Home>Finance>Exchange-Traded Derivative: Definition, Examples, Vs. OTC

Finance

Exchange-Traded Derivative: Definition, Examples, Vs. OTC

Published: November 20, 2023

Looking to understand finance? Learn all about exchange-traded derivatives: definition, examples, and how they differ from over-the-counter derivatives.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Exchange-Traded Derivatives: Definition, Examples, Vs. OTC

When it comes to navigating the world of finance, understanding the different types of derivative instruments is crucial. One such type is exchange-traded derivatives. In this article, we will delve into the definition of exchange-traded derivatives, explore some examples, and highlight the differences between exchange-traded derivatives and over-the-counter (OTC) derivatives.

Key Takeaways:

- Exchange-traded derivatives are financial contracts that are traded on regulated exchanges.

- Examples of exchange-traded derivatives include futures contracts, options, and exchange-traded funds (ETFs).

What are Exchange-Traded Derivatives?

Exchange-traded derivatives are financial contracts that are traded on regulated exchanges. These derivatives derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. The value of these contracts fluctuates based on the price movements of the underlying asset.

Exchange-traded derivatives offer investors a way to speculate on the future price movements of the underlying asset or to hedge against potential losses. These contracts are standardized and tradeable, making them highly liquid and easily accessible to investors.

Examples of Exchange-Traded Derivatives

There are several types of exchange-traded derivatives, each serving a different purpose in the financial markets. Here are some examples:

- Futures contracts: These are agreements to buy or sell an asset at a predetermined price and date in the future. Futures contracts are commonly used to speculate on the price movements of commodities, such as oil or gold.

- Options: Options give investors the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period. They are commonly used for hedging or to take advantage of potential price fluctuations.

- Exchange-traded funds (ETFs): ETFs are investment funds that trade on stock exchanges, allowing investors to gain exposure to a diversified portfolio of assets. These funds can track various underlying assets, such as stocks, bonds, or commodities.

Exchange-Traded Derivatives Vs. OTC Derivatives

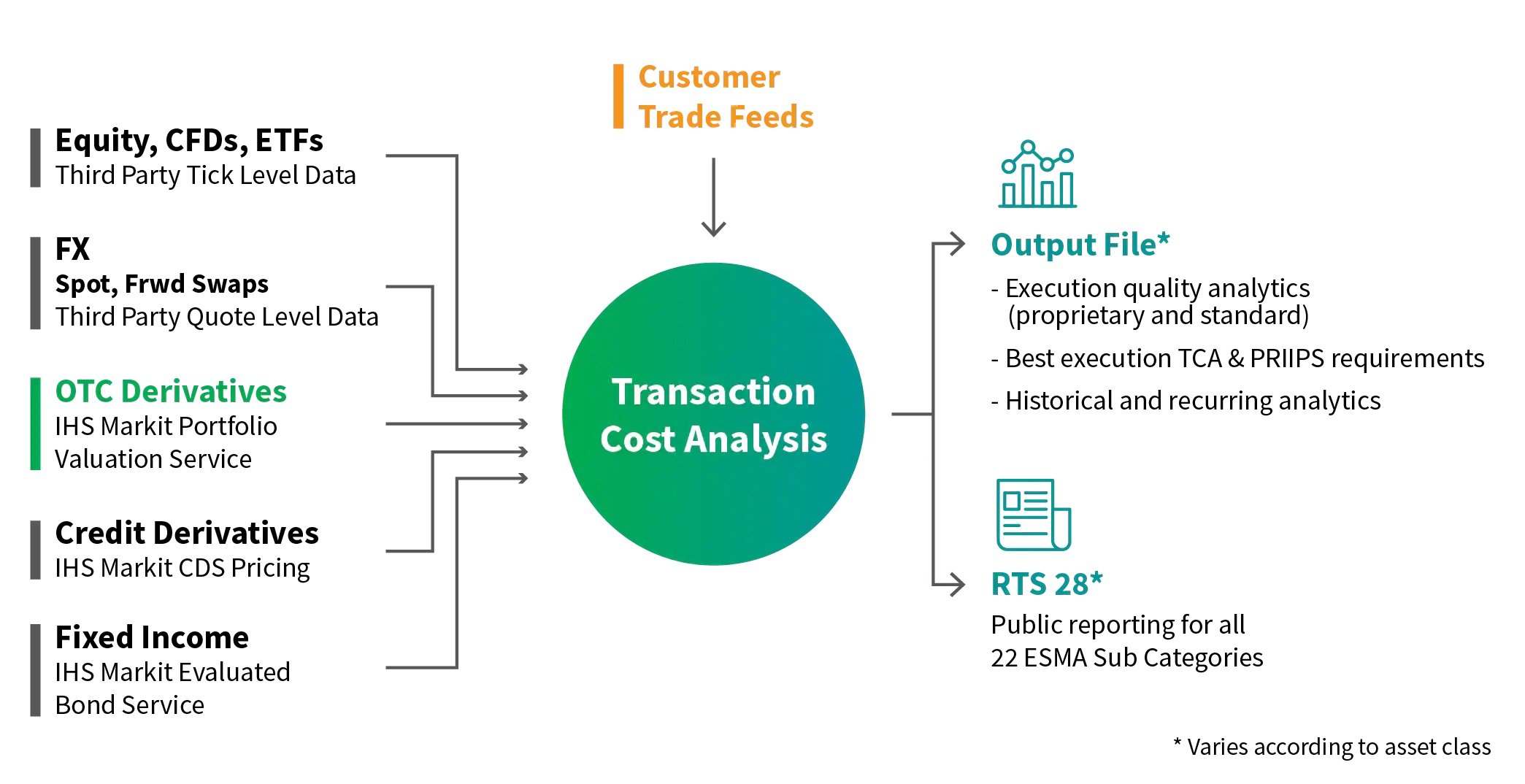

While exchange-traded derivatives are traded on regulated exchanges, over-the-counter (OTC) derivatives are privately negotiated contracts between two parties. Here are some key differences between the two:

- Standardization: Exchange-traded derivatives are standardized contracts with predetermined terms and conditions, making them easier to trade. OTC derivatives, on the other hand, are customized contracts tailored to the specific needs of the parties involved.

- Liquidity: Exchange-traded derivatives are highly liquid, as they can be bought and sold on regulated exchanges. OTC derivatives, in contrast, may lack liquidity as they typically involve a smaller number of participants.

- Counterparty risk: In exchange-traded derivatives, the exchange acts as the counterparty to all trades, reducing counterparty risk. OTC derivatives expose parties to counterparty risk, as they are directly dependent on the creditworthiness of the other party.

In conclusion, exchange-traded derivatives play a significant role in the global financial markets. They offer investors the opportunity to speculate on price movements, hedge against risk, and diversify their portfolios. Understanding the distinction between exchange-traded derivatives and OTC derivatives is essential for any investor looking to navigate the derivatives market.