Finance

Where To Mail Form 1099-MISC To IRS

Published: November 1, 2023

Discover where to mail Form 1099-MISC to the IRS for finance-related purposes. Easily navigate the process and ensure compliance with our helpful guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on where to mail Form 1099-MISC to the IRS. If you’re a business owner or self-employed individual, you are likely familiar with the annual filing of tax forms. One important form that must be submitted to the Internal Revenue Service (IRS) is Form 1099-MISC.

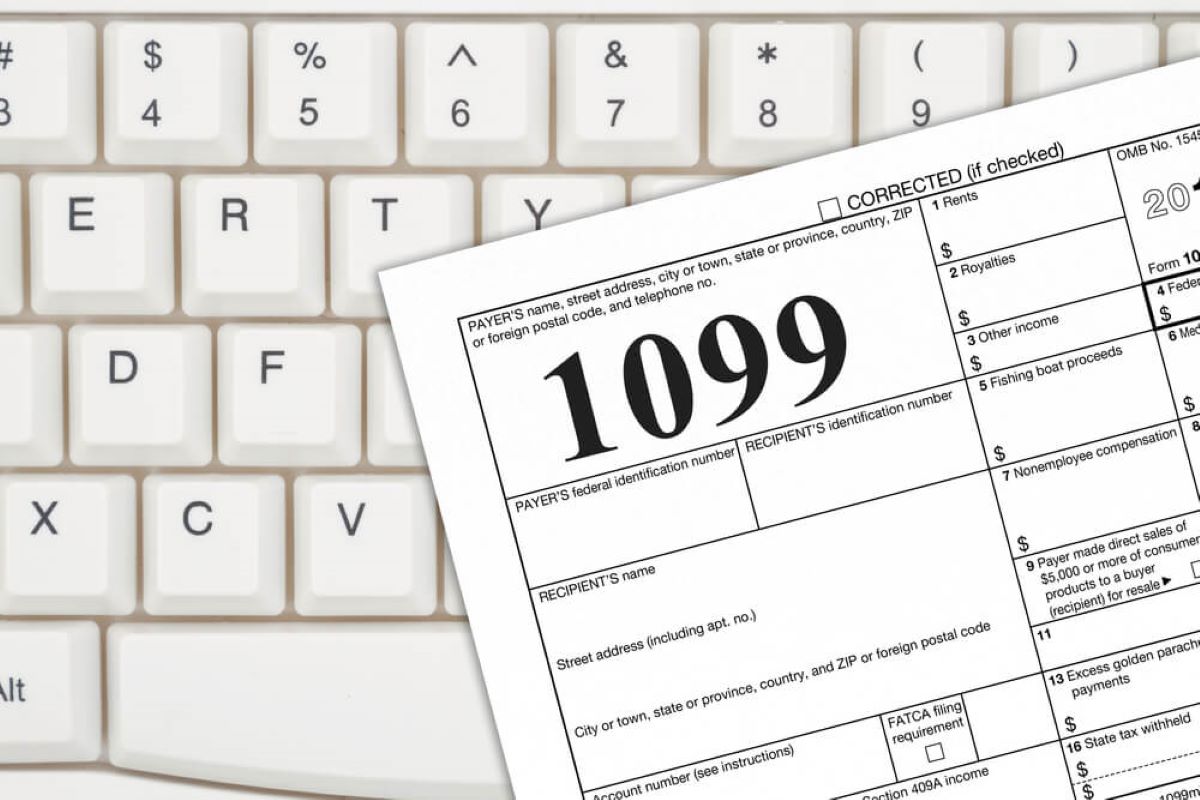

Form 1099-MISC is used to report various types of income other than wages, salaries, and tips. It is typically used to report payments made to independent contractors, freelancers, and other non-employees. As a payer, it is your responsibility to accurately complete and file Form 1099-MISC for each applicable recipient.

Filing Form 1099-MISC is an essential part of complying with your tax obligations and ensuring that the IRS has accurate information on income payments made to non-employees. By submitting this form, you provide the IRS with important data for assessing taxes owed by the recipients and monitoring compliance with tax laws.

In this guide, we will not only discuss where to mail Form 1099-MISC but also provide you with important guidelines and common mistakes to avoid when submitting this form to the IRS. Our aim is to help you navigate the filing process smoothly and efficiently.

