Finance

What Can You Do With A 678 Credit Score

Modified: February 21, 2024

Discover the financial opportunities available to you with a 678 credit score. From loans to credit cards, learn how to leverage your score to improve your financial standing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- What Is a 678 Credit Score?

- How Does a 678 Credit Score Impact Your Financial Life?

- Buying a Home with a 678 Credit Score

- Renting an Apartment with a 678 Credit Score

- Getting a Car Loan with a 678 Credit Score

- Qualifying for Credit Cards with a 678 Credit Score

- Finding Employment with a 678 Credit Score

- Improving Your Credit Score from 678

- Conclusion

Introduction

Your credit score is a crucial factor in determining your financial stability and opportunities. It plays a significant role in your ability to secure loans, rent an apartment, qualify for credit cards, and even find employment. One common credit score that individuals often find themselves with is a 678 credit score. In this article, we will explore what a 678 credit score means, how it impacts your financial life, and what options are available to you with this score.

Understanding credit scores can be a daunting task, but it is essential to grasp the basics. Credit scores are numerical representations of an individual’s creditworthiness, which is based on their past credit history and financial behavior. Lenders and financial institutions use these scores to assess the risk of lending money to an individual.

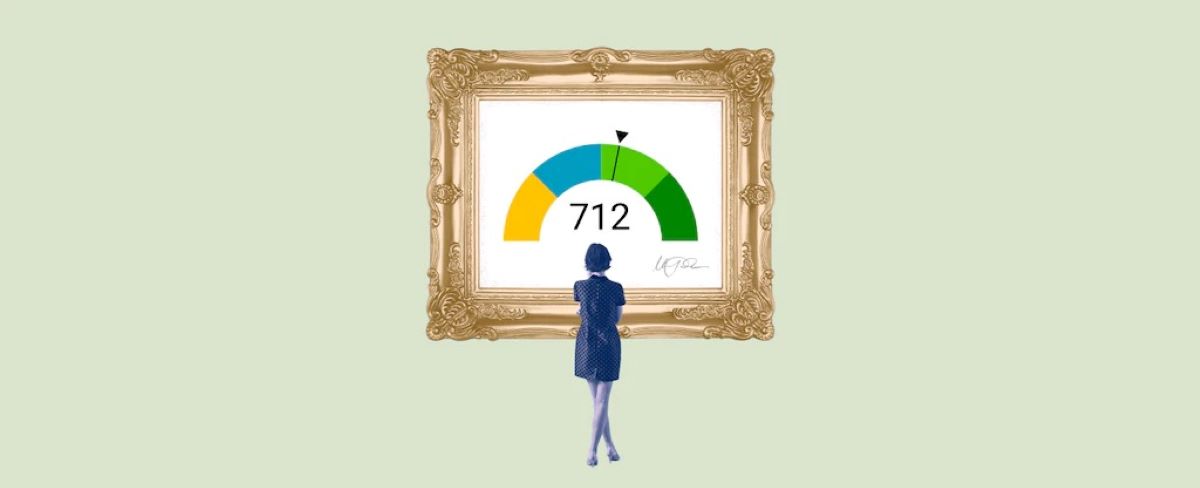

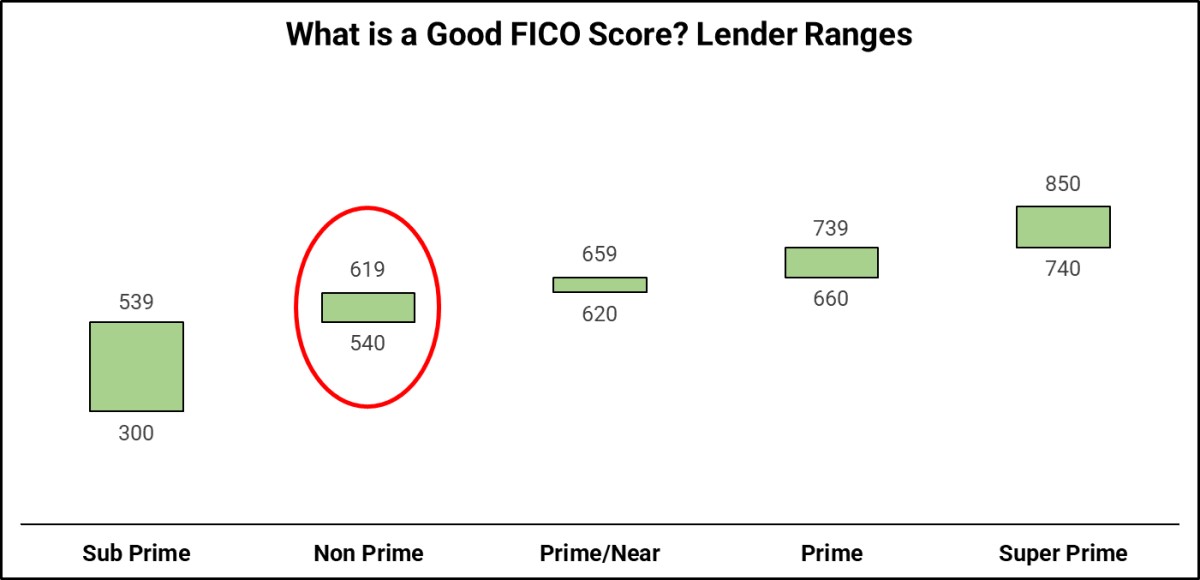

A credit score typically ranges from 300 to 850, with a higher score indicating better creditworthiness. While a 678 credit score is not considered excellent, it falls within the average range. It suggests that you have a decent credit history with opportunities to improve.

Having a 678 credit score can have various implications on your financial life. It can affect your ability to buy a home, rent an apartment, secure a car loan, qualify for credit cards, and even impact your employability. Understanding these implications and exploring the options available to you can empower you to make informed financial decisions and work towards improving your credit score.

In the following sections, we will delve deeper into how a 678 credit score can impact your financial life and the options you have in various scenarios. Whether you are hoping to buy a home, rent an apartment, get a car loan, or even find employment, this article will provide you with valuable insights and guidance.

