Finance

How To Trade Derivatives

Published: October 6, 2023

Learn how to trade derivatives in the finance industry and make profitable investments with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Derivatives

- Types of Derivatives

- Benefits and Risks of Trading Derivatives

- Getting Started with Derivative Trading

- Choosing a Derivative Trading Platform

- Understanding Market Indicators for Derivative Trading

- Analyzing and Evaluating Derivative Contracts

- Developing Derivative Trading Strategies

- Risk Management in Derivative Trading

- Monitoring and Adjusting Derivative Positions

- Conclusion

Introduction

Welcome to the exciting world of derivative trading! In today’s ever-evolving financial landscape, trading derivatives offers investors and traders a unique opportunity to profit from price movements in various financial markets. Whether you’re an experienced trader or a novice looking to explore new avenues for investment, understanding derivatives and how to trade them can significantly enhance your portfolio.

Derivatives are financial instruments that derive their value from an underlying asset or benchmark. These assets can include stocks, bonds, commodities, currencies, or even interest rates. Derivatives provide investors with the ability to speculate on price movements, hedge against potential losses, or gain exposure to assets they wouldn’t otherwise be able to access.

Derivative trading is a popular choice for individuals looking to diversify their investment strategies and potentially generate significant returns. However, it’s important to proceed with caution as derivatives can be complex and carry inherent risks. This article will provide you with a comprehensive overview of derivative trading, including the various types of derivatives, the benefits and risks involved, and practical tips to get started in this dynamic market.

Before diving into the world of derivative trading, it’s important to educate yourself on the fundamentals. Understanding the mechanics of derivatives and how they function is essential for making informed trading decisions. Additionally, familiarizing yourself with the different types of derivatives available will help you identify which ones align with your investment goals and risk appetite.

Throughout this article, we will explore the benefits and risks associated with derivative trading, as well as the steps you can take to mitigate potential losses. We will also discuss the importance of choosing a reliable derivative trading platform, analyzing market indicators, and developing effective trading strategies.

Remember, derivative trading is a dynamic and ever-changing market. It requires continuous learning and adaptation to stay ahead. So, buckle up and get ready to embark on an exciting journey into the world of derivative trading!

