Home>Finance>How A Personal Budget Relates To And Takes Into Account Your Personal Financial Goals

Finance

How A Personal Budget Relates To And Takes Into Account Your Personal Financial Goals

Published: December 23, 2023

Learn how to effectively manage your personal finance with a personalized budget that aligns with your financial goals. Understand the importance of integrating your personal goals into your budgeting strategy and achieve financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Personal Financial Goals

- Defining a Personal Budget

- The Importance of Aligning Your Budget with Financial Goals

- Incorporating Your Financial Goals into a Budget

- Tracking Progress towards Financial Goals through Your Budget

- Modifying Your Budget to Achieve Financial Goals

- Common Challenges in Balancing Budget and Financial Goals

- Conclusion

Introduction

When it comes to managing your personal finances, it’s important to have a clear understanding of your goals and how they relate to your overall financial well-being. One crucial aspect of this is the establishment of a personal budget, which acts as a roadmap to help you achieve your financial aspirations.

Your personal financial goals are unique to your circumstances and desires. They may include milestones such as saving for a down payment on a new home, paying off debt, or building an emergency fund. By creating a personal budget that takes into account these goals, you can effectively track your progress and make informed decisions about your spending and saving habits.

A personal budget, in simple terms, is a comprehensive plan that outlines your income and expenses on a monthly or yearly basis. It serves as a guide to help you allocate your resources efficiently towards meeting your financial objectives. By implementing a well-defined budget, you can gain control over your finances, reduce unnecessary expenses, and direct your resources towards what matters most to you.

The relationship between your personal budget and financial goals is crucial. Your budget acts as a tool that supports and aligns with your aspirations, ensuring that you are making the necessary financial moves to achieve them. It empowers you to make conscious decisions about your spending, saving, and investing habits, ultimately propelling you towards a more secure financial future.

In this article, we will explore how a personal budget relates to and takes into account your personal financial goals. We will delve into the importance of aligning your budget with your aspirations, the process of incorporating your goals into a budget, and how to track your progress towards your financial milestones. Additionally, we will discuss the potential challenges you may encounter when balancing your budget and goals, as well as strategies for overcoming them.

By the time you finish reading this article, you will have a clearer understanding of how a personal budget plays a pivotal role in achieving your financial aspirations. So, let’s dive in and explore the relationship between your personal budget and your personal financial goals.

Understanding Personal Financial Goals

Your personal financial goals are the specific objectives you set for yourself to achieve a desired level of financial security and success. These goals can encompass various aspects of your financial life, such as saving, investing, debt reduction, and improving your overall financial well-being.

When it comes to setting personal financial goals, it’s important to be specific and realistic. A general goal like “saving money” may not provide enough direction or motivation to stay on track. Instead, consider defining your goals in more precise terms, such as “saving $10,000 for a down payment on a house in the next two years” or “paying off $5,000 of credit card debt within six months.”

Having clear and well-defined financial goals is essential because they provide direction and purpose to your financial decisions. They serve as a roadmap and a source of motivation, helping you prioritize your spending and savings in a way that aligns with your aspirations.

Personal financial goals can be categorized into short-term, medium-term, and long-term objectives. Short-term goals typically span a few months to a year and may include building an emergency fund, paying off smaller debts, or saving for a vacation. Medium-term goals have a time horizon of 2-5 years and may involve larger purchases like a car or a down payment for a home. Long-term goals, on the other hand, are typically more than five years away and often revolve around retirement planning, education funding, or leaving a financial legacy for future generations.

By understanding your personal financial goals and categorizing them based on their timeline, you can better prioritize your resources and make informed decisions about where to allocate your money. This understanding also helps you create a personal budget that aligns with your goals and provides a roadmap for achieving them.

Ultimately, personal financial goals are unique to each individual or family and can vary based on factors such as income, lifestyle, and personal values. It’s essential to take the time to reflect on what matters most to you and what you want to achieve financially. This self-reflection will serve as a solid foundation for the rest of the budgeting process and help you stay motivated as you work towards your goals.

