger payments or paying off the balance in full can help reduce your outstanding balance more quickly.

- Rewards and Incentives: Some credit cards offer rewards programs that provide cashback, points, or other incentives on purchases. These rewards can be applied as credits to your account, effectively reducing your outstanding balance. Taking advantage of such programs can help lower your overall balance and save money.

- Cash Advances: Taking out cash advances from your credit card can significantly impact your outstanding balance. Cash advances often come with higher interest rates and may not have a grace period, meaning interest starts accruing immediately. It is advisable to avoid cash advances whenever possible to minimize their impact on your outstanding balance.

- Balance Transfers: Transferring a balance from one credit card to another can affect your outstanding balance. While balance transfers can provide temporary relief from high interest rates, it is essential to monitor the terms and interest rates associated with the transfer. Unpaid transferred balances will accumulate interest over time, potentially increasing your outstanding balance.

Understanding the factors that influence your outstanding balance allows you to make informed decisions about your credit card usage and manage your finances effectively. By carefully considering these factors, you can take control of your outstanding balance and work towards building a healthy financial future.

Managing Outstanding Balance

Managing your outstanding balance is crucial for maintaining control of your finances and avoiding unnecessary debt. Here are some effective strategies to help you manage your outstanding balance:

- Create a Budget: Establish a monthly budget that outlines your income and expenses. Allocate a specific amount towards credit card payments and ensure that it aligns with your outstanding balance. By sticking to your budget, you can avoid overspending and effectively manage your outstanding balance.

- Pay on Time: Make it a priority to pay your credit card bill on time to avoid late fees and potential increases in interest rates. Set up automatic payments or reminders to help ensure you never miss a payment. Timely payments also contribute positively to your credit score.

- Pay More Than the Minimum Due: Whenever possible, pay more than the minimum amount due on your credit card statement. By paying more than the minimum, you can reduce the outstanding balance more quickly and minimize the interest charges you’ll incur.

- Avoid Unnecessary Purchases: Limit discretionary spending and avoid making unnecessary purchases using your credit card. Focus on essential expenses and prioritize paying off your outstanding balance. Consider using cash or a debit card for non-essential expenses to avoid accumulating further credit card debt.

- Utilize Balance Transfer Offers: If you have a high outstanding balance on a credit card with a high-interest rate, consider transferring the balance to a card with a lower interest rate. However, be mindful of any transfer fees and the terms and duration of the promotional interest rate.

- Seek Professional Advice: If your outstanding balance feels overwhelming or unmanageable, consider seeking help from a financial advisor or credit counseling agency. They can provide guidance, help you develop a repayment plan, and negotiate with creditors on your behalf.

- Monitor Your Statements: Regularly review your credit card statements to keep track of your outstanding balance and identify any inaccuracies or fraudulent charges. This allows you to address issues promptly and maintain control over your finances.

By implementing these strategies, you can effectively manage your outstanding balance and work towards reducing your credit card debt. Remember, responsible credit card usage and proactive financial management are key to maintaining a healthy financial future.

Impact of Outstanding Balance on Credit Score

Your outstanding balance has a significant impact on your credit score. Credit scoring models, such as FICO and VantageScore, consider several factors when calculating your credit score, and your outstanding balance is one of them. Here’s how your outstanding balance can affect your credit score:

- Credit Utilization Ratio: The outstanding balance on your credit card is a key factor in determining your credit utilization ratio. This ratio is the percentage of your available credit that you are currently using. A high outstanding balance can lead to a high credit utilization ratio, which can negatively impact your credit score. It is generally recommended to keep your credit utilization ratio below 30% to maintain a healthy credit score.

- Payment History: Your outstanding balance is closely tied to your payment history. Timely payments contribute positively to your credit score, while late or missed payments can have a detrimental effect. By managing your outstanding balance and making consistent on-time payments, you can build a positive payment history, which is crucial for a healthy credit score.