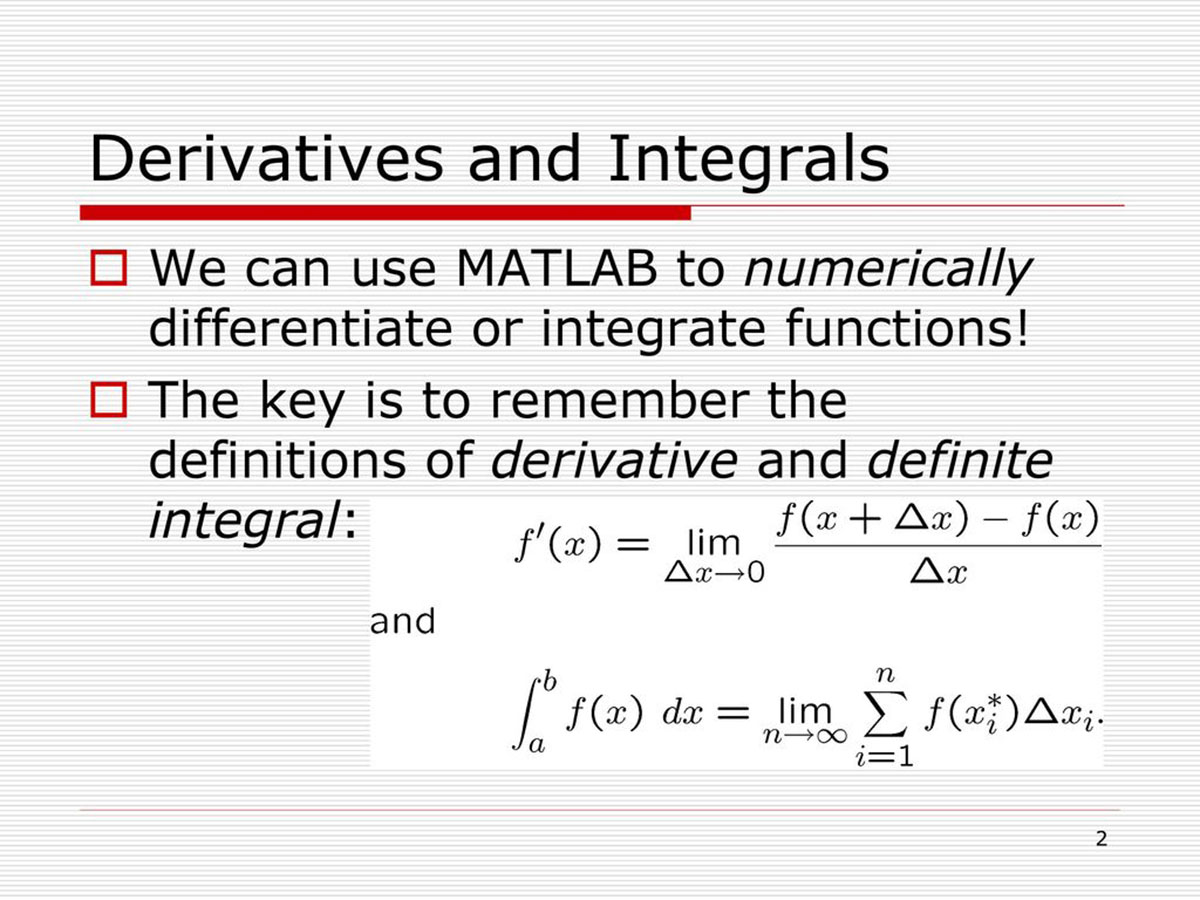

Understanding Derivatives

Derivatives are financial instruments that derive their value from an underlying asset or benchmark. They act as a contract between two parties, where the value of the derivative is determined by fluctuations in the price or value of the underlying asset. This underlying asset can be anything from stocks, bonds, commodities, currencies, or interest rates.

There are three main types of derivatives: futures contracts, options contracts, and swaps. Let’s take a closer look at each of these:

- Futures contracts: A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price and specified date in the future. It provides traders with the opportunity to speculate on the future price movements of the underlying asset. Parties involved in a futures contract are obligated to fulfill the terms of the contract, regardless of whether the price of the asset has moved in their favor or not.

- Options contracts: An options contract gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. This allows investors to hedge against potential losses or profit from favorable price movements without committing to the actual ownership of the underlying asset. There are two types of options: call options, which give the holder the right to buy, and put options, which give the holder the right to sell.

- Swaps: Swaps are agreements between two parties to exchange financial instruments or cash flows. They are often used to manage risks and hedge against interest rate or currency fluctuations. The most common types of swaps are interest rate swaps and currency swaps.

Derivatives serve various purposes in the financial markets. They can be used for speculation, hedging, arbitrage, or to gain exposure to assets that an investor wouldn’t otherwise have access to. Derivative trading allows investors to leverage their capital and potentially amplify their returns. However, it’s important to note that derivatives also carry inherent risks, especially due to the leverage they provide.

Derivatives are traded on various exchanges and over-the-counter (OTC) markets. The liquidity and availability of derivatives can vary depending on the type of derivative and the underlying asset being traded. Investors can access derivatives through brokerage accounts or derivative trading platforms.

Understanding the mechanics of derivatives is crucial before engaging in derivative trading. It’s essential to have a solid grasp of how the underlying asset’s price movements will impact the derivative’s value. Additionally, analyzing market trends and conducting thorough research are essential to make informed trading decisions.

In the next sections, we will explore the benefits and risks of trading derivatives, as well as the steps to get started and develop effective trading strategies.

Types of Derivatives

Derivatives encompass a wide range of financial instruments, each with its own unique characteristics and trading mechanisms. Here are some of the most commonly traded types of derivatives:

- Stock Options: Stock options are contracts that give the holder the right to buy (call option) or sell (put option) a specific number of shares of a particular stock at a predetermined price (strike price) within a specified period. Stock options provide investors with flexibility and can be used for speculation or hedging purposes.

- Futures Contracts: Futures contracts are agreements to buy or sell an asset (such as commodities, currencies, or indices) at a predetermined price and date in the future. They are standardized contracts traded on organized exchanges. Futures contracts allow traders to speculate on the price movements of underlying assets without requiring the full value of the asset upfront.

- Forwards: Forwards are similar to futures contracts, but they are typically traded over-the-counter instead of on organized exchanges. Forward contracts are customizable agreements between two parties to buy or sell an asset at a predetermined price on a specified future date. The terms of forward contracts can be tailored to suit the needs of the involved parties.

- Options Contracts: Options contracts give the holder the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specific timeframe. Options provide traders with the flexibility to speculate on price movements, hedge positions, or generate income through option writing strategies.

- Swaps: Swaps are agreements between two parties to exchange cash flows or financial instruments. The most common types of swaps include interest rate swaps, currency swaps, and commodity swaps. Swaps are often used to manage risks, hedge against interest rate or currency fluctuations, or take advantage of differences in borrowing costs.

- Contracts for Difference (CFDs): CFDs are popular derivatives that allow traders to speculate on price movements in various financial markets without owning the underlying asset. CFDs provide leverage, enabling traders to amplify potential returns. They are commonly used for trading stocks, indices, currencies, commodities, and cryptocurrencies.

- Options on Futures: Options on futures are derivatives that give the holder the right to buy or sell a futures contract at a predetermined price within a specified timeframe. Options on futures allow traders to benefit from price movements in futures contracts without having to trade the futures themselves.

Each type of derivative serves a specific purpose, depending on an investor’s risk appetite, trading strategy, and market outlook. Understanding the characteristics and trading mechanisms of each derivative is crucial to make informed trading decisions.

It’s important to note that derivatives can be sophisticated instruments and may not be suitable for all investors. They involve risks such as market volatility, leverage, and the potential for loss of capital. Therefore, before trading derivatives, it’s essential to educate yourself, carefully assess your risk tolerance, and seek guidance from professionals if needed.

In the next sections, we will delve into the benefits and risks associated with trading derivatives, as well as the steps to get started and develop effective trading strategies.