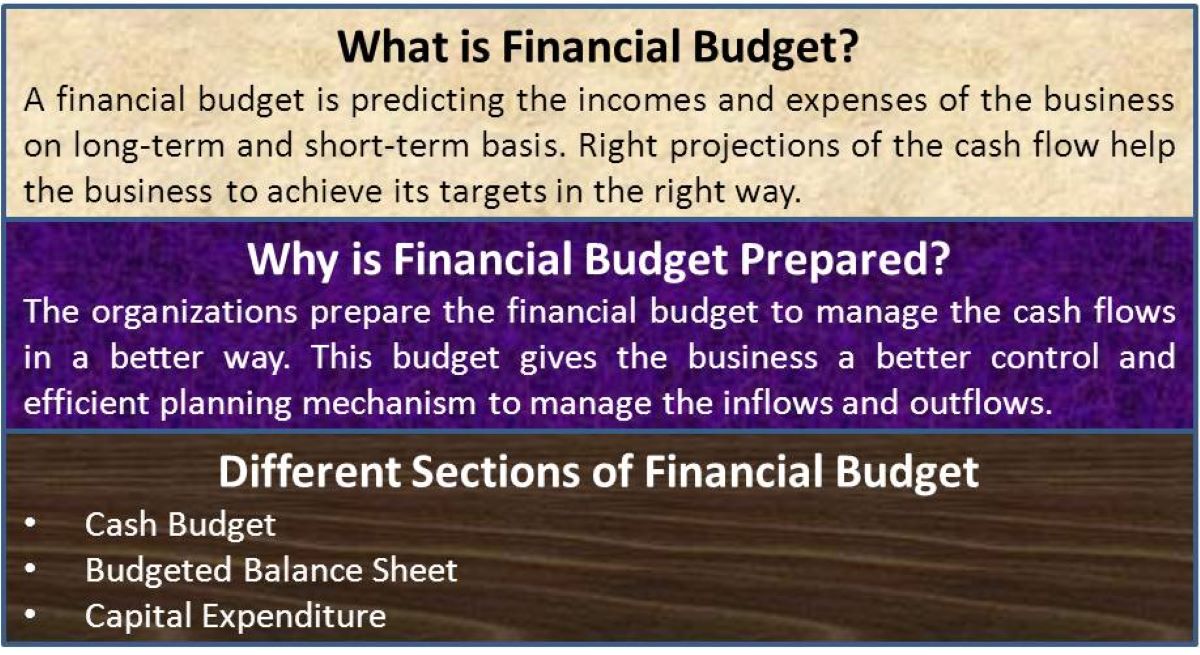

Defining a Personal Budget

A personal budget is essentially a financial plan that outlines your income and expenses over a specific period, typically on a monthly or yearly basis. It provides a detailed snapshot of your financial situation and helps you make informed decisions about how to allocate your money.

To create an effective personal budget, it’s important to gather accurate information about your income and expenses. Start by identifying all sources of income, including your salary, freelance work, rental income, or any other money that comes into your household. Next, collect data on your expenses, categorizing them into fixed expenses (such as rent/mortgage, utilities, and insurance) and variable expenses (such as groceries, entertainment, and discretionary spending).

Once you have a clear picture of your income and expenses, subtract your total expenses from your total income to calculate your discretionary income. This is the money left over after covering all necessary expenses and is available for savings, debt repayment, or other financial goals.

In addition to income and expenses, a personal budget should also account for irregular or unexpected costs. These may include medical expenses, car repairs, or home maintenance. Allocating a portion of your budget to an emergency fund can help you prepare for these unforeseen expenses and avoid financial stress.

A personal budget can be created in various formats, from pen and paper to spreadsheets or budgeting apps. Choose a method that works best for you, considering your comfort level with technology and your organizational preferences.

