Home>Finance>How Are Defined Benefit Plans Different From Defined Contribution Plans How Are They Similar

Finance

How Are Defined Benefit Plans Different From Defined Contribution Plans How Are They Similar

Modified: March 1, 2024

Discover the key differences and similarities between defined benefit plans and defined contribution plans in finance. Optimize your retirement strategy with expert guidance!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Defined Benefit Plans

- Definition of Defined Contribution Plans

- Key Differences Between Defined Benefit and Defined Contribution Plans

- Similarities Between Defined Benefit and Defined Contribution Plans

- Comparison of Retirement Income in Defined Benefit and Defined Contribution Plans

- Advantages and Disadvantages of Defined Benefit Plans

- Advantages and Disadvantages of Defined Contribution Plans

- Factors to Consider When Choosing Between Defined Benefit and Defined Contribution Plans

- Conclusion

Introduction

When it comes to retirement planning, it’s important to understand the different types of retirement plans available. Two of the most common types are defined benefit plans and defined contribution plans. While both aim to provide financial security for retirement, they differ significantly in how they are structured and the benefits they offer.

A defined benefit plan, also known as a traditional pension plan, is a retirement plan that provides a predetermined amount of income to employees after they retire. This amount is usually based on factors such as salary history, years of service, and age, and is guaranteed by the employer. Defined benefit plans are often seen in government organizations and larger corporations.

On the other hand, a defined contribution plan is a retirement plan in which both the employee and the employer contribute a set amount of money into an individual account for the employee. The final retirement income is dependent on how well the investments in the account perform. Popular examples of defined contribution plans include 401(k) plans and individual retirement accounts (IRAs).

Understanding the differences and similarities between defined benefit and defined contribution plans is crucial for making informed decisions about retirement planning. In this article, we will explore the key distinctions between these two types of retirement plans, as well as their similarities. We will also delve into the advantages and disadvantages of each, and provide factors to consider when choosing between these plans.

Definition of Defined Benefit Plans

Defined benefit plans, also known as traditional pension plans, are retirement plans that guarantee a specific amount of income to employees after they retire. This predetermined benefit is typically based on a formula that takes into account factors such as the employee’s salary history, years of service, and age at retirement.

In a defined benefit plan, the employer is responsible for funding and managing the plan. Contributions are made by the employer on behalf of the employee, and the investment risk is assumed by the employer. The employee does not have control over the investments within the plan.

Upon retirement, the employee receives a regular stream of income for the rest of their life, based on the formula established by the plan. The amount received may be adjusted for factors such as inflation or changes in cost of living.

Defined benefit plans offer the advantage of providing a predictable and guaranteed retirement income. This can be particularly beneficial for individuals who may live longer than expected or those who are at risk of outliving their retirement savings. Additionally, the investment management is handled by professionals, relieving employees of the need to make investment decisions.

However, defined benefit plans come with their own set of challenges. They require careful financial planning and funding on the part of the employer, as they are obligated to pay the predetermined benefits to employees. Additionally, the eligibility criteria for receiving the benefits may vary between plans, with some requiring a certain number of years of service before vesting.

In recent years, defined benefit plans have become less common in the private sector, with many employers transitioning to defined contribution plans. However, they still remain prevalent in government organizations and some larger corporations.

Definition of Defined Contribution Plans

Defined contribution plans are retirement plans in which both the employee and the employer contribute a set amount of money into an individual account for the employee’s retirement. The final retirement income is determined by the contributions made and the investment performance of the account.

In a defined contribution plan, employees have the opportunity to contribute a portion of their salary to the plan, often on a pre-tax basis. The employer may also make matching contributions, up to a certain percentage of the employee’s salary. These contributions are invested in a variety of investment options, such as stocks, bonds, and mutual funds, according to the employee’s preferences.

Unlike defined benefit plans where the employer bears the investment risk, defined contribution plans provide employees with more control over their retirement savings. They have the ability to choose how their contributions are invested and can make adjustments to their investment portfolio over time. The ultimate value of the retirement account upon retirement is determined by the performance of the investments.

Upon retirement, employees can choose how to utilize their defined contribution plan savings. They may opt to receive a lump sum payment, roll the funds into an individual retirement account (IRA), or choose to receive regularly scheduled withdrawals in the form of annuity payments.