- Credit Mix: Your credit mix refers to the variety of credit accounts you have, including credit cards, loans, and mortgages. While your outstanding balance on credit cards alone does not impact your credit mix directly, it is important to manage your total outstanding debt across different types of credit. Lenders typically prefer to see a well-balanced credit mix to assess your creditworthiness.

- Credit History Length: The length of your credit history is another factor that affects your credit score. Your outstanding balance is considered within the context of your credit history. Maintaining a low outstanding balance over an extended period demonstrates responsible credit management and can have a positive impact on your credit score.

- New Credit Applications: When you apply for new credit, lenders assess your outstanding debt as part of the decision-making process. A high outstanding balance might make lenders skeptical about extending additional credit, as it indicates a higher level of debt burden. Therefore, managing your outstanding balance is crucial when applying for new credit to increase your chances of approval.

It is important to note that while your outstanding balance has a significant impact on your credit score, it is not the sole determining factor. Other elements, such as your credit history, payment history, and overall financial health, also play a significant role. By managing your outstanding balance responsibly and making timely payments, you can positively influence your credit score and contribute to a strong credit profile.

Strategies to Reduce Outstanding Balance

Reducing your outstanding balance is an important step towards financial stability and debt management. Here are some effective strategies to help you pay down your credit card balance:

- Create a Repayment Plan: Start by assessing your outstanding balance and creating a realistic repayment plan. Determine how much you can afford to pay each month and set a goal for when you want to pay off the balance completely. Prioritize making consistent payments towards your outstanding balance to gradually reduce the amount owed.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum payment required on your credit card. By paying only the minimum, you may end up paying a significant amount in interest charges. Aim to pay as much as you can afford above the minimum to expedite the reduction of your outstanding balance.

- Use the Snowball or Avalanche Method: There are two popular methods for debt repayment known as the snowball and avalanche methods. With the snowball method, you focus on paying off the smallest outstanding balance first while making minimum payments on other accounts. Once the smallest balance is cleared, you move on to the next one. The avalanche method prioritizes paying off debts with the highest interest rates first. Choose the method that aligns best with your financial goals and preferences.

- Lower Your Interest Rate: Contact your credit card issuer to inquire about options for reducing your interest rate. If you have a good payment history, they may be willing to lower your rate, which can help you pay off your outstanding balance more quickly by reducing the amount of interest you need to pay.

- Control Spending: Evaluate your spending habits and identify areas where you can cut back. Minimize non-essential expenses and redirect those funds towards paying down your outstanding balance. Consider implementing a budget and tracking your expenses to gain better control over your spending.

- Utilize Windfalls and Extra Income: If you receive unexpected windfalls such as bonuses, tax refunds, or cash gifts, consider using those funds to make a significant payment towards your outstanding balance. Similarly, any extra income you earn can be allocated towards paying down your debt more aggressively.

- Transfer Balance to Lower Interest Rate Card: Explore the option of transferring your outstanding balance to a credit card with a lower interest rate or a promotional 0% APR. This can provide temporary relief from high interest charges, allowing you to focus on paying off the principal amount more quickly. However, be aware of any balance transfer fees and the duration of the promotional rate.

Remember, reducing your outstanding balance requires discipline and consistent effort. Stick to your repayment plan, avoid incurring new debts, and be patient with your progress. Over time, by implementing these strategies, you can successfully reduce your outstanding balance and achieve financial freedom.

Conclusion

Understanding and effectively managing your outstanding balance on a credit card is essential for maintaining control of your finances and avoiding unnecessary debt. By having a clear understanding of what an outstanding balance is, how it is calculated, and the factors that influence it, you can make informed decisions about your credit card usage.

Having a high outstanding balance can negatively impact your credit score, increase the amount of interest you pay, and hinder your financial well-being. However, by implementing strategies like creating a repayment plan, paying more than the minimum, and controlling your spending, you can effectively reduce your outstanding balance and improve your financial situation.

Remember to regularly monitor your credit card statements, make timely payments, and seek professional advice if needed. Building good financial habits and managing your outstanding balance responsibly can lead to a healthier credit profile, lower debt burden, and greater financial freedom.

Take control of your outstanding balance today and pave the way for a brighter financial future.