When defining your budget, it’s important to ensure that it is realistic and flexible. It should align with your financial goals and take into account any changes or adjustments that may occur in your income or expenses. Remember that a budget is a living document that should be regularly reviewed and updated as your financial situation evolves.

A well-defined personal budget allows you to track your spending, identify areas where you may be overspending, and make adjustments to ensure your financial goals are met. It provides a sense of control over your finances, empowering you to make conscious financial decisions and avoid unnecessary debt.

Ultimately, creating a personal budget is an essential step towards achieving your financial goals. It allows you to have a clear understanding of your income, expenses, and savings, providing a framework for smart financial management and helping you build a solid foundation for a secure financial future.

The Importance of Aligning Your Budget with Financial Goals

Aligning your personal budget with your financial goals is critical for achieving long-term financial success. By ensuring that your budget reflects your aspirations and priorities, you are more likely to make informed financial decisions and stay motivated to achieve your goals. Here are some key reasons why aligning your budget with your financial goals is essential:

1. Clear direction: When your budget is in line with your financial goals, it provides a clear roadmap for how to allocate your resources. It helps you prioritize your spending and saving, ensuring that your money is directed towards what truly matters to you. This clarity allows you to make conscious financial choices and avoid frivolous spending that could hinder your progress.

2. Focus and motivation: Aligning your budget with your financial goals keeps you focused and motivated. Seeing your progress towards your goals, whether it’s paying off debt or saving for a down payment, can be incredibly motivating. It serves as a reminder of the bigger picture and the positive impact your financial decisions are making towards achieving your aspirations.

3. Accountability and discipline: A budget that aligns with your goals holds you accountable for your financial actions. It establishes boundaries and guidelines for your spending and saving habits, helping you develop discipline and make responsible choices. It’s easier to resist impulse purchases when you are aware of the impact they may have on your ability to achieve your goals.

4. Financial progress tracking: When your budget is aligned with your goals, it becomes a tool for tracking your financial progress. Regularly reviewing your budget allows you to monitor your income, expenses, and savings, and compare them to your desired milestones. This tracking helps you stay on course, make adjustments when necessary, and celebrate your accomplishments along the way.

5. Reducing financial stress: Having a budget that aligns with your goals can alleviate financial stress. It provides a sense of control and confidence over your financial situation, knowing that you are actively working towards your aspirations. A well-aligned budget helps you avoid excessive debt, build a safety net, and prepare for unforeseen circumstances, providing peace of mind and financial security.

Remember, aligning your budget with your financial goals is an ongoing process. It requires regular evaluation, adjustments, and a willingness to adapt as your goals or circumstances change. Strive for a balance between meeting your current needs and preparing for the future, ensuring that your budget supports both short-term and long-term financial objectives.

By aligning your budget with your financial goals, you create a solid foundation for achieving financial success. It empowers you to take control of your finances, make informed choices, and ultimately turn your dreams into a reality.

Incorporating Your Financial Goals into a Budget

Integrating your financial goals into your budget is a crucial step towards achieving them. It involves aligning your income, expenses, and savings with your desired milestones. Here’s a step-by-step guide on how to incorporate your financial goals into your budget:

1. Identify your financial goals: Begin by clearly defining your financial goals. Whether it’s paying off debt, saving for retirement, or buying a home, be specific and establish a timeframe for each goal. This clarity will serve as a foundation for the rest of the process.

2. Prioritize your goals: Determine the level of priority for each of your financial goals. Assigning a priority will help you allocate resources more effectively and make informed decisions on where to concentrate your efforts.

3. Evaluate your current financial situation: Assess your income, expenses, and existing savings. Understanding your financial standing will help you determine how much you can allocate to your goals and identify areas where you may need to make adjustments.

4. Set realistic targets: Establish realistic targets for each financial goal. Consider your income, expenses, and other financial commitments when setting these targets. Setting attainable milestones will help you stay motivated and avoid frustration.

5. Create a budget framework: Establish a budget framework that includes categories for income, fixed expenses, variable expenses, savings, and debt payments. Allocate amounts to each category based on your goals and priorities. Ensure that your income exceeds your expenses, leaving room for savings and goal contributions.