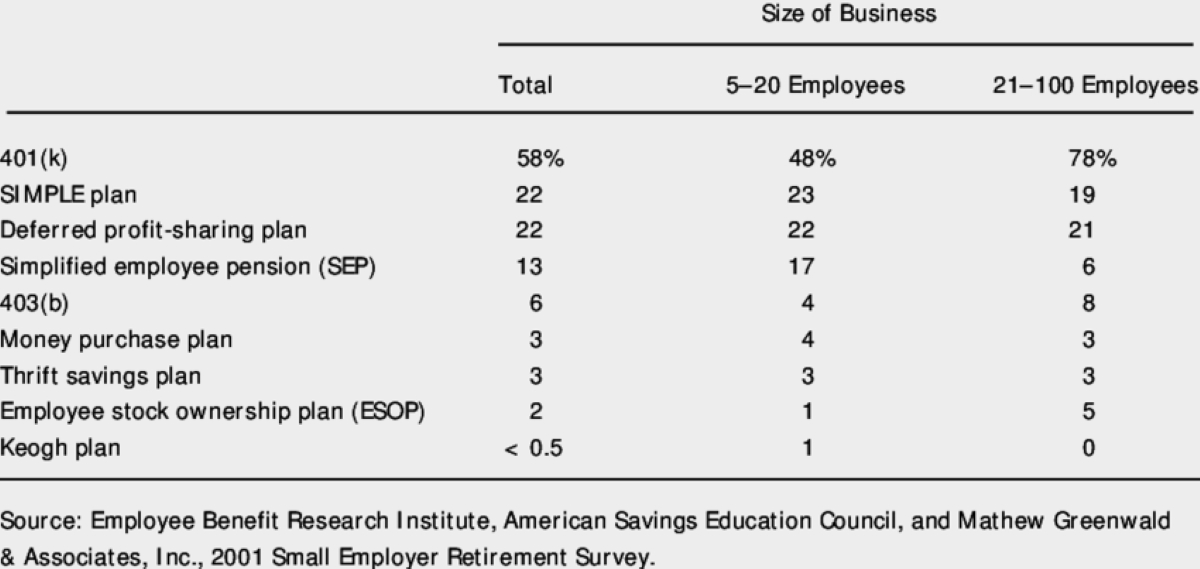

Defined contribution plans, such as 401(k) plans and individual retirement accounts (IRAs), have gained popularity in recent decades, especially in the private sector. They offer employees a certain level of flexibility and portability, allowing them to maintain their retirement savings even if they change employers.

However, defined contribution plans also come with certain risks and challenges. The investment performance of the account is subject to market fluctuations, and employees bear the responsibility of making investment decisions. The level of retirement income is not guaranteed, and it is dependent on the contributions made and the performance of the investments.

Furthermore, employees may face penalties if they withdraw funds from a defined contribution plan before reaching the eligible retirement age, and there may be limits on the amount that can be contributed each year.

Key Differences Between Defined Benefit and Defined Contribution Plans

While both defined benefit and defined contribution plans are designed to provide retirement benefits, there are several key differences between the two. These differences impact how the plans are funded, the level of guarantee in retirement income, and the role of the employee in managing their retirement savings.

