Finance

Exordium Clause Definition

Published: November 21, 2023

Discover the meaning of exordium clause in finance, its importance in legal contracts, and how it sets the stage for the rest of the agreement.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Demystifying Finance: Understanding the Basics and Beyond

Finance plays a crucial role in everyone’s life, but understanding its intricacies can often seem daunting. If you’re looking to demystify the world of finance and gain a better grasp of the subject, you’ve come to the right place. In this blog post, we’ll delve into the foundations of finance, explore key concepts, and provide expert insights to help you navigate and make the most of your financial journey.

Key Takeaways:

- Finance is a fundamental aspect of our daily lives, impacting our personal and professional endeavors.

- Gaining a solid understanding of finance empowers individuals to make informed decisions and achieve financial success.

1. The Basics: Let’s start with the essentials. Finance encompasses the management of money, assets, investments, and liabilities. It involves analyzing and assessing financial information to make decisions, control risk, and allocate resources effectively. Key areas of finance include personal finance, corporate finance, and public finance. Understanding these foundational aspects will enable you to navigate various financial scenarios confidently.

2. Budgeting and Financial Planning: Budgeting plays a crucial role in personal and business finance. It involves creating a financial roadmap by accounting for income, expenses, savings, and investments. Financial planning goes hand in hand with budgeting, focusing on setting short-term and long-term financial goals, such as retirement planning, education funding, and debt management. By implementing effective budgeting and financial planning techniques, you can gain control over your money and lay the groundwork for a secure financial future.

3. Investing and Risk Management: Investing is essential for wealth creation and growing your financial resources. This involves allocating funds to different assets, such as stocks, bonds, real estate, or mutual funds, with the expectation of generating returns over time. However, investing also comes with risks. Understanding risk management techniques, diversification, and asset allocation strategies allows you to mitigate potential losses and make more informed investment decisions.

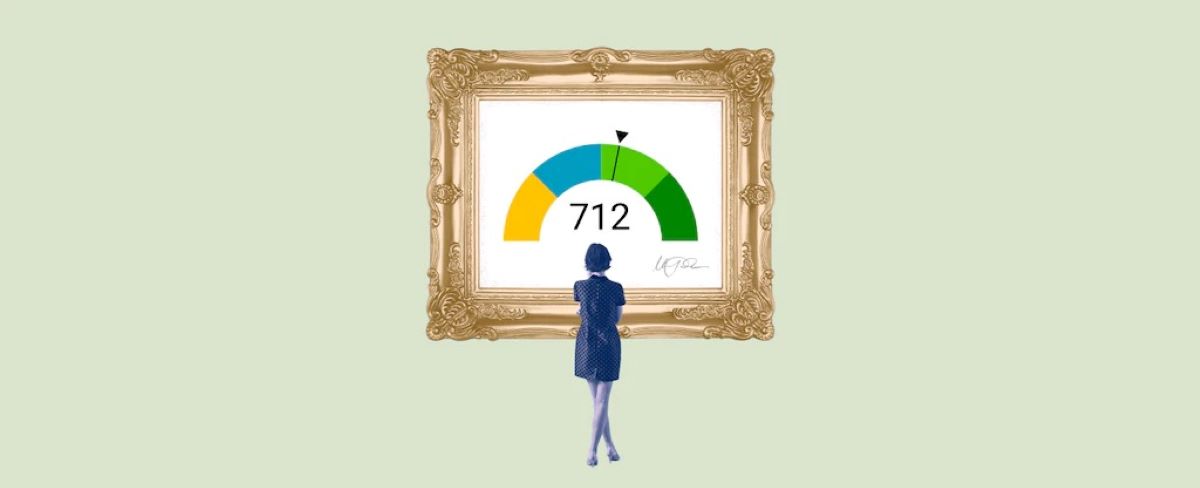

4. Credit and Debt Management: Credit is an essential tool in today’s financial world. It enables individuals and businesses to access funds for various purposes, whether it’s purchasing a home, starting a new venture, or funding education. However, managing credit responsibly is crucial to maintain a healthy financial profile. Understanding credit scores, interest rates, and debt management strategies can help you optimize your credit usage and avoid falling into debt traps.

5. Taxes and Financial Regulations: Taxes are an inevitable part of financial life. Understanding the basics of tax planning, deductions, and credits can help you optimize your tax obligations. Moreover, compliance with financial regulations, such as banking regulations and investment guidelines, ensures that you navigate the financial landscape ethically and legally.

6. Financial Literacy: Enhancing your financial literacy is key to taking control of your financial well-being. Continuously educating yourself about financial concepts, staying updated on market trends, and seeking professional advice are crucial steps towards becoming financially savvy. With the right knowledge and awareness, you can make informed decisions, avoid common pitfalls, and achieve your financial goals.

By demystifying the world of finance and understanding the basics, you’ll be equipped with the knowledge and tools necessary to make informed financial decisions. Whether you’re managing your personal finances, planning for retirement, or navigating the corporate finance landscape, grasping these foundational concepts is essential.

At Exordium Clause Definition, we’re passionate about empowering individuals with financial knowledge and expertise. Our team of experienced professionals is dedicated to guiding you on your financial journey, providing insights and support every step of the way. Stay tuned for more articles on various financial topics as we unravel the complexities of finance and help you achieve financial success.