Understanding Credit Scores

Before diving into the specifics of a 678 credit score, it is essential to have a clear understanding of credit scores in general. Credit scores are numerical values that reflect an individual’s creditworthiness, indicating how likely they are to repay their debts. These scores are generated by credit reporting agencies based on an individual’s credit history and financial behavior.

There are several credit scoring models available today, with the FICO score and VantageScore being the most commonly used ones. These models utilize various factors to calculate credit scores, including:

- Payment history: This factor assesses whether you have made your credit payments on time and accounts for about 35% of your credit score.

- Credit utilization: This factor measures the amount of credit you are currently using compared to your available credit limit, and accounts for around 30% of your credit score.

- Length of credit history: This factor considers the age of your credit accounts and the length of time you have had credit, contributing about 15% to your credit score.

- Credit mix: This factor takes into account the various types of credit you have, such as credit cards, loans, and mortgages, and makes up about 10% of your credit score.

- New credit: This factor evaluates how often you have applied for new credit and accounts for approximately 10% of your credit score.

A credit score is typically a three-digit number ranging from 300 to 850, with higher scores indicating better creditworthiness. The higher your credit score, the more likely you are to be approved for loans, receive favorable interest rates, and qualify for various opportunities.

It is important to note that credit scores can vary between credit reporting agencies and lenders due to the use of different scoring models and reporting practices. Therefore, it is advisable to regularly monitor your credit score and review your credit reports to ensure accurate information.

Now that we have a basic understanding of credit scores, let’s move on to exploring what it means to have a 678 credit score and how it can impact your financial life.

What Is a 678 Credit Score?

A 678 credit score falls within the average range of credit scores. It indicates that you have a fair credit history, but there is still room for improvement. While it may not be considered excellent, it is important to remember that credit scores are not the only factor lenders consider when evaluating loan applications or determining interest rates.