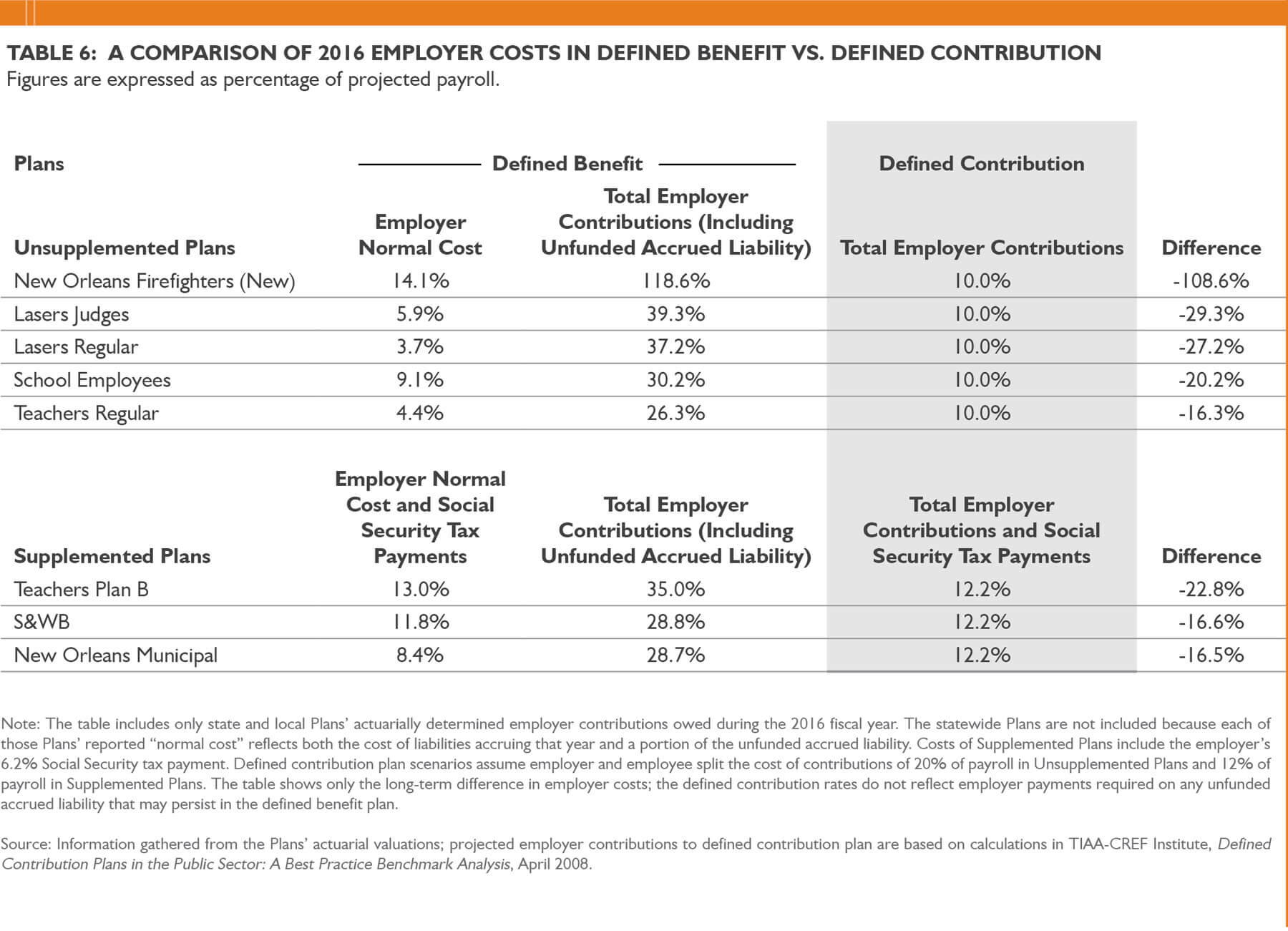

- Funding: In defined benefit plans, the employer is primarily responsible for funding the plan. They contribute a set amount of funds based on actuarial calculations to ensure that the promised benefits can be paid out. In defined contribution plans, both the employee and the employer contribute funds to individual accounts. The employer may offer matching contributions up to a certain percentage of the employee’s salary.

- Investment Risk: In defined benefit plans, the employer assumes the investment risk. They bear the responsibility of ensuring that there are enough funds to meet the predetermined retirement benefits. In defined contribution plans, the investment risk is transferred to the employee. The employee has control over how their contributions are invested, and the final retirement income is dependent on the performance of these investments.

- Retirement Income: A defining factor of defined benefit plans is the guarantee of a specific retirement income. The amount is determined by a formula based on factors such as salary history and years of service. In defined contribution plans, the retirement income is not guaranteed. It is dependent on the contributions made and the investment returns of the account. The final amount can vary based on market performance.

- Portability: Defined benefit plans are typically tied to the employer. If an employee changes jobs, they may lose access to the benefits accrued in the plan. Defined contribution plans, on the other hand, offer portability. Employees can typically roll over their account balance into another retirement account, such as an individual retirement account (IRA), if they leave their job.

