Finance

What Forex Brokers Allow Hedging

Published: January 15, 2024

Discover a list of Forex brokers that allow hedging. Find the best options for your financial needs in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

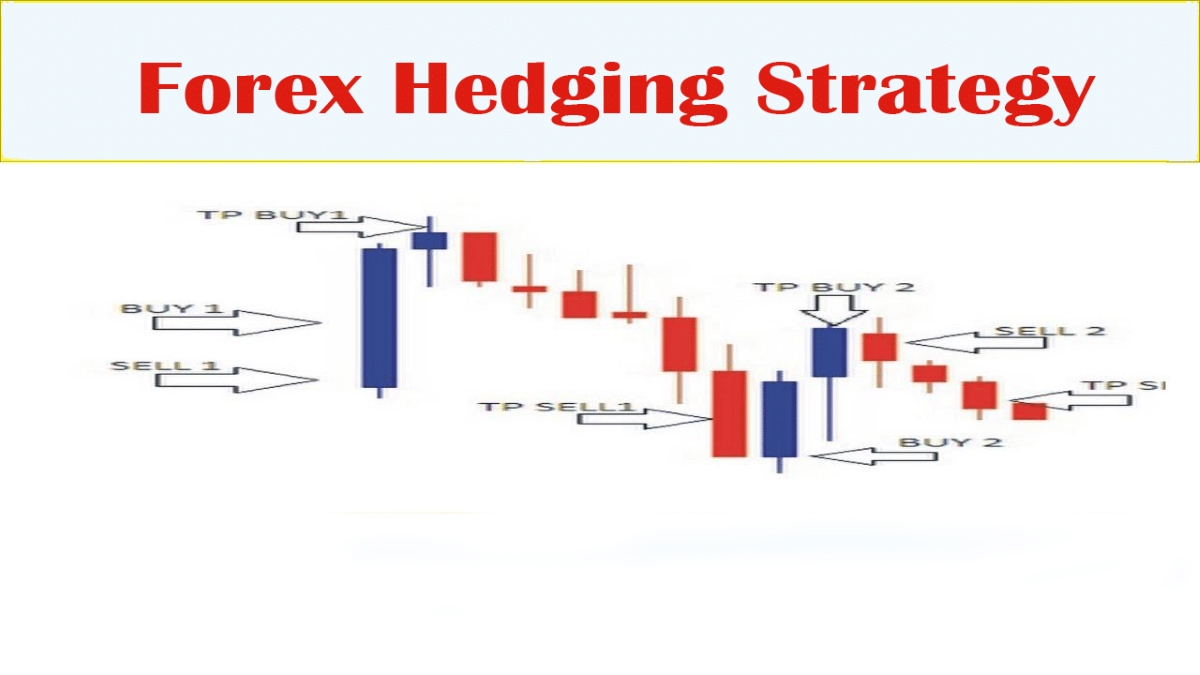

When it comes to forex trading, one of the strategies that traders often employ is hedging. Hedging is a risk management technique that involves opening multiple positions in order to offset potential losses. By effectively hedging their trades, forex traders can protect their investments from adverse market movements and volatility.

However, not all forex brokers permit hedging. Some brokers restrict or outright disallow hedging, while others embrace it and provide traders with the flexibility to employ this strategy. In this article, we will explore why some forex brokers allow hedging and the factors to consider when choosing a broker that permits hedging.

Hedging can be a valuable tool for forex traders. It allows them to reduce the risk associated with their trades by simultaneously taking opposing positions. For example, if a trader is long on a particular currency pair, they may open a short position to hedge against potential losses. This way, if the market moves in the opposite direction to their initial trade, the losses on one position can be offset by the gains on the other.

So why do some forex brokers allow hedging while others restrict or prohibit it? One reason is that allowing hedging gives traders more flexibility and control over their risk management. By allowing hedging, brokers empower traders to implement strategies that align with their trading style and risk tolerance. This can attract experienced traders who value the ability to hedge their positions.

What is hedging in forex trading?

In forex trading, hedging refers to the practice of opening multiple positions in order to offset potential losses. It is a risk management technique that helps traders protect their investments from unfavorable market movements and volatility.

