Home>Finance>Form 1065: U.S. Return Of Partnership Income-Definition, Filing

Finance

Form 1065: U.S. Return Of Partnership Income-Definition, Filing

Published: November 27, 2023

Learn about Form 1065: U.S. Return of Partnership Income in the finance industry. Understand its definition and filing requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Form 1065: U.S. Return of Partnership Income

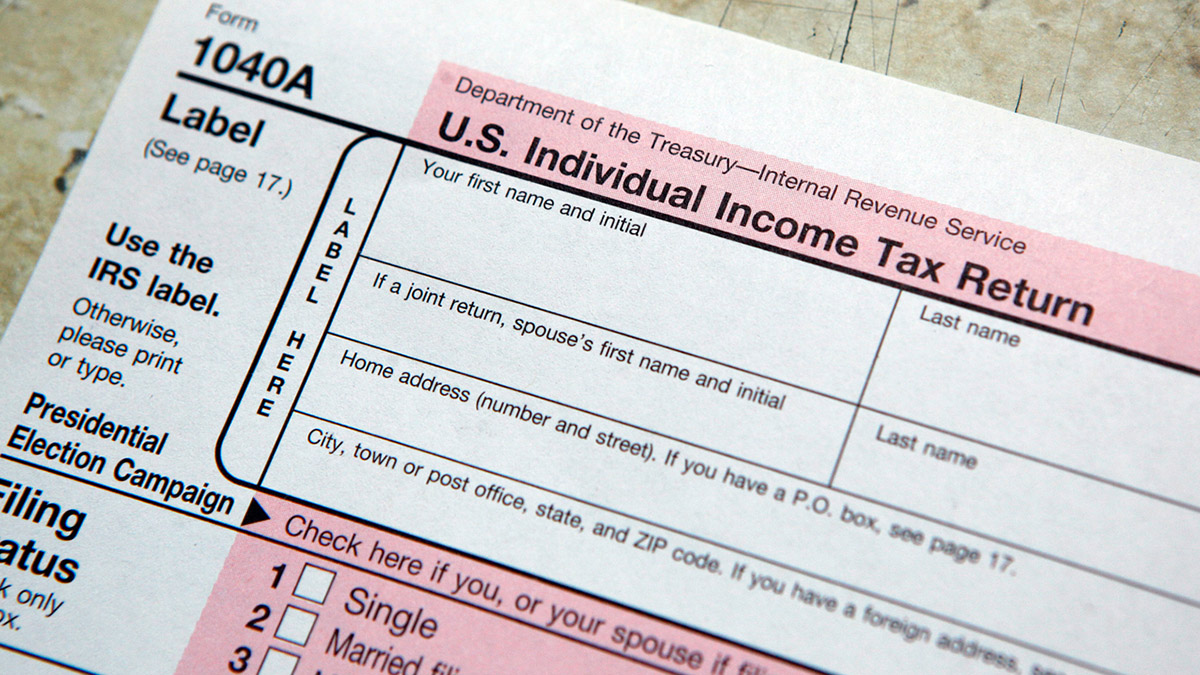

When it comes to managing your finances, it’s essential to have a clear understanding of the different tax forms and requirements. One such form that business owners and partners need to be familiar with is Form 1065: U.S. Return of Partnership Income. This blog post will guide you through the definition of Form 1065 and its filing process, giving you the necessary knowledge to stay compliant and make informed financial decisions for your partnership.

Key Takeaways:

- Form 1065 is used by partnerships to report their income, deductions, and tax liability to the IRS.

- Partnerships are required to file Form 1065 annually, even if they don’t owe any taxes.

So, what exactly is Form 1065 and who needs to file it? Form 1065 is the tax document used by partnerships to report their income, deductions, and tax liability to the IRS. A partnership, according to the IRS, is an entity formed by two or more individuals who join for the purpose of carrying on a trade or business. This form is not used to determine the partnership’s tax liability; instead, it serves as an informational return.

Now that we’ve covered the basics, let’s dive into the filing process. Here are the steps you need to follow to successfully complete and file Form 1065:

- Gather all necessary information: Before you begin filling out Form 1065, ensure you have all the required information at hand. This includes the partnership’s financial records, such as income statements, balance sheets, and expense receipts.

- Complete the form: Form 1065 consists of different sections, each requiring specific information. Provide accurate details regarding the partnership’s income, deductions, and tax credits. It is important to double-check the information to avoid errors.

- Attach Schedule K-1: Each partner must receive a Schedule K-1, which outlines their share of the partnership’s income, deductions, and losses. Attach this form to the filed Form 1065.

- Submit the form: Once the form is completed and the necessary schedules attached, you can submit it to the IRS. Make sure to keep a copy for your records.

Filing Form 1065 is an annual requirement for partnerships, regardless of whether they owe any taxes or not. The deadline for filing is the 15th day of the third month following the end of the partnership’s tax year. However, if your partnership needs more time to prepare the form, you can file for an extension using Form 7004.

In conclusion, as a partner in a business entity, it’s crucial to familiarize yourself with Form 1065 and its filing process. By understanding the purpose and requirements of this form, you can ensure compliance with IRS regulations and maintain accurate financial records for your partnership. Remember, seeking professional guidance from a tax advisor or accountant can help simplify the process and minimize potential errors.