- Investment Choices: Defined benefit plans do not provide employees with investment choices. The employer manages the investments on behalf of the employees. In defined contribution plans, employees have control over their investments and can choose from a range of options, such as stocks, bonds, and mutual funds. They can tailor their investment strategy to their risk tolerance and retirement goals.

These key differences highlight the contrasting nature of defined benefit and defined contribution plans. While defined benefit plans offer a predetermined retirement income and are primarily funded by the employer, defined contribution plans provide flexibility, grant control over investments, and rely on the performance of individual accounts.

Similarities Between Defined Benefit and Defined Contribution Plans

Although defined benefit and defined contribution plans have distinct characteristics, there are also some similarities between the two types of retirement plans. These commonalities relate to their overarching goals and the potential benefits they offer to employees.

- Retirement Savings: Both defined benefit and defined contribution plans are designed to help employees accumulate savings for retirement. They provide individuals with a means of setting aside funds during their working years to support their financial needs once they retire.

- Tax Advantages: Both types of plans offer tax advantages to employees. Contributions made to defined contribution plans, such as 401(k) plans and IRAs, are typically tax-deferred, meaning they are made with pre-tax dollars. This allows employees to reduce their taxable income and potentially lower their tax liability in the present. Similarly, defined benefit plans may offer tax advantages by allowing employers to deduct contributions made on behalf of employees.

- Employer Contributions: In both defined benefit and defined contribution plans, employers often make contributions to help employees build their retirement savings. While the structure and amount of employer contributions may vary, they serve as an additional benefit to employees beyond their regular compensation.

- Retirement Age: Both types of plans are typically structured around a specified retirement age. Whether it is the age at which employees become eligible to receive defined benefit plan benefits or the age at which they can begin withdrawing from a defined contribution plan without penalties, retirement age is a common component of these plans.

- Employee Benefit: Both defined benefit and defined contribution plans are designed to provide employees with financial security during retirement. They aim to ensure that individuals have a source of income to support their expenses and maintain their standard of living once they are no longer working.

While defined benefit plans and defined contribution plans may differ in their funding structures, investment management, and the level of retirement income guarantee, they share the fundamental purpose of assisting employees in preparing for a financially secure retirement. Understanding these similarities can help individuals make informed decisions when it comes to choosing the most suitable retirement plan for their needs and goals.

Comparison of Retirement Income in Defined Benefit and Defined Contribution Plans

One of the key differences between defined benefit and defined contribution plans is how retirement income is determined. In defined benefit plans, retirees receive a predetermined amount of income based on a formula that takes into account factors such as salary history and years of service. In defined contribution plans, retirement income is based on the contributions made and the investment performance of the individual account. Let’s compare these two approaches to retirement income.

Defined Benefit Plans: Defined benefit plans offer a guaranteed retirement income. The amount is typically calculated using a formula that considers the employee’s salary history and years of service. This means that retirees will receive a specified amount of income each month for the rest of their lives. The predictability and stability of defined benefit plans can provide retirees with a sense of financial security and peace of mind, knowing that their retirement income is assured, regardless of market conditions.

On the downside, the retirement income provided by defined benefit plans may not keep up with inflation over time. Some plans may have provisions to adjust benefits for the cost of living, but this is not always the case. Additionally, the income from defined benefit plans is typically not transferable upon the death of the retiree, meaning that any remaining funds do not pass on to beneficiaries.

Defined Contribution Plans: In defined contribution plans, retirement income is not guaranteed. Instead, it is dependent on several factors, including the contributions made by the employee and employer, the investment choices, and the performance of the investments within the account. The value of the account can fluctuate based on market conditions, and retirees must carefully manage their withdrawals to ensure their savings last throughout their retirement years.

Defined contribution plans offer retirees more flexibility in terms of accessing their retirement savings. They can choose whether to receive the savings as a lump sum, roll it over into an IRA, or receive regular withdrawals. However, this flexibility also introduces the risk of mismanaging the funds and potentially exhausting them too soon.

Retirees relying on defined contribution plans face the challenge of converting their savings into a steady stream of income. Many choose to use strategies such as systematic withdrawals or annuity products to ensure a consistent cash flow. Annuities, both immediate and deferred, can provide retirees with a guaranteed income stream, similar to a defined benefit plan, but at the cost of giving up control over the principal investment.