When traders hedge, they take opposing positions to reduce the risk associated with their trades. For example, if a trader is long on a particular currency pair, they may simultaneously open a short position to hedge against potential losses. This way, if the market moves in the opposite direction to their initial trade, the losses on one position can be offset by the gains on the other.

Hedging in forex trading can be done in different ways. One common hedging strategy is using correlated currency pairs. Traders may enter into positions on two currency pairs that have a strong correlation, meaning they tend to move in the same direction. By hedging with correlated pairs, traders can mitigate the risk of their primary trade by taking a position on the opposite pair.

Another hedging technique is using options contracts. Forex options give traders the right, but not the obligation, to buy or sell a currency pair at a specific price within a certain timeframe. They provide a way to hedge against potential losses by limiting the downside risk while still allowing for potential gains if the market moves in the trader’s favor.

It’s essential to note that hedging is not a strategy for generating profits, but rather a risk management tool. The primary goal is to protect the trader’s capital and minimize potential losses. Additionally, hedging can impose additional costs, such as spreads and commissions, so traders must carefully consider the potential impact on their overall trading costs.

Overall, hedging in forex trading helps traders reduce their exposure to market risk and volatility. It can be a valuable tool for both short-term and long-term traders, enabling them to navigate market fluctuations and protect their investments from adverse movements.

Why do some forex brokers allow hedging?

While some forex brokers restrict or prohibit hedging, others embrace and permit this risk management strategy. There are several reasons why these brokers allow hedging:

1. Flexibility for traders: By allowing hedging, forex brokers provide traders with greater flexibility in managing their positions. Hedging enables traders to offset potential losses by opening opposing positions, allowing them to adapt to changing market conditions and mitigate risk.

2. Attracting experienced traders: Allowing hedging can be an attractive feature for experienced traders who value risk management tools. By offering hedging capabilities, brokers can attract seasoned traders who employ advanced strategies and seek more control over their positions.

3. Increased trading volume: Forex brokers typically generate revenue through spreads and commissions. Allowing hedging can encourage traders to increase their trading volume, as they have the option to hedge their positions and engage in more trades. This increased activity can benefit brokers in terms of higher trading volumes and associated fees.

4. Competitive advantage: In a crowded forex brokerage industry, allowing hedging can provide a competitive advantage. Brokers that permit hedging may attract traders who specifically seek this capability, potentially leading to higher client retention rates and attracting clients from competing brokers that do not allow hedging.

5. Client satisfaction and loyalty: By allowing hedging, brokers demonstrate their commitment to meeting the needs of their clients. Traders who prefer to hedge their positions may be more likely to choose and remain loyal to brokers that cater to their risk management preferences. This can contribute to long-term client satisfaction and retention rates.

6. Differentiation in the market: Allowing hedging can serve as a unique selling proposition for forex brokers. In a sea of brokers that have similar offerings, the ability to hedge sets them apart and positions them as an attractive option for traders who prioritize risk management.

While the decision to allow hedging ultimately rests with each forex broker, those that do permit it often do so to meet the demands and preferences of their clients. By offering hedging capabilities, brokers can attract experienced traders, increase trading volumes, differentiate themselves in the market, and enhance client satisfaction – benefits that can contribute to their overall success and reputation within the industry.

Factors to consider when choosing a forex broker that allows hedging

When selecting a forex broker that allows hedging, there are several important factors to consider to ensure the best possible trading experience. Here are some key factors to keep in mind:

1. Hedging policies and restrictions: Although a broker allows hedging, it’s crucial to understand their specific policies and any potential restrictions. Some brokers may have limitations on the number of hedged positions or specific requirements for executing hedging strategies. It’s essential to review and understand these policies before committing to a broker.

2. Trading platform and tools: A robust and user-friendly trading platform is essential for executing hedging strategies effectively. Look for a broker that offers a reliable platform with advanced charting capabilities, risk management tools, and order execution features that support hedging. This will enable you to monitor and manage your hedged positions efficiently.

3. Execution quality: Fast and reliable order execution is crucial for executing hedging strategies successfully. Look for a broker that provides reliable and speedy execution of orders so that you can enter and exit positions effectively. Slippage or delays in execution can impact the effectiveness of hedging strategies.