With a 678 credit score, you may find that you have access to some financial products and opportunities, but you may also encounter limitations. Lenders may view you as a moderate risk, and this could impact the terms and conditions offered to you.

It is important to remember that credit scores are fluid and can change over time. By adopting positive financial habits and making responsible credit decisions, you can work towards improving your credit score and opening up more opportunities in the future.

When considering a 678 credit score, it is worth noting that different credit scoring models may have slightly different interpretations of the score. However, the general range and implications remain relatively consistent.

Now that we understand what a 678 credit score signifies, let’s explore how it can impact various aspects of your financial life.

How Does a 678 Credit Score Impact Your Financial Life?

A credit score of 678 can have a significant impact on your financial life. It can affect your ability to secure loans, rent an apartment, qualify for credit cards, and even impact your employment opportunities. Understanding these implications can help you make informed decisions and take steps to improve your credit standing.

Loan Applications: When applying for loans, such as mortgages, personal loans, or auto loans, lenders consider your credit score to assess the risk of lending to you. A credit score of 678 may make it more challenging to qualify for loans, especially those with more favorable interest rates or terms. You may still be eligible for loans, but you may face higher interest rates or stricter lending criteria.

Credit Cards: With a 678 credit score, you may be eligible for certain credit cards, but you may not qualify for those with the most competitive rewards programs or lower interest rates. You may have access to credit cards with moderate credit limits and potentially higher interest rates. Responsible credit card usage and timely payments can help you improve your credit score over time.

Renting an Apartment: Landlords and property managers often run credit checks when evaluating potential tenants. A 678 credit score could impact your ability to rent an apartment, as landlords may consider you a moderate risk. They may require a larger security deposit or request a co-signer to mitigate their perceived risk.

Employment Opportunities: Some employers perform credit checks as part of the hiring process, especially for roles that involve financial responsibilities or require a certain level of trust. While a credit score of 678 may not automatically disqualify you from employment, a negative credit history or excessive debt could raise concerns for certain employers.

Interest Rates and Insurance Premiums: A lower credit score can result in higher interest rates on loans and credit cards. Additionally, it may impact the premiums you pay for insurance policies, such as auto or home insurance. It is important to shop around and compare rates to ensure you are getting the best possible terms.

While a 678 credit score may present some challenges, it is important to view it as an opportunity for improvement. By practicing responsible financial habits, such as making timely payments, keeping credit utilization low, and monitoring your credit reports for inaccuracies, you can work towards boosting your credit score over time.

In the following sections, we will explore specific scenarios and how a 678 credit score can impact your ability to buy a home, rent an apartment, secure a car loan, qualify for credit cards, and find employment. We will also provide some tips on how to improve your credit score.

Buying a Home with a 678 Credit Score

When it comes to buying a home, your credit score plays a crucial role in the mortgage approval process. With a credit score of 678, you may face some challenges, but it is still possible to achieve your dream of homeownership.

Lenders consider credit scores as an indicator of your ability to repay a mortgage loan. While a 678 credit score falls within the average range, it might make it more difficult to qualify for certain loan programs or secure the most favorable interest rates.

Here are a few things to keep in mind when buying a home with a 678 credit score:

- Explore loan options: Research different loan programs that cater to borrowers with moderate credit scores. FHA loans, for example, have more flexible credit requirements and can be a suitable option for borrowers with credit scores in the 600s.

- Save for a larger down payment: A larger down payment can help offset a lower credit score. Saving up for a significant down payment demonstrates financial responsibility and can increase your chances of mortgage approval.

- Work on improving your credit: Take steps to improve your credit score before applying for a mortgage. Pay off outstanding debts, make timely payments, and keep your credit utilization low. These actions can help boost your credit score and strengthen your mortgage application.

- Consider a co-signer: If you’re unable to qualify for a mortgage on your own, having a co-signer with a stronger credit profile can increase your chances of approval. Make sure to discuss this option with a trusted family member or friend before proceeding.