Understanding Form 1099-MISC

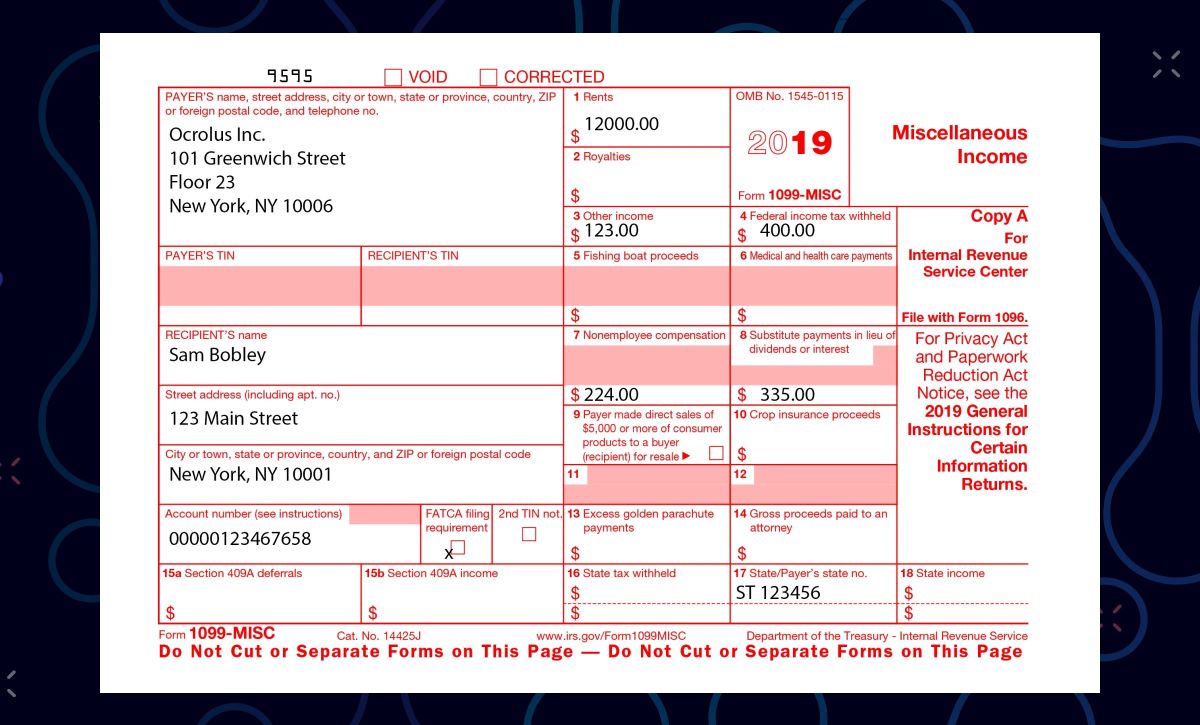

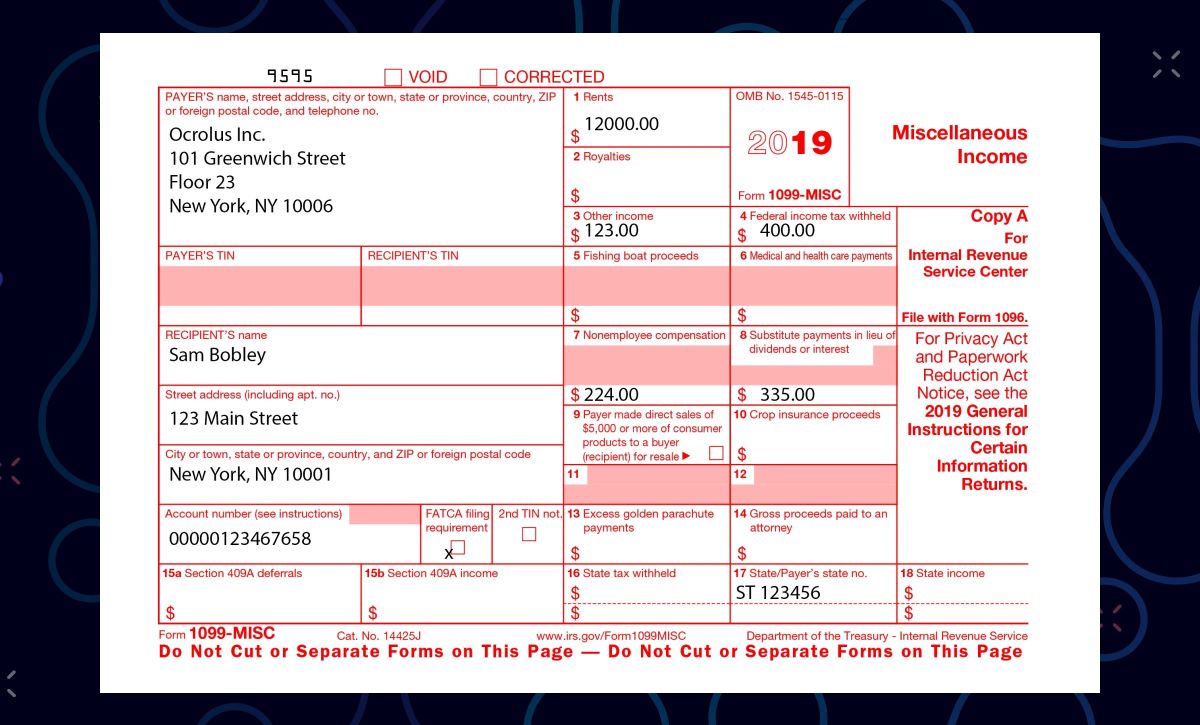

Before we delve into the details of where to mail Form 1099-MISC, it’s important to have a clear understanding of what this form entails. Form 1099-MISC, also known as Miscellaneous Income, is used to report income paid to individuals or other entities who are not considered employees.

Form 1099-MISC captures a wide range of payment types, such as rental income, royalties, nonemployee compensation, and other miscellaneous income. This form is typically used by businesses and self-employed individuals to report payments made to independent contractors, freelancers, and other non-employee individuals or entities.