Benefits and Risks of Trading Derivatives

Trading derivatives offers a range of potential benefits and risks. Understanding these advantages and disadvantages is crucial before entering the derivative market. Let’s explore them in more detail:

Benefits of Trading Derivatives:

- Enhanced Trading Opportunities: Derivatives provide access to a wide range of markets, allowing traders to participate in price movements across various asset classes, including stocks, commodities, currencies, and interest rates. This opens up opportunities for diversification and potential profits.

- Leverage: Derivatives allow traders to control a larger position with a smaller amount of capital through the use of leverage. This can amplify potential returns, enabling traders to make more significant profits with a smaller initial investment. However, it’s important to note that leverage also amplifies potential losses.

- Hedging and Risk Management: Derivatives can be used as effective tools for hedging and managing risk. Investors can mitigate potential losses by taking offsetting positions in derivatives that correlate with their existing portfolio. This helps to protect against adverse price movements and provides a level of security in volatile markets.

- Flexibility and Customization: Derivatives offer flexibility and customization options, allowing traders to tailor their positions according to their specific investment goals and risk appetite. They can choose from a variety of contract sizes, expiration dates, strike prices, and more, to create a trading strategy that suits their needs.

- Opportunities in Different Market Conditions: Derivatives can provide opportunities to profit in both rising and falling markets. Traders can take long (buy) or short (sell) positions depending on their market outlook, enabling them to benefit from price movements in either direction.

Risks of Trading Derivatives:

- Market Volatility: Derivative markets can be highly volatile, which can result in rapid and significant price fluctuations. Volatility introduces the risk of substantial gains or losses, especially when using leverage.

- Leverage Risk: While leverage can amplify potential profits, it also increases the risk of substantial losses. If the market moves against a leveraged position, losses can exceed the initial investment. It’s crucial to understand and manage the risks associated with using leverage effectively.

- Counterparty Risk: Derivatives are typically traded through intermediaries such as exchanges or brokerage firms. There is a risk of default or failure of these counterparty institutions, which can lead to losses or the inability to fulfill contract obligations. It’s important to choose reputable and regulated platforms to mitigate counterparty risk.

- Complexity: Derivatives can be complex financial instruments with intricate features and pricing mechanisms. It’s important to have a thorough understanding of the derivative being traded to make informed decisions. Lack of knowledge and experience can increase the risk of making costly mistakes.

- Regulatory and Legal Risks: The derivative market is subject to extensive regulations and legal requirements. Compliance with these rules and staying updated on regulatory changes is necessary to avoid legal issues and protect investors’ interests.

It’s essential to carefully assess the benefits and risks of trading derivatives based on your financial goals, risk tolerance, and experience. Developing a solid understanding of derivative fundamentals, risk management techniques, and trading strategies can help mitigate potential risks and increase the likelihood of success in derivative trading.

In the next sections, we will explore the steps involved in getting started with derivative trading, choosing a trading platform, and developing effective trading strategies.

Getting Started with Derivative Trading

If you’re interested in venturing into derivative trading, it’s important to familiarize yourself with the necessary steps to get started. Here’s a guide to help you kick-start your derivative trading journey:

1. Educate Yourself:

Before diving into derivative trading, it’s crucial to educate yourself about the fundamentals of derivatives, various types of derivatives, and how they work. Understand the mechanics of derivative contracts, the factors that affect their value, and the risks associated with trading derivatives. Online resources, books, courses, and tutorials can provide valuable knowledge to enhance your understanding.

2. Define Your Investment Goals and Risk Tolerance:

Clearly defining your investment goals and risk tolerance is essential when trading derivatives. Determine the amount of capital you’re willing to invest, how much risk you can comfortably handle, and the desired timeframe for your investments. This will help you establish a solid foundation and guide your trading decisions.

3. Choose the Right Brokerage Firm or Trading Platform:

Selecting the right brokerage firm or trading platform is vital for derivative trading. Look for platforms that offer a wide range of derivatives, competitive fees, reliable customer support, user-friendly interfaces, and robust trading tools. Ensure that the platform is regulated and provides secure trading environments to protect your funds.

4. Open a Trading Account:

Once you have chosen a suitable trading platform, you’ll need to open a trading account. Complete the registration process by providing the required personal and financial information. Verify your identity and fulfill any additional document requirements. Choose the appropriate account type based on your trading needs, such as individual, joint, or corporate accounts.

5. Fund Your Account:

After opening a trading account, you’ll need to fund it with your desired capital. Most trading platforms offer various funding methods, such as bank transfers, credit/debit cards, or online payment processors. Ensure that you understand the funding options, fees, and processing times associated with each method.

6. Develop a Trading Plan:

A trading plan is essential for successful derivative trading. Define your trading strategy, including entry and exit points, risk management techniques, and profit targets. Incorporate rules for position sizing, stop-loss orders, and risk-reward ratios. Regularly assess and adjust your trading plan based on market conditions and your trading performance.

7. Start with Simulated Trading:

If you’re new to derivative trading or want to test your strategies, consider starting with simulated or paper trading. Many trading platforms offer virtual trading accounts that allow you to trade with virtual funds in real-market conditions. Practice your trading strategies, gain experience, and refine your skills before moving on to live trading.