- Shop around and compare lenders: Different lenders might have varying criteria and options for borrowers with a 678 credit score. It’s essential to shop around, compare interest rates, and terms to find the lender that best suits your needs.

While a 678 credit score may require some additional effort and consideration during the homebuying process, it should not discourage you from pursuing your homeownership goals. With careful planning, responsible financial management, and the right strategies, you can overcome the challenges and make your dream of owning a home a reality.

Remember, it’s always a good idea to consult with a knowledgeable mortgage professional who can guide you through the homebuying process and provide personalized advice based on your unique financial situation.

Renting an Apartment with a 678 Credit Score

When it comes to renting an apartment, landlords often consider credit scores as part of their tenant screening process. With a credit score of 678, it’s important to understand how it may impact your ability to secure a rental property. While a 678 credit score is considered average, there are steps you can take to increase your chances of renting the apartment you desire.

Landlords utilize credit scores to evaluate your financial responsibility and determine the likelihood of timely rent payments. Here are some tips for renting an apartment with a 678 credit score:

- Be transparent and provide explanations: If you have a lower credit score, it can be helpful to provide the landlord with a cover letter that explains any extenuating circumstances that may have impacted your credit. This could include job loss, medical expenses, or other unforeseen situations.

- Show proof of stable income: Demonstrating a steady and reliable source of income can help offset a lower credit score. Provide copies of recent pay stubs, employment verification, or bank statements to showcase your financial stability.

- Offer a larger security deposit: Some landlords may be more inclined to overlook a lower credit score if you are willing to offer a larger security deposit. This can provide them with an added sense of security against potential financial risks.

- Provide rental references: If you’ve had a positive rental history in the past, it can be beneficial to provide letters of recommendation or contact information for previous landlords. This shows that you have a track record of being a responsible and reliable tenant.

- Consider a co-signer: Having a co-signer with a stronger credit profile can help alleviate concerns for landlords. Ensure that your co-signer understands the responsibilities and risks associated with co-signing a lease.

- Search for apartments with flexible criteria: Some landlords or property management companies may have more lenient credit score requirements. Look for apartments that are specifically advertised as “credit-friendly” or consider working with a real estate agent who can assist you in finding such accommodations.

It’s important to approach the rental process with confidence and remain proactive in addressing any concerns the landlord may have. Providing complete and accurate information, along with demonstrating your commitment to fulfilling your rent obligations, can increase your chances of renting an apartment, even with a 678 credit score.

Remember, each landlord may have different criteria and policies, so it’s always a good idea to communicate openly, ask questions, and be prepared to negotiate if needed. With patience and persistence, you can find an apartment that fits your needs and works within your financial situation.

Getting a Car Loan with a 678 Credit Score

When it comes to getting a car loan, your credit score plays a significant role in determining your eligibility and the terms of the loan. With a credit score of 678, you may face some challenges, but it is still possible to secure a car loan and finance your new vehicle.

Lenders use credit scores to assess the risk of lending to borrowers and determine the interest rates and loan terms they offer. While a 678 credit score falls within the average range, it may influence the interest rates you qualify for and impact your options.

Here are some tips to increase your chances of getting a car loan with a 678 credit score:

- Improve your credit before applying: Take steps to improve your credit score by paying off any outstanding debts, making timely payments, and keeping your credit utilization low. This can help boost your credit score and make you a more attractive borrower to lenders.

- Save for a down payment: A larger down payment can help offset a lower credit score and increase your chances of loan approval. By saving up and making a substantial down payment, you can demonstrate your commitment and reduce the loan amount you need to finance.

- Consider a co-signer: If you’re having trouble getting approved for a car loan on your own, having a co-signer with a stronger credit profile can increase your chances of loan approval. Keep in mind that both you and the co-signer are equally responsible for repaying the loan.

- Shop around for lenders: Different lenders have varying criteria and may be more willing to work with borrowers with a 678 credit score. It’s important to shop around and compare interest rates, terms, and loan options to find the best deal available.