In summary, while defined benefit plans offer a guaranteed and predictable retirement income, defined contribution plans provide flexibility and individual control over retirement savings. The choice between the two depends on personal circumstances, risk tolerance, and the level of financial security desired in retirement.

Advantages and Disadvantages of Defined Benefit Plans

Defined benefit plans, also known as traditional pension plans, offer several advantages and disadvantages to both employers and employees. Understanding these pros and cons can help individuals make informed decisions about their retirement planning and employers determine the most suitable retirement benefits for their workforce.

Advantages:

- Guaranteed Retirement Income: Defined benefit plans provide retirees with a guaranteed income for life. This predictable stream of income can offer financial security and peace of mind, as retirees do not have to worry about fluctuations in market returns or outliving their savings.

- Professional Investment Management: Employers are responsible for managing the investments in defined benefit plans. This means that professionals with expertise in investment management handle the funds, relieving employees of the burden of making investment decisions.

- Longevity Protection: Defined benefit plans offer protection against the risk of longevity. Retirees who live longer than expected can still count on a consistent income stream from the plan, ensuring they are able to cover their expenses throughout their retirement years.

Disadvantages:

- Cost and Funding Responsibilities: Defined benefit plans can be costly for employers, as they are responsible for funding the plan to ensure the promised benefits can be paid out. Employers must carefully manage the financial aspects of the plan, including contributions and investment performance, to meet these obligations.

- Limited Portability: Defined benefit plans are often tied to the employer. If an employee changes jobs before reaching retirement eligibility, they may lose access to the benefits accrued in the plan. This lack of portability can be a disadvantage for individuals who frequently change employers throughout their careers.

- Uncertainty in Future Benefits: Changes in the economic landscape or the financial stability of the employer can impact the ability of defined benefit plans to pay out promised benefits. In some cases, employers may reduce benefits or even terminate the plan altogether, leaving employees with less retirement income than they anticipated.

In summary, defined benefit plans offer the advantage of a guaranteed retirement income and professional investment management. However, they also come with the potential disadvantages of high costs and funding responsibilities for employers, limited portability, and the uncertainty of future benefits. Individuals should carefully consider these factors before deciding if a defined benefit plan aligns with their retirement goals and financial circumstances.

Advantages and Disadvantages of Defined Contribution Plans

Defined contribution plans, such as 401(k) plans and individual retirement accounts (IRAs), have gained popularity in recent years. These retirement plans offer several advantages and disadvantages for both employers and employees. Understanding these pros and cons can help individuals make informed decisions about their retirement savings and employers design effective retirement benefits for their workforce.

Advantages:

- Flexibility and Portability: Defined contribution plans offer employees flexibility in terms of contribution amounts and investment options. Participants can adjust their contributions based on financial circumstances, and they have control over how their funds are invested. Additionally, if an employee changes jobs, they can typically roll over their retirement account balance into another qualified retirement account.

- Employee Contributions Matched by Employers: Many defined contribution plans include employer matching contributions. This means that for every dollar an employee contributes, the employer will contribute a certain percentage, typically up to a certain limit. This matching feature provides an additional benefit and helps employees accelerate their retirement savings.

- Individual Investment Management: In defined contribution plans, employees have the ability to make investment choices based on their risk tolerance and financial goals. This allows individuals to tailor their investments to their preferences and potentially achieve higher returns.

Disadvantages:

- Investment Risk: Unlike defined benefit plans, which provide a guaranteed retirement income, the retirement income from defined contribution plans is subject to market fluctuations. The success of the plan is dependent on the performance of individual investments in the account. Poor investment decisions or market downturns can lead to a decrease in the account balance and a lower retirement income.

- Post-Retirement Income Uncertainty: The retirement income in a defined contribution plan is not guaranteed, as it depends on factors such as the contributions made, investment returns, and withdrawal strategy. Retirees must carefully manage their withdrawals to ensure their savings last throughout their retirement years.

- Investment Responsibility: With the freedom to make investment choices comes the responsibility for managing those investments. Employees who are not familiar with investment strategies or lack the time and expertise may find it challenging to navigate the complexities of investing for retirement.

