Finance

Foreign Items Definition

Published: November 26, 2023

Discover the meaning of foreign items in finance and how they impact your financial statements. Learn how to accurately define and manage these items for a successful financial strategy.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Finance: Understanding Foreign Items Definition

Welcome to our blog series on finance! In this installment, we will explore the fascinating world of foreign items and their definition in the realm of finance. If you’ve ever come across this term and have been curious about its meaning, you’ve come to the right place. In this post, we’ll break down exactly what foreign items are and why they are important to understand in the finance industry.

Key Takeaways:

- Foreign items refer to assets, liabilities, revenues, or expenses denominated in a currency different from an entity’s functional currency.

- Understanding foreign items is crucial for businesses engaging in international trade or operating in diverse economic environments.

What are Foreign Items?

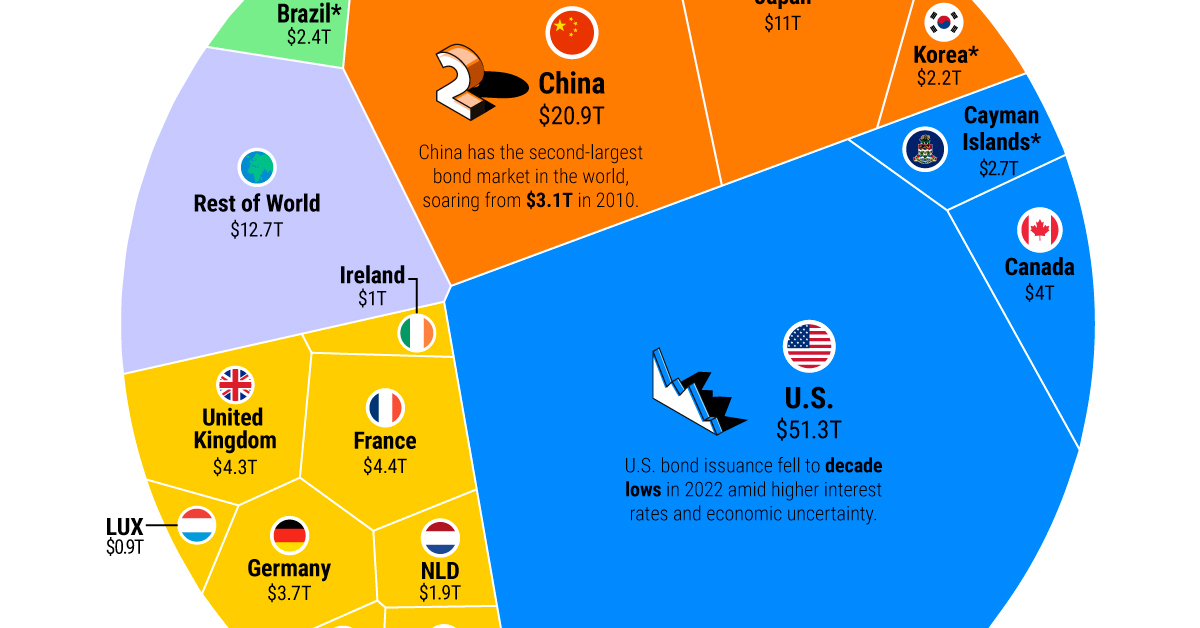

Foreign items, in the context of finance, encompass assets, liabilities, revenues, or expenses that are denominated in a currency different from an entity’s functional currency. Essentially, they represent financial transactions or balances that involve foreign currencies.

Foreign items can arise in various scenarios, including:

- Importing and exporting goods or services

- Investing in foreign markets

- Making payments or receiving income in foreign currencies

- Borrowing or lending money internationally

- Operating subsidiaries or branches in foreign countries

Why are Foreign Items Important?

Understanding foreign items is of paramount importance for businesses operating in today’s globalized economy. Here are a couple of reasons why:

1. International Trade:

Foreign items play a vital role in international trade. When a company conducts business across borders, it often deals with a variety of currencies. Being able to accurately account for and report these foreign items ensures transparency in financial statements and facilitates decision-making processes.

2. Exchange Rate Risk Management:

Foreign items expose companies to exchange rate risks. Fluctuations in currency exchange rates can have a significant impact on a company’s financial performance and profitability. By understanding foreign items, companies can implement risk management strategies to mitigate the adverse effects of exchange rate fluctuations.

3. Financial Reporting:

Regulatory requirements demand that companies disclose information related to foreign items in their financial statements. By correctly accounting for foreign items, businesses can comply with reporting standards and provide stakeholders with transparent and accurate financial information.

In conclusion, foreign items are an integral part of the finance industry. Whether you’re a small business owner engaged in international trade or a multinational corporation with operations around the world, understanding foreign items is crucial for managing risks, making informed decisions, and meeting regulatory obligations. By grasping the concept of foreign items, you can navigate the complexities of the global marketplace with confidence and clarity.