8. Monitor and Evaluate:

Once you begin trading, closely monitor your positions and evaluate your trades. Keep track of your successes and failures, analyze the reasons behind them, and identify areas for improvement. Consider using trading journals or software to track and analyze your performance. Stay updated on market news, economic indicators, and relevant events that can impact the derivative markets.

Remember that derivative trading involves risk, and there are no guarantees of profits. Be disciplined, patient, and realistic about your expectations. Continuous learning, adaptability, and emotional control are key factors for long-term success in derivative trading.

In the next sections, we will explore choosing a derivative trading platform, understanding market indicators, analyzing and evaluating derivative contracts, and developing effective trading strategies to enhance your derivative trading journey.

Choosing a Derivative Trading Platform

Choosing the right derivative trading platform is crucial for a successful trading experience. With numerous options available in the market, it’s important to consider several factors before making a decision. Here are some key considerations when selecting a derivative trading platform:

1. Regulatory Compliance:

Ensure that the trading platform you choose is regulated by a reputable financial authority. Regulatory oversight ensures that the platform operates within legal boundaries and follows industry best practices. This provides a level of security and protection for your funds and trading activities.

2. Product Availability:

Check if the trading platform provides access to a wide range of derivatives, including futures, options, swaps, and other popular derivatives. Having a diverse selection of instruments allows you to explore different markets and trading strategies. Make sure the platform offers the derivatives you are interested in trading.

3. User-Friendly Interface:

Opt for a trading platform that offers a user-friendly interface and intuitive navigation. The platform should be easy to understand and operate, whether you are executing trades, accessing account information, or analyzing charts and indicators. A user-friendly interface will help you streamline your trading process and minimize potential errors.

4. Trading Tools and Features:

Consider the trading tools and features offered by the platform. Look for real-time market data, charting capabilities, technical analysis tools, and risk management features such as stop-loss orders and take-profit levels. Access to research materials, educational resources, and demo accounts can also be beneficial when evaluating and honing your trading strategies.

5. Security Measures:

Security should be a top priority when choosing a trading platform. Ensure that the platform implements robust security measures such as encryption protocols, two-factor authentication, and segregated client accounts. Research the platform’s track record and reputation for security to ensure the safety of your funds and personal information.

6. Transaction Costs and Fees:

Compare the transaction costs, fees, and commissions charged by different trading platforms. Look for platforms that offer competitive pricing structures without compromising on the quality of services provided. Consider the costs associated with account maintenance, deposit and withdrawal fees, and inactivity fees.

7. Customer Support:

Consider the level of customer support offered by the trading platform. Look for platforms that provide responsive and knowledgeable customer support through various channels such as phone, email, or live chat. Prompt and efficient customer support can significantly enhance your trading experience, especially in times of technical difficulties or account-related issues.

8. Mobile Trading:

If you prefer to trade on the go, consider choosing a trading platform that offers mobile trading capabilities. A mobile trading app allows you to monitor your positions, execute trades, and access account information from your smartphone or tablet, providing flexibility and convenience.

It’s important to research and compare different trading platforms based on your specific needs and preferences. Consider reading reviews, seeking recommendations from fellow traders, and even trying out demo accounts to get a firsthand experience of the platform’s features and functionality.

Remember that choosing the right trading platform is a critical decision that can impact your trading experience. Take your time, do your due diligence, and select a platform that aligns with your trading goals and provides a secure and efficient trading environment.

In the next sections, we will explore market indicators for derivative trading, analyzing and evaluating derivative contracts, and developing effective trading strategies to enhance your derivative trading journey.

Understanding Market Indicators for Derivative Trading

When it comes to derivative trading, understanding market indicators is crucial to make informed trading decisions. These indicators provide valuable insights into market trends, sentiment, and potential price movements. By analyzing and interpreting market indicators, traders can identify opportunities and manage risk more effectively. Here are some essential market indicators to consider:

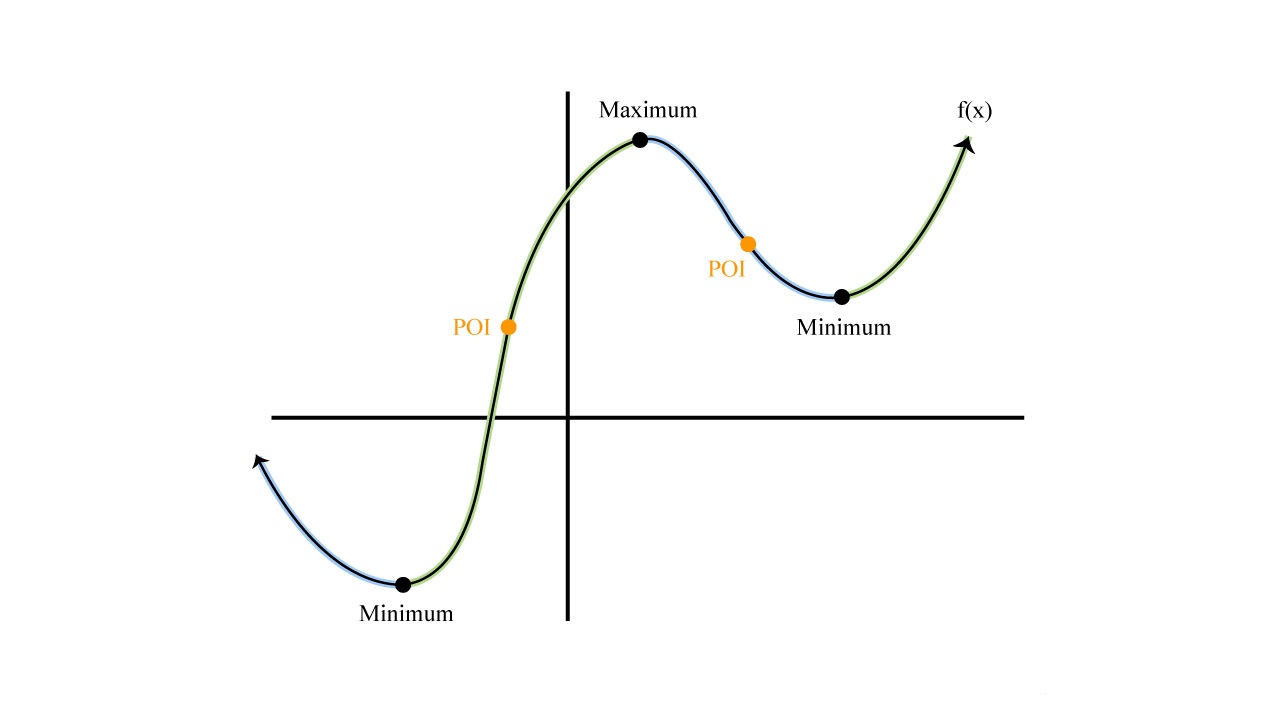

1. Price Charts:

Price charts are the foundation of technical analysis, a method used to study historical price data to predict future price movements. Candlestick charts, line charts, and bar charts can provide valuable information about price patterns, support and resistance levels, and trends. Analyzing these charts can help traders identify optimal entry and exit points for derivative trades.

2. Moving Averages:

Moving averages are calculated averages of historical prices over a specific period. They help smooth out price fluctuations and provide a clearer picture of market trends. Traders often use moving averages to identify potential trend reversals, support and resistance levels, and to generate buy or sell signals.

3. Volatility Indicators:

Volatility indicators, such as the Average True Range (ATR) or Bollinger Bands, help measure the degree of price fluctuations in a market. High volatility suggests greater price movements and potential trading opportunities, while low volatility implies stability and potentially smaller price moves. Understanding volatility is crucial for risk management and position sizing in derivative trading.

4. Volume:

Volume measures the number of shares or contracts traded in a given period. Analyzing volume can provide insights into market liquidity, confirming the strength of price movements. High volume during price increases or decreases indicates market interest and can be a sign of a sustainable trend. Conversely, low volume may suggest a lack of strong conviction in the market.

5. Economic Indicators:

Economic indicators, such as interest rates, GDP growth, employment data, and inflation rates, can significantly impact financial markets. These indicators provide insights into the health of a country’s economy, influencing the prices of underlying assets, commodities, or currencies. Traders should monitor economic indicators to anticipate potential market shifts that may impact derivative trading opportunities.

6. Market Sentiment Indicators:

Market sentiment indicators help gauge the overall mood and sentiment of market participants. These indicators include metrics such as the Put/Call ratio, the Fear and Greed Index, or the CBOE Volatility Index (VIX). By understanding market sentiment, traders can assess the level of fear, complacency, or optimism in the market, helping them make informed trading decisions.

It’s important to note that no single market indicator can guarantee accurate predictions. Traders should utilize a combination of indicators, along with other tools and analyses, to increase the probability of successful trading decisions. Additionally, it’s crucial to stay updated on market news, events, and economic releases that may impact the effectiveness of these indicators.

By incorporating market indicators into your trading approach, you can gain insights into potential price movements, identify trends, and manage risk more effectively. Continuously learning and adapting your analysis based on current market conditions will further enhance your ability to make informed and profitable derivative trades.

In the next section, we will delve into analyzing and evaluating derivative contracts, providing insights into understanding key contract features and considerations when trading derivatives.

Analyzing and Evaluating Derivative Contracts

When it comes to trading derivatives, analyzing and evaluating the underlying contract is essential to make informed trading decisions. Understanding the key features and considerations of derivative contracts can help traders assess the potential risks and rewards. Here’s a guide to help you analyze and evaluate derivative contracts effectively:

1. Contract Specifications:

Start by studying the contract specifications of the derivative you are interested in trading. These specifications include the underlying asset, contract size, expiration date, and settlement method. Understanding these details is crucial as they determine the trading parameters and ultimately affect the value and risk associated with the derivative contract.

2. Payoff Structure:

Examine the payoff structure of the derivative contract. Determine how the option or futures contract’s value will change based on the movement of the underlying asset’s price. This will help you assess the potential profit or loss and understand the contract’s sensitivity to different price scenarios.