- Consider a dealership that offers financing: Some dealerships have relationships with multiple lenders and can help connect you with financing options that fit your credit profile. They may have more flexibility in approving loans for borrowers with lower credit scores.

While it may be more challenging to get a car loan with a 678 credit score, it is still possible to find lenders who are willing to work with you. Keep in mind that you may face higher interest rates compared to borrowers with better credit scores. However, by making timely payments and managing your car loan responsibly, you can improve your credit score over time.

It’s important to carefully review loan terms, read the fine print, and ensure that the loan fits within your budget. Avoid taking on more debt than you can comfortably afford and prioritize making your car loan payments on time to protect your credit standing.

Remember, each lender has its own approval criteria, so it’s beneficial to explore your options and find a lender who can provide the best terms based on your unique financial situation.

Qualifying for Credit Cards with a 678 Credit Score

Having a credit card can be a valuable tool for managing your finances and building your credit history. However, when you have a credit score of 678, it’s important to understand how it may impact your ability to qualify for credit cards and the types of cards that may be available to you.

A credit score of 678 falls within the average range, suggesting a fair credit history but with room for improvement. While it may not make you eligible for premium or high-reward credit cards, there are still options available to you.

Here are some tips and considerations for qualifying for credit cards with a 678 credit score:

- Look for cards for fair credit: Many credit card issuers offer specific cards for individuals with fair credit scores. These cards may have lower credit limits and fewer rewards compared to premium cards but can still provide you with an opportunity to build credit and access credit card benefits.

- Secured credit cards: If you have difficulty getting approved for traditional credit cards, consider applying for a secured credit card. Secured cards require a security deposit, which becomes your credit limit. They are often easier to qualify for since the deposit serves as collateral for the issuer.

- Choose cards with no annual fee: Look for credit cards that do not charge an annual fee. Paying unnecessary fees can be burdensome, especially if you’re working on improving your credit score. Avoiding annual fees allows you to use your credit card without incurring additional costs.

- Apply for cards that match your credit profile: Some credit card issuers provide prequalification tools that allow you to check if you’re likely to be approved before submitting a formal application. This process minimizes the risk of getting rejected, which can negatively affect your credit score.

- Manage your credit responsibly: Once you’ve been approved for a credit card, it’s important to use it responsibly. Make timely payments, keep your credit utilization low, and avoid maxing out your credit limit. These actions can positively impact your credit score over time.

While a 678 credit score may limit your access to certain credit card options, it does not mean you cannot obtain a credit card. Responsible credit card usage and consistent, on-time payments can help improve your credit score, opening up more opportunities for better credit card offers in the future.

Remember, it’s important to carefully review the terms and conditions of any credit card you’re considering. Read the fine print, understand the interest rates, fees, and rewards structure, and choose a card that aligns with your financial goals and circumstances.

Over time, with responsible credit card management and overall financial responsibility, you can work towards improving your credit score and qualifying for more competitive credit card offers.

Finding Employment with a 678 Credit Score

While many people may not realize it, your credit score can sometimes play a role in the employment process. Some employers conduct credit checks as part of the background screening process, particularly for positions that involve financial responsibilities or require a high level of trust. While a credit score of 678 is considered average, it’s important to understand how it may impact your job search and what you can do to mitigate any potential concerns.

Here are some tips for navigating the job market with a 678 credit score:

- Know your rights: Familiarize yourself with the laws and regulations regarding credit checks in your jurisdiction. Some areas have restrictions on how credit information can be used in employment decisions.

- Be prepared to address it: If you know that a potential employer may conduct a credit check, be ready to explain any negative items on your credit report. Be honest and open about any extenuating circumstances and highlight steps you have taken to improve your financial situation.

- Showcase your qualifications: Focus on highlighting your skills, experience, and qualifications relevant to the position. Emphasize your expertise, achievements, and any positive professional references or recommendations you have.

