Home>Finance>Broker: Definition, Types, Regulation, And Examples

Finance

Broker: Definition, Types, Regulation, And Examples

Published: October 19, 2023

Learn about brokers in finance, including their definition, types, regulation, and examples. Explore the world of financial intermediaries in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Broker: Definition, Types, Regulation, and Examples

Looking to understand more about brokers and how they operate? Look no further! In this blog post, we will provide you with a comprehensive guide to brokers – their definition, types, regulation, and real-life examples. Whether you’re a beginner looking to dip your toes into the world of finance or a seasoned investor, this article will provide you with the essential information you need.

Key Takeaways:

- A broker is an intermediary who facilitates buying and selling transactions on behalf of their clients.

- Choosing the right type of broker is important for your specific financial needs and goals.

1. What is a Broker?

A broker, in the financial context, is an individual or firm that acts as an intermediary between buyers and sellers in various markets, such as stocks, bonds, commodities, or currencies. They facilitate the buying and selling of financial instruments on behalf of their clients and earn a commission or fee for their services. Brokers play a crucial role in providing access to financial markets and executing trades efficiently.

2. Types of Brokers

Brokers can be categorized into several types based on the financial markets they operate in and the services they provide. Here are some common types of brokers:

- Stock Broker: These brokers specialize in trading stocks and other securities on stock exchanges. They advise clients on investment decisions and execute trades in the stock market.

- Forex Broker: Forex brokers deal in the foreign exchange market, facilitating currency trading. They provide access to various currency pairs and allow individuals and institutions to trade currencies.

- Commodity Broker: Commodity brokers focus on trading commodities like gold, oil, wheat, and other raw materials in commodity markets. They enable investors to speculate on commodity prices and hedge against price fluctuations.

- Options Broker: Options brokers specialize in options trading, which involves buying and selling options contracts. They assist clients in understanding options strategies and executing trades accordingly.

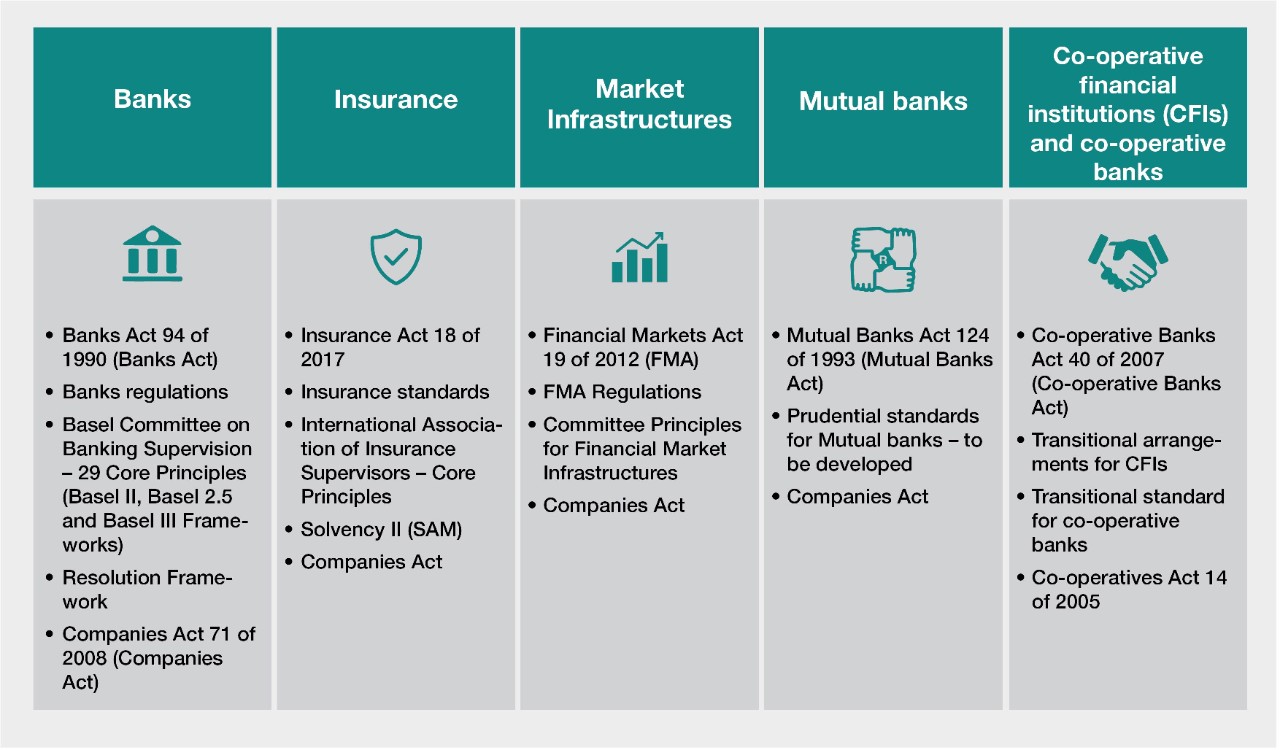

3. Broker Regulation

Regulation is an important aspect to consider when choosing a broker. Regulatory bodies ensure that brokers adhere to certain standards, practices, and ethical guidelines, providing protection to investors. Regulatory requirements may vary from country to country, but some well-known regulatory organizations include:

- Securities and Exchange Commission (SEC): Regulates securities and stock markets in the United States.

- Financial Conduct Authority (FCA): Regulates financial firms and markets in the United Kingdom.

- Australian Securities and Investments Commission (ASIC): Regulates financial markets and services in Australia.

- Financial Services Agency (FSA): Regulates the financial industry in Japan.

4. Real-Life Examples of Brokers

Now that you have a better understanding of brokers, let’s look at a couple of real-life examples:

- Charles Schwab: Charles Schwab is a well-known stock broker that offers a wide range of investment services, including brokerage, banking, and advisory services. They provide access to various investment products and have a user-friendly online trading platform.

- TD Ameritrade: TD Ameritrade is another popular brokerage firm in the United States. They offer a diverse range of investment options, educational resources, and advanced trading tools to help investors make informed decisions.

In conclusion, brokers act as intermediaries in financial markets, facilitating buying and selling transactions on behalf of their clients. Choosing the right broker is crucial for your investment needs, and understanding the types of brokers and regulatory aspects is essential in making an informed decision. We hope this guide has provided you with valuable insights into the world of brokers and their role in the finance industry.

Have you ever worked with a broker? Share your experiences in the comments below!