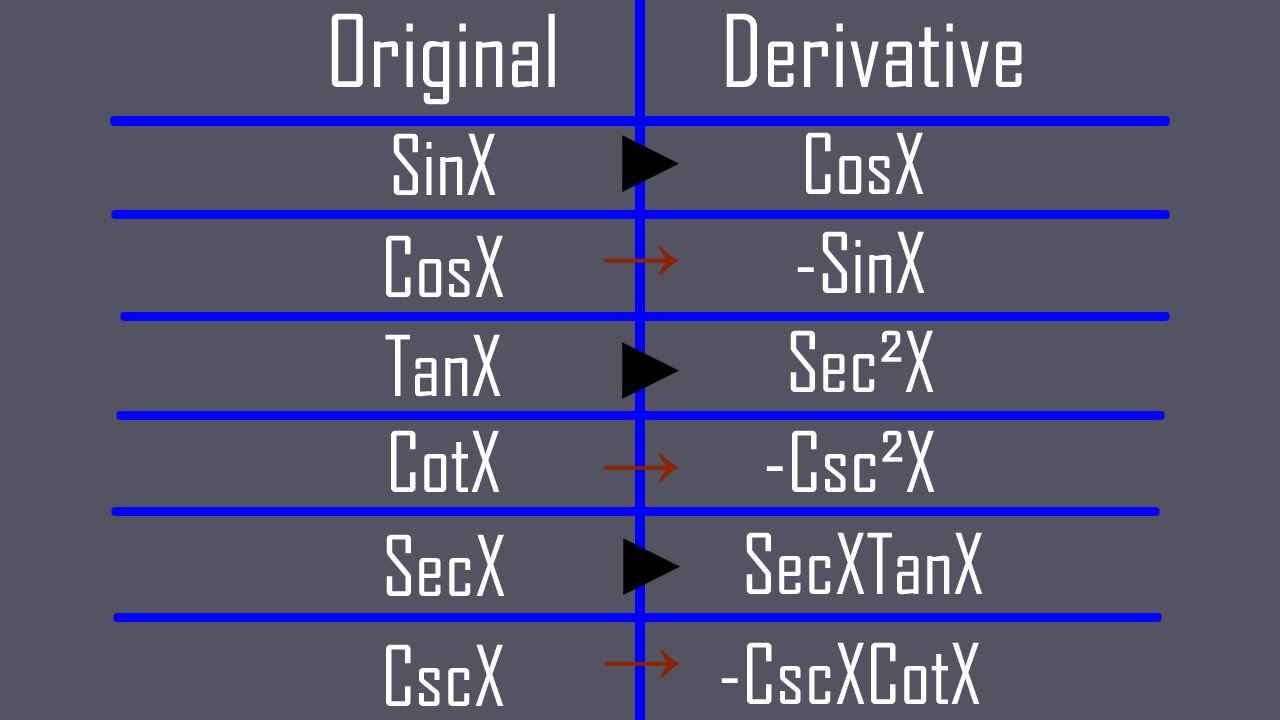

3. Delta and Greeks:

Delta and other Greeks (such as gamma, theta, and vega) are measures that quantify the sensitivity of option prices to changes in factors such as the underlying price, time, and implied volatility. These values indicate the potential risk and reward characteristics of the derivative contract. Understanding and analyzing the Greeks can help you assess the impact of various market variables on the contract’s value.

4. Market Liquidity:

Consider the liquidity of the derivative contract. Liquidity refers to the ease of buying and selling the contract without significant price impact. Contracts with higher liquidity tend to have tighter bid-ask spreads and lower potential slippage. Adequate liquidity is crucial to ensure efficient execution and minimize transactional costs.

5. Historic and Implied Volatility:

Examine the historical and implied volatility of the underlying asset. Historic volatility reflects the asset’s price fluctuations over a specific period, while implied volatility is the market’s expectation of future price volatility. Volatility affects derivative prices and can impact the potential risk and reward of the contract. Understanding and assessing volatility levels is crucial for position sizing and implementing risk management strategies.

6. Fundamental and Technical Analysis:

Perform fundamental and technical analysis to assess the fundamental factors and market trends that may impact the underlying asset and, subsequently, the derivative price. Evaluate financial statements, economic data, industry trends, and other relevant factors to gain insights into the potential direction of the contract’s value. Technical analysis tools, such as chart patterns and indicators, can help identify entry and exit points for derivative trades.

7. Risk-Reward Assessment:

Evaluate the risk-reward profile of the derivative contract. Assess the potential profit and loss scenarios based on different market conditions and your trading strategy. Consider your risk tolerance, portfolio diversification, and overall investment objectives. Understanding and managing the risk-reward ratio is crucial to making informed trading decisions.

Remember that analyzing and evaluating derivative contracts require a combination of quantitative analysis, market research, and risk assessment. Continuously monitor the contract’s characteristics, market conditions, and any relevant news or events that may impact its value. Regularly review and refine your analysis to adapt to changing market dynamics.

In the next section, we will discuss developing derivative trading strategies to help you execute trades more effectively and improve your chances of success.

Developing Derivative Trading Strategies

Developing effective trading strategies is crucial for successful derivative trading. A well-thought-out strategy helps traders make informed decisions, manage risk, and optimize their chances of profitability. Here are key steps to consider when developing derivative trading strategies:

1. Define Your Trading Goals:

Start by defining your trading goals. Determine whether you are looking for short-term gains, long-term growth, income generation, or capital preservation. Clear goals will guide your trading approach and help you select the appropriate derivative contracts and trading strategies.