6. Adjust your spending: Review your current spending habits and identify areas where you can cut back or make adjustments to free up funds for your goals. This may involve reducing discretionary expenses, renegotiating bills, or finding ways to save on everyday expenses.

7. Automate savings and debt payments: Automate your savings contributions and debt payments to ensure they are consistently made. Set up automatic transfers to separate accounts earmarked for specific goals. This approach ensures that you prioritize your goals and reduces the temptation to divert funds elsewhere.

8. Regularly review and adjust: Make it a habit to review your budget regularly, ideally on a monthly basis. Evaluate your progress, reassess your goals, and make any necessary adjustments. Life circumstances and priorities may change, and your budget should reflect these changes.

9. Stay motivated and accountable: Stay motivated by regularly tracking your progress towards your goals. Celebrate milestones along the way and seek accountability through support from friends, family, or financial communities. Sharing your goals and progress can provide extra motivation and support.

10. Seek professional guidance: If needed, consider seeking guidance from a financial advisor or planner. They can provide expert advice, help you break down complex goals, and ensure your budget is well-aligned with your long-term financial objectives.

Incorporating your financial goals into your budget requires discipline, commitment, and regular assessment. Remember, it’s important to strike a balance between enjoying the present while also planning for your future. With a well-structured budget, you can make meaningful progress towards your financial goals and create a path towards financial success.

Tracking Progress towards Financial Goals through Your Budget

Tracking the progress you make towards your financial goals through your budget is essential for staying on track and achieving your desired milestones. By monitoring your income, expenses, and savings, you can measure your progress, make adjustments as needed, and stay motivated. Here’s how you can effectively track your progress towards your financial goals through your budget:

1. Regularly review your budget: Set aside time each month to review your budget. Compare your actual income and expenses with what you had planned. This allows you to identify any discrepancies and take corrective actions.

2. Track your expenses: Keep a record of your day-to-day expenses to accurately track your spending. Utilize budgeting apps or spreadsheets to categorize your expenses and gain a clear understanding of where your money is going.

3. Measure against your goals: Regularly measure your progress against each of your financial goals. Determine how much you have saved or paid off and how much remains to be achieved. Having a visual representation of your progress can serve as a motivator to stay focused.

4. Adjust your budget as needed: Life circumstances and financial goals may change along the way. Be prepared to make adjustments to your budget to reflect these changes. This may involve reallocating funds from one goal to another, increasing or reducing monthly contributions, or revising your target completion dates.

5. Celebrate milestones: Celebrate each milestone you reach along the way. It’s important to acknowledge your progress and reward yourself for the hard work and dedication you put into achieving your financial goals. This can help to boost motivation and maintain a positive mindset.

6. Seek support and accountability: Share your financial goals and progress with someone you trust, such as a friend, family member, or financial advisor. Having someone to hold you accountable and provide support can be immensely beneficial throughout your financial journey.

7. Monitor your debt repayment: If your financial goals include paying off debt, track your progress closely. Keep an eye on your debt balances and the interest you are paying. As you make additional payments, the progress you see will inspire you to continue working towards becoming debt-free.

8. Stay motivated: Maintain your motivation by visualizing the positive impact achieving your financial goals will have on your life. Whether it’s financial freedom, a sense of security, or the ability to pursue your passions, reminding yourself of the long-term benefits can keep you focused on your journey.

9. Analyze areas for improvement: Continuously look for areas where you can improve your financial management. Identify any patterns of overspending or habits that hinder your progress. Take steps to address these areas and make changes to your budget and spending behavior accordingly.

10. Review and reflect: Take time to reflect on your financial journey and the progress you’ve made. Recognize the lessons you’ve learned along the way and use them to improve your budgeting skills and strategies for future goals.

Remember, tracking progress is an ongoing process that requires commitment and regular reassessment. By closely monitoring your budget and progress towards your financial goals, you have the power to make adjustments, stay motivated, and ultimately achieve the financial success you desire.