- Highlight responsible financial behavior: If you have areas of strength in your credit history, such as a history of making timely payments, emphasize them during interviews or through your application materials. Show that you are proactive in managing your financial obligations.

- Work on improving your credit: Use your job search as an opportunity to improve your credit score. Make timely payments, reduce any outstanding debt, and always strive to maintain responsible financial habits. Over time, these actions will reflect positively on your credit report.

- Focus on reputation and character: While the credit check might be one factor in the hiring process, employers also value qualities such as honesty, integrity, and a solid work ethic. Demonstrate these traits through your professional demeanor, references, and past work accomplishments.

It’s important to remember that not all employers conduct credit checks, and even if they do, a lower credit score does not automatically disqualify you from employment. Many employers understand that credit scores do not necessarily reflect job performance or reliability.

Stay positive, focused, and proactive in your job search. Leverage your strengths, network with professionals in your field, and emphasize your qualifications and achievements. With determination, persistence, and a strong work ethic, you can find suitable employment opportunities regardless of your credit score.

Improving Your Credit Score from 678

If your credit score is currently at 678, there are several steps you can take to improve it over time. Building a solid credit history demonstrates financial responsibility and can open up doors to better loan terms, lower interest rates, and more opportunities. Here are some strategies to help improve your credit score:

- Pay bills on time: Consistently making payments by the due date is one of the most effective ways to establish a positive credit history. Late payments can have a significant negative impact on your credit score, so make sure to pay all bills promptly.

- Reduce credit card balances: Aim to keep your credit card balances low, ideally below 30% of your available credit limit. High credit utilization can lower your credit score, so focus on paying down outstanding balances to improve this aspect of your credit profile.

- Establish a mix of credit: Lenders want to see that you can manage different types of credit responsibly. Consider diversifying your credit portfolio by adding different types of credit, such as a car loan or a small personal loan, in addition to credit cards.

- Avoid opening too many new accounts: While having a diverse credit mix is beneficial, opening too many new accounts within a short period can be seen as risky behavior. Only open new accounts when necessary and be cautious about applying for numerous credit cards or loans simultaneously.

- Regularly review your credit reports: Obtain copies of your credit reports from the major credit bureaus (Experian, Equifax, and TransUnion) and review them for accuracy. If you spot any errors or discrepancies, dispute them promptly to ensure your credit information is correct.

- Be patient and consistent: Building or improving credit takes time. Focus on implementing good financial habits consistently and managing your credit responsibly. Over time, these positive behaviors will reflect in an improved credit score.

By following these strategies, you can gradually raise your credit score above 678 and attain better financial opportunities. Remember that improving your credit score is a long-term commitment, so be patient and stay committed to responsible financial practices.

If you need additional guidance, consider reaching out to a reputable credit counseling agency or a financial advisor. These professionals can provide personalized advice and help you create a plan to improve your credit score effectively.

Conclusion

A credit score of 678 may fall within the average range, but it still has implications for your financial life. While it may present some challenges, it’s important to remember that your credit score is not permanent and can be improved over time with responsible financial habits and proactive credit management.

When dealing with a 678 credit score, it’s essential to understand how it can impact various aspects of your financial life, such as buying a home, renting an apartment, securing a car loan, qualifying for credit cards, and even finding employment. Despite the potential limitations, there are still paths available to you in each scenario.

Whether you’re looking to improve your credit score, qualify for loans, or unlock better financial opportunities, it’s crucial to be proactive and take steps towards financial health. Paying bills on time, reducing credit card balances, and diversifying your credit mix are just a few strategies that can help you on your journey to a higher credit score.

Remember, your credit score is just one part of the bigger financial picture. It’s important to focus on building a strong financial foundation by practicing responsible money management, budgeting effectively, and saving for the future.

In the end, a credit score of 678 is not an obstacle, but rather an opportunity for improvement. By taking control of your financial well-being, making informed decisions, and working towards building a positive credit history, you can pave the way for a brighter financial future.