2. Conduct Market Analysis:

Perform thorough market analysis to identify potential trading opportunities. Utilize technical analysis tools, such as price charts, oscillators, and trend indicators, to identify entry and exit points. Combine technical analysis with fundamental analysis to understand the underlying asset’s value, industry trends, and macroeconomic factors that may impact derivative prices.

3. Determine Your Risk Tolerance:

Assess your risk tolerance before executing trades. Understand the potential risks associated with derivative trading, including market volatility, leverage, and counterparty risk. Set clear risk management rules, such as determining stop-loss levels, position sizing, and diversification principles, to protect your capital and manage risk effectively.

4. Select Suitable Derivative Contracts:

Select derivative contracts that align with your trading goals and risk tolerance. Consider factors such as contract specifications, liquidity, payoff structures, and the underlying asset’s volatility. Choose contracts that allow you to express your trading strategy effectively and provide sufficient liquidity to enter and exit positions without significant slippage.

5. Implement a Proper Trading Plan:

Develop a well-defined trading plan that outlines your strategy, entry and exit criteria, risk management rules, and trade execution guidelines. Stick to your plan and avoid making impulsive decisions based on market emotions. Regularly evaluate and refine your trading plan based on performance analysis and market conditions.

6. Test and Adapt Your Strategy:

Before risking real capital, test your strategy in a simulated trading environment or with small position sizes. This allows you to assess the strategy’s effectiveness and make any necessary adjustments. Monitor and analyze your trades, identify strengths and weaknesses, and make informed modifications to improve your trading strategy.

7. Stay Informed and Adapt to Changing Market Conditions:

Stay updated on market news, economic data, and events that may impact derivative prices. Continuously research and learn about new developments in the derivatives market. Adapt your trading strategy as market conditions change, and remain flexible to capture new opportunities or manage potential risks.

Remember that developing a successful trading strategy requires discipline, patience, and continuous learning. Avoid overtrading, manage your emotions, and stick to your defined plan. Regularly assess your trading performance, including profitability and risk management, to identify areas for improvement.

It’s crucial to note that no trading strategy guarantees profit, and losses are a part of trading. Ensure that you have a solid understanding of derivative products and the associated risks before executing trades. Consider seeking professional advice or mentoring to enhance your trading skills and improve your chances of success.

In the next section, we will explore risk management techniques to help you mitigate potential losses and protect your capital in derivative trading.

Risk Management in Derivative Trading

Risk management plays a crucial role in derivative trading as it helps traders protect their capital and minimize potential losses. Trading derivatives involves inherent risks, such as market volatility, leverage, and counterparty risk. Effective risk management strategies can help mitigate these risks and maximize the chances of long-term success. Here are key techniques to consider when managing risk in derivative trading:

1. Set Risk Limits:

Establish risk limits based on your risk tolerance and trading capital. Determine the maximum amount you are willing to risk on each trade or portfolio. Strictly adhere to these limits and avoid exceeding them, as it helps prevent significant losses and maintains consistency in risk management.

2. Utilize Stop-Loss Orders:

Implement stop-loss orders to automatically exit a position if the market moves against you beyond a certain point. Stop-loss orders act as a crucial risk management tool by limiting potential losses. Place these orders at strategic levels based on your analysis and risk tolerance.

3. Diversify Your Portfolio:

Diversification is key in risk management. Spread your investments across different derivatives, asset classes, and markets. A well-diversified portfolio reduces the impact of a single trade or market event on your overall capital. Be cautious not to over-diversify, as it can dilute potential returns.

4. Manage Leverage:

Be mindful of the leverage used in derivative trading. While leverage can amplify potential gains, it also increases the risk of significant losses. Keep leverage ratios within tolerable limits and avoid overexposing your trading capital.

5. Continuous Monitoring:

Regularly monitor your positions and the market conditions. Stay informed about market news, economic releases, and events that may impact derivative prices. Adjust your risk management strategies if market conditions change to adequately manage your risk exposure.

6. Risk-Reward Ratio:

Assess and maintain a favorable risk-reward ratio for each trade. Ensure that the potential reward justifies the potential risk. Aim for a risk-reward ratio that allows you to have more significant potential gains, while keeping potential losses manageable.

7. Stay Emotionally Disciplined:

Emotional discipline is vital in managing risk. Avoid making impulsive decisions based on fear or greed. Stick to your predefined trading plan and risk management strategies, regardless of market fluctuations or short-term emotions.

8. Stay Educated and Seek Professional Guidance:

Continuously educate yourself about risk management techniques and best practices in derivative trading. Stay updated on industry developments and consult with experienced traders or professionals if needed. Seeking professional guidance and mentorship can provide valuable insights and perspectives.

Remember, risk management is an ongoing process that requires continuous evaluation and adjustment. Regularly review your risk management strategies and performance to identify areas for improvement. By effectively managing risk, you protect your capital and create a solid foundation for long-term success in derivative trading.

