Home>Finance>Form 2848: Power Of Attorney And Declaration Of Representative Definition

Finance

Form 2848: Power Of Attorney And Declaration Of Representative Definition

Published: November 27, 2023

Learn the definition and purpose of Form 2848: Power of Attorney and Declaration of Representative in finance, granting legal authority to act on behalf of taxpayers.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Form 2848: Power of Attorney and Declaration of Representative Definition

When it comes to managing your finances, there are numerous forms and documents that play a crucial role in ensuring smooth and legal operations. One such form is Form 2848, commonly known as the Power of Attorney and Declaration of Representative. In this blog post, we will dive into the details of Form 2848, its definition, and how it can benefit you in matters relating to your finances.

Key Takeaways:

- Form 2848 authorizes an individual or organization to act as your representative in financial matters with the Internal Revenue Service (IRS).

- By using Form 2848, you grant your representative the authority to perform specific tasks on your behalf, such as filing tax returns, responding to IRS inquiries, and accessing your financial information.

What is Form 2848?

Form 2848, also known as the Power of Attorney and Declaration of Representative, is a legal document that grants another person or organization the power to act on your behalf in financial matters with the IRS. When you fill out this form, you effectively authorize your chosen representative to perform specific tasks and make decisions regarding your taxes and finances.

So why would you need to grant someone else the authority to represent you before the IRS? There are several reasons why individuals or businesses choose to use Form 2848. Some common scenarios include:

- 1. Limited Availability: If you are frequently unavailable due to travel, illness, or any other reason, having a trusted representative handle your financial matters ensures that important tasks are taken care of in a timely manner.

- 2. Expertise and Experience: Sometimes, the complexities of tax laws and regulations can be overwhelming for individuals. By appointing a representative, you gain access to their expertise and experience, allowing you to navigate through any tax-related issues more efficiently.

- 3. Convenience: Having a designated representative can save you time and effort when it comes to dealing with the IRS. They can handle correspondence, inquiries, and other interactions with the IRS on your behalf.

Now that we understand the why, let’s explore how to fill out Form 2848.

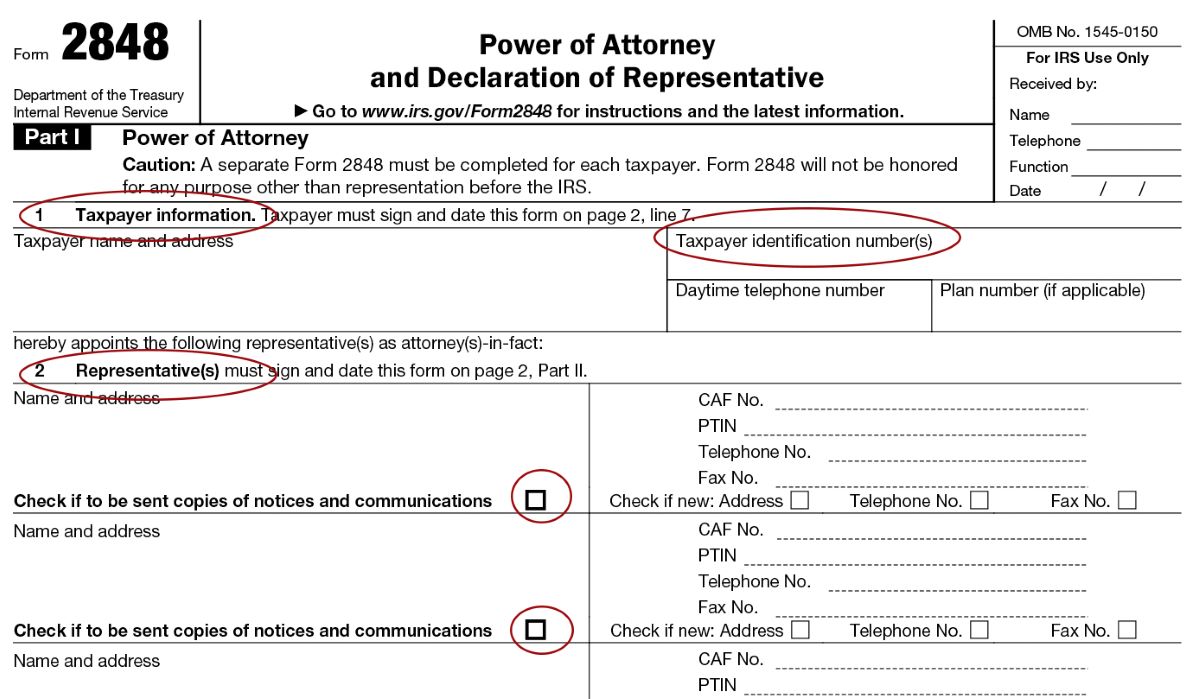

How to Fill out Form 2848

Filling out Form 2848 requires attention to detail and accuracy to ensure that your representative is authorized correctly. Here’s a step-by-step guide:

- Step 1: Enter your name and contact information at the top of the form.

- Step 2: Identify your representative by providing their name, contact information, and their relationship to you.

- Step 3: Specify the tax matters for which you are authorizing the representative. This may include filing tax returns, responding to inquiries, or accessing your financial information. Be clear and explicit in listing the specific tasks.

- Step 4: Sign and date the form to validate your authorization.

It is essential to review the completed form carefully before submission to avoid any errors that may invalidate the power of attorney. Also, keep in mind that Form 2848 typically expires after one year, so it is crucial to review and renew it as needed.

Final Thoughts

Form 2848, the Power of Attorney and Declaration of Representative, enables you to grant someone else the authority to represent you in financial matters with the IRS. By appointing a representative, you can save time, benefit from their expertise, and ensure that your financial affairs are managed efficiently. Remember to follow the instructions carefully when filling out the form to ensure its validity. If you need assistance or have any questions, consult with a qualified tax professional for guidance.