It is important to note that not all types of income are reported on Form 1099-MISC. For example, employee wages and salaries are reported on Form W-2, which is used specifically for reporting employee compensation.

When completing Form 1099-MISC, you’ll need to gather the necessary information for each recipient, including their name, address, taxpayer identification number (TIN) or social security number (SSN), and the total amount of payments made to them during the tax year. This information is essential for accurate reporting and compliance with IRS regulations.

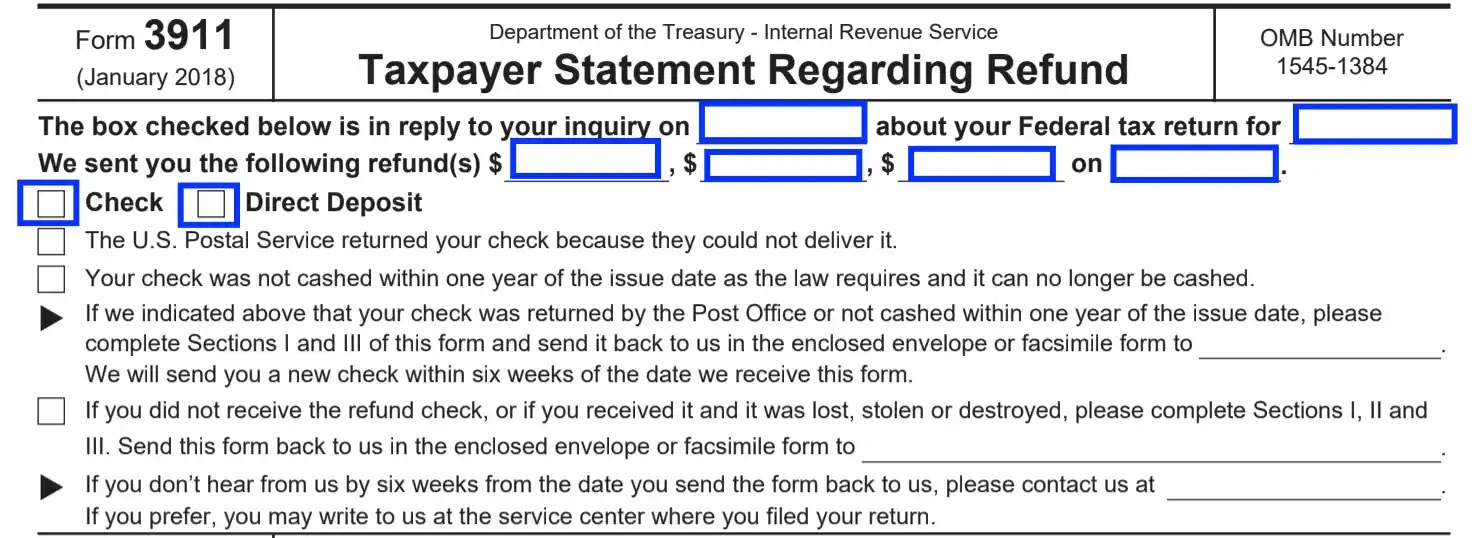

Once you have compiled the required information, you can then move forward with filing Form 1099-MISC. This can be done electronically using the IRS’s online filing system, or by submitting a paper form to the IRS by mail.

