Home>Finance>Forex Broker: Definition, Role, Regulation, And Compensation

Finance

Forex Broker: Definition, Role, Regulation, And Compensation

Published: November 26, 2023

Learn about the role and regulation of forex brokers in the finance industry, and how they are compensated. Understand the definition and key aspects of this important financial service.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Secrets of Forex Brokers: Everything You Need to Know

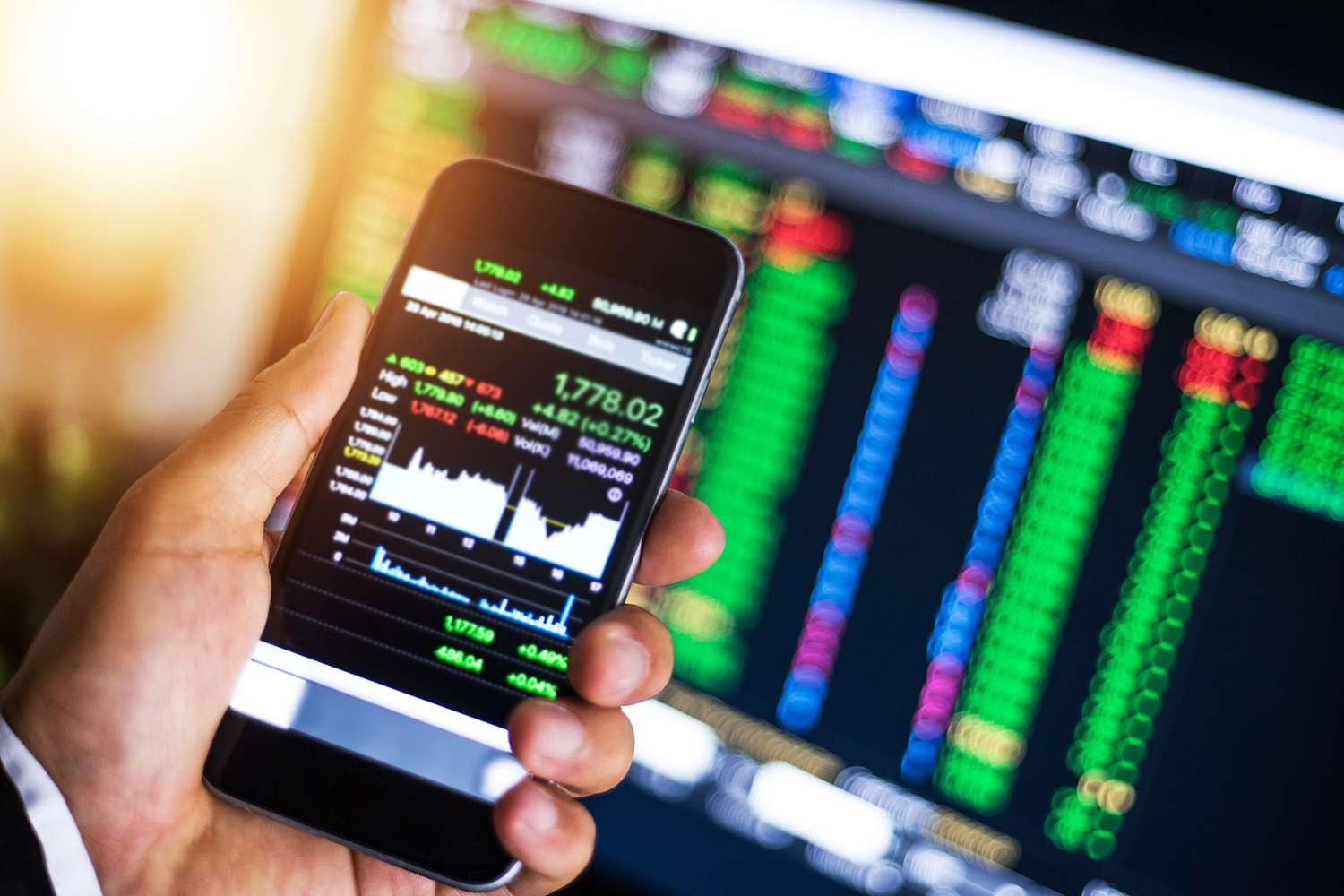

Are you curious about the world of forex trading? Looking to dive into the exciting world of online trading and make profits from currency fluctuations? Well, it’s time to familiarize yourself with an important player in the forex market – the forex broker. In this article, we will demystify the role of a forex broker, explore their regulation and compensation, and shed light on how they can help you navigate the often complex landscape of forex trading.

Key Takeaways:

- Forex brokers act as intermediaries between traders and the global currency market.

- They provide traders with access to trading platforms, market analysis, and other tools.

What is a Forex Broker?

A forex broker is an entity or individual that facilitates currency trading on behalf of retail traders and institutional investors. Think of them as the bridge between traders and the global forex market. These brokers execute trades on behalf of their clients, provide access to trading platforms, offer technical analysis tools, and even provide educational resources.

A forex broker essentially allows you to enter the fast-paced world of currency trading without requiring you to directly interact with the market.

The Role of a Forex Broker

So, what exactly does a forex broker do? Let’s break it down:

- Provide Access to Market: Forex brokers give traders access to the global forex market, which is otherwise difficult to access as an individual. They connect you to liquidity providers and ensure that you can buy or sell currencies at any time.

- Execution of Trades: When you place a trade on a trading platform, the forex broker executes it on your behalf. They receive your order and find a counterparty to match it. This ensures that your trades are executed smoothly and efficiently.

- Trading Platforms and Tools: Forex brokers provide traders with access to powerful trading platforms where you can analyze the market, place trades, and manage your portfolio. They also offer technical analysis tools, indicators, and real-time market data to help inform your trading decisions.

- Educational Resources: Many forex brokers offer educational resources, including webinars, video tutorials, and ebooks, to help traders enhance their knowledge and skills.

Regulation and Compensation of Forex Brokers

Regulation and safety should be a top priority when choosing a forex broker. The forex industry is regulated by various financial authorities worldwide, such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC) in Australia, and the Securities and Exchange Commission (SEC) in the United States.

Regulated forex brokers are required to adhere to certain standards and comply with rules designed to protect investors. These regulations typically cover areas such as client funds segregation, minimum capital requirements, and transparent pricing.

Forex brokers earn their compensation through spreads, which are the differences between the bid and ask prices of currency pairs. This means that when you trade, you pay a slightly higher price than the current market price, and when you sell, you receive a slightly lower price than the current market price. The spread represents the broker’s profit margin.

In Conclusion

Forex brokers play a crucial role in the world of online trading, providing traders with access to the global currency market and offering essential trading tools and resources. By understanding their role, regulation, and compensation model, you’ll be better equipped to choose a reliable and trustworthy forex broker as you embark on your trading journey.

Remember, always prioritize safety and regulation when selecting a forex broker and never hesitate to research and compare different options to find the one that suits your trading style and preferences.