Modifying Your Budget to Achieve Financial Goals

As you progress towards your financial goals, it’s important to be flexible with your budget and make modifications when necessary. Life circumstances, unexpected expenses, or changes in priorities may require adjustments to ensure you stay on track. Here are some key strategies for modifying your budget to achieve your financial goals:

1. Regularly reassess your goals: Take the time to reassess your financial goals periodically. As your circumstances change or new opportunities arise, your goals may need to be adjusted. Whether it’s a change in income, a shift in priorities, or a new financial objective, ensure your goals remain relevant and attainable.

2. Review your budget categories: Evaluate your budget categories and determine if they need to be modified. Are there areas where you can cut back or reallocate funds towards your goals? Consider adjusting discretionary spending, entertainment expenses, or subscription services to free up money for important financial milestones.

3. Increase your savings contributions: If your current budget doesn’t allow for substantial savings contributions, consider finding ways to increase your income or reduce expenses. Look for opportunities to slash unnecessary costs and redirect those funds towards your savings goals. Even small adjustments can add up over time.

4. Prioritize your debt repayment: If paying off debt is one of your financial goals, consider modifying your budget to allocate more funds towards debt repayment. Explore strategies like the snowball or avalanche method to accelerate debt payoff and free up cash flow for other goals.

5. Automate your savings: Automating your savings contributions is an effective way to ensure you’re consistently saving towards your goals. Set up automatic transfers from your checking account to separate savings accounts dedicated to each specific goal. This removes the temptation to spend those funds elsewhere and fosters a disciplined saving habit.

6. Consider adjustments for changing expenses: Life changes may lead to changes in expenses. For example, if you’ve recently had a child, your budget might need to account for new expenses like childcare or education savings. Evaluate these changes and modify your budget accordingly to accommodate them.

7. Seek opportunities to increase income: Look for ways to increase your income to accelerate progress towards your financial goals. Explore side hustles, freelance work, or digital platforms that allow you to monetize your skills or hobbies. Increasing your income can provide you with additional funds to allocate towards your goals.

8. Revisit your budget regularly: Make it a habit to regularly revisit and review your budget. Set aside time each month to assess your progress, analyze your spending, and make any necessary modifications. This allows you to stay engaged with your financial goals and make proactive changes when needed.

9. Adjust for unforeseen circumstances: Unexpected events can arise, impacting your budget and financial goals. Be prepared to adjust your budget accordingly to account for emergencies, medical expenses, or other unforeseen circumstances. Having an emergency fund can provide a safety net and minimize the impact on your financial goals.

10. Seek guidance if needed: If you find it challenging to modify your budget successfully or navigate changes to your financial goals, consider seeking guidance from a financial advisor. They can provide valuable insights, help you evaluate your options, and assist in creating a budget that aligns with your revised objectives.

Remember, modifying your budget to achieve your financial goals is a continuous process. Stay adaptable, be willing to make adjustments along the way, and maintain a mindset focused on long-term financial success. With a flexible and goal-oriented budget, you can effectively navigate changes and make steady progress towards achieving your financial aspirations.

Common Challenges in Balancing Budget and Financial Goals

While creating a budget that aligns with your financial goals is crucial, it’s not always a smooth process. There are common challenges that individuals face when trying to balance their budget and achieve their financial goals. Understanding and addressing these challenges can help you stay on track and overcome obstacles. Here are some common challenges you may encounter:

1. Overspending: One of the most prevalent challenges is the temptation to overspend. Impulse purchases, lack of discipline, or the desire for instant gratification can lead to exceeding your budgeted amounts. It’s important to establish self-control and practice mindful spending to avoid sabotaging your progress towards your goals.

2. Insufficient income: Limited income can create challenges in budgeting for financial goals. If your income is not enough to support your goals and cover necessary expenses, it may be necessary to explore avenues for increasing your income. Consider additional part-time work, freelancing, or seeking a higher-paying job to bridge the income gap.