Now that we have a basic understanding of Form 1099-MISC, let’s move on to learn about the purpose of filing this form with the IRS.

Purpose of Filing Form 1099-MISC with the IRS

The primary purpose of filing Form 1099-MISC with the IRS is to provide accurate information about payments made to non-employees or entities during the tax year. This form ensures transparency and compliance with tax regulations, allowing the IRS to properly assess taxes owed by the recipients of these payments.

Here are a few key reasons why filing Form 1099-MISC is important:

- Tax Reporting: Form 1099-MISC serves as a tax reporting tool for businesses and self-employed individuals. By filing this form, you inform the IRS about the income paid to independent contractors, freelancers, and other non-employee individuals or entities. The recipients of these payments are required to include this income on their personal tax returns.

- Income Verification: Form 1099-MISC helps the IRS verify the income reported by recipients. It allows the IRS to cross-reference the amounts reported on Form 1099-MISC with the income reported on the recipients’ tax returns. This helps ensure that individuals and entities accurately report their earnings and pay the appropriate amount of taxes.

- Tax Compliance: By filing Form 1099-MISC, you are fulfilling your tax obligations as a payer. This ensures that you are meeting your responsibilities under tax laws and regulations. The IRS may impose penalties for failure to file accurate and timely 1099-MISC forms.

- Record-Keeping: Filing Form 1099-MISC also serves as a record-keeping tool for businesses and self-employed individuals. It provides documentation of the payments made, which can be helpful for future reference or in the event of an IRS audit.

Overall, the purpose of filing Form 1099-MISC is to promote transparency and compliance with tax laws. It allows the IRS to track income payments made to non-employees and ensures that everyone involved in the payment process fulfills their tax obligations.

Now that we understand the purpose of filing Form 1099-MISC with the IRS, let’s move on to the next section where we will discuss where to mail this form.

Where to Mail Form 1099-MISC to the IRS

When it comes to submitting Form 1099-MISC to the IRS, the mailing address will depend on the location of your business and the type of form you are filing. The IRS has specific mailing addresses designated for different regions and types of forms.

To determine the correct mailing address for Form 1099-MISC, you can refer to the instructions provided by the IRS on their official website or consult with a tax professional. However, here are some general guidelines to help you understand where to mail Form 1099-MISC:

- Electronic Filing: If you are filing Form 1099-MISC electronically, you do not need to mail a paper copy to the IRS. Electronic filing provides a faster and more efficient way to submit your forms, and eliminates the need for traditional mail.

- Paper Filing: If you are filing Form 1099-MISC on paper, you will need to mail it to the appropriate IRS location. The specific address will depend on the state where your business is located. The IRS provides a list of addresses for different states in the instructions for Form 1099-MISC. Make sure to carefully review the instructions and select the correct address for your location.

It’s important to note that sending Form 1099-MISC to the wrong address may result in processing delays or your form not being properly recorded by the IRS. To avoid any issues, double-check the mailing address before sending your form to ensure it reaches the correct destination.

In addition to mailing your Form 1099-MISC to the appropriate IRS address, you may also need to provide a copy to the recipient of the income. This copy allows the recipient to accurately report the income on their tax return. Be sure to carefully follow the instructions provided by the IRS for distributing copies to the recipients.

Ultimately, the correct mailing of Form 1099-MISC is vital to ensure compliance with tax regulations and to provide the IRS with accurate information about the income payments you have made. Now that we know where to mail this form, let’s move on to some important guidelines to keep in mind when preparing and mailing Form 1099-MISC.