4. Trading costs: Consider the trading costs associated with hedging. Brokers may charge spreads, commissions, or other fees on trades, which can impact the overall profitability of your hedging strategies. Compare the trading costs of different brokers to find one that offers competitive rates while providing the necessary hedging capabilities.

5. Regulation and security: Ensure that the broker is regulated by a reputable financial authority. Regulation helps protect traders’ funds and ensures fair practices. Additionally, look for brokers that provide robust security measures to safeguard your personal and financial information.

6. Customer support: Hedging strategies can be complex, so having access to reliable customer support is crucial. Choose a broker that offers responsive and knowledgeable customer support to address any concerns or technical issues related to hedging.

7. Educational resources: If you are new to hedging or want to enhance your knowledge, consider brokers that provide educational resources on hedging strategies and risk management. Access to educational materials such as webinars, tutorials, and trading guides can help you understand and implement effective hedging strategies.

8. Reputation and reviews: Research the broker’s reputation and read reviews from other traders. Look for brokers with a strong track record of reliable service, transparency, and positive customer experiences.

When choosing a forex broker that allows hedging, it’s crucial to consider these factors to ensure a positive trading experience. Remember, the broker should align with your trading goals, risk tolerance, and overall trading strategy. Taking the time to evaluate these factors will help you find a broker that suits your needs and preferences for hedging in the forex market.

List of forex brokers that allow hedging

When it comes to choosing a forex broker that allows hedging, it’s important to have a comprehensive list of reputable brokers to consider. Here is a compilation of well-known forex brokers that permit hedging:

1. IG Group: IG allows hedging for forex traders, providing flexibility and risk management capabilities. They offer a user-friendly trading platform alongside educational resources for traders of all experience levels.

2. OANDA: OANDA is a trusted broker that allows hedging. They offer competitive spreads, a reliable trading platform, and a range of advanced charting and analysis tools to support hedging strategies.

3. Pepperstone: Pepperstone is another popular broker that permits hedging. They provide access to multiple trading platforms, including MetaTrader 4 and cTrader, making it convenient for traders to execute and manage hedged positions.

4. IC Markets: IC Markets is known for its low trading costs and tight spreads. They allow hedging and provide traders with a choice of platforms, including MetaTrader 4 and MetaTrader 5, offering a range of hedging capabilities.

5. Forex.com: Forex.com is a regulated broker that allows hedging for forex traders. They offer a user-friendly trading platform, educational resources, and competitive trading conditions to support hedging strategies.

6. FXTM: FXTM (ForexTime) is a global broker that permits hedging. They offer a range of trading accounts, including an ECN account for advanced traders looking to implement hedging strategies.

7. XM: XM is a reputable broker that allows hedging and provides traders with access to a wide range of financial instruments. They offer competitive pricing, multiple trading platforms, and educational resources.

8. ThinkMarkets: ThinkMarkets allows hedging and provides traders with access to a variety of markets, including forex, commodities, and cryptocurrencies. They offer a range of platforms, competitive pricing, and educational resources.

Remember, it’s important to conduct thorough research and consider other factors such as regulation, trading conditions, and customer support when choosing a forex broker. The list above serves as a starting point, but it’s essential to gather more information and compare the offerings of different brokers to find the one that best suits your trading needs and goals.

Conclusion

In conclusion, hedging is a risk management strategy that can be valuable for forex traders looking to protect their investments from adverse market movements. While not all forex brokers allow hedging, there are several reputable brokers that embrace this approach and provide traders with the flexibility to hedge their positions. Choosing a forex broker that allows hedging requires careful consideration of factors such as their hedging policies, trading platforms and tools, execution quality, trading costs, regulation and security, customer support, and educational resources.

Some well-known forex brokers that permit hedging include IG Group, OANDA, Pepperstone, IC Markets, Forex.com, FXTM, XM, and ThinkMarkets. These brokers offer traders the ability to execute and manage hedged positions, providing the necessary tools and support for effective risk management.

It’s crucial to thoroughly research and evaluate different brokers before making a decision. Consider your trading goals, risk tolerance, and overall strategy when choosing a broker that allows hedging. Additionally, read reviews and seek recommendations from other traders to gauge the reputation and reliability of the broker.

By selecting a forex broker that allows hedging and meets your trading needs, you can effectively implement risk management strategies, protect your investments, and navigate the dynamic forex market with confidence.