Home>Finance>Foreign Currency Convertible Bond (FCCB) Defined, How It Works

Finance

Foreign Currency Convertible Bond (FCCB) Defined, How It Works

Published: November 26, 2023

Learn the ins and outs of Foreign Currency Convertible Bonds (FCCBs) in finance. Discover how this investment instrument works and its benefits.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Foreign Currency Convertible Bond (FCCB) Defined, How It Works

Welcome to our Finance blog category! Today, we are going to dive into the intriguing world of Foreign Currency Convertible Bonds (FCCBs). If you’ve ever wondered what FCCBs are and how they work, you’ve come to the right place! In this blog post, we will unravel the mysteries behind FCCBs, explaining their definition and providing insights into their functioning.

Key Takeaways:

- FCCBs are hybrid financial instruments that combine features of both debt and equity.

- Investors have the option to convert the bond into equity shares of the issuing company.

Now, let’s begin our journey into the fascinating world of FCCBs!

What are Foreign Currency Convertible Bonds (FCCBs)?

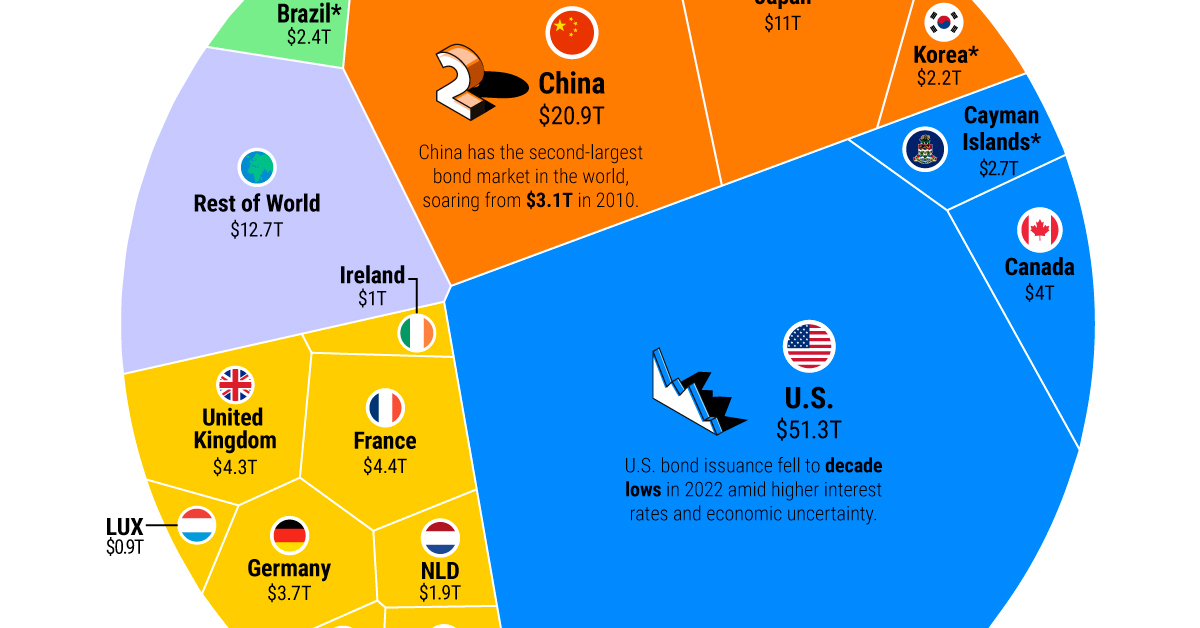

Foreign Currency Convertible Bonds, commonly known as FCCBs, are financial instruments that serve as a hybrid between debt and equity. These bonds are issued by companies to raise capital from international investors. They are denominated in a foreign currency, making them attractive to investors seeking exposure to foreign markets.

Here’s how FCCBs work:

- Issuance: A company borrows money by issuing FCCBs to international investors. The bonds have a specific maturity period and carry an interest rate, which the issuing company pays to the bondholders.

- Conversion Option: The unique characteristic of FCCBs lies in the conversion option they offer. Holders of FCCBs have the right to convert their bonds into a predetermined number of equity shares of the issuing company. This conversion typically occurs at a pre-set conversion price.

- Maturity and Redemption: At the end of the bond’s maturity period, the bondholder has two options: either exercise the conversion option and convert the bond into equity shares, or demand repayment of the principal amount in the base currency.

Benefits and Risks of FCCBs

FCCBs offer several benefits for both companies and investors. Let’s take a look at some of them:

Benefits:

- Capital Raise: FCCBs enable companies to access funding from international investors, expanding their capital base.

- Lower Interest Costs: Compared to traditional debt instruments, FCCBs often carry lower interest rates, reducing the overall interest burden for the issuer.

- Potential Dilution Control: Companies have the option to set a conversion price higher than the prevailing market price, allowing them to control the dilution of existing shareholders’ equity.

- Diversification for Investors: FCCBs provide investors with the opportunity to diversify their portfolios geographically, as they are denominated in a foreign currency.

Risks:

- Conversion Risk: The value of equity shares into which the bond can be converted is subject to market conditions. If the share price declines, bondholders might refrain from converting, resulting in holding debt with potentially lower value.

- Foreign Exchange Risk: Since FCCBs are denominated in a foreign currency, fluctuations in exchange rates can impact the bond’s value when converting back to the base currency.

- Interest Rate Risk: Changes in interest rates can affect the attractiveness of the bond, as bondholders evaluate the potential conversion or redemption benefits.

Conclusion

Foreign Currency Convertible Bonds (FCCBs) offer a unique financial instrument that combines debt and equity features, allowing companies to raise capital from international investors. The conversion option provided to bondholders adds an extra level of flexibility, making FCCBs an attractive option for both issuers and investors.

However, it’s essential to understand the benefits and risks associated with FCCBs before considering investment or issuance. As with any financial instrument, careful analysis and consideration of market conditions are crucial to make informed decisions.

We hope this blog post has provided you with a better understanding of FCCBs and their functioning. If you have any further questions or would like to explore more financial topics, feel free to browse through our Finance category for more insightful articles!