3. Emergencies and unexpected expenses: Unexpected events or emergencies can derail your budget and hinder your progress towards your goals. It’s vital to have an emergency fund to cover unexpected expenses, allowing you to maintain your financial stability and avoid dipping into funds allocated for your goals.

4. Prioritization of goals: Balancing multiple financial goals can be challenging, especially when they have different timelines and levels of urgency. It may be necessary to prioritize your goals and allocate funds accordingly. Assess the importance and urgency of each goal to determine the appropriate allocation of your resources.

5. Debt repayment: Managing debt payments can put a strain on your budget and impact your ability to allocate funds towards your goals. It’s important to prioritize debt reduction as part of your financial goals and consider strategies like debt consolidation or refinancing to reduce interest rates and free up more funds for other goals.

6. Lifestyle adjustments: Achieving financial goals often requires making lifestyle adjustments and cutting back on certain expenses. This can be challenging, especially if you’re accustomed to a certain standard of living. It’s necessary to evaluate your priorities and make conscious choices to align your lifestyle with your financial aspirations.

7. Lack of tracking and accountability: Failure to regularly track your expenses and review your budget can hinder your progress towards your goals. It’s important to establish a habit of consistently monitoring your budget, tracking your spending, and holding yourself accountable. Use budgeting apps, spreadsheets, or other tools to help you stay organized and on top of your finances.

8. Emotional spending: Emotional triggers can lead to impulsive and unnecessary purchases. Stress, boredom, or emotional highs and lows can drive you to spend money impulsively, ultimately derailing your budget. Develop strategies, such as creating a waiting period for non-essential purchases or finding alternative ways to cope with emotions that do not involve spending money.

9. Lack of financial education: A lack of financial education and understanding can pose challenges in effectively managing a budget and working towards financial goals. Take the time to educate yourself about personal finance, budgeting, and goal setting. Seek out resources, workshops, or courses that can provide you with the knowledge and tools to navigate your financial journey.

10. Lack of long-term perspective: Maintaining a long-term perspective is crucial when balancing your budget and financial goals. It’s important to keep your eye on the bigger picture and the long-term benefits of achieving your goals. This can help you stay motivated, make necessary sacrifices, and prioritize your financial future over short-term desires.

While these challenges may be common, they are not insurmountable. Developing good financial habits, staying disciplined, and being adaptable can help you overcome these obstacles and achieve the financial success you desire.

Conclusion

Creating and maintaining a budget that aligns with your financial goals is crucial for achieving long-term financial success. Through this article, we have explored the importance of understanding your financial goals, defining a personal budget, and incorporating your aspirations into your financial plan.

By aligning your budget with your financial goals, you gain clarity, direction, and motivation. Your budget becomes a powerful tool that guides your spending and saving decisions and helps you make progress towards your desired milestones. It allows you to prioritize your resources, track your progress, and make adjustments as needed.

However, balancing your budget and financial goals is not without its challenges. Overspending, insufficient income, unexpected expenses, and the need for lifestyle adjustments can present hurdles along the way. It is important to stay vigilant, exercise discipline, and continuously reassess your goals and budget to overcome these challenges and stay on track towards your financial aspirations.

Remember, modifying your budget when necessary and seeking support or guidance when needed are essential strategies for success. Regularly tracking your progress, celebrating milestones, and staying accountable are key to maintaining motivation and momentum. With dedication, perseverance, and a flexible mindset, you can navigate these challenges and achieve your financial goals.

Ultimately, integrating your financial goals into your budget is about taking control of your financial future. It allows you to make informed financial decisions, build a foundation of financial security, and create the lifestyle you desire. By aligning your budget and goals, you are crafting a path towards a more stable and prosperous future.

Through conscious budgeting, disciplined spending, and a clear vision of your financial goals, you have the power to transform your financial life. Start today, embrace the process, and let your budget become the roadmap to your financial success.