Important Guidelines for Mailing Form 1099-MISC

When mailing Form 1099-MISC to the IRS, it is crucial to follow certain guidelines to ensure that your form is processed accurately and timely. Here are some important guidelines to consider:

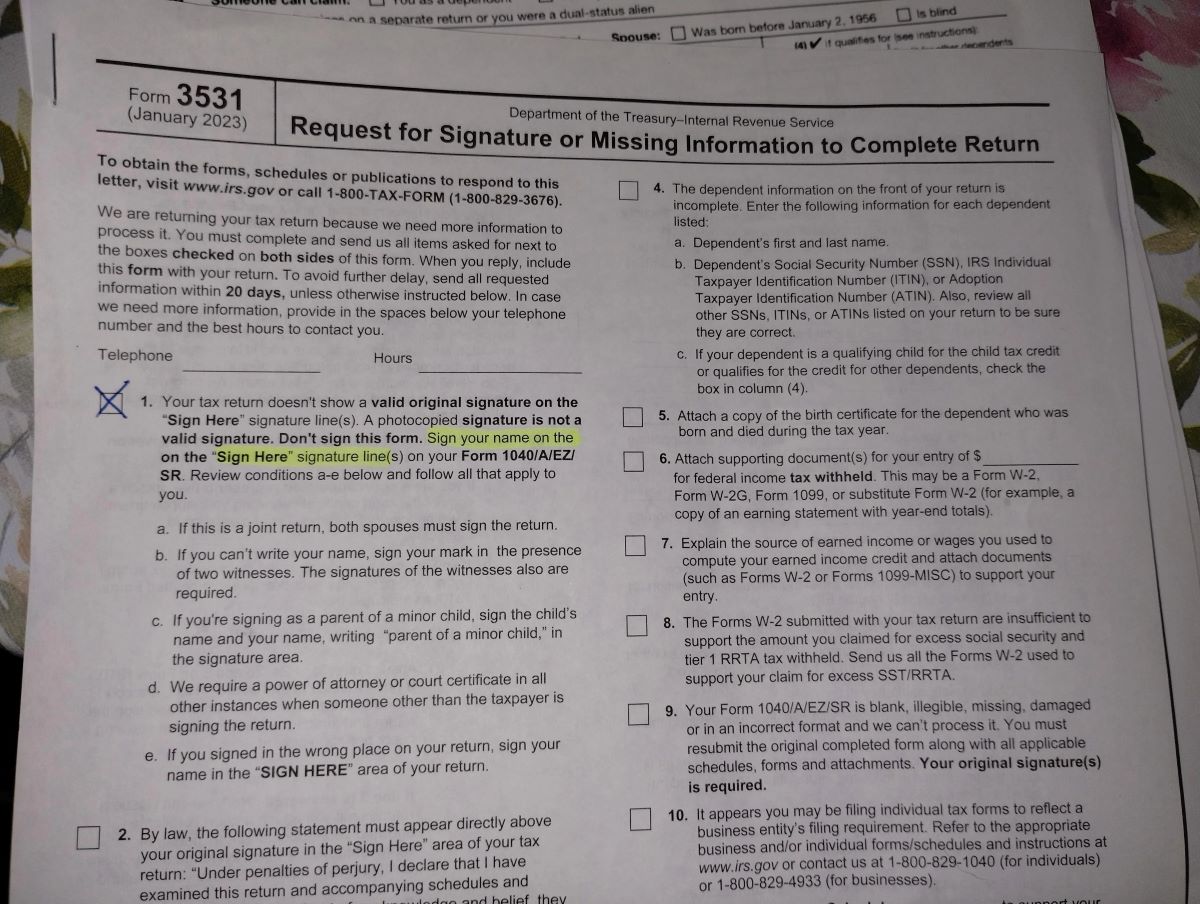

- Use Correct Forms: Make sure you are using the most recent version of Form 1099-MISC provided by the IRS. Using outdated or incorrect forms may lead to errors or delays in processing your submission.

- Complete Forms Accurately: Double-check all the information you enter on Form 1099-MISC to ensure accuracy. This includes recipient names, TINs or SSNs, and payment amounts. Mistakes or omissions may result in processing complications or penalties.

- Include All Necessary Copies: If required, include the appropriate number of copies of Form 1099-MISC to be sent to the IRS and the recipients of the income. Failure to provide necessary copies may result in non-compliance.

- Label and Organize Forms: Clearly label your mail with “Form 1099-MISC” and the tax year for which the form is being filed. Organize the forms in a logical order to facilitate easy processing by the IRS.

- Choose the Right Mailing Service: Utilize a reliable and trackable mailing service when sending your Form 1099-MISC to the IRS. Retain the mailing receipt and related documentation for your records.