In the next section, we will discuss the importance of monitoring and adjusting derivative positions to optimize trading performance.

Monitoring and Adjusting Derivative Positions

Monitoring and adjusting derivative positions is crucial for optimizing trading performance and managing risk. As market conditions change, it’s essential to stay vigilant, assess your positions, and make necessary adjustments. Here are key considerations for effectively monitoring and adjusting derivative positions:

1. Regular Position Monitoring:

Regularly monitor your derivative positions to stay informed about their performance and potential risks. Keep a close eye on market trends, news, and events that may impact the underlying asset or the derivative itself. Use trading platforms, real-time market data, and news feeds to ensure you have updated information.

2. Evaluate Profit and Loss:

Assess the profitability or losses of your derivative positions. Determine if the positions are meeting your expectations and financial goals. Don’t solely focus on profits; also analyze losing positions to identify potential improvements or reasons for the losses. This evaluation will help you make informed decisions on whether to hold, adjust, or exit a position.

3. Consider Risk-Reward Ratio:

Regularly evaluate the risk-reward ratio of your derivative positions. Assess if the potential rewards still justify the risks associated with the positions. If the risk-reward ratio becomes unfavorable, consider adjusting or closing the positions to protect your capital and seek better opportunities.

4. Adjust Stop-Loss and Take-Profit Levels:

Modify your stop-loss and take-profit levels, if necessary, based on changing market conditions. Adjusting these levels allows you to protect potential profits and limit potential losses. Consider price movements, volatility, and key support or resistance levels when recalibrating these orders.

5. Continuously Reevaluate Market Conditions:

Stay updated on market conditions, economic releases, and relevant news. Continuous evaluation of market factors impacting your derivative positions helps you make well-informed adjustments. Adapt your trading decisions based on changing trends, volatility, or unexpected events that may affect your positions.

6. Utilize Trailing Stop-Loss Orders:

Consider using trailing stop-loss orders to protect profits as your positions move favorably. Trailing stops move automatically as the price advances, locking in profits while still allowing for potential upside gains. This feature helps protect against sudden reversals and allows you to capture more significant profits during price trends.

7. Manage Time Decay for Options:

If trading options contracts, be mindful of time decay. Options lose value as they approach expiration, and a declining time value can impact your positions. Regularly assess the remaining time until expiration and consider adjusting or rolling over options contracts to extend the time frame and maintain exposure to potential price movements.

8. Review and Adjust Hedging Strategies:

If using derivatives for hedging purposes, regularly review and adjust your hedging strategies. Assess if the hedge is effectively managing the risk exposure of the underlying asset. Evaluate the correlation between the derivative and the asset being hedged, making adjustments as needed to ensure optimal risk mitigation.

Continuous monitoring and adjustment of derivative positions are essential to adapt to changing market dynamics, protect your capital, and maximize potential profits. Regularly reevaluate your trading decisions and risk management strategies to stay aligned with your trading goals and take advantage of new opportunities that arise.

Remember, trading decisions should be based on sound analysis, market research, and risk assessment. Cultivate discipline, emotional control, and a willingness to adapt your positions as market conditions warrant. By staying proactive in monitoring and adjusting your derivative positions, you position yourself for increased trading success.

In the next section, we will conclude with a summary of the key points covered and highlight the importance of continuous learning in derivative trading.

Conclusion

Derivative trading offers investors and traders a dynamic and potentially lucrative opportunity to participate in various financial markets. Throughout this comprehensive guide, we have explored the fundamentals of derivatives, the types of derivatives available, and the benefits and risks associated with derivative trading. We have provided insights into getting started with derivative trading, choosing the right trading platform, understanding market indicators, analyzing and evaluating derivative contracts, developing trading strategies, and effectively managing risk.

Understanding derivatives and how they function is crucial for making informed trading decisions. The different types of derivatives, such as options, futures, and swaps, each serve a specific purpose in the market. By selecting the appropriate derivative and employing effective trading strategies, investors can enhance their portfolios and potentially generate significant profits.

However, it’s essential to remember that derivative trading carries inherent risks. Volatility, leverage, and counterparty risks should be carefully managed through risk management techniques such as setting risk limits, utilizing stop-loss orders, diversifying portfolios, and constant monitoring and evaluation of positions. By implementing these risk management strategies, traders can protect their capital and navigate the unpredictable nature of derivative markets.

Developing effective derivative trading strategies involves setting clear goals, conducting market analysis, selecting suitable derivative contracts, and continuously monitoring and adjusting positions. It’s crucial to stay informed about market indicators, economic data, and news that can impact derivative prices. Continual learning, adapting to market conditions, and seeking professional guidance can significantly enhance trading performance.

In summary, derivative trading offers exciting opportunities for investors and traders, but it requires knowledge, skill, and careful risk management. By understanding the fundamentals, employing effective strategies, and implementing robust risk management techniques, traders can navigate the derivative markets with confidence and increase their chances of success.

Remember, derivative trading is a continuously evolving field. Stay curious, stay informed, and never stop learning. Keep up with industry developments, research new trading techniques, and adapt your strategies as needed. With perseverance, discipline, and a forward-thinking mindset, you can thrive in the world of derivative trading.