Finance

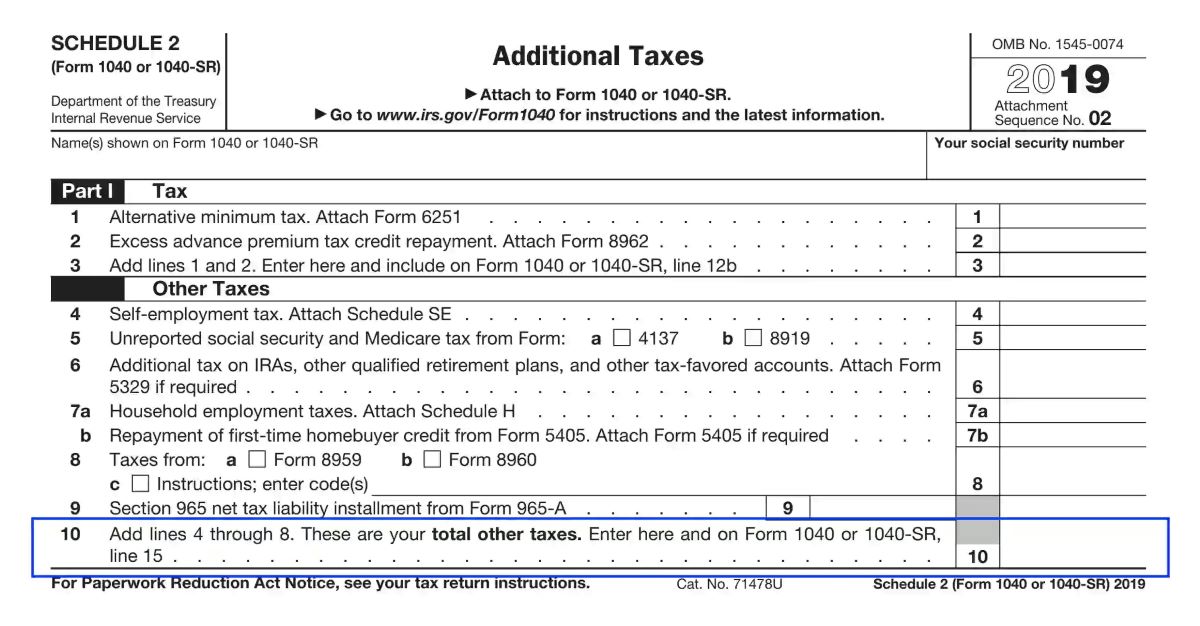

Schedule TO Definition

Published: January 23, 2024

Learn about the schedule to definition in finance and understand its significance in financial planning and reporting. Explore the key aspects and considerations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Schedule TO: A Guide to Takeover Bids in Finance

When it comes to the world of finance, there are many terms and concepts that can be overwhelming for both beginners and seasoned professionals. One such term is Schedule TO, which is an essential component of takeover bids. In this blog post, we will delve into the definition of Schedule TO and provide a comprehensive guide to help you navigate through this crucial aspect of corporate finance.

Key Takeaways:

- Schedule TO is a required form filed with the Securities and Exchange Commission (SEC) by a company conducting a takeover bid.

- It contains important information about the acquiring company, the target company, and the terms of the offer.

Before we dive into the details of Schedule TO, let’s first understand what a takeover bid entails. In the corporate world, a takeover bid refers to the acquisition attempt of one company (the acquirer) to gain control over another company (the target). This can be done through various strategies, such as purchasing a majority of the target company’s shares or merging the two entities.

Now, let’s focus on Schedule TO. When a company decides to make a takeover bid, it is required by the SEC to file a Schedule TO form to disclose crucial information related to the bid. This form provides transparency and ensures that investors have access to all the relevant information they need to make informed decisions.

So, what exactly does Schedule TO include? Here are the key components:

- Information about the Acquiring Company: This section provides details about the company initiating the takeover bid. It typically includes information about the acquirer’s business, financials, and any strategic reasons for the proposed transaction.

- Information about the Target Company: In this section, the Schedule TO form discloses information about the target company. This includes details about its business operations, financial performance, and any potential risks or uncertainties associated with the acquisition.

- Terms and Conditions of the Offer: The Schedule TO form outlines the specific terms and conditions of the takeover bid. This includes the proposed price per share, the timeline for the offer, any potential contingencies, and the overall structure of the transaction.

- Procedures for Accepting the Offer: This section provides instructions for shareholders of the target company on how to accept or reject the takeover bid. It may also outline any additional steps or requirements that need to be fulfilled.

Once the Schedule TO form is filed with the SEC, it becomes publicly available, allowing investors and other interested parties to review the details of the takeover bid. This transparency helps maintain fairness and protects the interests of shareholders.

In conclusion, understanding Schedule TO is crucial for anyone involved in the finance and corporate world. By familiarizing yourself with this requirement, you can navigate takeover bids more confidently and make well-informed decisions. So, whether you are an investor, a financial professional, or simply curious about the intricate world of finance, Schedule TO is a concept worth exploring.