In summary, defined contribution plans offer flexibility, portability, and the potential for individual investment control. However, they also carry the risk of market fluctuations, uncertainty in post-retirement income, and the responsibility of managing investments. Employees and employers should carefully consider these factors when deciding on the most suitable retirement plan for their needs.

Factors to Consider When Choosing Between Defined Benefit and Defined Contribution Plans

Choosing between a defined benefit plan and a defined contribution plan is an important decision that depends on various factors. Understanding these factors can help individuals make an informed choice that aligns with their retirement goals and financial circumstances.

- Stability of Retirement Income: Consider whether you prefer a guaranteed retirement income or are comfortable with the potential fluctuations in income that come with a defined contribution plan. Defined benefit plans offer a predetermined retirement income, while defined contribution plans offer more flexibility but carry the risk of market performance.

- Employer Contributions: Evaluate the employer contributions offered in each plan. Defined benefit plans are typically fully funded by the employer, while defined contribution plans often include employer matching contributions. Compare the contribution amounts and determine which option provides the most desirable employer benefits.

- Investment Control: Consider your investment preferences and comfort level with making investment decisions. If you prefer having control over the investment choices and tailoring your portfolio, a defined contribution plan may be more suitable. However, if you prefer professionals managing your investments, a defined benefit plan may be a better fit.

- Portability: Assess the importance of portability in your retirement plan. Defined contribution plans typically offer more portability, allowing you to maintain your retirement savings if you change jobs. Defined benefit plans, on the other hand, may not allow you to take your benefits with you if you leave your employer before retirement eligibility.

- Risk Tolerance: Evaluate your risk tolerance and comfort level with uncertainties in retirement income. Defined benefit plans offer more stability and predictability, while defined contribution plans expose you to market fluctuations. Assess your risk appetite and determine which plan aligns with your tolerance for potential risk.

- Longevity Considerations: Take into account your life expectancy and potential longevity risks. If you anticipate living longer or have concerns about outliving your savings, a defined benefit plan may provide added security. However, if you have a shorter life expectancy or prefer more control over your retirement savings, a defined contribution plan may be more suitable.

- Employment Stability: Consider the stability of your employment situation. If you anticipate staying with your current employer until retirement and value a guaranteed income, a defined benefit plan may be advantageous. On the other hand, if you anticipate changing jobs throughout your career, a defined contribution plan offers more portability.

It’s essential to carefully evaluate these factors, taking into account your personal circumstances, financial goals, and risk tolerance. Consult with a financial advisor to assess the pros and cons of each plan in relation to your specific situation. Ultimately, the right choice will depend on your individual preferences and priorities for retirement planning.

Conclusion

Choosing between a defined benefit plan and a defined contribution plan is an important decision that requires careful consideration of various factors. Each type of retirement plan offers distinct advantages and disadvantages, and understanding these can help individuals make an informed choice that aligns with their financial goals and circumstances.

Defined benefit plans provide retirees with a guaranteed income for life, offering stability and peace of mind. They are fully funded by the employer and relieve employees of the responsibility of managing investments. However, they can be costly for employers, lack portability, and are subject to potential reductions or plan terminations.

Defined contribution plans, on the other hand, offer flexibility and individual control over retirement savings. They often include employer matching contributions and provide portability if an employee changes jobs. However, they expose employees to market risk, require investment management, and come with income uncertainty in retirement.

When making a decision, it is important to consider factors such as the stability of retirement income, employer contributions, investment control, portability, risk tolerance, longevity considerations, and employment stability. Assessing these factors will help determine the plan that best aligns with individual preferences, risk appetite, and long-term financial goals.

Ultimately, there is no one-size-fits-all answer to the defined benefit versus defined contribution plan debate. It is crucial to carefully evaluate the advantages and disadvantages of each plan and seek guidance from financial professionals if needed. Regularly reassessing your retirement goals and adjusting your plan as circumstances change is also essential to ensure you stay on track towards a financially secure retirement.

Remember that retirement planning is a long-term commitment, and the decision you make today can significantly impact your financial well-being in the future. With careful consideration and thoughtful planning, you can choose the retirement plan that best suits your needs and helps you achieve your retirement goals.