- Verify Mailing Address: Ensure that you are mailing your Form 1099-MISC to the correct IRS address based on your business location. Review the IRS instructions or consult with a tax professional to confirm the correct address.

- Meet Deadlines: File and mail Form 1099-MISC to the IRS by the appropriate deadline, which is typically at the end of January for paper filers. Failure to meet the deadline may result in penalties or interest charges.

- Keep Copies for your Records: Retain a copy of Form 1099-MISC and any related documentation for your records. These records will be important for future reference and in case of an audit.

By adhering to these guidelines, you can enhance the accuracy and timeliness of your Form 1099-MISC filing. It is essential to take the necessary precautions to avoid errors, penalties, and delays in processing.

Now that we have covered the important guidelines, let’s move on to the final section where we will discuss common mistakes to avoid while mailing Form 1099-MISC.

Common Mistakes to Avoid While Mailing Form 1099-MISC

When mailing Form 1099-MISC to the IRS, it’s important to be aware of common mistakes that could lead to processing issues or penalties. By avoiding these mistakes, you can ensure a smooth and accurate filing process. Here are some common mistakes to watch out for:

- Incorrect or Incomplete Information: One of the most common mistakes is providing incorrect or incomplete information on Form 1099-MISC. Double-check all the details, including recipient names, addresses, TINs or SSNs, and payment amounts. Inaccurate information may result in processing delays or penalties.

- Missed Deadlines: Failing to meet the filing deadline for Form 1099-MISC can lead to penalties. Make sure you are aware of the deadline, which is typically at the end of January for paper filers. Plan ahead and allow sufficient time to complete and mail the forms to avoid missing the deadline.

- Using Outdated Forms: Always use the most recent version of Form 1099-MISC provided by the IRS. Using outdated or incorrect forms may lead to errors or rejections by the IRS. Check the IRS website or consult with a tax professional to obtain the updated forms.

- Failure to Include Necessary Copies: Ensure that you include all necessary copies of Form 1099-MISC, both for the IRS and the recipients of the income. Failure to provide these copies may result in non-compliance and may complicate the tax reporting process for the recipients.

- Missing or Incorrect TINs or SSNs: Accurate taxpayer identification numbers (TINs) or social security numbers (SSNs) are crucial when reporting income on Form 1099-MISC. Ensure that you have the correct TINs or SSNs for each recipient and double-check the accuracy before filing. Incorrect or missing TINs or SSNs can lead to penalties or rejections.

- Not Verifying Mailing Address: Verify the correct mailing address for your location before sending Form 1099-MISC to the IRS. The IRS has specific addresses for different regions and form types. Sending the form to the wrong address may result in processing delays or your form not being properly recorded.

- Failure to Keep Copies: It is essential to keep copies of Form 1099-MISC and any related documentation for your records. These copies will be useful for future reference or in the event of an IRS audit. Failure to maintain proper records could make it difficult to resolve issues or respond to inquiries in the future.

By being aware of these common mistakes and taking the necessary precautions, you can minimize errors and ensure the accurate and timely submission of Form 1099-MISC to the IRS. Now, let’s conclude our guide on mailing Form 1099-MISC.

Conclusion

Filing Form 1099-MISC with the IRS is an important responsibility for businesses and self-employed individuals who make payments to non-employees. Understanding where to mail this form and following the correct procedures ensures compliance with tax regulations and promotes transparency in reporting income.

In this guide, we have covered the key aspects of mailing Form 1099-MISC, including understanding the purpose of filing this form, knowing where to mail it, important guidelines to follow, and common mistakes to avoid.

It’s crucial to use the correct forms, complete them accurately, and include all necessary copies when mailing Form 1099-MISC to the IRS. Verifying the mailing address, meeting deadlines, and keeping copies for your records are vital steps to ensure a smooth filing process.

By avoiding common mistakes and following the guidelines provided, you can ensure that your Form 1099-MISC is processed accurately and in a timely manner. Remember, accurate reporting and compliance with tax laws are essential for maintaining a good standing with the IRS and avoiding potential penalties.

If you have any doubts or need further assistance, it is always advisable to consult with a tax professional or refer to the official IRS instructions for Form 1099-MISC.

We hope this guide has been informative and helpful in understanding where to mail Form 1099-MISC to the IRS. Stay diligent in your tax obligations and continue to stay informed about any updates or changes in tax regulations to ensure a smooth filing process year after year.