Finance

Delivery Instrument Definition

Published: November 10, 2023

Discover the meaning of delivery instruments in the finance industry. Learn how these instruments are used for transactions and more.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Finance: A Guide to Delivery Instruments

Finance is a vast and complex field that encompasses various aspects of managing money, investments, and financial instruments. One such important aspect is the use of delivery instruments, which play a crucial role in facilitating transactions in the financial marketplace. In this blog post, we will explore the definition, types, and key characteristics of delivery instruments, shedding light on their significance in the world of finance.

Key Takeaways:

- Delivery instruments are financial instruments used as a mechanism to transfer assets or funds from one party to another.

- They provide security and transparency in transactions, ensuring that both parties fulfill their obligations.

What are Delivery Instruments?

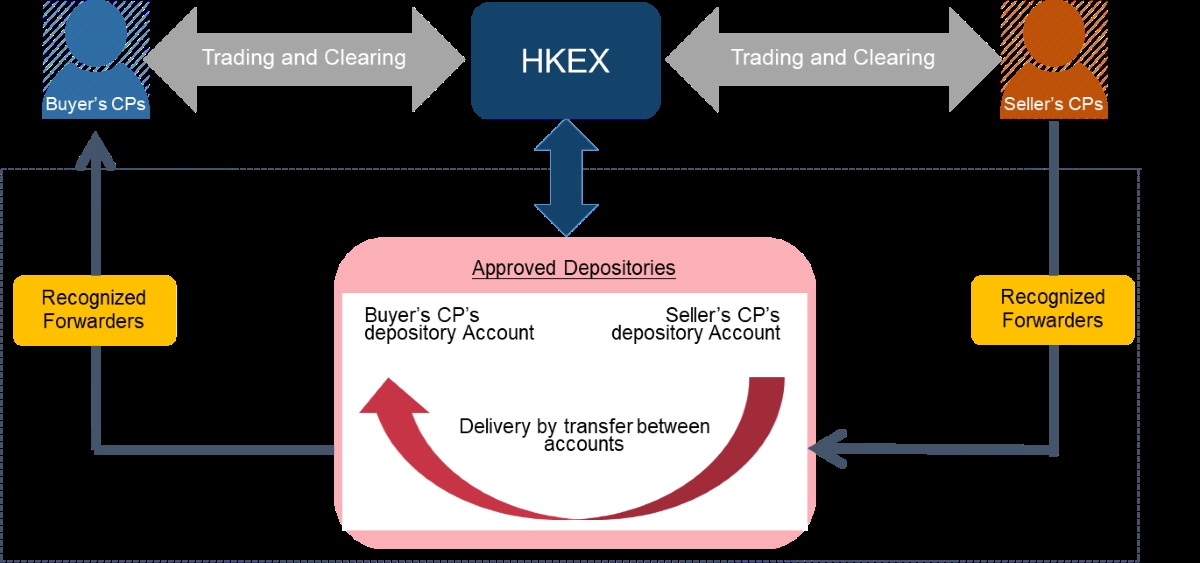

Delivery instruments, in the context of finance, are a specific type of financial instrument used to transfer assets or funds from one party to another. They act as a means of fulfilling contractual obligations, ensuring the smooth and secure exchange of goods or services. These instruments are legal agreements that outline the terms and conditions of the transaction, providing a level of transparency and accountability for involved parties.

In simple terms, delivery instruments serve as proof of ownership or entitlement to a specific asset or amount of money. They facilitate the transfer of these assets or funds, ensuring that all parties involved are protected and can rely on the fulfillment of contractual obligations. Delivery instruments are widely used in various financial transactions, including trade finance, derivatives, and investment agreements.

Now, let’s explore some common types of delivery instruments:

Types of Delivery Instruments

- Bill of Lading: A bill of lading is a delivery instrument used in international trade to acknowledge the receipt of goods for shipping. It serves as evidence of the contract of carriage between the shipper and the carrier, ensuring the safe and timely delivery of goods to the intended recipient.

- Warehouse Receipt: A warehouse receipt is a document issued by a warehouse keeper, acknowledging the deposit of goods into storage. It represents ownership and entitlement to the stored goods and enables their transfer to a new owner.

- Stock Certificates: Stock certificates are physical or electronic documents that represent ownership in a company. They serve as delivery instruments, allowing the transfer of ownership and facilitating the trading of stocks in the financial markets.

- Promissory Notes: Promissory notes are written agreements in which one party promises to pay a specified sum to another party at a determined future date or on demand. They serve as delivery instruments for debt obligations, ensuring the repayment of borrowed funds.

- Checks: Checks are widely recognized as delivery instruments for the transfer of funds from one bank account to another. They provide a secure and convenient way to make payments, acting as a guarantee of payment by the issuing party.

Key Characteristics of Delivery Instruments

Delivery instruments share several key characteristics that make them essential in financial transactions:

- Enforceable Contracts: Delivery instruments are legally binding contracts that outline the terms and conditions of a transaction. They provide an enforceable mechanism to ensure that all parties fulfill their obligations.

- Transferability: Most delivery instruments are designed to be easily transferable, allowing the smooth transfer of ownership or funds from one party to another.

- Security: Delivery instruments often include security features to protect against fraud, counterfeiting, or unauthorized access.

- Transparency: These instruments provide transparency by clearly stating the rights and obligations of the involved parties, ensuring a fair and accountable transaction process.

The Significance of Delivery Instruments in Finance

Delivery instruments play a vital role in the world of finance by providing a reliable and secure mechanism for transferring assets or funds. They establish trust between parties involved in a transaction and minimize the risk of non-payment or non-delivery. By utilizing delivery instruments, financial markets and institutions can operate efficiently, enabling trade, investments, and commercial activities to thrive.

In conclusion, delivery instruments are an indispensable part of the finance industry. Whether it’s transferring ownership of goods, circulating funds, or facilitating investments, these instruments ensure the smooth, secure, and accountable exchange of assets and funds. Understanding the types and characteristics of delivery instruments is crucial for navigating the complexities of the financial world and ensuring the integrity of transactions.